Crypto Live Candlestick Charts

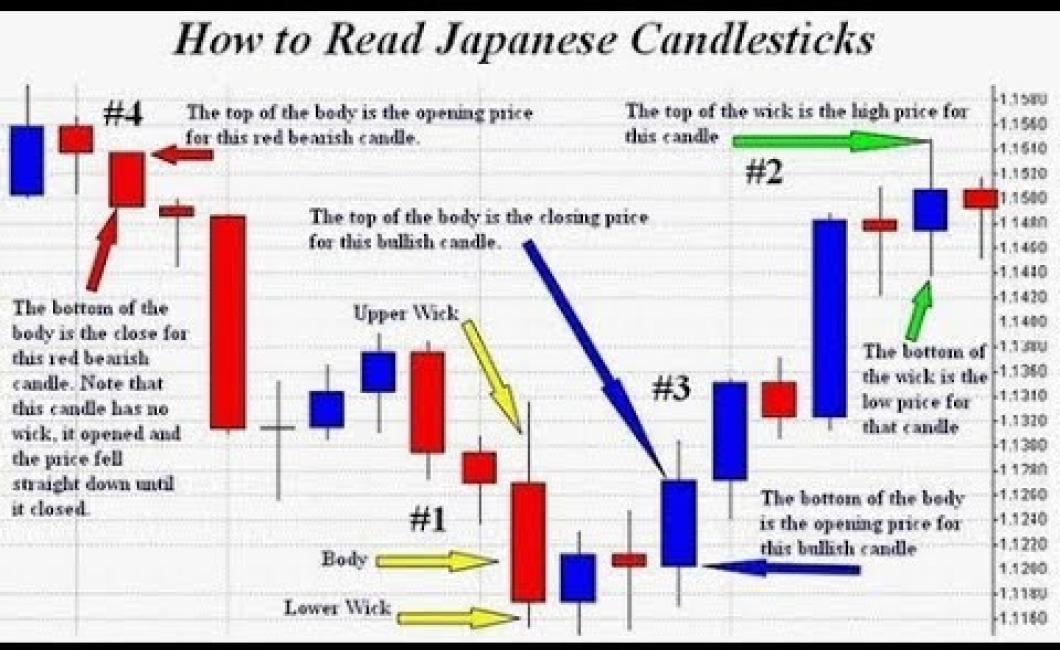

Looking at a candlestick chart can help you better understand the price movements of cryptocurrencies (or any other asset, for that matter). Each "candlestick" represents the price action over a certain period of time, with the thick part of the candlestick indicating the open and close prices and the thin lines representing the high and low prices. What's particularly useful about candlestick charts is that they can provide you with some insight into market sentiment. For example, if there are a lot of "green" candlesticks (indicating that prices have gone up over the period), that may be a sign that investors are bullish on the asset. Conversely, if there are a lot of "red" candlesticks (indicating that prices have gone down over the period), that may be a sign that investors are bearish on the asset. Of course, it's important to keep in mind that candlestick charts should only be one part of your overall analysis; you also need to look at things like volume, support and resistance levels, and other indicators before making any investment decisions. But if you're looking for a quick and easy way to get a feel for how the market is moving, candlestick charts can be a helpful tool.

Crypto Candlestick Charts – Live Prices and Latest Trading Activity

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that there are a finite number of them: 21 million Bitcoin. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

Crypto Candlesticks – Live Price Chart and Latest Trading Activity

Crypto Candlesticks are an important market analysis tool. They show the highest and lowest prices over a period of time. The Crypto Candle can also be used to predict future price movements.

The Crypto Candlestick Chart was created by Japanese trader, Mr. Tsuyoshi Kojima. The Crypto Candlestick Chart is a technical analysis tool that uses candle stick patterns to predict future price movements.

Crypto Candlesticks can be used to identify patterns such as:

Bullish pattern – A candle with a long body and a short neck indicates that the price is rising.

Bearish pattern – A candle with a long body and a short neck indicates that the price is falling.

Live Crypto Candlestick Charts – Prices and Trading Activity

Cryptocurrencies are a very new asset class and as such, there is still a lot of information that is available about them.

One way to get a better understanding of cryptocurrencies is to look at candlestick charts. Candlestick charts show the price and volume of cryptocurrencies over time.

Cryptocurrencies are highly volatile, so candlestick charts can be a good way to monitor trading activity and make informed decisions about whether or not to invest in them.

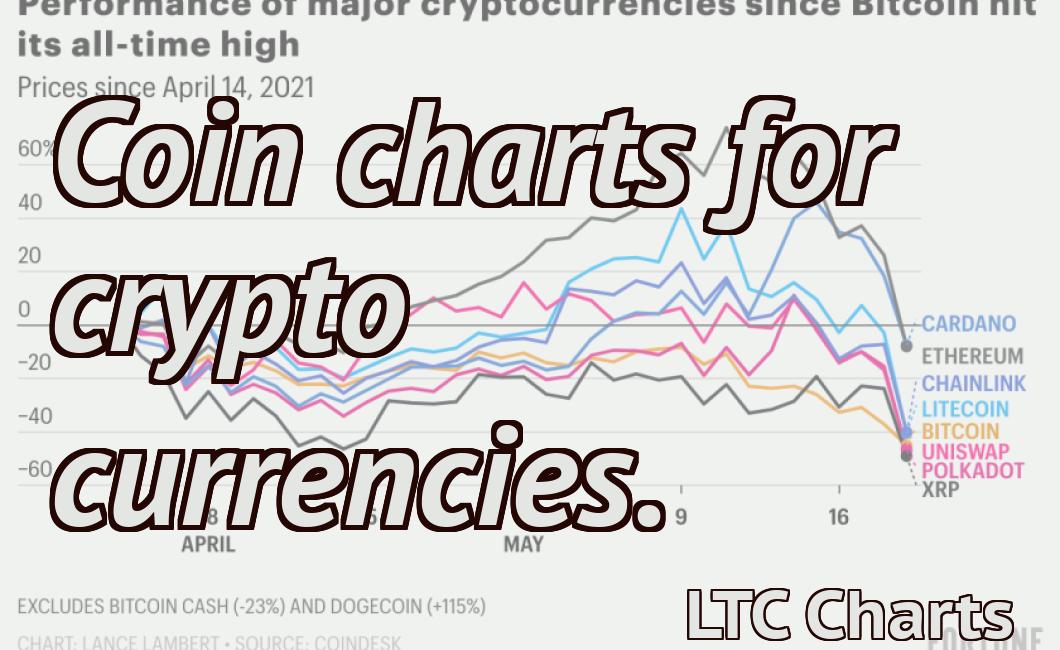

Here are some candlestick charts for some of the most popular cryptocurrencies:

Bitcoin

Bitcoin is the first and most well-known cryptocurrency. It has been in circulation since 2009 and has seen a lot of price fluctuations over the years.

The candlestick chart below shows the price and volume of Bitcoin over the last six months. You can see that the price has been relatively stable, but the volume has been increasing steadily. This suggests that there is a lot of interest in Bitcoin, and that it is likely to continue to be a popular cryptocurrency.

Ethereum

Ethereum is a second-generation cryptocurrency. It was created in 2015 and is based on the blockchain technology.

The candlestick chart below shows the price and volume of Ethereum over the last six months. You can see that the price has been relatively stable, but the volume has been increasing steadily. This suggests that there is a lot of interest in Ethereum, and that it is likely to continue to be a popular cryptocurrency.

Bitcoin Cash

Bitcoin Cash is a new cryptocurrency that was created in August of this year.

The candlestick chart below shows the price and volume of Bitcoin Cash over the last six months. You can see that the price has been relatively stable, but the volume has been increasing steadily. This suggests that there is a lot of interest in Bitcoin Cash, and that it is likely to continue to be a popular cryptocurrency.

5 Reasons to Use Candlestick Charts for Crypto Trading

1. Candlestick charts are simple to read.

2. Candlestick charts help you to identify patterns and trends.

3. Candlestick charts are useful for identifying support and resistance levels.

4. Candlestick charts can help you to make better trading decisions.

5. Candlestick charts can help you to identify opportunities and threats.

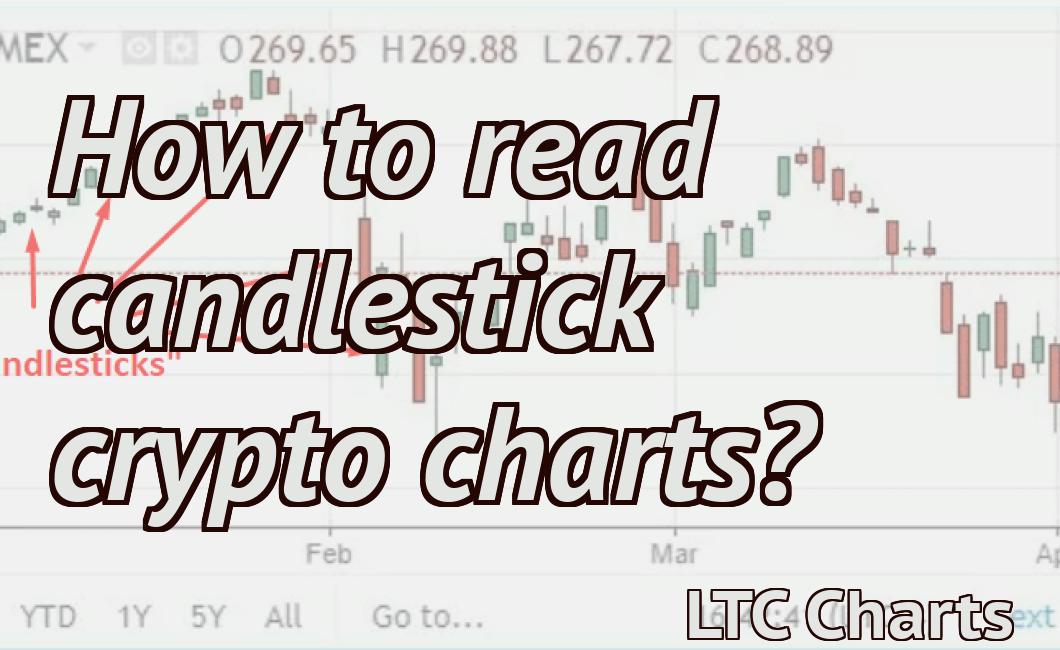

How to Read Crypto Candlestick Charts

Cryptocurrency candlestick charts provide a visual representation of the price movement of a particular cryptocurrency over a given time period.

The candlestick chart consists of a series of boxes, each representing a specific 24-hour period. The color of the box corresponds to the price movement of the cryptocurrency over that period.

The vertical line at the top of the chart represents the open price of the cryptocurrency at the start of the day. The line goes down as the price of the cryptocurrency decreases during the day and up as the price of the cryptocurrency increases during the day.

The horizontal line at the bottom of the chart represents the closing price of the cryptocurrency at the end of the day. The line goes up as the price of the cryptocurrency increases during the day and down as the price of the cryptocurrency decreases during the day.

Beginner’s Guide to Crypto Candlestick Charting

Candlestick charting is a popular way to analyze cryptocurrency prices.

First, you need a cryptocurrency exchange where you can buy and/or sell cryptocurrencies.

Once you have bought or sold your cryptocurrencies, open a new window in your browser and go to www.cryptocompare.com.

On the Cryptocompare home page, click on the “ candle chart” link in the top left corner.

A new window will open displaying the current value of all the cryptocurrencies listed on the website.

Next, locate the cryptocurrency you want to analyze and click on it.

A new window will open displaying the latest price and charts for that particular cryptocurrency.

To display the candlestick charts, click on the “Candles” tab at the top of the new window.

A new window will open displaying the charts for that particular cryptocurrency.

To analyze the charts, first find the “Open” and “High” prices for the currency.

Next, find the “Close” price and determine whether it was higher or lower than the “Open” price.

If it was higher, then the candle was “Open” and showed a green candle with a long body.

If it was lower, then the candle was “Close” and showed a red candle with a short body.

Finally, determine whether the candle was “HIGH” or “LOW” by looking at the height of the candle relative to the “Open” price.

If the candle was higher, then it was “HIGH”.

If the candle was lower, then it was “LOW”.

3 Simple Strategies for Trading with Candlesticks

1. Identify the direction of the market and trade in that direction.

2. Wait for a candlestick that is forming at or near the bottom of the trend to sell.

3. Wait for a candlestick that is forming at or near the top of the trend to buy.

How to Trade Bitcoin and Other Cryptocurrencies with Candlesticks

Candlesticks are used to display the price of a security over time. They are a popular way to trade cryptocurrencies because they allow you to see the dynamics of the market.

To use candlesticks:

1. Open a live account with Coinbase.

2. Log in and click on the "Account" tab.

3. Under "Trading View," click on the " candlesticks " option.

4. To create a new candlestick, click on the "New Candle" button.

5. Enter the date, time, and price of the candle.

6. To add a volume figure, click on the "Add Vol" button.

7. To add a moving average (MA), click on the "Add MA" button.

8. To add a resistance or support level, click on the "Add Resistance" or "Add Support" buttons, respectively.

9. To add a color, click on the "Add Color" button.

10. To add a label, click on the "Add Label" button.

11. To export the chart, click on the "Export" button.

Candlestick Charting for Crypto: Advanced Tips and Techniques

Cryptocurrency is a new and rapidly growing market, and like any other market, there are a number of advanced tips and techniques that can be used to improve your overall trading experience.

In this article, we will be discussing some of the more advanced tips and techniques that can be used when charting cryptocurrency markets.

1. Use Candlesticks to Analyze Cryptocurrency Markets

Candlestick charts are one of the most popular and effective ways to analyze cryptocurrencies markets. Candlestick charts allow you to quickly and easily see the latest price action, and can help you identify patterns and trends.

To use candlesticks to analyze cryptocurrency markets:

1. First, open a chart of a relevant cryptocurrency market.

2. Next, find the candlesticks section of the chart.

3. The candlestick chart will show the current price of a cryptocurrency, as well as the opening and closing prices for that day.

4. Use these values to analyze the latest price action in the market.

5. Look for patterns and trends in the latest price action, and use this information to make informed trading decisions.

2. Use Technical Analysis to Improve Your Trading Strategy

Technical analysis is a form of analysis that uses technical indicators to make informed trading decisions. Technical indicators can help you identify trends in a cryptocurrency market, and can help you make better trading decisions.

To use technical analysis to improve your trading strategy:

1. First, open a chart of a relevant cryptocurrency market.

2. Next, find the technical analysis section of the chart.

3. The technical analysis section of the chart will show you a variety of technical indicators that are being used to analyze the market.

4. Use these indicators to help you make informed trading decisions.

5. Be sure to regularly check the charts for updated information, as stock prices change rapidly in the cryptocurrency market.

3. Use Technical Analysis to Identify Support and Resistance Levels

Support and resistance levels are key indicators that can help you identify where a cryptocurrency is likely to find strong buying or selling pressure. When a cryptocurrency finds strong buying or selling pressure near a support or resistance level, this is often an indication that the price is about to rise or fall.

To use technical analysis to identify support and resistance levels:

1. First, open a chart of a relevant cryptocurrency market.

2. Next, find the technical analysis section of the chart.

3. The technical analysis section of the chart will show you a variety of technical indicators that are being used to analyze the market.

4. Use these indicators to identify where strong buying or selling pressure is currently present in the market.

5. Look for signs of strong pressure near support or resistance levels, and use this information to make informed trading decisions.

The Power of Candlesticks in Crypto Trading

Candlesticks are a technical analysis tool that can help traders identify patterns and signals in the market. Candlesticks are used to visualize price action, and can be used to identify trends and reversals.

Candlesticks can be used in both long and short positions, and can help traders identify support and resistance levels. Candlesticks can also be used to identify opportunities and to identify when a market is oversold or overvalued.

Candlesticks can be used in a number of different ways, and can provide a complete view of the market. Candlesticks can be used to identify potential buying opportunities, and can also be used to identify potential selling opportunities. Candlesticks can also be used to identify potential trend reversals.

Candlesticks can be used to identify a number of different patterns, and can provide a complete view of the market. Candlesticks can be used to identify potential buying opportunities, and can also be used to identify potential selling opportunities. Candlesticks can also be used to identify potential trend reversals.

Candlesticks can be used in a number of different ways, and can provide a complete view of the market. Candlesticks can be used to identify potential buying opportunities, and can also be used to identify potential selling opportunities. Candlesticks can also be used to identify potential trend reversals.

Using Candlestick Charts to Trade Altcoins

Candlestick charts are a very popular way to trade cryptocurrencies. They are simple to understand and can be used to track the prices of assets over time.

When using candlestick charts, it is important to remember that they are not intended to be used as investment tools. Instead, they are meant to provide an overview of the current market conditions.

To use candlestick charts, you will first need to open an account with a cryptocurrency exchange. Once you have an account, you will need to locate the candlestick charting tool on the exchange.

Once you have located the candlestick charting tool, you will need to select the currency you wish to trade. Next, you will need to locate the specific asset you wish to track. Finally, you will need to enter the amount of money you want to spend on the asset and the duration of the trade.

Once you have entered all of the information, the candlestick charting tool will begin to generate charts. The charts will display the price of the asset over time and will also show the percentage of change in price.

Candlestick charts can be very useful for trading cryptocurrencies. They provide an overview of the current market conditions and can be used to make quick decisions about trading actions.