Crypto Trading Charts

If you're serious about cryptocurrency trading, then you need to be looking at crypto trading charts. Charts provide a visual representation of price action and allow traders to identify patterns and trends that may otherwise be difficult to spot. By tracking chart data, traders can make more informed decisions about when to buy and sell cryptocurrencies. There are a variety of different chart types that can be used for crypto trading. The most popular include candlestick charts and bar charts. Candlestick charts provide more detailed information than bar charts, including the opening and closing prices for each period, as well as the highs and lows. Bar charts simply show the closing price for each period. Both candlestick charts and bar charts can be further customized to show different time frames, such as 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, 4-hour, or daily. Shorter time frames are more suited for day trading, while longer time frames can be used to identify longer-term trends. In addition to tracking price action, crypto trading charts can also be used to track market volume. This is important because it can help traders gauge the strength of a particular move. If there is high volume accompanying a price move, it is typically considered to be more significant than if there is low volume. Finally, another useful tool that can be found on some crypto trading charts is an indicator known as the Relative Strength Index (RSI). The RSI is a momentum indicator that measures whether a market is overbought or oversold. When the RSI is above 70, it is considered overbought, and when it is below 30, it is considered oversold.

The Benefits of Using Trading Charts for Crypto Trading

There are many benefits to using trading charts for crypto trading. These include:

1. Easier navigation.

Trading charts make it easier to follow the movements of a cryptocurrency over time. This is especially helpful when trading more complex assets, such as Bitcoin and Ethereum, which can be difficult to follow without them.

2. Increased accuracy.

Trading charts help to increase accuracy by highlighting key indicators that can help you predict future movements. This can help you make more informed decisions when trading cryptocurrencies.

3. Increased profits.

Using trading charts can help you to make profits by correctly predicting the movement of a cryptocurrency. This can be especially profitable when trading more volatile assets, such as Bitcoin and Ethereum.

How to Read and Analyze Crypto Trading Charts

Crypto trading charts can be used to help analyze the market, spot trends, and make informed trading decisions.

When looking at crypto trading charts, it is important to focus on the following key factors:

1. The chart timeframe

2. The price action

3. The technical indicators

4. The market conditions

1. The chart timeframe

Crypto trading charts typically display prices over a period of 30, 60, or 120 minutes. This timeframe allows for detailed analysis of price action and provides an overall understanding of the market conditions.

2. The price action

Crypto trading charts typically display two types of price action: up or down. While this may not be the only type of price action that exists in the market, it is a common indicator of overall sentiment. When looking at the overall trend of the market, it is important to focus on the most dominant price action.

3. The technical indicators

Crypto trading charts often display a variety of technical indicators, including moving averages, Bollinger bands, and Ichimoku Clouds. These indicators can help identify potential trends and provide insight into the market conditions.

4. The market conditions

Crypto trading charts are often used in conjunction with market conditions indicators, such as the RSI and MACD. These indicators can help identify any potential changes in the market conditions and provide an overall understanding of the market sentiment.

Different Types of Crypto Trading Charts and Their Uses

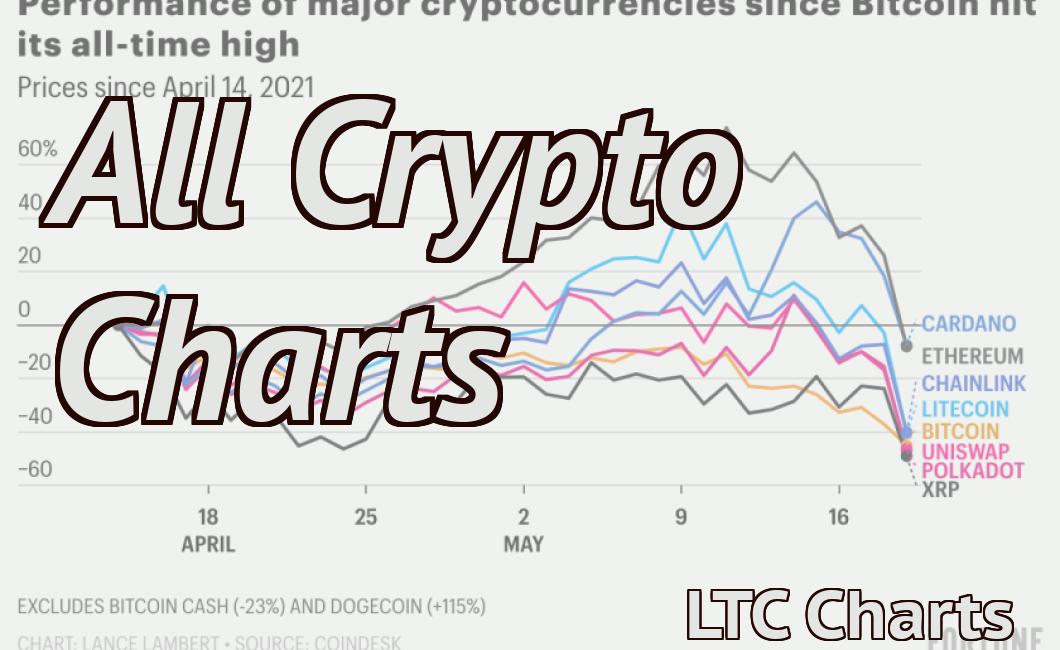

Crypto trading charts are essential for anyone looking to make informed decisions when it comes to trading cryptocurrencies. They allow you to see the price of a particular cryptocurrency over time, as well as where it is currently trading.

There are a variety of different types of crypto trading charts, and their uses can vary depending on your trading strategy.

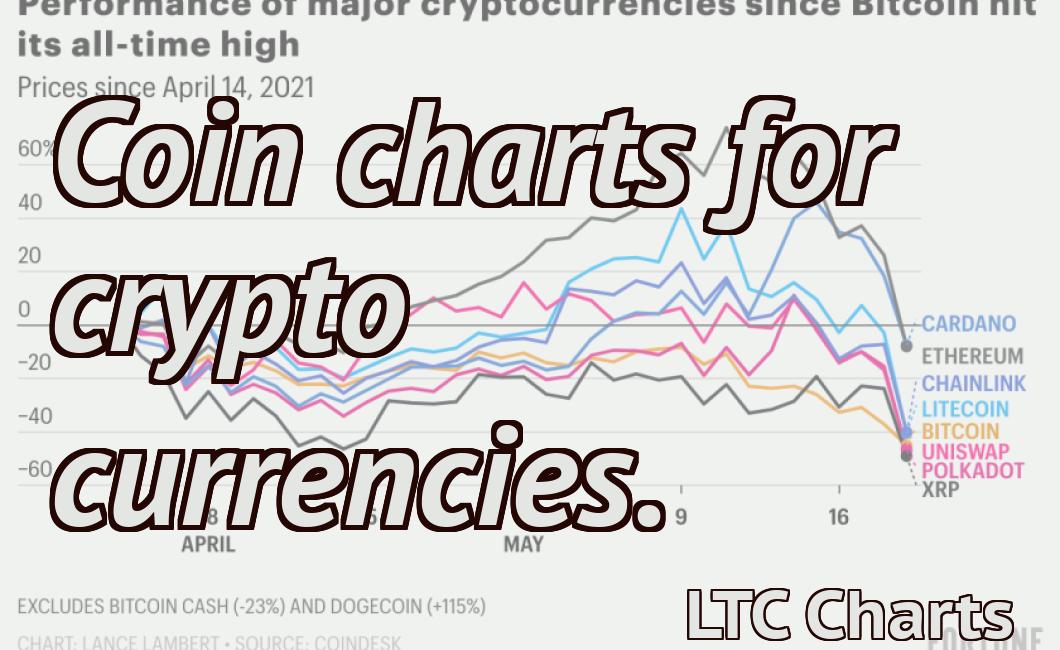

1. Price Charts

Price charts are the most common type of crypto trading chart, and they show the price of a cryptocurrency over time. They can be used to track the price of a cryptocurrency over a short period of time, or over a longer period of time.

Price charts can be used to find out where a cryptocurrency is currently trading, as well as where it has been trading in the past. They can also be used to predict where the price of a cryptocurrency is likely to go in the future.

2. Volume Charts

Volume charts are similar to price charts, but they show the amount of cryptocurrency that has been traded over a certain period of time. They can be used to track the volume of a cryptocurrency over a short period of time, or over a longer period of time.

Volume charts can be used to determine where the market is currentlyocating its resources, as well as where it is likely to go in the future.

3. Moving Averages

Moving averages are a type of technical indicator that is used to help traders predict where the price of a cryptocurrency is likely to go in the future.

Moving averages are calculated by taking the average value of a set number of stocks, and they are used to predict where the price of a cryptocurrency is likely to go in the future.

4. Technical Indicators

Technical indicators are a type of technical indicator that is used to help traders predict where the price of a cryptocurrency is likely to go in the future.

Technical indicators are calculated by taking the average value of a set number of stocks, and they are used to predict where the price of a cryptocurrency is likely to go in the future.

5. Crypto Trading Signals

Crypto trading signals are a type of technical indicator that is used to help traders predict where the price of a cryptocurrency is likely to go in the future.

Crypto trading signals are calculated by taking the average value of a set number of stocks, and they are used to predict where the price of a cryptocurrency is likely to go in the future.

Technical Analysis for Crypto Trading: What You Need to Know

The following are the key points to consider when performing crypto trading analysis:

1.Technical Analysis is the process of studying charts and indicators to predict future price movements.

2.Some popular technical indicators used in crypto trading are the Bollinger Bands, MACD, RSI and the Fibonacci Retracement.

3.Crypto trading is a highly speculative activity, and therefore should only be undertaken with caution.

4.Always do your own research before trading any cryptocurrency.

How to Use Candlestick Charts for Crypto Trading

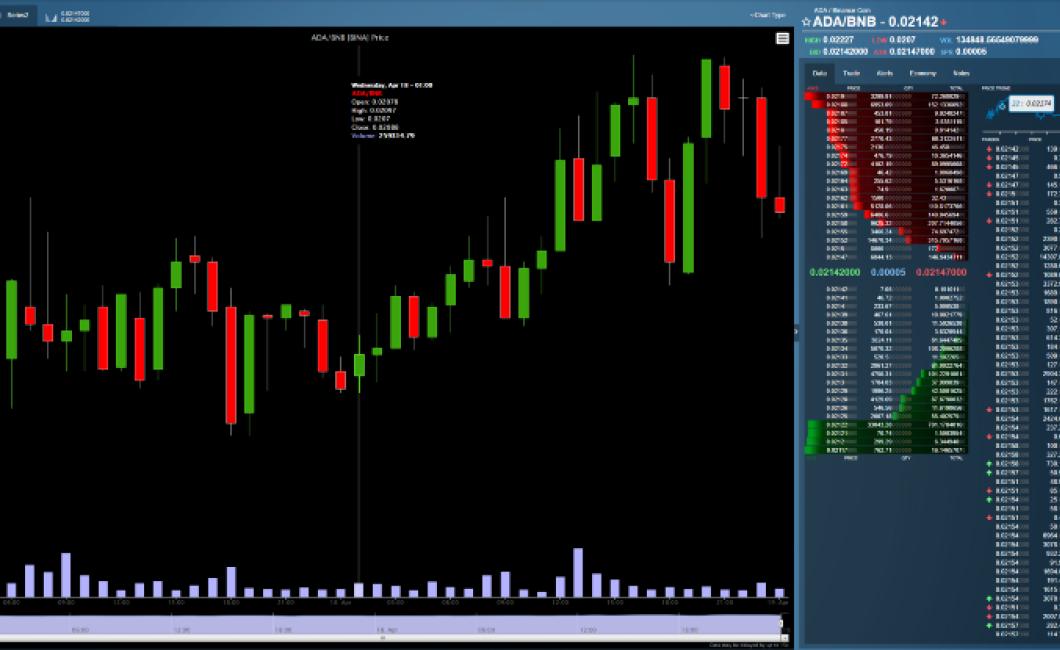

Candlestick charts are a popular way to visualize price movements of cryptocurrencies. They show the price of a cryptocurrency over a given period of time, typically 24 hours. Candlestick charts can be helpful for understanding the behavior of a specific cryptocurrency, and for making trading decisions.

To use candlestick charts for cryptocurrency trading, first find the currency you want to trade. Then, find the candlestick that best represents the current price of that currency. For example, if the current price of a cryptocurrency is $50, the first candlestick would be at $50.01. The next candlestick would be at $49.99, and so on.

Once you have found the appropriate candlestick, you can use it to make your trading decisions. For example, if the current price of a cryptocurrency is below the first candlestick, you might sell. If the current price of a cryptocurrency is above the first candlestick, you might buy.

Using Volume Analysis to Trade Cryptocurrencies

Volume analysis is a useful tool for traders when assessing the value of cryptocurrencies. Volume is a key indicator of market interest, and can give you clues about how volatile a cryptocurrency is.

To use volume analysis, you need to find a cryptocurrency exchange that allows you to view its 24-hour trading volume. Once you have found an exchange, open it up in a new window and look for the “Volume” tab.

On the Volume tab, you will see a list of all the cryptocurrencies that have been traded on the exchange in the past 24 hours. The higher the volume of a cryptocurrency, the more valuable it is likely to be.

To use volume analysis to trade cryptocurrencies, you need to first identify which cryptocurrencies are worth investing in. Based on the volume data on the various exchanges, you can then decide which cryptocurrencies to buy and sell.

What You Should Know About Reading Crypto Trading Charts

Reading crypto trading charts can help you to better understand the current state of the cryptocurrency market and make informed investment decisions.

Cryptocurrency trading is a highly technical and complex process, so it is important to use reliable and accurate charts to make informed decisions.

Here are some key things to keep in mind when reading crypto trading charts:

1. Technical analysis is an important part of trading, and charts can help you to identify patterns and trends in the market.

2. Always consult with a financial advisor before making any investment decisions.

3. Always be prepared for potential volatility in the market, and always keep a close eye on your investments.