Where to read crypto charts?

This article discusses where to find reliable crypto charts for trading purposes. It recommends websites and software programs that offer good charting tools and data.

How to read crypto charts for beginners

Crypto charts are a great way to get a snapshot of the current state of the cryptocurrency market.

There are a few things to keep in mind when reading crypto charts:

1. Don’t invest more than you can afford to lose.

2. Always do your own research before making any investment decisions.

3. Always be aware of risk factors associated with cryptocurrencies.

Here are some tips on how to read crypto charts for beginners:

1. Use a tradingview account to access crypto charts.

2. Compare the prices of different cryptocurrencies and make informed decisions based on that information.

3. Look for trends in the prices of different cryptocurrencies.

4. Consider entering into short or long positions in cryptocurrencies according to your own risk tolerance.

The different types of crypto charts and what they mean

Crypto charts are used to track the performance of different cryptocurrencies. There are three main types of crypto charts:

1. Price chart

A price chart shows the price of a cryptocurrency over time. The x-axis shows the date, and the y-axis shows the currency’s price.

2. Volume chart

A volume chart shows the amount of cryptocurrency traded over time. The x-axis shows the date, and the y-axis shows the volume of cryptocurrency traded.

3. Circulating supply chart

A circulating supply chart shows the number of cryptocurrency units in circulation over time. The x-axis shows the date, and the y-axis shows the circulating supply of cryptocurrency units.

How to use crypto charts to make better investment decisions

Crypto charts can be used to assess the health of a cryptocurrency market, and to make better investment decisions.

The first step is to assess the current market conditions. This can be done by looking at the price of a particular cryptocurrency, as well as the number of active users and daily trading volumes.

Once the market conditions have been assessed, it is then important to look at the historical performance of a cryptocurrency. This can be done by looking at its price chart, as well as its volume and active user charts.

Finally, it is also important to look at the technical indicators to get a better understanding of the current state of the cryptocurrency market. These can include the Bollinger bands, RSI, and the MACD.

The most popular crypto charting tools and how to use them

CryptoCharts is a popular crypto charting tool used to track the performance of digital currencies and other cryptocurrencies.

To use CryptoCharts, first open the website and sign in. Then click on the “Charts” tab and select the cryptocurrency or digital asset you want to track.

CryptoCharts will display the latest price and volume information for the selected cryptocurrency. You can also use the charts to find patterns in the price movement and identify potential investment opportunities.

CryptoCharts also offers a variety of other features, such as a market cap list and a news section.

Binance Coin (BNB)

To use Binance Coin’s charting tool, open the website and sign in. Then click on the “Wallets” tab and select the wallet you want to view the BNB chart from.

The Binance Coin chart will display the latest price and volume information for the BNB token. You can also use the charts to find patterns in the price movement and identify potential investment opportunities.

You can also use the Binance Coin chart to find information about the Binance exchange, such as trade volume and hot wallets.

CoinMarketCap

CoinMarketCap is a popular crypto charting tool used to track the performance of all types of digital currencies and assets.

To use CoinMarketCap, first open the website and sign in. Then click on the “Charts” tab and select the cryptocurrency or digital asset you want to track.

CoinMarketCap will display the latest price and volume information for the selected cryptocurrency. You can also use the charts to find patterns in the price movement and identify potential investment opportunities.

CoinMarketCap also offers a variety of other features, such as a market cap list and a news section.

Tips and tricks for reading crypto charts like a pro

There are a few things to keep in mind when analyzing crypto charts:

1. Look for patterns

It can be helpful to look for patterns in order to better understand the current state of a cryptocurrency. For example, if a cryptocurrency is experiencing a dip in price, it may be worth investigating why this is happening. If you see a consistent pattern of price drops over time, this could suggest that there is an underlying issue that needs to be addressed.

2. Consider the currency’s overall market cap

When examining a cryptocurrency’s chart, it’s important to also consider its overall market cap. This figure shows how much money is currently being invested in the currency. If a currency has a high market cap, this may suggest that it is a more valuable investment. Conversely, if a currency has a low market cap, this may suggest that it is less reliable.

3. Watch the trend line

One of the most important things to watch when analyzing a cryptocurrency chart is the trend line. This line indicates whether or not the price of the currency is trending upwards or downwards. If the trend line is moving in the same direction as the price of the currency, this suggests that the trend is stable. If the trend line is moving in a different direction than the price of the currency, this may suggest that the trend is changing.

4. Consider the volume of transactions

Another important thing to watch when analyzing a cryptocurrency chart is the volume of transactions. This figure shows how many transactions have been made in relation to the overall market cap of the currency. If the volume of transactions is high, this may suggest that there is strong demand for the currency. Conversely, if the volume of transactions is low, this may suggest that there is weak demand for the currency.

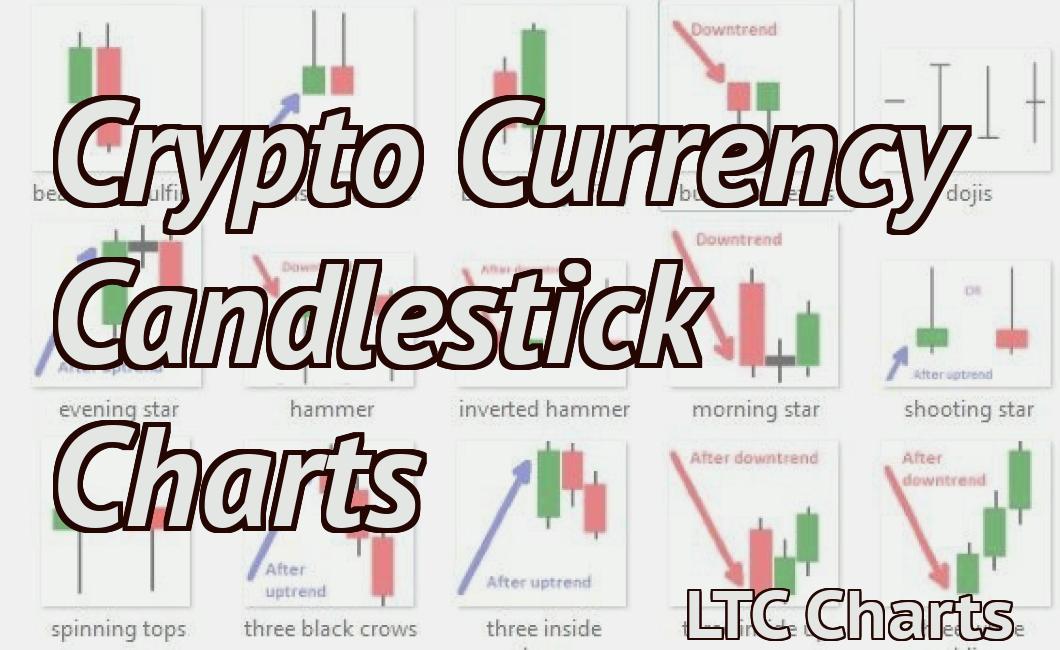

How to interpret different types of crypto chart patterns

There are many different types of crypto chart patterns, and each one has a different meaning.

1. Bullish candle pattern: This pattern typically signals that the price of a cryptocurrency is about to go up. The candles in the pattern will usually be longer than normal, and the price will increase quickly after the pattern is formed.

2. Bearish candle pattern: This pattern typically signals that the price of a cryptocurrency is about to go down. The candles in the pattern will usually be shorter than normal, and the price will decrease quickly after the pattern is formed.

3. Double bottom pattern: This pattern typically signals that the price of a cryptocurrency is about to go up and then down again. The first bottom in the pattern will be lower than the second, and the price will go up after the second bottom is formed.

4. Head-and-shoulders pattern: This pattern typically signals that the price of a cryptocurrency is about to go up or down. The pattern will consist of two peaks, and the price will usually go down after the first peak is formed and go up after the second peak is formed.

The most important things to look for when reading crypto charts

When analyzing crypto charts, the most important things to look for are:

1. How high or low the price has been over the past few days or weeks

2. The trend of the price over time

3. The volume of active trades (the more trades that are taking place, the more liquid the token or coin is)

4. The price action (how the price has moved over the past few minutes or hours)

5. The technical indicators (such as the Bollinger Bands or MACD)

6. The supply and demand metrics (to see how much of a supply and demand imbalance there is for a given token or coin)

How to spot potential trading opportunities using crypto charts

There are a few ways to use crypto charts to spot potential trading opportunities.

1. Look for trends.

One way to look for potential trading opportunities is to look for trends. If the price of a cryptocurrency is trending up or down, that may be an indication that there are opportunities to make an investment in that cryptocurrency.

2. Check out the volatility.

Another way to look for potential trading opportunities is to check out the volatility of the cryptocurrency. Volatility refers to how much the price of a cryptocurrency can change in a short period of time. High volatility may indicate that there are opportunities to make some quick profits by buying and selling the cryptocurrency quickly.

3. Look for indicators.

Some cryptocurrencies may have specific indicators that can be used to spot potential trading opportunities. For example, a cryptocurrency that is trading near its all-time high (ATH) may be an indication that there are opportunities to make some big profits by buying the cryptocurrency at the current price. Conversely, a cryptocurrency that is trading near its all-time low (ATL) may be an indication that there are opportunities to make some big profits by selling the cryptocurrency at the current price.