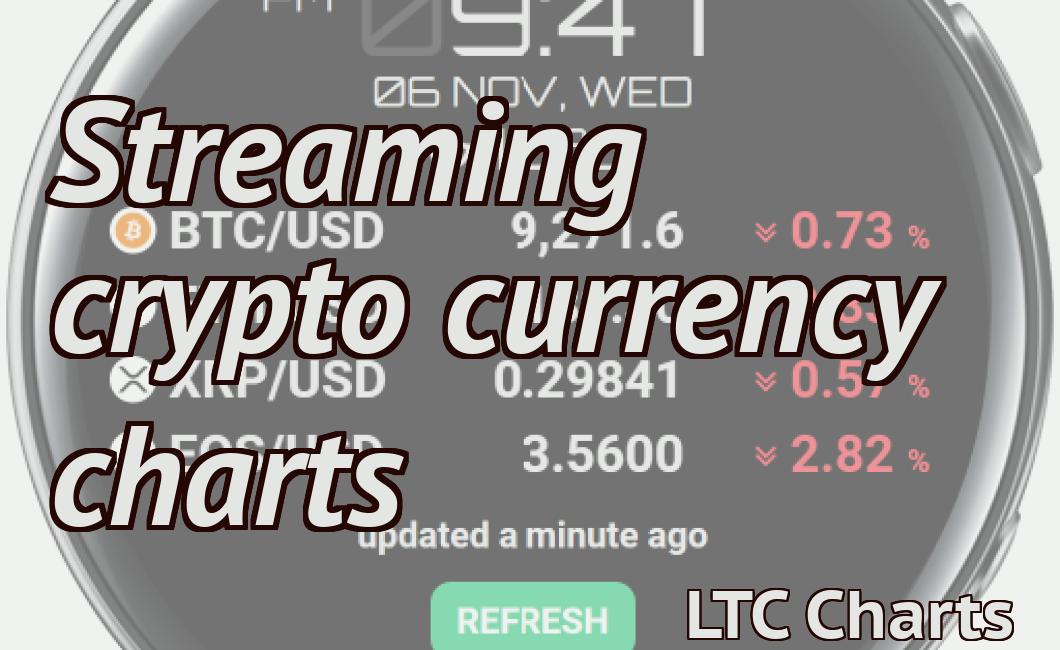

Crypto prices go haywire on Coinbase.

The article discusses how the prices of cryptocurrencies on Coinbase, one of the largest cryptocurrency exchanges, have been fluctuating wildly. The reasons for this are unclear, but it may be due to increased demand or speculation.

Crypto Prices Go Haywire On Coinbase

What Happened?

Cryptocurrencies, like Bitcoin and Ethereum, are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

On Coinbase, users can purchase and sell cryptocurrencies, as well as use them to buy goods and services. On July 26, a bug caused Coinbase’s system to crash, resulting in the loss of $5 million worth of Bitcoin and Ethereum. As a result, cryptocurrency prices on Coinbase soared, going from $280 to $4,000 in a matter of hours.

Why Did Crypto Prices Go Up?

Cryptocurrencies are speculative investments, and their prices are highly volatile. This volatility is caused by a number of factors, including global economic conditions, news events, and regulatory changes.

What Should I Do If I Invest In Cryptocurrencies?

If you are investing in cryptocurrencies, it is important to stay informed about the latest news and developments. You should also exercise caution when making investments, and always consult with a financial advisor before making any decisions.

Why Did Crypto Prices Go Haywire On Coinbase?

Cryptocurrencies are based on blockchain technology, a distributed database that allows for secure, transparent and tamper-proof transactions. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an unknown person or group of people using the name Satoshi Nakamoto. Bitcoin is pseudonymous, meaning that there is no real name associated with it. Each Bitcoin is divisible to eight decimal places (0.00000001 BTC), and has a total supply of 21 million coins.

Bitcoins are created by miners who use powerful computers to solve complex cryptographic problems. When a miner solves a cryptographic problem, they are rewarded with Bitcoin. The more Bitcoin that is mined, the harder the problems become and the more valuable the Bitcoin becomes.

In February of 2018, Coinbase, one of the world’s leading digital currency platforms, announced that it was adding support for Ethereum and Litecoin. Ethereum is a second-generation blockchain platform that uses a different proof-of-work algorithm than Bitcoin. Litecoin is a cryptocurrency that uses a different mining algorithm than Bitcoin.

Shortly after Coinbase announced that it was adding support for Ethereum and Litecoin, prices of Ethereum and Litecoin soared. On Sunday, February 4, 2018, Ethereum was trading at $932.53 USD and Litecoin was trading at $263.24 USD. By the end of the day, Ethereum had climbed to $1,380.92 USD and Litecoin had climbed to $357.12 USD.

On Monday, February 5, 2018, prices of Ethereum and Litecoin continued to surge. By the end of the day, Ethereum was trading at $1,604.10 USD and Litecoin was trading at $376.71 USD.

What Caused Crypto Prices To Go Haywire On Coinbase?

Cryptocurrencies are notoriously volatile, meaning prices can vary greatly from one day to the next. This is especially true for popular digital tokens like Bitcoin and Ethereum, which can see their value swing by hundreds of dollars in a matter of minutes.

There are a number of reasons why crypto prices can fluctuate so much. Some of it has to do with the underlying technology behind cryptocurrencies, while other factors, like political or financial events, can also play a role.

One potential cause of Coinbase’s recent crypto price volatility is a bug that was discovered on the Coinbase platform. The bug caused some users to be inadvertently credited with a large number of Bitcoin Cash tokens. As a result, the value of Bitcoin Cash on Coinbase surged by over 50%, causing a corresponding drop in the value of Bitcoin and Ethereum.

Still, there are many other factors that influence crypto prices, and it’s impossible to predict which ones will have the biggest impact on a given day. Consequently, it’s always best to monitor prices closely and make sure that you understand all of the factors that are influencing them before making any major investing decisions.

What Does This Mean For The Future Of Crypto Prices?

The future of crypto prices is still up in the air, but it's likely that they will continue to rise in the short term. This news confirms that investors are still interested in this sector, and that there is still a lot of potential for growth.

How Will This Affect The Future Of Crypto Prices?

There is no definitive answer to this question as the future of cryptocurrency prices is largely contingent on a number of factors, including but not limited to:

The overall health of the crypto economy

The regulatory environment surrounding cryptocurrencies

The performance of specific cryptocurrencies

The overall market cap of all cryptocurrencies

The price of Bitcoin, Ethereum, and other major cryptocurrencies

While it is impossible to predict the future price movements of cryptocurrencies with certainty, it is generally safe to say that any positive or negative developments affecting the overall health of the crypto economy, the regulatory environment surrounding cryptocurrencies, or the performance of specific cryptocurrencies could have a significant impact on prices.

What Does This Mean For Investors In Crypto Currency?

Cryptocurrency investors should be aware that the SEC has not explicitly endorsed any specific digital asset, but has made it clear that it is monitoring the space. This means that any digital asset that is considered a security must comply with securities laws. This could lead to a decline in prices for digital assets that are not compliant with securities laws, as investors may want to avoid these assets in light of the SEC's actions.

What Does This Mean For The Future Of Coinbase?

Coinbase is one of the most popular and well-known platforms for buying, selling, and storing cryptocurrencies. However, the recent news that the SEC is considering whether to list Bitcoin and other cryptocurrencies as securities has caused some uncertainty in the market.

If Bitcoin and other cryptocurrencies are classified as securities, this could mean that Coinbase would be required to register with the SEC and comply with existing regulations. This would likely make it more difficult for Coinbase to operate, and could lead to increased competition from other platforms.

However, it's still unclear whether or not Bitcoin and other cryptocurrencies will be classified as securities. If they are, this could have a significant impact on the future of Coinbase and the cryptocurrency market as a whole.

How Will This Affect Coinbase In The Future?

Coinbase has been one of the most popular cryptocurrency exchanges in the world. They offer a user-friendly platform and have been able to grow rapidly since they first launched in 2012.

However, there is speculation that they may eventually be forced to comply with new regulations. If this happens, it could lead to them losing some of their appeal to users, and their business could potentially decline.

What Does This Mean For Other Exchanges?

The SEC's decision is likely to have a ripple effect on other exchanges, as it provides a precedent for regulating exchanges. In particular, exchanges will now be more likely to request customer data from their customers in order to comply with anti-money laundering and Know Your Customer regulations.

How Will This Affect The Crypto Market As A Whole?

There is no clear answer to this question as the effect that a potential ban by the Chinese government would have on the cryptocurrency market as a whole is difficult to predict. However, if the ban were to occur, it could lead to a decrease in the value of cryptocurrencies, as investors may decide to sell off their holdings. Additionally, it could also lead to a decrease in the number of people investing in cryptocurrencies, as they may be less interested in buying them if they are not legal in China.

What Are Experts Saying About The Recent Price Swings?

There is no single answer to this question as opinions will vary depending on the expert. However, some experts believe that recent price swings are due to a number of factors, including demand from buyers and sellers, global economic conditions, and cryptocurrency volatility.