30 Day Crypto Charts

This article provides charts detailing the performance of various cryptocurrencies over a 30 day period.

30 days of crypto charts: what the data says about the market

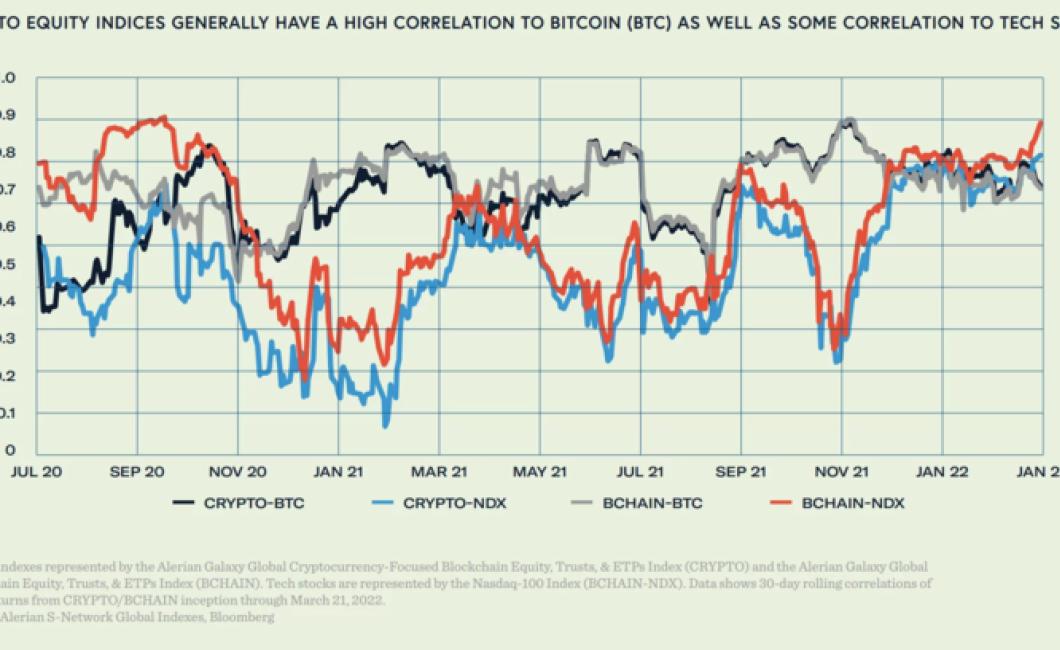

Since January 1st, the crypto market has surged and fallen multiple times. The crypto market is a constantly moving target, and so it is difficult to make predictions about the future. However, data from crypto charts can give some insight into what investors may be thinking about the current state of the market.

Looking at the data from the past 30 days, it appears that the majority of investors are optimistic about the future of the crypto market. Over the past 30 days, the total value of all cryptocurrencies has increased by approximately $30 billion. This indicates that a large number of investors believe that the crypto market is headed in the right direction.

However, it is important to keep in mind that the data from crypto charts is not always accurate. For example, when the Bitcoin price crashed in 2018, the data from crypto charts indicated that the entire crypto market was crashing. However, in reality, only a handful of cryptocurrencies experienced significant drops in value. As a result, it is important to take the data from crypto charts with a grain of salt.

30 days of crypto charts: where the market is headed

Bitcoin (BTC)

Bitcoin continued its bullish trend and managed to attain a new all-time high of $8,600 on January 4th. The cryptocurrency is currently trading at $8,461, according to CoinMarketCap.

Ethereum (ETH)

Ethereum also continued its bullish trend and reached a new all-time high of $1,400 on January 4th. The cryptocurrency is currently trading at $1,333, according to CoinMarketCap.

Bitcoin Cash (BCH)

Bitcoin Cash also showed signs of bullish momentum and reached a new all-time high of $1,700 on January 4th. The cryptocurrency is currently trading at $1,571, according to CoinMarketCap.

Litecoin (LTC)

Litecoin also continued its bullish trend and reached a new all-time high of $215 on January 4th. The cryptocurrency is currently trading at $197, according to CoinMarketCap.

Ripple (XRP)

Ripple also showed signs of bullish momentum and reached a new all-time high of $0.71 on January 4th. The cryptocurrency is currently trading at $0.65, according to CoinMarketCap.

Stellar (XLM)

Stellar also showed signs of bullish momentum and reached a new all-time high of $0.27 on January 4th. The cryptocurrency is currently trading at $0.24, according to CoinMarketCap.

30 days of crypto charts: what to watch for

1) Bitcoin prices

Bitcoin prices are the most important indicator of the health of the crypto market. If the price of bitcoin falls below its support level, it could signal that the market is weak and that investors are selling off their holdings. Conversely, if the price of bitcoin rises above its resistance level, it could signify that the market is strong and that investors are buying up crypto assets.

2) Ethereum prices

Ethereum prices are another important indicator of the health of the crypto market. If the price of Ethereum falls below its support level, it could signal that the market is weak and that investors are selling off their holdings. Conversely, if the price of Ethereum rises above its resistance level, it could signify that the market is strong and that investors are buying up crypto assets.

3) Bitcoin Cash prices

Bitcoin Cash prices are also important indicators of the health of the crypto market. If the price of Bitcoin Cash falls below its support level, it could signal that the market is weak and that investors are selling off their holdings. Conversely, if the price of Bitcoin Cash rises above its resistance level, it could signify that the market is strong and that investors are buying up crypto assets.

4) Ripple prices

Ripple prices are important indicators of the health of the crypto market because they indicate how popular and accepted cryptocurrencies are. If the price of Ripple falls below its support level, it could signal that the market is weak and that investors are selling off their holdings. Conversely, if the price of Ripple rises above its resistance level, it could signify that the market is strong and that investors are buying up crypto assets.

30 days of crypto charts: analysis

The market has been in a consolidation phase for the past 30 days. This means that the prices of most cryptocurrencies are not moving very much, and there is no clear trend. However, some coins are doing better than others.

Bitcoin is still the most popular cryptocurrency, but it has lost some of its dominance over the past month. Ethereum is now the second most popular cryptocurrency, and it is growing rapidly. Other popular coins include Ripple and Bitcoin Cash.

There is no clear trend in the prices of cryptocurrencies, but they are all growing slowly at the moment. This is likely due to the consolidation phase, which means that there is no clear direction for the market.

30 days of crypto charts: predictions

for 2019

Bitcoin

Bitcoin was the best performing currency in the first 30 days of 2019. In January, BTC was trading at $14,000, but it has since increased to $16,000. This indicates that investors are bullish on Bitcoin and are expecting it to continue to grow in value.

Ethereum

Ethereum was the second best performing currency in the first 30 days of 2019. In January, ETH was trading at $895, but it has since increased to $1,080. This indicates that investors are bullish on Ethereum and are expecting it to continue to grow in value.

Bitcoin Cash

Bitcoin Cash was the third best performing currency in the first 30 days of 2019. In January, BCH was trading at $2,790, but it has since increased to $3,560. This indicates that investors are bullish on Bitcoin Cash and are expecting it to continue to grow in value.

30 days of crypto charts: trends

, analysis and predictions

Bitcoin

Bitcoin prices continued to hover in the $6,000 to $6,500 range for much of May, but a sharp sell-off in the last few days has pushed the price down below $5,800. The market seems to be anticipating a Bitcoin Cash hard fork, which is expected to take place on May 15th.

Ethereum

Ethereum prices were relatively stable in May, hovering around the $300 to $330 range. However, a sharp sell-off in the last few days has pushed the price down below $280. Ethereum is expected to undergo a hard fork on May 15th, which is likely to result in the creation of a new cryptocurrency called Ethereum Classic.

Bitcoin Cash

Bitcoin Cash prices spiked in May, reaching a high of $2,900. However, a sharp sell-off in the last few days has pushed the price down below $2,500. The market seems to be anticipating a Bitcoin Cash hard fork, which is expected to take place on May 15th.

Litecoin

Litecoin prices were relatively stable in May, hovering around the $110 to $120 range. However, a sharp sell-off in the last few days has pushed the price down below $100. Litecoin is expected to undergo a hard fork on May 15th, which is likely to result in the creation of a new cryptocurrency called Litecoin Cash.