Crypto Charts How To Read

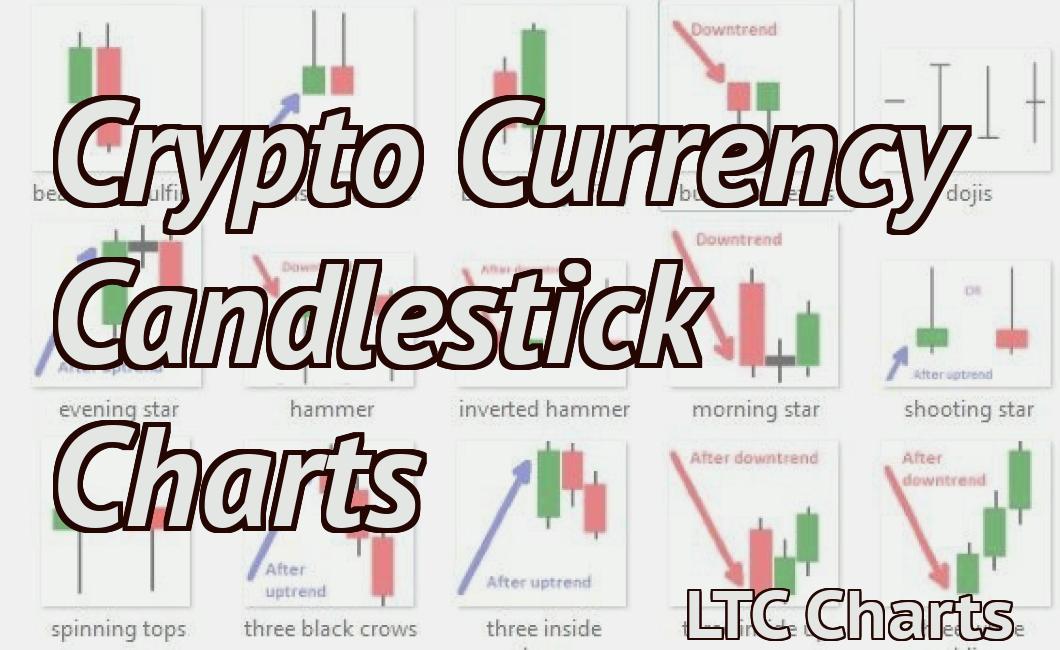

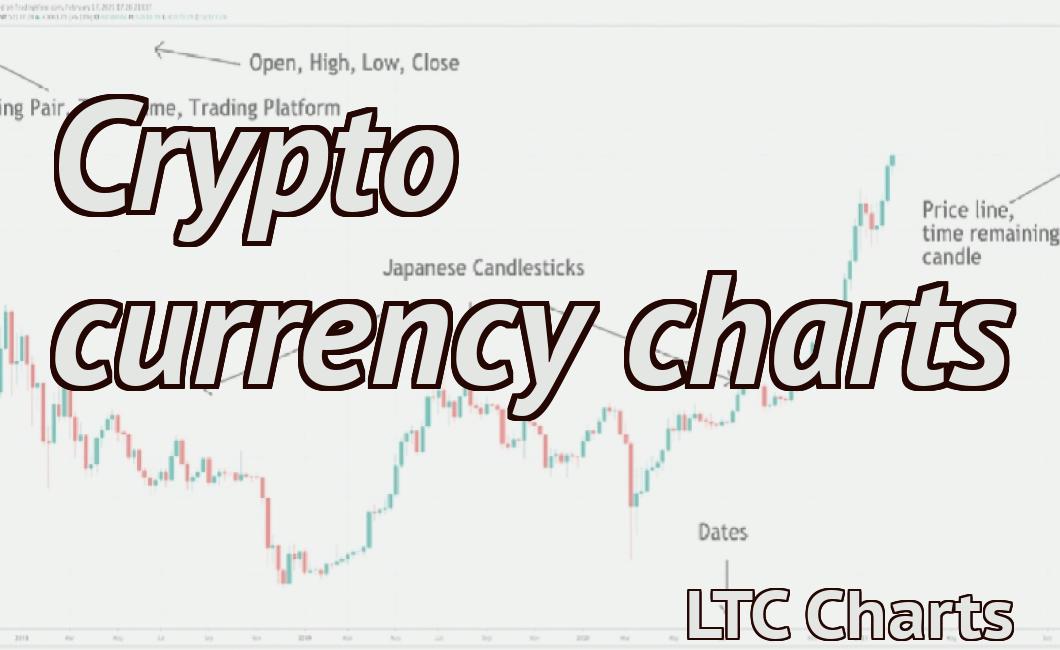

If you're new to the world of cryptocurrency, you may be wondering how to read crypto charts. Thankfully, it's not as complicated as it may seem. In this article, we'll show you how to read crypto charts so that you can make informed investment decisions. Crypto charts can be a little daunting at first, but they're actually quite simple once you know what you're looking for. The most important thing to remember is that each chart represents the price of a particular cryptocurrency over time. There are two main types of crypto charts: line charts and candlestick charts. Line charts simply plot the price of a cryptocurrency over time, while candlestick charts provide more detailed information such as the opening and closing prices, highs and lows, and the trading volume. Once you know how to read crypto charts, you'll be able to spot trends and make informed investment decisions. So, let's get started!

How to read crypto charts

Cryptocurrency charts are often divided into two main categories: technical analysis and fundamentals.

Technical analysis is the study of patterns on charts in order to predict future price movements. It is often used to make investment decisions based on short-term trends.

Fundamental analysis looks at the underlying technology, economics, and other factors that influence the price of a cryptocurrency. It is used to determine whether a cryptocurrency is overvalued or undervalued.

The difference between bearish and bullish markets

A bearish market is a market where the value of stocks, bonds, and other assets is decreasing. This can be due to a number of reasons, including fear of future economic conditions, concerns about company performance, or a general pessimism about the future.

A bullish market is a market where the value of stocks, bonds, and other assets is increasing. This can be due to a number of reasons, including optimism about the future, expectations of strong company performance, or a general optimism about the future.

What do crypto charts mean?

Cryptocurrencies are complex and ever-changing financial instruments. Their prices are based on a number of factors, including supply and demand, news events and global sentiment. Cryptocurrency charts can help you stay up to date on price movements and understand how different cryptocurrencies are performing.

How to make sense of cryptocurrency charts

Cryptocurrency charts can be quite confusing. It can be hard to understand what is happening, and what is important.

There are a few things you can do to make sense of cryptocurrency charts:

1. Look at the overall trend.

It is important to look at the overall trend of the cryptocurrency. This will help you understand how the price is moving over time, and what is important.

2. Look at the price action.

Price action is important when it comes to cryptocurrency charts. This is how the price of the cryptocurrency is changing over time.

3. Look at the technical indicators.

Technical indicators can help you understand how the cryptocurrency is performing. These indicators can include the Bollinger Bands, the MACD, and the RSI.

How to use technical analysis when trading cryptocurrencies

Technical analysis is a method of trading that uses charts and indicators to predict future price movements. Technical analysis can help you identify patterns in the market that can provide clues about where the price of a cryptocurrency is likely to go.

When using technical analysis, it is important to be aware of the fact that it is a tool that can be used to make investment decisions. Therefore, it is important to consult with a financial advisor before using technical analysis to trade cryptocurrencies.

How to read cryptocurrency market trends

Cryptocurrency market trends are difficult to predict, but there are a few methods that can be used to try to understand what is happening.

One way to try to understand cryptocurrency market trends is to look at the price of specific cryptocurrencies over time. This can be useful to see if there is a trend in the prices of different cryptocurrencies, and to understand how the prices are changing over time.

Another way to try to understand cryptocurrency market trends is to look at the number of transactions that are being made. This can help to see how active the cryptocurrency markets are, and to understand which cryptocurrencies are being used most.

Finally, cryptocurrency market trends can also be monitored through social media platforms. This is because people often share information about cryptocurrency market trends on social media, which can give a more general understanding of what is happening.

What are the most important indicators to look for in crypto charts

?

The most important indicators to look for in crypto charts are the price, volume, and moving averages.