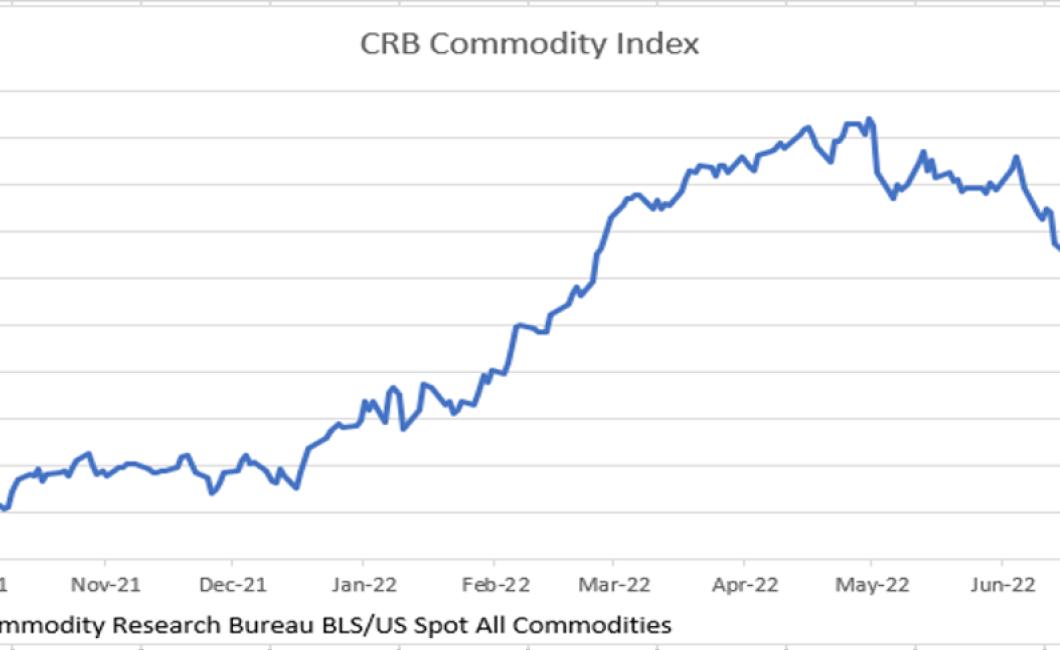

What do crypto depth charts look like before a downturn?

Crypto depth charts are visual representations of the order book for a given cryptocurrency. They usually have three components: the bid side, the ask side, and the last trade price. The bid side is a list of all the buy orders that are currently being made for a given cryptocurrency. The ask side is a list of all the sell orders that are currently being made for a given cryptocurrency. The last trade price is the most recent price at which a trade was made. Depth charts can be used to predict future prices by looking at the bids and asks that are currently being made. If there are more bids than asks, it is likely that the price will go up. If there are more asks than bids, it is likely that the price will go down.

How to read a crypto depth chart to predict market movements

Crypto depth charts are a great way to understand the current market conditions and predict future movements.

A crypto depth chart is a graphical representation of the liquidity and supply of a particular cryptocurrency. The chart displays the number of coins available for purchase as well as the price at which those coins are being sold.

The height of the bars on a crypto depth chart indicates the number of coins available for purchase. The further up the bar, the more coins are available for purchase. The width of the bars indicates the price at which those coins are being sold.

The color of the bars on a crypto depth chart indicates the liquidity of the coin. Green bars indicate high liquidity, while red bars indicate low liquidity.

What do crypto depth charts reveal about market conditions?

Crypto depth charts can help traders and investors identify patterns in the market and make informed decisions. Patterns that may be indicative of a bull or bear market, for example, may be revealed by the position of individual coins in the depth chart. Additionally, changes in the price of a coin may be indicative of shifts in sentiment in the market.

How to use crypto depth charts to your advantage

Crypto depth charts are a powerful tool that can help you understand the current state of the cryptocurrency market.

By understanding how much money different cryptocurrencies have been trading for, you can determine which cryptocurrencies are experiencing the most demand and which cryptocurrencies are experiencing the least demand.

This information can help you make informed decisions when trading cryptocurrencies.

The benefits of using crypto depth charts

Crypto depth charts can help investors make informed decisions when investing in cryptocurrencies.

Crypto depth charts allow you to see the performance of different cryptocurrencies over time, and how their prices have varied. This can help you to make informed investment decisions, and to determine which cryptocurrencies are worth investing in.

Crypto depth charts can also help you to identify which cryptocurrencies are worth holding for the long term, and which are likely to experience price volatility over the short term. By understanding the performance of different cryptocurrencies, you can ensure that you are taking advantage of the best opportunities available.

How to make the most out of crypto depth charts

If you are looking for a way to make the most out of crypto depth charts, it is important to understand how each chart works.

A crypto depth chart is a visual representation of a cryptocurrency's price movement over time. It shows how much money a specific cryptocurrency has changed hands throughout the day or week.

When you are looking at a crypto depth chart, it is important to understand the following:

The horizontal axis shows the time period from 0 to 24 hours.

The vertical axis shows the price of the cryptocurrency.

The size of the circles shows how much money has been exchanged for that cryptocurrency during that time period.

The colors of the circles show how popular that cryptocurrency is at that moment.

The size and color of the circles can change depending on how much money is being exchanged for that cryptocurrency.

It is important to remember the following when looking at a crypto depth chart:

1) The size and color of the circles change based on how much money is being exchanged for that cryptocurrency at that moment.

2) The horizontal axis shows the time period from 0 to 24 hours.

3) The vertical axis shows the price of the cryptocurrency.

4) The size of the circles shows how much money has been exchanged for that cryptocurrency during that time period.

The ins and outs of crypto depth charts

Cryptocurrencies are often traded on decentralized exchanges or over-the-counter (OTC) markets. Most exchanges list a limited number of coins and therefore offer a depth chart that shows the prices of different coins at different times.

When you first open an account with an exchange, you will be given a limited number of trading pairs in which to trade. This means that you will not be able to see the prices of other coins.

To see the prices of other coins, you will need to use a crypto depth chart. A crypto depth chart is a chart that shows the prices of different coins at different times.

The crypto depth chart is divided into two sections: the top section is called the order book and the bottom section is called the market.

The order book is where buyers and sellers list their orders. The order book is updated every few seconds and shows the latest price at which each coin is being traded.

The market is where the coins are actually traded. The market is updated every few seconds and shows the latest price at which each coin is being traded.

What you need to know about crypto depth charts

Cryptocurrencies are built on blockchain technology, which is a distributed database that contains a public ledger of all cryptocurrency transactions. Cryptocurrency wallets store digital copies of these public ledgers.

Cryptocurrency prices are determined by supply and demand. The greater the demand for a particular cryptocurrency, the higher its price will be. Conversely, if there is a lack of demand for a cryptocurrency, its price will be lower.

Cryptocurrency exchanges allow buyers and sellers to trade cryptocurrencies. The size of a trade can determine the price of a cryptocurrency. A large trade will result in a higher price, while a small trade will result in a lower price.

The lowdown on crypto depth charts

Cryptocurrencies are ranked according to the depth of their market capitalization. The deeper a cryptocurrency’s market cap is, the more valuable it is.

Cryptocurrencies are often ranked according to their market caps. The market caps of cryptocurrencies are measured by multiplying the price of a given cryptocurrency by the total number of coins in circulation. The more valuable a cryptocurrency is, the higher its market cap.

How to get the most out of crypto depth charts

Crypto depth charts are a great way to get a quick snapshot of the current state of the crypto markets.

Here are some tips to get the most out of crypto depth charts:

1. Use crypto depth charts to stay informed about the latest market trends.

2. Compare different crypto assets to see which ones are performing the best.

3. Use crypto depth charts to help you make informed investment decisions.

The secret to success with crypto depth charts

Crypto depth charts are a powerful tool for understanding a cryptocurrency's market potential. By plotting the price of a cryptocurrency over time, you can see how its price has fluctuated and what factors have influenced its value.

Depth charts are a great way to visualize the dynamics of the cryptocurrency market and spot opportunities for investment. By understanding how a cryptocurrency's price has fluctuated, you can better predict future movements.

When creating your own crypto depth chart, it is important to keep the following tips in mind:

1. Use a consistent time frame

When creating your crypto depth chart, it is important to use a consistent timeframe. This will help you to better understand the overall dynamics of the cryptocurrency market.

2. Track historical prices

When creating your crypto depth chart, it is important to track historical prices. This will help you to better understand how value has been determined in the past.

3. Note trends

When creating your crypto depth chart, it is important to note trends. This will help you to better understand the overall dynamics of the cryptocurrency market.

Make the most of your crypto depth charts

Crypto depth charts show the market sentiment on a certain coin at a given point in time. This information can be used to help make informed decisions when trading cryptocurrencies.

Keep in mind that crypto depth charts are not foolproof, and they cannot predict the future movements of a coin. However, they can provide useful information about the current state of the market.

Consider using crypto depth charts to:

Understand how the market is feeling about a particular cryptocurrency.

Identify whether a cryptocurrency is over or undervalued.

Decide whether it's worth investing in a particular coin.

Do your own research before trading cryptocurrencies. However, using crypto depth charts as a guide can help you make informed decisions.