I'm addicted to looking at crypto charts.

Looking at crypto charts has become an addiction for many people. They find themselves scrolling through various online exchanges and comparing prices. Some even spend hours looking at different patterns and analyzing them.

Why do Cryptocurrency Traders Look at Charts?

Cryptocurrency traders look at charts to help them predict future prices and movements of the different cryptocurrencies. Cryptocurrencies are complex and highly volatile, which makes it difficult for most people to predict their future prices. Charts allow traders to see the price movement of a particular cryptocurrency over time and make predictions about where it is likely to go next.

How to Read Crypto Charts for Beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To read cryptocurrency charts, you first need to find a crypto exchange that trades the specific coin you are interested in. Once you have found an exchange, you will need to sign up for an account. After you have signed up, you will need to find the currency you are interested in trading. To find the currency, you will need to look at the “market cap” of the coin. The market cap is the total value of the coin in circulation. The higher the market cap, the more valuable the coin.

To read cryptocurrency charts, you will first need to find the coin you are interested in trading.

Once you have found the coin, you will need to find the “market cap” of the coin. The market cap is the total value of the coin in circulation. The higher the market cap, the more valuable the coin. To find the market cap, you will need to look at the “coin price” column on the right-hand side of the chart. The coin price is the price of the coin on the exchange.

To read cryptocurrency charts, you will next need to find the “supply” and “demand” columns. The supply column shows how many coins are in circulation. The demand column shows how many coins are being bought on the exchange.

To read cryptocurrency charts, you will next need to find the “overall trend” column. The overall trend shows how the price of the coin is changing over time.

To read cryptocurrency charts, you will lastly need to find the “high” and “low” columns. The high and low columns show how high and low the price of the coin was on the exchange.

The Different Types of Crypto Charts

Cryptocurrency charts are an essential part of any trader’s toolkit. They can help you to identify trends, spot market corrections, and predict future price movements.

There are three main types of cryptocurrency charts:

1. Price charts

Price charts show the price of a cryptocurrency over time. They can be simple or complex, and can use a variety of timeframes (e.g. daily, weekly, monthly, etc.).

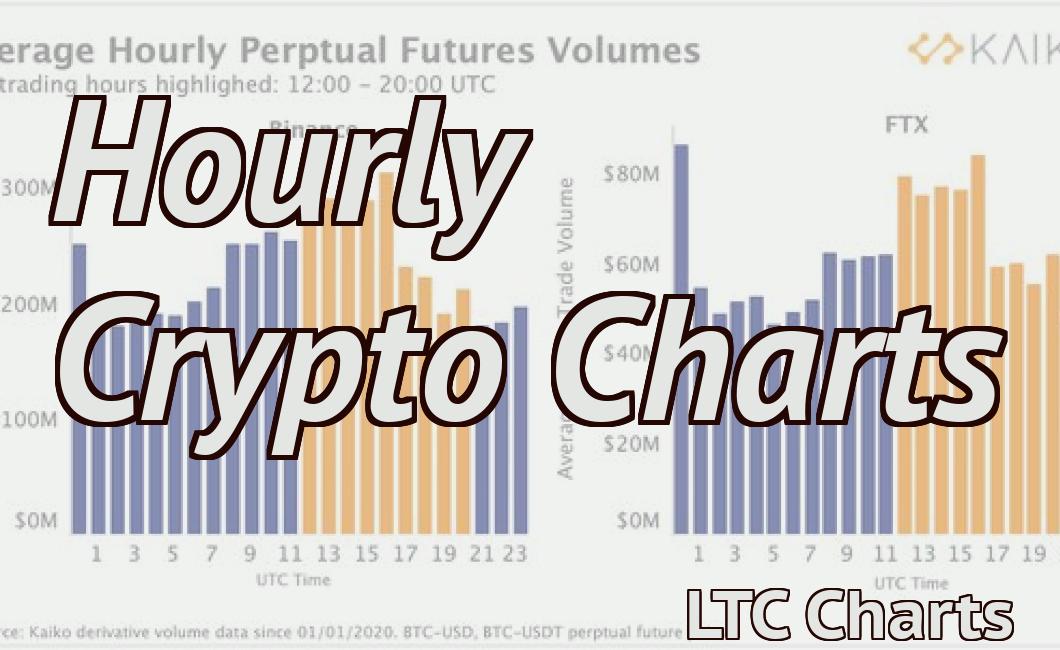

2. Volume charts

Volume charts show the amount of cryptocurrency traded over time. They can be simple or complex, and can use a variety of timeframes (e.g. daily, weekly, monthly, etc.).

3. News charts

News charts show the latest news or events related to a cryptocurrency. They can be simple or complex, and can use a variety of timeframes (e.g. daily, weekly, monthly, etc.).

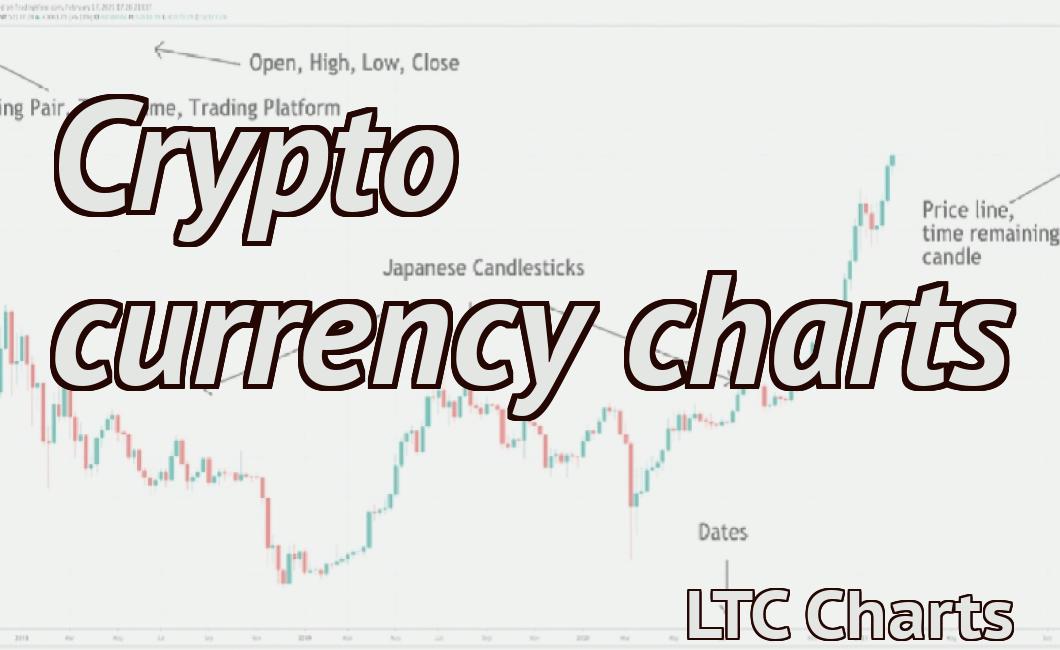

What do Candlesticks Tell Us About the Market?

Candlesticks indicate the price of a security over a specific period of time. The width of the candle represents the open, or high, price, and the length of the candle represents the close, or low, price.

How to Use Technical Analysis to Trade Cryptocurrencies

Technical analysis is a form of analysis that looks at the price and volume of assets to try and determine trends. This can help traders make informed decisions about whether to buy or sell assets.

There are a few steps that you can take to use technical analysis to trade cryptocurrencies.

1. Look at the historical prices of assets. This will give you an idea of what prices are typically seen in the market.

2. Look at the price charts to see if there are any specific patterns that are being repeated. This can help you identify whether a particular asset is over or undervalued.

3. Compare the prices of different assets to see if there is a correlation between them. This can help you decide which assets to buy or sell.

Trading Volume: What Does It Mean?

Trading volume is simply the total number of trades that have been made in a particular security during a given trading day. It is a key indicator of liquidity, which is the ability of a security to be bought and sold quickly and at fair prices.

Support and Resistance Levels in Trading

The support and resistance levels in trading are important because they define the boundaries of a trading range. When the price of a security is below the support level, investors may be inclined to buy the security, since they believe that the price will rise and that the security is undervalued. Conversely, when the price of a security is above the resistance level, investors may be inclined to sell the security, since they believe that the price will fall and that the security is overvalued.

What are Fibonacci Retracements and How to Use Them

A Fibonacci retracement is a technical analysis tool that is used to identify the level of support and resistance that a stock may be facing. The Fibonacci retracement can be used to determine when a stock may be oversold or overbought.

To use a Fibonacci retracement, you will need to identify the previous high and low prices for the stock. You will then calculate the Fibonacci retracement by dividing the previous high price by the previous low price. The resulting number will indicate the level of support or resistance that the stock may be facing.

The MACD Indicator: How to Use It

The MACD Indicator is a technical analysis indicator that helps traders determine the trend of an asset. The MACD is composed of two moving averages, the MACD Line and the MACD Divergence.

The MACD Line is a line that shows the average of the two moving averages. The MACD Divergence is a line that shows the difference between the two moving averages.

When the MACD Line is above the MACD Divergence, the trend is up. When the MACD Line is below the MACD Divergence, the trend is down.

Pivot Points in Trading: What They Are and How to Use Them

Pivot points are used in technical analysis to help traders identify potential buying and selling opportunities. Pivot points are defined as points at which the price of an asset moves from its previous trading range.

There are two types of pivot points: interim and definitive. An interim pivot point is a point at which the asset has moved slightly outside of its previous trading range but remains within the same trend. A definitive pivot point is a point at which the asset has moved significantly outside of its previous trading range and is no longer part of the same trend.

To use pivot points in trading, first find the asset’s current trading range. Next, locate the asset’s interim pivot point. Finally, locate the asset’s definitive pivot point. If the asset’s current price is within the asset’s trading range, then the asset’s current price is likely within the asset’s interim and definitive pivot points. If the asset’s current price is outside of the asset’s trading range, then the asset’s current price is likely above or below the asset’s interim and definitive pivot points.

Crypto Trading Tips for Beginners

Cryptocurrencies are a new and exciting investment opportunity, but like any investment, there are risks involved. If you're new to trading cryptocurrencies, here are some tips to help you get started:

1. Do your research: Before you start trading cryptocurrencies, make sure you have a good understanding of what they are and what they represent. Cryptocurrencies are complex systems with a lot of moving parts, so it's important to understand the basics before you invest.

2. Buy low and sell high: When you first start trading cryptocurrencies, it's important to remember that the prices can be volatile. So, it's important to buy coins when they're low and sell them when they're high. This will help you make money while avoiding too much risk.

3. Stay disciplined: When you start trading cryptocurrencies, it's important to remember that you are trading a highly volatile asset. So, it's important to stay disciplined and avoid over-investing. This will help you avoid getting stuck with a losing position.

4. Don't get too greedy: When you first start trading cryptocurrencies, it's important to remember that the prices can be volatile. So, it's important to stay disciplined and avoid getting too greedy. This will help you avoid getting stuck with a losing position.

5. Don't invest more than you can afford to lose: When you start trading cryptocurrencies, it's important to remember that the prices can be volatile. So, it's important to stay disciplined and avoid over-investing. This will help you avoid getting stuck with a losing position.