How to read crypto prices?

This article provides an overview of how to read crypto prices. It covers the basics of what to look for when reading crypto prices, including the different ways to read them and what factors can affect them.

How to read crypto prices – a beginner’s guide

Crypto prices are always fluctuating, so it can be hard to keep up. Here’s a beginner’s guide to reading crypto prices:

1. Look at the current price. This is the most important thing to focus on.

2. Look at the 24-hour price. This is the most recent price and is more accurate than the average price.

3. Look at the 7-day price. This is a longer-term trend and can give you a better idea of where the cryptocurrency is headed.

4. Watch for news affecting the cryptocurrency. This can Affect the price in a positive or negative way.

How to interpret crypto prices – what do they mean?

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

How to make sense of crypto prices – a step-by-step guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To make sense of crypto prices, you need to understand three things:

1. What is a cryptocurrency?

A cryptocurrency is a digital or virtual token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

2. What is a blockchain?

A blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as "completed" blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the block chain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

3. What is a price of a cryptocurrency?

The price of a cryptocurrency is the value of a single unit of that cryptocurrency. This value can be expressed in various ways, including USD, BTC, ETH, or any other accepted currency.

How to decode crypto prices – what are the key indicators?

There is no one definitive answer to this question. However, some key indicators that may be helpful in decoding crypto prices include:

1. The overall market cap of a cryptocurrency

2. The number of active addresses (users who have added coins to their wallets)

3. The popularity of a cryptocurrency among investors and traders

4. The trading volume of a cryptocurrency

How to understand crypto prices – an essential guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are traded on exchanges and can also be used to purchase goods and services. Bitcoin, the most popular cryptocurrency, has been increasing in value rapidly and was worth more than $20,000 as of November 2017.

How to decipher crypto prices – a comprehensive guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Their price is determined by supply and demand on decentralized exchanges, as well as by global events and trends.

To understand cryptocurrency prices, you need to understand three things: the supply and demand of cryptocurrency, the technology behind cryptocurrencies, and the global events and trends affecting cryptocurrencies.

1. The supply and demand of cryptocurrency

The supply of cryptocurrency is determined by the number of tokens that have been created and released into the market. The total number of tokens in circulation is called the “supply.” The number of tokens that are available for purchase is called the “demand.”

The demand for cryptocurrency is determined by the number of people who want to buy and use the tokens. The number of people who want to buy a certain cryptocurrency is called the “market cap.” The market cap is the total value of all cryptocurrencies in circulation.

2. The technology behind cryptocurrencies

Cryptocurrencies use a blockchain technology to secure their transactions and to control the creation of new units. A blockchain is a digital ledger of all cryptocurrency transactions. Each block in the blockchain contains a list of transactions that have been made. The blockchain is decentralized, meaning it is not subject to government or financial institution control.

3. Global events and trends affecting cryptocurrencies

Global events and trends affect the demand for and supply of cryptocurrency. For example, when the price of bitcoin goes up, more people want to buy it. This increase in demand causes the price of bitcoin to go up.

Likewise, when the price of bitcoin goes down, more people want to sell it. This decrease in demand causes the price of bitcoin to go down.

How to read crypto prices – a complete guide

Crypto prices are constantly moving and can be quite volatile. Before you start trading, it’s important to understand how to read crypto prices.

The most important thing to remember is that crypto prices are not set in stone. They are highly volatile and can change quickly.

To read crypto prices, you first need to understand the different types of markets.

The three main markets for cryptocurrencies are:

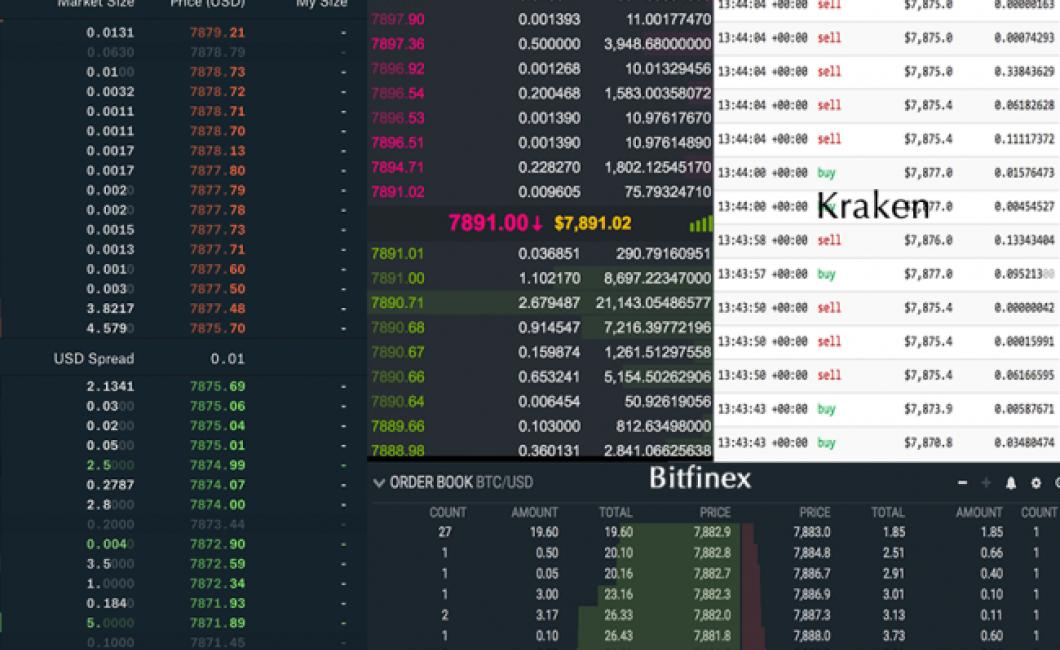

1) Crypto exchanges

2) Fiat exchanges

3) P2P trading platforms

Crypto exchanges are where you can buy and sell cryptocurrencies. They typically have a set price for each digital asset and allow you to trade between different cryptocurrencies.

Fiat exchanges are where you can buy and sell traditional currencies, such as the US dollar, euro, and Japanese yen, using cryptocurrencies.

P2P trading platforms are where you can buy and sell cryptocurrencies directly with other users. This is the most popular way to trade cryptocurrencies.

To read cryptocurrency prices, you need to understand two things: the price of a cryptocurrency and the volume of that cryptocurrency.

The price of a cryptocurrency is the amount of money that you need to pay to buy that cryptocurrency.

The volume of a cryptocurrency is the number of coins that have been traded on the crypto exchange over the past 24 hours.

To read cryptocurrency prices, you need to understand both of these things.

The first thing you need to do is find the price of a cryptocurrency on an exchange. This can be done by searching for that cryptocurrency on the exchange’s website or by using a cryptocurrency price tracker.

Once you have found the price of a cryptocurrency, you need to find the volume of that cryptocurrency. This can be done by using a cryptocurrency volume tracker.

Once you have found the volume of a cryptocurrency, you can start to read the prices of other cryptocurrencies based on that volume.