Candle Charts For Crypto

If you're looking to trade cryptocurrencies, it's important to know how to read a candle chart. In this article, we'll explain what crypto candle charts are and how to interpret them.

How to Use Candle Charts to Trade Crypto

Candle charts are a great way to track and trade cryptocurrencies. Simply create a chart with candles that represent your chosen cryptocurrency and track the price over time.

When you see a candle that is close to the bottom of the chart, this is usually a good time to sell your cryptocurrency. Conversely, when you see a candle that is close to the top of the chart, this is usually a good time to buy your cryptocurrency.

The Benefits of Trading with Candle Charts

1. You can see the trend of a market

Candle charts can help you see the trend of a market. If you're looking to buy or sell stocks, you can use candle charts to see when the market is going up or down. You can also use candle charts to see when the market is in a buy or sell territory.

2. You can get an idea of when a stock is overpriced or undervalued

Candle charts can also help you see when a stock is overpriced or undervalued. If you're looking to buy a stock, you can use candle charts to see when the stock is at a good price. If you're looking to sell a stock, you can use candle charts to see when the stock is at a good price.

3. You can use candle charts to time your trades

You can also use candle charts to time your trades. If you're looking to buy a stock, you can use a candle chart to see when the stock is at a good price. If you're looking to sell a stock, you can use a candle chart to see when the stock is at a good price.

The Different Types of Crypto Candle Charts

There are three main types of crypto candle charts:

1. Time-based candle charts

2. Volume-based candle charts

3. Weighted average price (WAP) candles

Each of these types of charts has its own advantages and disadvantages. We'll explore each in more detail below.

Time-Based Crypto Candle Charts

Time-based crypto candle charts are the simplest type of chart and are usually the most popular. They show the price of a cryptocurrency over time, usually in candles.

The advantage of time-based crypto candle charts is that they're easy to understand. You can see the price movement over time, and you can see how the price has changed relative to other cryptocurrencies.

The disadvantage of time-based crypto candle charts is that they don't provide a lot of information. You can't see how the price is performing relative to other cryptocurrencies, or how the price is performing at any specific point in time.

Volume-Based Crypto Candle Charts

Volume-based crypto candle charts are similar to time-based crypto candle charts, but they also show how much cryptocurrency has been traded over time. This information can help you understand how active the market is and how volatile the price is.

The advantage of volume-based crypto candle charts is that they provide more information than time-based crypto candle charts. You can see how the price is performing relative to other cryptocurrencies, as well as how the price is performing at any specific point in time.

The disadvantage of volume-based crypto candle charts is that they're more complex than time-based crypto candle charts. You have to understand how volume works in order to use them properly.

Weighted Average Price (WAP) Candles

Weighted average price (WAP) candles are the most complex type of crypto candle chart. They show the price of a cryptocurrency over time, but they also show how the price has changed relative to other cryptocurrencies.

The advantage of weighted average price (WAP) candles is that they provide a lot of information. You can see how the price is performing relative to other cryptocurrencies, as well as how the price is performing at any specific point in time.

The disadvantage of weighted average price (WAP) candles is that they're more complex than time-based or volume-based crypto candle charts. You need to understand how weighted average price (WAP) works in order to use them properly.

How to Read a Crypto Candle Chart

Crypto candle charts are used to help traders and investors understand the dynamics of a given cryptocurrency market. Candle charts are a simple way to visualize the daily and weekly price changes for a given cryptocurrency.

To read a crypto candle chart, you first need to identify the candles that represent the current price of the cryptocurrency. The candles will be represented by circles with different colors. The colors will correspond to the prices at which the candles were formed.

Next, you need to identify the trend that the cryptocurrency is following. This can be done by looking at the direction of the candles or by studying the size and shape of the candles.

Finally, you need to examine the supply and demand factors that are affecting the price of the cryptocurrency. This can be done by looking at the size and shape of the candles or by studying the overall trends that are being followed.

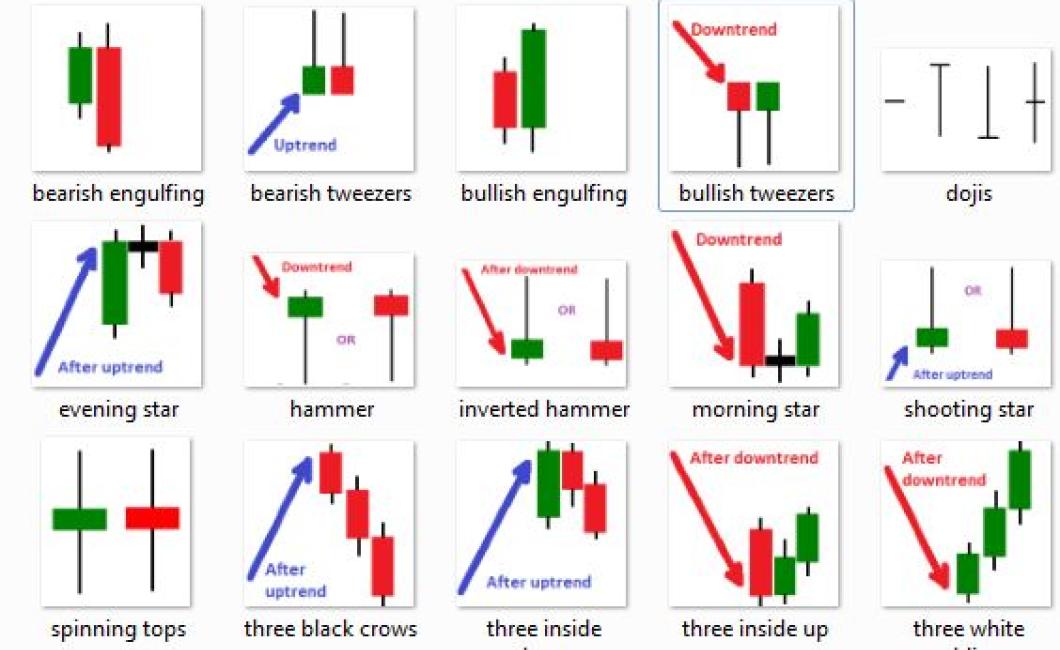

What do Candlesticks Mean in Crypto Trading?

When traders look at candlesticks charts, they are analyzing the market to see if there is an uptrend or downtrend. Candlesticks can also be used to identify support and resistance levels.

How to Analyze Bitcoin Price Charts

There are a few ways to analyze bitcoin price charts. One way is to look at the historical data, and see how the bitcoin price has behaved in the past. Another way to analyze bitcoin price charts is to look at the current market conditions, and see how the bitcoin price is performing relative to other currencies.

Ethereum Price Analysis: ETH Bullish Pennant Forming, but $200 is Key

The Ethereum price is currently trading at $197.31 and has been trending upwards over the past few days. However, despite the bullish trend, the $200 mark is still a key support zone for the ETH price.

If the Ethereum price can break past the $200 mark, then we could see further gains towards the $220-230 range. On the other hand, if the Ethereum price falls below the $200 mark, then we could see further losses towards the $170-180 range.

Overall, the Ethereum price is still in a bullish trend, but it is important to keep an eye on the $200 support zone in order to ensure that losses do not get too out of control.

Bitcoin Price Analysis: BTC at Risk of Heavy Pullback If $9,000 Broken

Bitcoin price analysis suggests that the cryptocurrency is at risk of a heavy pullback if it breaks below $9,000. The current price of Bitcoin is sitting at $8,915, which is down 1.4% for the day.

As of this writing, Bitcoin is down 1.5% over the past 24 hours. This follows a 1.7% loss over the past seven days. If the downward trend continues, Bitcoin could potentially fall below $9,000, which would be a significant decline from its current price.

The Bitcoin price has been trading in a range for the past few days. On the one hand, there is a strong demand for the cryptocurrency, as evidenced by the fact that the market is still rallying. On the other hand, there is a lot of uncertainty surrounding the future of Bitcoin and the broader cryptocurrency market.

This uncertainty was highlighted earlier this week when CoinMarketCap removed China from its list of major cryptocurrency markets. This caused a lot of uncertainty among investors, who are now wondering if the entire cryptocurrency market is in a bubble.

If the global cryptocurrency market falls, it is likely that Bitcoin will follow suit. This is because Bitcoin is the most popular cryptocurrency and it is considered to be a store of value. A large number of investors are now holding Bitcoin, which means that a significant decline in the value of Bitcoin would have a significant impact on the overall market.

If you are thinking about investing in Bitcoin, it is important to keep in mind that the cryptocurrency is still very volatile. A decline in the value of Bitcoin could happen at any time, so you should always be prepared for an unexpected decline.

Litecoin Price Analysis: LTC Primed for Bullish Breakout Above $80

Litecoin appeared primed for a bullish breakout above $80 following strong buying interest in the past few days. The coin is up more than 7% in the past 24 hours and is currently trading at $79.50.

Litecoin has been on a tear lately, increasing more than 7% in the past 24 hours.

The Litecoin price is up more than 7% in the past 24 hours.

Litecoin appears primed for a bullish breakout above $80 following strong buying interest in the past few days. The coin is up more than 7% in the past day and is currently trading at $79.50.

XRP Price Analysis: XRP/USD Could Extend Gains Above $0.3250

The Ripple price is trading above the $3200 support level against the US Dollar. The XRP/USD pair is expected to rebound and break the $3250 resistance level.

There is a bullish trend line formed with support at $3175 on the 4-hours chart of the Ripple price (data feed from Kraken). If the price manages to break the $3250 resistance level, it could extend its gains above the $3290 level.

On the downside, if the Ripple price fails to break the $3250 support level, it may drop back towards the $3175 support zone.

Binance Coin Price Analysis: BNB Primed For Further Gains Above $30

The Binance Coin (BNB) is primed for further gains above the $30 price point, according to analysts at eToro.

The cryptocurrency is up nearly 60% over the past month and currently sits at a value of $33.58.

BNB has been experiencing strong momentum in recent weeks, with its value surging on several major exchanges.

According to eToro analysts, the Binance Coin is well-positioned to continue its rally in the near future.

The team at eToro believes that the Binance Coin has a lot of potential and is set to become a major player in the blockchain industry.

eToro analysts believe that the Binance Coin has a lot of potential and is set to become a major player in the blockchain industry.

They believe that the Binance Coin’s strong performance is due to its strong fundamentals and its ability to offer a unique user experience.

eToro analysts believe that the Binance Coin is well-positioned to continue its rally in the near future, and they believe that it could reach a value of $50 within the next few months.

Bitcoin SV Price Analysis: BSV/USD Rebounds From $250, Further Gains Likely

The price of Bitcoin SV, also known as BSV, has rebounded from around $250 to $285 in the past 24 hours. The cryptocurrency is likely to continue gaining in value in the near future, as the market conditions are currently supportive.

Bitcoin SV is a fork of Bitcoin that restores the 2-way peg. The project was created by Craig Wright, who has been associated with Bitcoin for many years. Wright has recently filed a lawsuit against Bitmain, the leading mining company, for fraud.

The 2-way peg is a feature that allows Bitcoin SV to function as a true digital asset. It allows users to exchange BSV for BTC and vice versa, without the need for third-party exchanges.

The market conditions are currently supportive of Bitcoin SV. The cryptocurrency is trading at an average price of $285, which is above the $260 level that was seen earlier this week.

The overall market conditions are positive, as the market is seeing a rise in the prices of altcoins. This is likely due to the fact that the market is expecting the SEC to approve the listing of Bakkt, a new cryptocurrency exchange platform. The approval of Bakkt is expected to increase the liquidity in the market and fuel the growth of other cryptocurrencies.