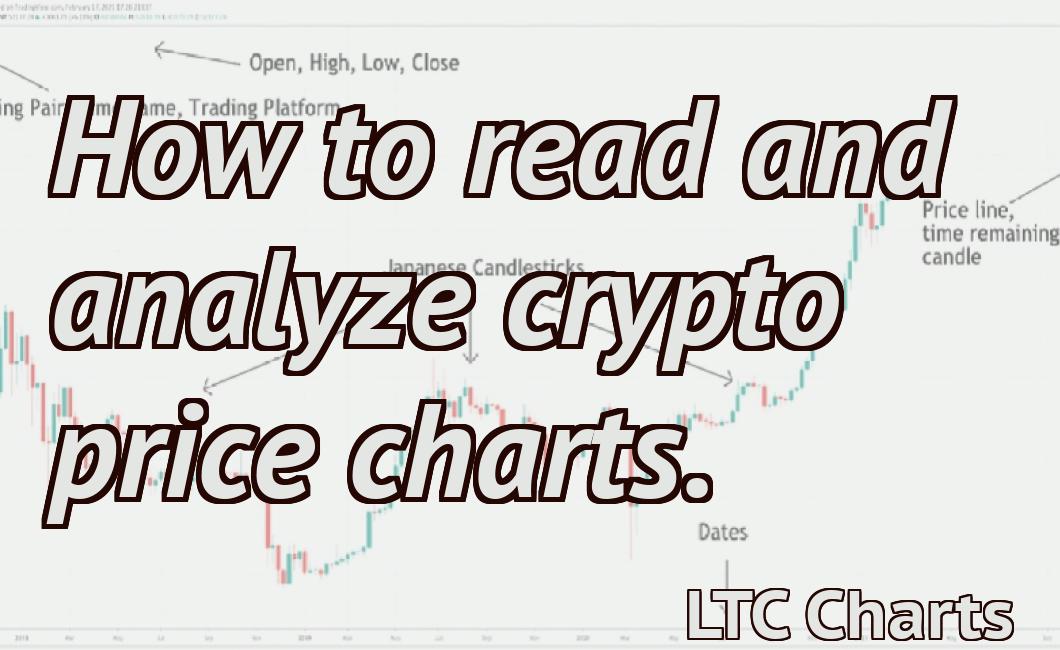

How to learn crypto charts?

If you want to learn how to read crypto charts, there are a few things you need to know. First, you need to understand what each chart is telling you. There are three main types of charts: candlestick charts, bar charts, and line charts. Each one tells you different information about the price movements of a coin. Candlestick charts show you the open, high, low, and close prices for a coin over a certain period of time. They also show you the direction of the price trend. Bar charts show you the same information as candlestick charts, but they also show you the volume traded during that period of time. Line charts only show you the closing prices for a coin over time. Once you understand what each chart is telling you, you need to know how to read them. The most important thing to look at is the price trend. Is the price going up or down? You can also look at support and resistance levels to see where the price might turn around. Finally, don't forget to keep an eye on the news. Cryptocurrency prices can be affected by events happening all over the world. If something big happens, make sure to check the charts to see how it affects the price of your coins.

How to Read Crypto Charts

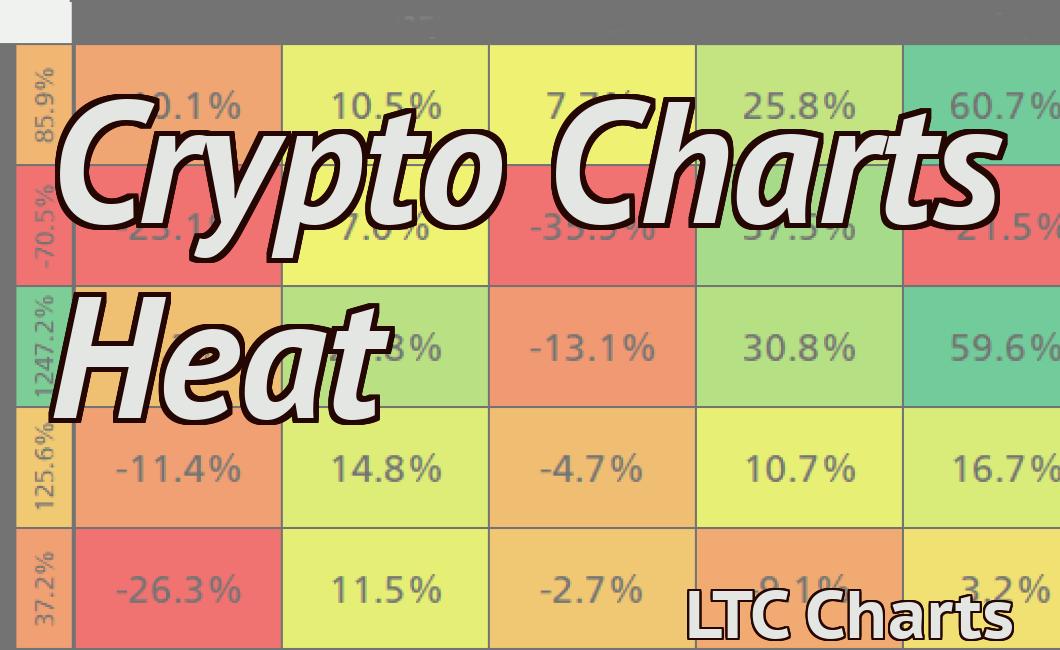

Crypto charts are used to display cryptocurrency prices and other technical data. The most common way to read a crypto chart is to identify areas of support and resistance. When a price moves above an area of support, it is likely to continue moving up. Conversely, when a price moves below an area of resistance, it is likely to continue moving down.

It is also important to pay attention to the MACD (Moving Average Convergence Divergence) indicator. This measures the difference between the two averages, and is often used to identify potential turning points in the market.

A Beginner’s Guide to Interpreting Cryptocurrency Charts

Cryptocurrencies are a new and rapidly growing form of currency. They are digital, decentralized, and often anonymous. Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrency charts can be used to monitor the price of cryptocurrencies, track changes in market capitalization, and analyze the performance of a cryptocurrency over time. In this beginner’s guide, we will describe how to use cryptocurrency charts and provide a few tips for interpreting them.

How to Use Cryptocurrency Charts

To use cryptocurrency charts, first open a cryptocurrency trading platform. This can be done by searching for “cryptocurrency trading” on Google or by clicking the link provided by your cryptocurrency exchange.

Once you have opened the trading platform, find the chart that you want to use. For example, if you are interested in tracking the price of Bitcoin, you would search for “Bitcoin chart” on the trading platform.

To view the Bitcoin chart, you will need to open the “Bitcoin Price” tab. The Bitcoin Price tab will display the current price of Bitcoin as well as the historical prices for the past 24 hours, 7 days, and 30 days.

You can also use the Bitcoin Price tab to generate buy and sell orders. To generate a buy order, click the “Buy” button next to the price of Bitcoin that you want to buy. To generate a sell order, click the “Sell” button next to the price of Bitcoin that you want to sell.

You can also use the Bitcoin Price tab to locate active buy and sell orders. Active buy orders are orders that have been placed within the last 10 minutes. Active sell orders are orders that have been placed within the last 10 minutes.

To view the Ethereum chart, you will need to open the “Ethereum Price” tab. The Ethereum Price tab will display the current price of Ethereum as well as the historical prices for the past 24 hours, 7 days, and 30 days.

You can also use the Ethereum Price tab to generate buy and sell orders. To generate a buy order, click the “Buy” button next to the price of Ethereum that you want to buy. To generate a sell order, click the “Sell” button next to the price of Ethereum that you want to sell.

You can also use the Ethereum Price tab to locate active buy and sell orders. Active buy orders are orders that have been placed within the last 10 minutes. Active sell orders are orders that have been placed within the last 10 minutes.

To view the Litecoin chart, you will need to open the “Litecoin Price” tab. The Litecoin Price tab will display the current price of Litecoin as well as the historical prices for the past 24 hours, 7 days, and 30 days.

You can also use the Litecoin Price tab to generate buy and sell orders. To generate a buy order, click the “Buy” button next to the price of Litecoin that you want to buy. To generate a sell order, click the “Sell” button next to the price of Litecoin that you want to sell.

You can also use the Litecoin Price tab to locate active buy and sell orders. Active buy orders are orders that have been placed within the last 10 minutes. Active sell orders are orders that have been placed within the last 10 minutes.

How to Use Crypto Charts to Trade Bitcoin and Altcoins

Crypto charts are a great way to track the price of cryptocurrencies and altcoins. They allow you to see how the prices of different cryptocurrencies and altcoins are changing over time.

To use crypto charts to trade Bitcoin and altcoins, first find a cryptocurrency or altcoin that you want to trade. Then, find a cryptocurrency or altcoin chart that shows the price of that cryptocurrency or altcoin over time.

Once you have found the cryptocurrency or altcoin chart, you will need to find the price of the cryptocurrency or altcoin at the time that you want to trade it. You can do this by looking at the bottom of the cryptocurrency or altcoin chart.

Then, you will need to find the price of the cryptocurrency or altcoin that you want to trade on the current crypto chart. To do this, you will need to find the intersection of the price of the cryptocurrency or altcoin that you want to trade and the price of the cryptocurrency or altcoin on the current crypto chart.

Technical Analysis for Crypto Trading - The Ultimate Guide

Crypto trading is a highly volatile and complex activity. To make the most out of this exciting market, you need to have a sound understanding of technical analysis. This guide will teach you the basics of technical analysis, and help you apply it to cryptocurrency trading.

What is Technical Analysis?

Technical analysis is the use of charts and indicators to identify patterns in price movement and to make trading decisions. Technical analysis can help you identify opportunities in the market, and can help you make informed decisions about when to buy and sell.

Technical analysis is not a 100% accurate predictor of future prices, but it can help you identify patterns in price movement that can help you make informed decisions about when to buy and sell.

How Does Technical Analysis Work?

When you are technical analysis, you are looking for patterns in price movement. You can use charts to identify trends, and you can use indicators to identify support and resistance levels. You can use these patterns to make informed trading decisions.

For example, let's say you are looking at the price of Bitcoin. You might see that the price has been moving up and down a lot, and that there seems to be a trend of increasing prices. You might then decide to buy Bitcoin when the price is at the lower end of the trend, and sell it when the price is at the higher end of the trend. This is an example of using technical analysis to make a trading decision.

Technical analysis is not a 100% accurate predictor of future prices, but it can help you identify patterns in price movement that can help you make informed decisions about when to buy and sell.

How Can I Use Technical Analysis in Crypto Trading?

There are a few ways that you can use technical analysis in your crypto trading.

First, you can use technical analysis to identify trends in the market. For example, you might see that the market is trending up, and you can use this information to make decisions about when to buy and sell.

Second, you can use technical analysis to identify support and resistance levels. For example, you might see that the price is bouncing off of a certain support level, and you can use this information to make decisions about when to buy or sell.

Third, you can use technical analysis to identify buying and selling opportunities. For example, you might see that the market is approaching a buying opportunity, and you can use this information to make decisions about when to buy Bitcoin.

Fourth, you can use technical analysis to predict future prices. For example, you might see that the price is going to hit a certain level in the future, and you can use this information to make predictions about when the price will hit that level.

Finally, you can use technical analysis to optimize your trading strategy. For example, you might see that your trading strategy is not maximizing your profits, and you can adjust your strategy based on your findings from technical analysis.

How Should I Use Technical Analysis in Crypto Trading?

There is no one right way to use technical analysis in your crypto trading. However, there are some general guidelines that you should follow when using technical analysis in your trading.

First, always take a long-term view when using technical analysis in your trading. Don't get too caught up in the short-term fluctuations of the market.

Second, always use sound judgement when making trading decisions based on your findings from technical analysis. Don't overreact to any trend that you see in the market, or get too aggressive when buying or selling cryptocurrencies.

Third, always keep a close eye on your portfolio risk when using technical analysis in your trading. Make sure that your trading strategies are safe and risk-free before implementing them into your trading strategy.

Fourth, always try to stay aware of the latest news affecting the market when using technical analysis in your trading. This will help you make more informed decisions about when to buy and sell cryptocurrencies.

Finally, always be prepared for the ever-changing cryptocurrency market. Don't get surprised by any sudden changes in prices, and always be prepared to react quickly to the changing market conditions.

How to trade cryptocurrency: A beginner’s guide

1. Know what you are trading. Cryptocurrencies are a new and rapidly growing market, so do your research before investing. There are a variety of different cryptocurrencies available, so it is important to know what each one does and what its potential value is.

2. Get a wallet. A cryptocurrency wallet is a digital storage space where you can store your coins. There are a variety of different wallets available, so it is important to choose the one that is right for you.

3. Buy coins. The first step in trading cryptocurrency is buying coins. You can buy coins online, in physical stores, or through brokerages.

4. Sell coins. Once you have bought coins, the next step is to sell them. You can sell them online, in physical stores, or through brokerages.

5. Monitor prices. It is important to monitor prices while trading cryptocurrency to ensure that you are making the most profit possible.

How to read crypto charts: The basics

Crypto charts are used to help traders and investors track the price of cryptocurrencies.

When you open a crypto chart, you will see a list of cryptocurrencies, with their current price and total market capitalization.

Cryptocurrencies are listed in order from left to right, with the most recent coin on the right.

To make changes to your chart settings, click on the "settings" button in the toolbar at the top of the chart.

There are a few different settings you can change:

1. Time frame: This setting controls how long you have data for. You can choose from 1 day, 1 week, 1 month, or 1 year.

2. Show candles: This setting shows the open, high, low, and close (OTL) prices for each candle.

3. Show lines: This setting shows the price movements on a simple linear scale.

4. Chart type: You can choose between a candlestick chart and a bar chart.

5. Chart colors: You can change the colors of the lines and markers on the chart.

6. Margin: This setting allows you to adjust the margin size for your trade.

7. Chart scaling: This setting controls how the chart is scaled. You can choose between small, medium, or large sizes.

How to read crypto charts: Candlesticks

Candlesticks are used to display the price of a cryptocurrency over a given period of time. Each candle shows the value of a particular cryptocurrency at a specific point in time.

To read the crypto charts, first identify the type of chart being displayed. The most common types of charts are candlesticks and line charts.

Candlesticks:

Candlesticks display the price of a cryptocurrency over a given period of time. Each candle shows the value of a particular cryptocurrency at a specific point in time.

To read the candlesticks, first identify the type of candle. The most common types of candles are opening, high, low, and closing.

Opening: The first candle opens at the price shown and indicates the beginning of the trading period.

High: The candle reaches its highest point during the trading period.

Low: The candle reaches its lowest point during the trading period.

Closing: The last candle closes at the price shown and indicates the end of the trading period.

Line charts:

Line charts display the price of a cryptocurrency over a given period of time. The height of each line indicates the value of a cryptocurrency at that point in time.

To read the line charts, first identify the type of line. The most common types of lines are ascending and descending.

Ascending: The line rises over time, indicating that the value of the cryptocurrency is increasing.

Descending: The line falls over time, indicating that the value of the cryptocurrency is decreasing.

How to read crypto charts: Support and resistance levels

Cryptocurrencies are traded on digital exchanges and can be bought and sold with fiat currencies. These markets are highly volatile and can move quickly in either direction.

To make sense of these charts, you need to understand support and resistance levels.

Support levels are the points at which a cryptocurrency's price has been unable to break through and continue moving higher. If the price reaches a support level, it will likely stay there for a while, as traders will wait for the price to rebound before investing more.

Resistance levels are points at which the price of a cryptocurrency is unable to move lower and continues to decline. If the price reaches a resistance level, it will likely stay there for a while, as traders will wait for the price to rebound before investing more.

How to read crypto charts: Trend lines

The trend lines on crypto charts are important to watch for two reasons:

1. They show where the price of a digital asset is likely to go in the future.

2. They can be used to help make trading decisions.

Trend lines can be found on most crypto charts, and they are typically horizontal lines that indicate whether the price of a digital asset is going up or down.

When the price of a digital asset is moving along a trend line, it is usually safe to invest in that asset. Conversely, if the price of a digital asset is moving outside of a trend line, it is usually not safe to invest in that asset.

How to read crypto charts: Moving averages

The moving averages are a technical indicator that can be used to help identify whether a cryptocurrency is over or undervalued.

The moving average is a line plotted on a chart that shows the average price over a certain period of time. The shorter the time period, the more recent data will be included in the calculation, and the smoother the line will be.

When looking at a cryptocurrency’s moving average, it is important to keep in mind that it is not a buy or sell signal. Rather, it is a tool that can help you identify whether the price is over or undervalued.

How to read crypto charts: Relative Strength Index

The Relative Strength Index (RSI) is a technical analysis indicator that measures the performance of a security relative to the rest of the market. The RSI oscillates between 0 and 100, with values above 50 indicating an oversold market and values below 50 indicating an overbought market.

The RSI can be used to identify oversold or overbought markets and can be used to determine when to buy or sell a security. When the RSI is below the 50 level, it is considered oversold and indicates that the security is likely to decline in value. When the RSI is above the 50 level, it is considered overbought and indicates that the security is likely to increase in value.