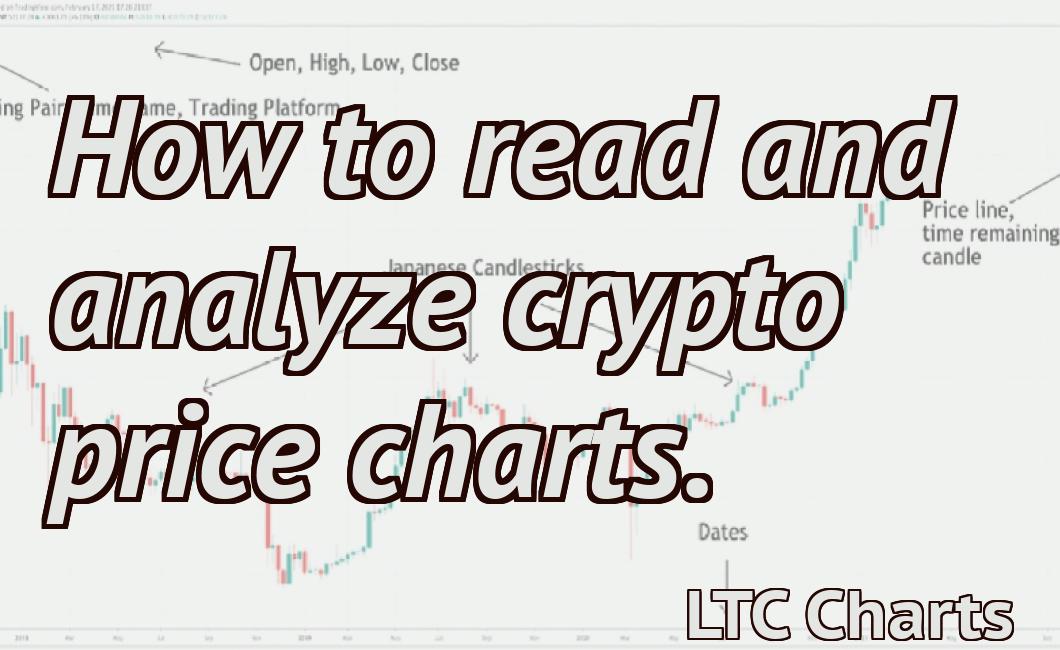

Reading the correction on crypto charts.

This article discusses how to read the correction on crypto charts. It explains that the correction is simply a retracement of the recent price action and that it is not necessarily indicative of a change in the overall trend. The article also provides some tips on how to trade during a correction.

How to properly read a crypto chart

Cryptocurrency charts are used to help investors and traders understand the movement of digital assets.

The first step is to identify the price range of the coin you are viewing. Once you have this information, you can begin to see how the price of the coin is moving and how this compares to other coins in the same price range.

To read a crypto chart, you will need to understand technical analysis. Technical analysis is a way of analyzing financial data to determine trends and opportunities.

Some basic indicators you will want to look for on a crypto chart include:

The RSI (Relative Strength Index)

The MACD (Moving Average Convergence Divergence)

The SMA (Simple Moving Average)

The Bollinger Band

The Fibonacci Retracement

Once you have identified these indicators, you can use them to make informed investment decisions.

What do all the lines on a crypto chart mean?

Crypto charts are used to plot the price of a digital asset against time. The lines on a crypto chart represent the price of a digital asset over a given period of time.

How to identify support and resistance levels on a crypto chart

A crypto chart displays the price of a cryptocurrency over a given period of time. The horizontal axis represents time, while the vertical axis represents price.

When looking at a crypto chart, you first need to identify the support and resistance levels. These are the points at which the price of the cryptocurrency is likely to stay stable.

If the price of the cryptocurrency is below the support level, then traders may sell their tokens. If the price of the cryptocurrency is above the resistance level, then traders may buy their tokens.

It is important to remember that support and resistance are not set in stone. They can change over time, depending on the market conditions.

What is the difference between a candlestick chart and a line chart?

A candlestick chart is a type of chart that shows the price of a security over time. The line chart is a type of chart that shows the price of a security over time, with the x-axis showing the date and the y-axis showing the price.

How to read charts when trading cryptocurrencies

Cryptocurrencies are often traded on price charts, which show the prices of a digital asset over time. Price charts can be used to track the performance of a digital asset, and to identify opportunities for buying and selling.

To read a price chart, first identify the time period being examined. This can be done by looking at the "time" column on the chart. For example, if the time period is one day, then the column will say "1 day." If the time period is one month, then the column will say "1 month." Once the time period is identified, look at the "price" column to find the price of the digital asset at that particular point in time.

To understand how a digital asset is performing over time, it is important to look at both the "high" and "low" points of the price chart. The "high" point is the highest price point recorded on the chart, and the "low" point is the lowest price point recorded on the chart. It is important to note that these are not actual purchase or sale points - they are just points at which the price of the digital asset was high or low relative to the rest of the data in the chart.

When looking at a digital asset's performance, it is also important to consider the "volume" column. This column shows the amount of money exchanged hands for the digital asset over the course of the time period being examined. This information can help you understand how active the market for the digital asset is, and how likely it is that you will be able to buy or sell it at a reasonable price.

The basics of reading crypto charts

Crypto charts are used to track the price of cryptocurrencies. The data is gathered from exchanges and other sources and then plotted on a graph. The purpose of these charts is to provide a visual representation of the movement of cryptocurrencies.

When looking at crypto charts, it is important to keep in mind the following tips:

1. Crypto charts are not a prediction tool.

2. The prices shown on crypto charts are not real-time.

3. Crypto charts are not always accurate.

A guide to understanding crypto charts for beginners

Crypto charts are a great way for beginners to understand the market trends and prices of different cryptocurrencies.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrencies are not FDIC-insured and are not subject to bank withdrawal or deposit limits.

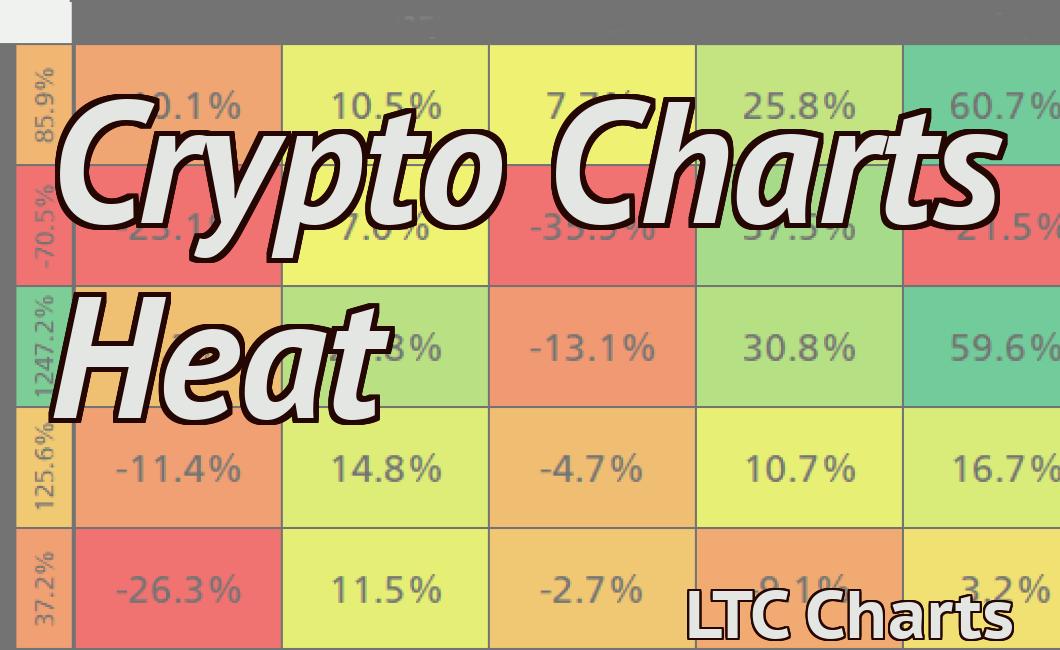

To understand crypto charts, you need to understand three things:

1. The price of a cryptocurrency

2. The volume of a cryptocurrency

3. The trend of a cryptocurrency

How to make sense of cryptocurrency charts

Cryptocurrency charts are a useful way to track the price of a digital asset over time. Charts can be divided into two main groups: technical analysis and fundamental analysis.

Technical analysis

Technical analysis is the use of charts and other indicators to study the behavior of a cryptocurrency's price. Technical analysts may use charts to identify patterns in price movement, to predict future prices, and to determine when to buy or sell a cryptocurrency.

Fundamental analysis

Fundamental analysis is the examination of a cryptocurrency's underlying technology, economics, and market potential. Fundamental analysts may use charts to identify trends in price movement, to assess the health of a cryptocurrency's ecosystem, and to measure the viability of a cryptocurrency's long-term investment prospects.

10 things you need to know about reading crypto charts

1. Cryptocurrencies are not a stock and are not regulated by the SEC.

2. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

3. Bitcoin was the first and most well-known cryptocurrency. It was created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto.

4. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

5. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

6. Cryptocurrencies are not backed by any physical assets and their value is based on how much people are willing to pay for them.

7. Cryptocurrencies are often volatile, meaning their value can change quickly.

8. Cryptocurrencies are not legal tender, which means they cannot be used to pay any taxes.

9. Cryptocurrencies are often associated with cybercrime and theft, although this is not always the case.

10. Cryptocurrencies are still in their early stages, so there is a lot of uncertainty surrounding them.

The Do's and Don'ts of reading crypto charts

There is no one-size-fits-all answer to this question, as the best way to read crypto charts depends on the individual trader's strategy and preferences. However, some general tips that may be useful for readers of crypto charts include:

Do pay attention to the overall trend of the market.

Do study the chart in detail, looking for signs of support and resistance levels, as well as patterns that may indicate which direction the market is likely to move in next.

Do not get swayed by short-term price movements, as these can be easily manipulated by traders.

Do not invest money that you cannot afford to lose.

If you don't know how to read crypto charts, you're missing out

Cryptocurrency charts are a great way to track the performance of digital coins and tokens. By understanding how these charts work, you can better understand how your investment is performing.

Here's what you need to know about reading crypto charts

Cryptocurrencies are often traded on decentralized exchanges, where prices are not always easy to track.

Cryptocurrencies are often traded on decentralized exchanges, where prices are not always easy to track. Bitcoin, the most popular cryptocurrency, is traded on exchanges including Bitfinex, Coinbase, and Gemini.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the most popular cryptocurrency, is traded on exchanges including Bitfinex, Coinbase, and Gemini.