Crypto Pair Charts

Crypto Pair Charts is a tool that allows users to compare the prices of different cryptocurrencies. The tool also allows users to see the price history of each currency pair.

How to Read Crypto Pair Charts

Crypto pair charts are used to track the performance of two cryptocurrencies against each other.

The first thing to do is to identify the two cryptocurrencies being compared. This can be done by looking at the names of the coins or by scanning through the list of exchanges where they are traded.

Once the two cryptocurrencies have been identified, the next step is to find the relevant crypto pair chart. This can be done by searching for the name of the pair or by using the list of exchanges where the coins are traded.

Once the crypto pair chart has been found, the next step is to analyse it. This can be done by looking at the prices of the coins, their volumes, and their 24-hour trading volumes.

It is also important to consider the historical data on the pair chart, so that you can get a better understanding of how the cryptocurrencies have behaved over the past few months or years.

What do Crypto Pair Charts Mean?

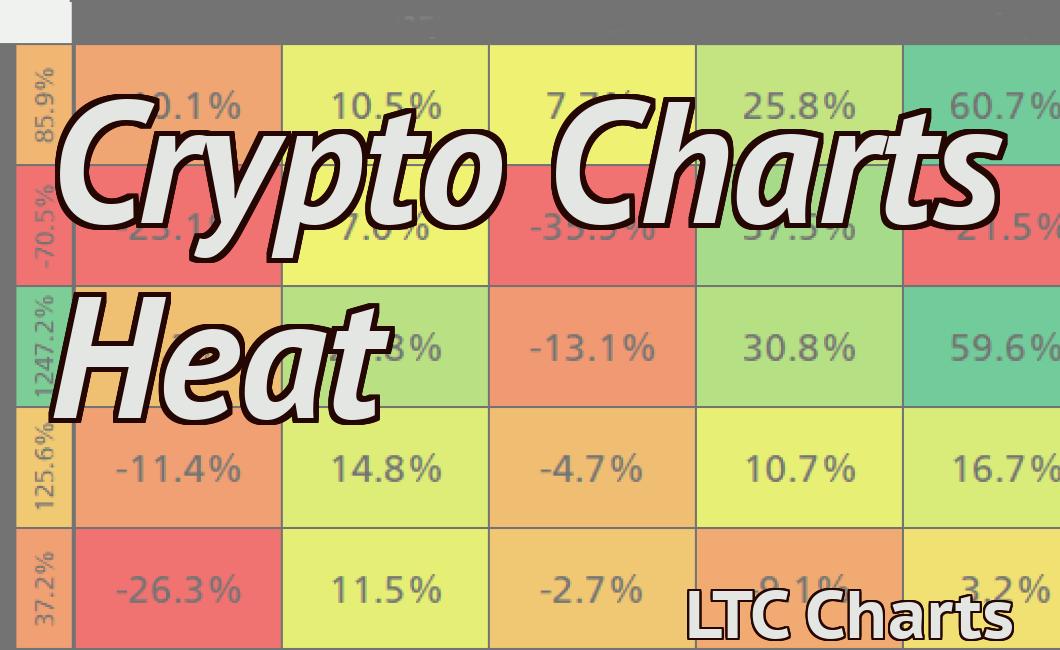

Crypto pair charts are used to show the correlation between two cryptocurrencies. correlation is a measure of how closely two variables move together. A high correlation means that the two cryptocurrencies move in tandem, while a low correlation means that they move independently.

How to Analyze Crypto Pair Charts

Crypto pair charts are a great way to analyze the market activity of a particular crypto asset. They can help you to identify trends and patterns in the market, and can also help you to make informed investment decisions.

To create a crypto pair chart, you will first need to gather data on the price of the two cryptocurrencies involved. You can use a variety of sources to gather this data, including cryptocurrency exchanges, online price tracking tools, and news sites.

Once you have the data, you will need to create a chart using a software program such as Excel or Google Sheets. You will then need to plot the price data on a graph, and to add information about the volumes of trade for each cryptocurrency.

When creating a crypto pair chart, it is important to be aware of the following factors:

The time period over which the data was collected.

The type of data that was collected.

The currencies involved.

The geographic location of the exchanges where the currencies were traded.

The relative strengths of the currencies involved.

The trend of the market activity.

The indicators that you use to analyze the market.

crypto pair charts can help you to make informed investment decisions, and to understand trends in the market.

The Benefits of Crypto Pair Charting

Crypto pair charting is a powerful tool that can be used to analyze the market conditions and make informed investment decisions. Here are some of the benefits of using crypto pair charting:

1. It Can Help You Identify Trends

Crypto pair charting can help you identify trends in the market, including changes in price, volume, and supply/demand. This information can help you make informed investment decisions and stay ahead of the curve.

2. It Can Help You Make Better Trading Decisions

Crypto pair charting can help you make better trading decisions by providing you with information about the market conditions. This information can help you identify opportunities and avoid potential pitfalls.

3. It Can Help You Spot Market Manipulations

Crypto pair charting can help you spot market manipulations, including pump and dump schemes and price collusion. This information can help you protect your investment and stay informed about the market conditions.

4. It Can Help You Build a Better Portfolio

Crypto pair charting can help you build a better portfolio by providing you with information about the market conditions. This information can help you identify opportunities and avoid potential pitfalls.

5. It Can Help You Avoid Bad Investments

Crypto pair charting can help you avoid bad investments by providing you with information about the market conditions. This information can help you identify opportunities and avoid potential pitfalls.

The Different Types of Crypto Pair Charts

There are three types of crypto pairs charts:

1) Price vs. Supply

2) Price vs. Volume

3) Price vs. Market Capitalization

1) Price vs. Supply

This type of chart displays the price of a cryptocurrency against its total supply. This can be helpful in determining when a cryptocurrency is overvalued or undervalued.

2) Price vs. Volume

This type of chart displays the price of a cryptocurrency against the number of transactions that have been made on the network. This can be helpful in determining when a cryptocurrency is experiencing strong demand or weak demand.

3) Price vs. Market Capitalization

This type of chart displays the price of a cryptocurrency against the market capitalization of all other cryptocurrencies. This can be helpful in determining when a cryptocurrency is becoming more valuable or less valuable.

How to Create Your Own Crypto Pair Charts

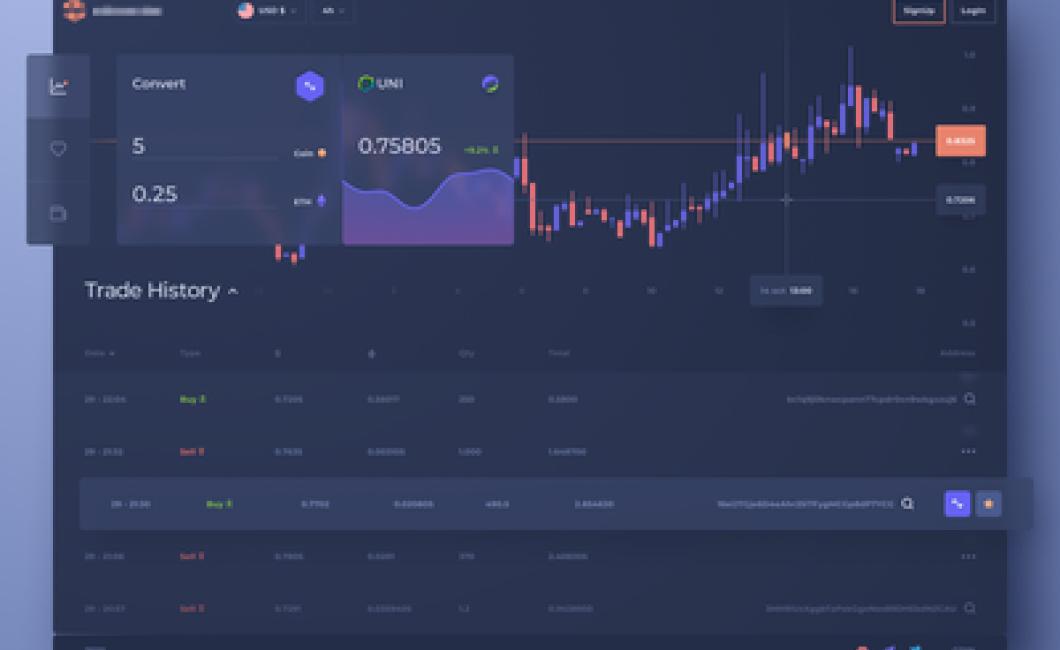

On CryptoCompare, you can create your own crypto pair charts.

1. On the CryptoCompare home page, click on the "Charts" button in the top left corner.

2. On the Charts page, click on the "Pairs" tab.

3. In the Pairs table, click on the "Create Chart" button.

4. In the Chart Creation dialog box, type a name for your chart and select a time period.

5. Select a currency pair and a second currency to chart.

6. Click on the "Create Chart" button.

7. Your chart will appear on the Charts page.

The Advantages of Using Crypto Pair Charts

There are many reasons why you might want to use crypto pair charts.

They can be a quick and easy way to see how different cryptocurrencies are correlated.

Crypto pair charts can help you identify potential buying and selling opportunities.

They can help you determine the best time to buy or sell a cryptocurrency.

They can help you spot arbitrage opportunities.

They can help you make informed decisions when investing in cryptocurrencies.

The Disadvantages of Crypto Pair Charts

Crypto pair charts can be difficult to read and understand. They can also be misleading, as they may not always accurately reflect the true price of a cryptocurrency.

10 Tips for Interpreting Crypto Pair Charts

1. Look at the overall trend

If you are analysing a crypto pair chart, it is important to look at the overall trend. This will give you an idea of whether the price is going up or down, and whether there is any significant activity happening on the chart.

2. Look at the price action

Another thing to look at on a crypto pair chart is the price action. This will show you how the price has been moving over the past few minutes, hours, or days. This can help you to identify trends and patterns, and to make more informed trading decisions.

3. Check the volume

Volume is another important factor to consider when analysing a crypto pair chart. This will show you how many coins are being traded on the chart at any given time. This can be useful in determining whether the price is being driven by genuine demand from buyers or sellers, or whether there is some other reason for the movement.

4. Check the market cap

Another thing to look at on a crypto pair chart is the market cap. This will give you an idea of the overall value of the coins being traded on the chart. This can be useful in determining whether there is a lot of interest in the coins, and whether they are likely to be worth investing in.

5. Check the historical data

Another thing to look at on a crypto pair chart is the historical data. This can give you an idea of how the prices have behaved in the past, and can help you to make better predictions about future movements.

6. Check the technical indicators

Finally, you may also want to check the technical indicators. These can provide you with information about the strength of the current market trend, and about the potential for further price rises or falls.

Guidelines for Understanding Crypto Pair Charts

When looking at crypto pair charts, it is important to understand how the different cryptocurrencies are correlated. Correlation can be measured on a scale of -1 to 1, where 1 indicates a perfect correlation and -1 indicates a complete inverse correlation.

Cryptocurrencies that are highly correlated are said to be "positively correlated." This means that when one cryptocurrency rises in price, the other is likely to follow suit. Conversely, cryptocurrencies that are negatively correlated are said to be "negatively correlated." This means that when one cryptocurrency falls in price, the other is likely to follow suit.

Generally speaking, cryptocurrencies that are correlated positively are more likely to rise in price together. Conversely, cryptocurrencies that are correlated negatively are more likely to fall in price together.

For example, Bitcoin and Ethereum are positively correlated, which means that when one increases in price, the other is likely to do so as well. Bitcoin and Litecoin are negatively correlated, which means that when one decreases in price, the other is likely to do so as well.

FAQs About Crypto Pair Charts

1. What is a crypto pair chart?

A crypto pair chart is a graphical representation of the price movement of two cryptocurrencies. Crypto pair charts can be used to identify relationships between cryptocurrencies and to forecast future price movements.

2. What are the benefits of using a crypto pair chart?

The main benefits of using a crypto pair chart are that it can help you to identify relationships between cryptocurrencies and to forecast future price movements.

3. How do I create a crypto pair chart?

To create a crypto pair chart, you first need to gather the data for the chart. You can collect this data by tracking the prices of two cryptocurrencies either directly or via a third-party tool such as CoinMarketCap. Once you have the data, you can use a crypto pair charting tool to create the chart.

4. What are the different types of crypto pair charts?

There are two main types of crypto pair charts: trend and support/resistance.

Trend crypto pair charts show the price movement of two cryptocurrencies over time. They often show how the two cryptocurrencies move in relationship to one another.

Support/resistance crypto pair charts show how two cryptocurrencies interact with one another at specific points in time. They can be used to identify potential areas of resistance and support, and to forecast future price movements.