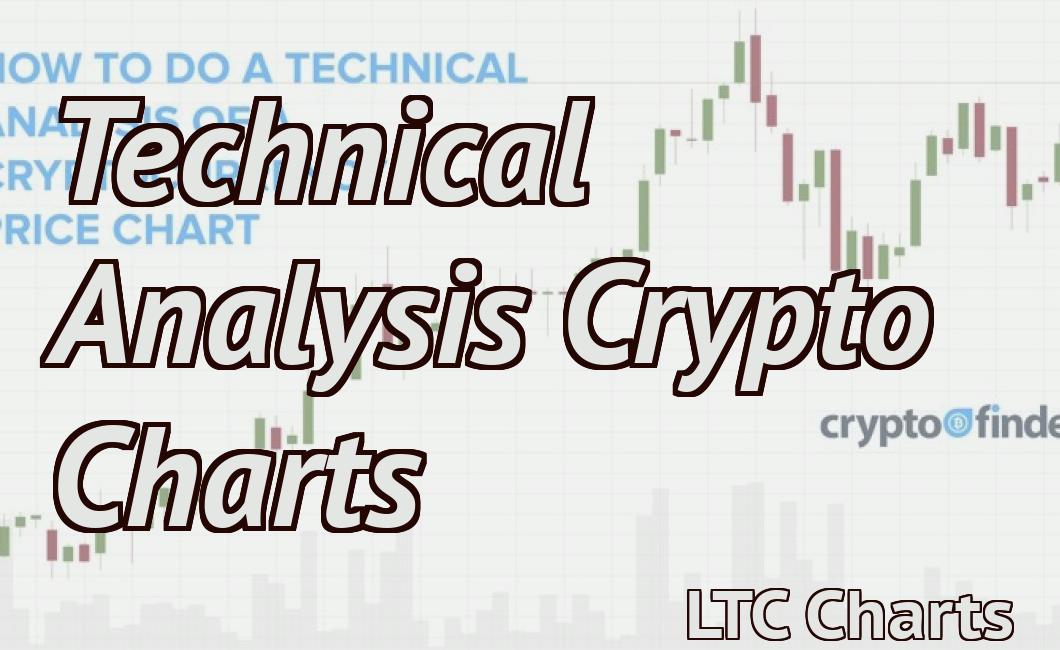

Learn how to trade crypto charts.

If you're looking to get into the cryptocurrency market, one of the first things you need to learn is how to trade crypto charts. This guide will teach you the basics of reading crypto charts and help you make better trading decisions.

How to read crypto trading charts

When you're looking at crypto trading charts, you want to pay attention to the following things:

1. The price of the cryptocurrency

2. The volume of the cryptocurrency

3. The trend of the cryptocurrency

4. The technical indicators

5. The crypto market sentiment

Here's a guide on how to read crypto trading charts:

1. Look at the price of the cryptocurrency. This will give you an idea of how much value the cryptocurrency is currently worth.

2. Look at the volume of the cryptocurrency. This will tell you how much cash is being traded in the market.

3. Look at the trend of the cryptocurrency. This will tell you how the cryptocurrency is moving over time.

4. Look at the technical indicators. These will help you identify potential trends in the market.

5. Look at the crypto market sentiment. This will give you an idea of how investors are feeling about the market.

What do crypto trading charts mean?

Crypto trading charts are used by traders to help them understand the price of cryptocurrencies over time. They can be used to identify patterns in the prices of different cryptocurrencies, and to predict future prices.

How to use crypto trading charts

Crypto trading charts are a valuable tool for understanding the current state of the market. They can help you identify trends and opportunities, and make informed decisions about where to invest your money.

Cryptocurrency trading is a highly speculative activity, and it is important to do your research before investing any money. That said, trading charts can be a helpful way to stay informed.

Here are some tips on how to use crypto trading charts:

1. Look at the chart overview.

The first thing you want to look at is the chart overview. This will provide you with a general idea of the market conditions. You can also see how prices are moving, and how volatile the market is.

2. Check for trends.

Once you have a general idea of the market conditions, you should look for trends. This will help you identify which assets are in demand, and which ones are overvalued.

3. Watch for opportunities.

Once you have identified trends and opportunities, you should watch for them on the chart. This will help you make informed decisions about where to invest your money.

The benefits of using crypto trading charts

There are many benefits to using crypto trading charts. They can help you to make informed decisions about your investments, and can help you to track your progress over time.

Crypto trading charts can help you to track your investment performance

Crypto trading charts can help you to track your investment performance. They can show you how your investments have performed over time, and can help you to identify any trends. This can help you to make more informed decisions about your investments, and to improve your chances of success.

Crypto trading charts can help you to make better investment decisions

Crypto trading charts can also help you to make better investment decisions. They can help you to identify the key factors that influence the price of cryptocurrencies, and can help you to make informed decisions about your investments. This can help you to improve your chances of success, and to achieve greater returns on your investment.

The top 7 crypto trading chart patterns

1. The triangle

2. The head and shoulders

3. The hammer

4. The pennant

5. The double bottom

6. The triple bottom

7. The cup and handle

How to read and interpret candlestick charts

Candlestick charts are used to monitor the performance of stocks, commodities, and other financial instruments.

The candlestick chart shows the opening and closing prices of the stocks, commodities, or other financial instruments. The vertical axis shows the price range of the stock, commodity, or other financial instrument. The horizontal axis shows the time period.

The first thing to look at in a candlestick chart is the open and close prices. These are the prices at which the stock, commodity, or other financial instrument was bought and sold.

Next, look at the histogram. This shows the distribution of prices over the time period. The histogram will show whether the stock, commodity, or other financial instrument is behaving mainly in a narrow or wide range.

The next thing to look at is the volume. This shows how many times the stock, commodity, or other financial instrument was bought and sold. If the volume is high, it suggests that people are buying and selling the stock, commodity, or other financial instrument a lot. If the volume is low, it suggests that people are not buying or selling the stock, commodity, or other financial instrument a lot.

Finally, look at the technical indicators. These indicators may help you to determine whether the stock, commodity, or other financial instrument is overvalued or undervalued.

How to trade cryptocurrencies using charts

Cryptocurrencies are traded on a number of exchanges, and it can be difficult to determine the best way to trade them. One option is to use charts to help you determine where the price is going.

To use charts to trade cryptocurrencies, you will first need to find an exchange that offers charts. Once you have found an exchange, you will need to sign up for an account. After you have registered, you will need to access your account settings. In your account settings, you will find the charts section. Here, you will find charts that show the price of cryptocurrencies.

Once you have found a chart that you want to use, you will need to find the cryptocurrency that you want to trade. You can do this by using the search function on the exchange, or by scanning through the list of cryptocurrencies that is provided on the chart. Once you have found the cryptocurrency that you want to trade, you will need to find the price that you want to buy or sell it at. To do this, you will need to use the arrows on the chart to move the price around. You can also use the zoom function on the chart to get a closer look at the price.