Crypto Analysis Charts

If you're looking for the latest information on crypto analysis charts, this is the article for you. We'll take a look at what these charts are, how they can be used to analyze cryptocurrency prices, and some of the top resources for finding them.

Why Crypto Analysis Charts Matter

Crypto analysis charts are an important part of any crypto trader’s arsenal. They can help identify trends, spot potential buy and sell points, and even reveal information about a cryptocurrency’s technical analysis.

Trend Spotting

One of the most important uses of crypto analysis charts is trend spotting. By monitoring the prices of a cryptocurrency over time, you can identify whether the price is trending up, down, or sideways. This information can help you determine whether it’s a good time to buy or sell.

Buy and Sell Points

Crypto analysis charts can also help you identify buy and sell points. These points indicate where the price of a cryptocurrency is likely to go next. By using these charts, you can make informed decisions about when to buy or sell.

Technical Analysis

Cryptocurrencies are complex assets, and analyzing them using traditional technical analysis techniques can be difficult. But crypto analysis charts can make the process a lot easier. By monitoring a cryptocurrency’s price, volume, and other indicators, you can get a better understanding of how it’s performing. This information can help you make informed investment decisions.

How to Use Crypto Analysis Charts

Crypto analysis charts are essential when it comes to understanding the behavior of digital assets. They can help you to identify patterns in price movements, and to predict future trends.

When you first start using crypto analysis charts, it can be helpful to become familiar with a few basic terms. Here are some of the most important ones:

Volatility: Volatility is a measure of how much an asset's price changes over a given period of time. The higher the volatility, the more erratic the price movements.

Positive correlation: When two assets move in a correlated manner, this means that their prices move together in a predictable way. This can be a sign that there is something else driving the price movements, such as market speculation.

Negative correlation: When two assets move in a negative correlation, this means that their prices move in opposite directions. This can be indicative of a real trend, or of market manipulation.

Bollinger Bands: Bollinger Bands are a popular tool for measuring volatility. They are made up of two bands, which represent the range of price fluctuations that are typically seen over a given period of time.

MACD: The Moving Average Convergence/Divergence (MACD) indicator is used to measure the strength of a trend. It consists of two lines, which indicate the average rate of change of a cryptocurrency's price over a given period of time.

RSI: The Relative Strength Index (RSI) is a popular tool for measuring momentum. It is made up of two indicators, which show the level of investor enthusiasm over a given period of time.

The Benefits of Crypto Analysis Charts

Crypto analysis charts can help investors make informed decisions about the best time to buy and sell cryptocurrencies. By providing a visual representation of the performance of individual cryptocurrencies, these charts can help traders identify trends and make informed investment decisions.

Cryptocurrency analysis charts can also help you stay informed about the overall market performance. By tracking the performance of various cryptocurrencies over time, you can identify which cryptocurrencies are performing well and which ones are struggling. This information can help you make informed investment decisions.

Cryptocurrency analysis charts can also help you identify opportunities in the cryptocurrency market. By identifying patterns in the performance of different cryptocurrencies, you can identify opportunities to buy low and sell high. This information can help you make profitable investments in the cryptocurrency market.

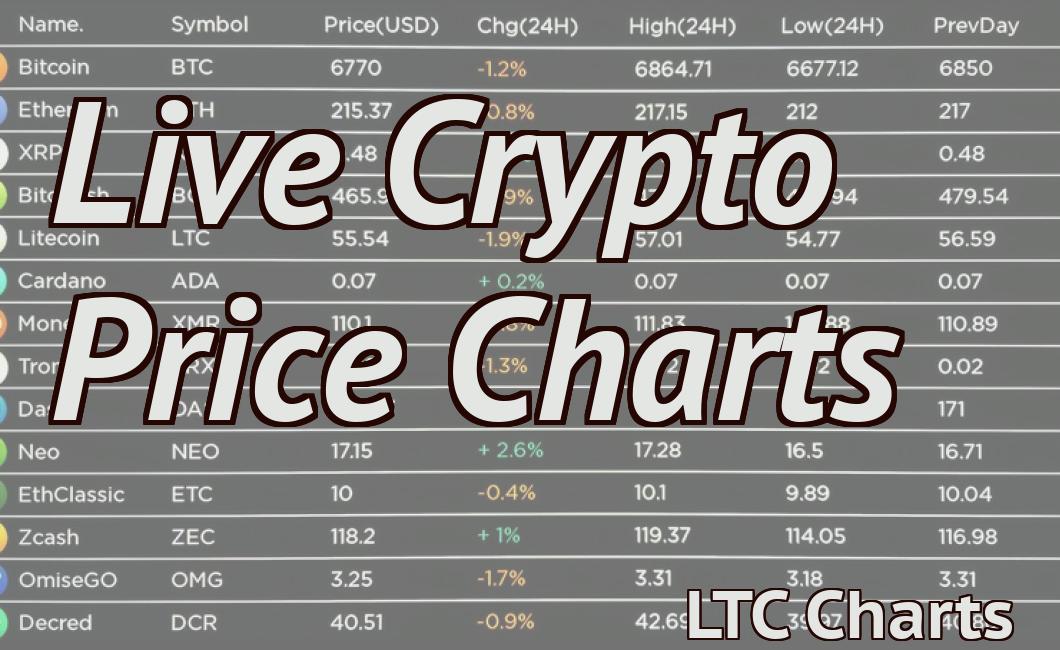

The Top 5 Crypto Analysis Charts

1. Bitcoin Price Index (BTC/USD)

2. Ethereum Price Index (ETH/USD)

3. Bitcoin Cash Price Index (BCH/USD)

4. Ripple Price Index (XRP/USD)

5. Litecoin Price Index (LTC/USD)

The Different Types of Crypto Analysis Charts

There are a few different types of crypto analysis charts that traders and investors might use.

The first type is called a supply and demand chart. This type of chart shows how much of a cryptocurrency is being currently mined and in circulation. It can also show how much is being bought and sold.

The second type of chart is called a price chart. This type of chart shows the price of a cryptocurrency over time. It can also show how volatile the price is.

The third type of chart is called a volume chart. This type of chart shows how much cryptocurrency is being traded each day. It can also show how volatile the price is.

How to Read Crypto Analysis Charts

There are a few different ways to read crypto analysis charts.

The first way is to look at the overall trend. If the chart is displaying a positive trend, then it is likely that the price of the cryptocurrency is going up. Conversely, if the chart is displaying a negative trend, then it is likely that the price of the cryptocurrency is going down.

The second way to read a crypto analysis chart is to look at specific indicators. For example, if the chart is displaying an upward trend, then the indicator might be displaying a green or positive color. Conversely, if the chart is displaying a downward trend, then the indicator might be displaying a red or negative color.

The third way to read a crypto analysis chart is to look at the volume of the cryptocurrency. When the volume of the cryptocurrency is high, then it is likely that more people are buying and selling the cryptocurrency. Conversely, when the volume of the cryptocurrency is low, then it is likely that fewer people are buying and selling the cryptocurrency.

What Crypto Analysis Charts Tell Us

Crypto analysis charts are a great way to track the performance of a particular cryptocurrency. These charts can help you determine whether or not the cryptocurrency is experiencing positive or negative growth.

Crypto analysis charts can also help you identify any potential risks associated with investing in a particular cryptocurrency. By examining the charts, you can identify any patterns that may indicate a potential bubble or market crash.

Cryptocurrency analysis charts are an essential tool for anyone interested in investing in cryptocurrencies. By using these charts, you can quickly and easily determine whether or not a particular cryptocurrency is experiencing positive or negative growth.

Cryptocurrency analysis charts can also help you identify any potential risks associated with investing in a particular cryptocurrency. By examining the charts, you can identify any patterns that may indicate a potential bubble or market crash.

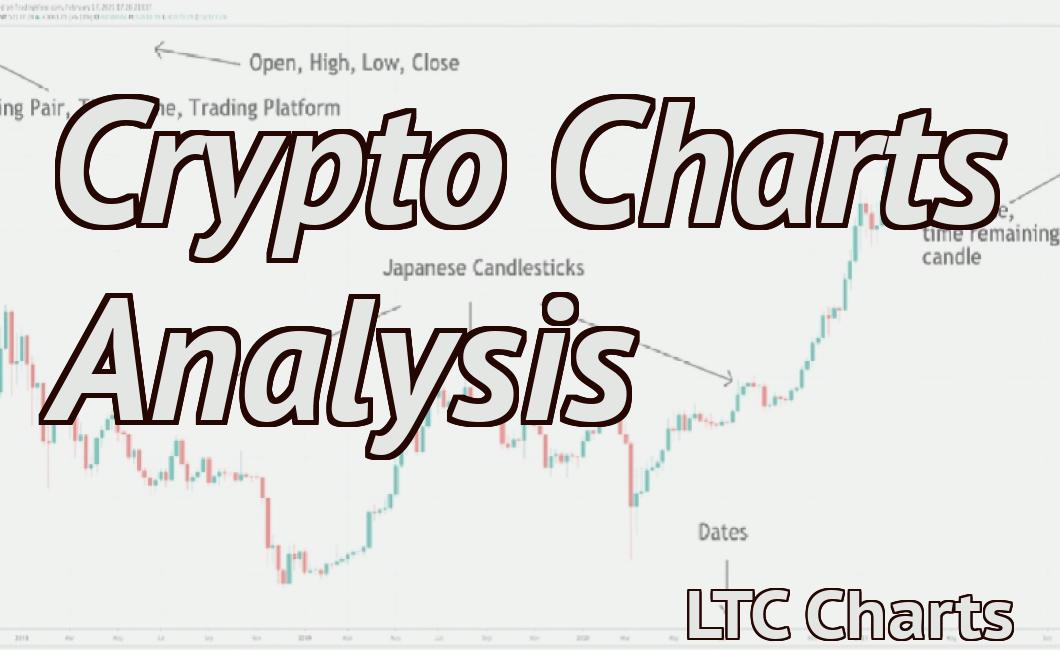

Interpreting Crypto Analysis Charts

Cryptocurrency charts are used to display the performance of a cryptocurrency over time. The data is usually collected from exchanges and compiled into a graph.

The most common type of chart is a price-time graph, which plots the price of a cryptocurrency against time. A horizontal line represents the current price, while the vertical axis shows the time span.

A trendline is often plotted on price-time graphs to indicate whether the price is increasing or decreasing over time. If the trendline is rising, then the cryptocurrency is experiencing a positive trend. If the trendline is falling, then the cryptocurrency is experiencing a negative trend.

A volume-time graph displays the total amount of cryptocurrency traded over time. The horizontal axis shows the amount of cryptocurrency traded per day, while the vertical axis shows the total amount of cryptocurrency traded over the entire time span.

A market cap-time graph displays the market value of a cryptocurrency over time. The horizontal axis shows the market value of a cryptocurrency per day, while the vertical axis shows the total market value of all cryptocurrencies over the entire time span.

Crypto Analysis Chart Patterns

There are a number of chart patterns that can be used to identify potential opportunities in the cryptocurrency market. Some common patterns include:

Top Cryptocurrencies

This is one of the most common chart patterns and it can be seen when a particular cryptocurrency rises rapidly in value. This could be an indication that there is a lot of interest in that particular cryptocurrency, or it could be the result of speculation.

A crypto market crash can also cause a top cryptocurrency to form. When this happens, investors may sell their holdings, causing the price of the cryptocurrency to decrease.

Cryptocurrency Volatility

Cryptocurrencies are highly volatile and this can be a good or bad thing. When a cryptocurrency is highly volatile, it means that the price can change a lot over short periods of time. This is good news for investors who are able to make quick decisions, but it can be stressful for those who are trying to buy or sell a cryptocurrency.

Cryptocurrency Bull and Bear Markets

A cryptocurrency bull market is when the price of a cryptocurrency rises rapidly. This could be due to increased demand from investors or it could be the result of speculation. A cryptocurrency bear market is the opposite situation and the price of a cryptocurrency falls rapidly. This could be due to decreased demand from investors or it could be the result of speculation.

Using Crypto Analysis Charts for Profit

Crypto analysis charts are a great way to track the performance of a cryptocurrency over time. By plotting the price against time, you can see how the value of the coin has changed over the past day, week, or month.

Some of the most popular crypto analysis charts include the Bitcoin price chart, the Ethereum price chart, and the Litecoin price chart.

By using these charts, you can quickly and easily determine which cryptocurrencies are worth investing in.

The Future of Crypto Analysis Charts

Crypto analysis charts have become a staple in the crypto world, as they provide an easy way for investors to get a quick overview of a particular cryptocurrency’s performance.

As the crypto market continues to grow, it’s likely that more and more charts will become available. This means that there’s always something new to look at, and that investors can always find something useful to learn.

One of the key benefits of crypto analysis charts is that they allow investors to see how a particular cryptocurrency is performing relative to its peers. This can help them to identify potential opportunities and to make informed decisions about which cryptocurrencies to invest in.

Overall, crypto analysis charts are an essential tool for anyone who wants to understand the latest trends in the crypto market.