Crypto Charts Analysis

In this article, we will take a look at some of the most popular cryptocurrency charts and analyze them to see what they can tell us about the future of the market.

Bitcoin Price Analysis: BTC Primed for Further Upside as Macro Outlook Remains Favorable

Bitcoin is primed for further upside as macroeconomic conditions remain favorable, according to a recent report from Fundstrat Global Advisors.

The report noted that global economic expansion is expected to continue, with the U.S. unemployment rate trending down and the Eurozone unemployment rate remaining low. Meanwhile, China’s economy is continuing to grow and Japan is seeing a rise in consumer spending.

“As a result, we believe that the global macro backdrop remains supportive of cryptocurrencies and blockchain technology,” the report reads.

The Fundstrat analysts highlighted that bitcoin is up more than 2,000% since the beginning of the year, and they predict that the digital asset will continue to appreciate in the coming months. They also noted that despite recent price volatility, the digital asset remains well supported by global demand.

“Overall, we remain positive on bitcoin and see further upside potential in the near-term as long as macro conditions remain favorable,” the report concludes.

Ethereum Price Analysis: ETH Primed for Further Upside as Macro Outlook Remains Favorable

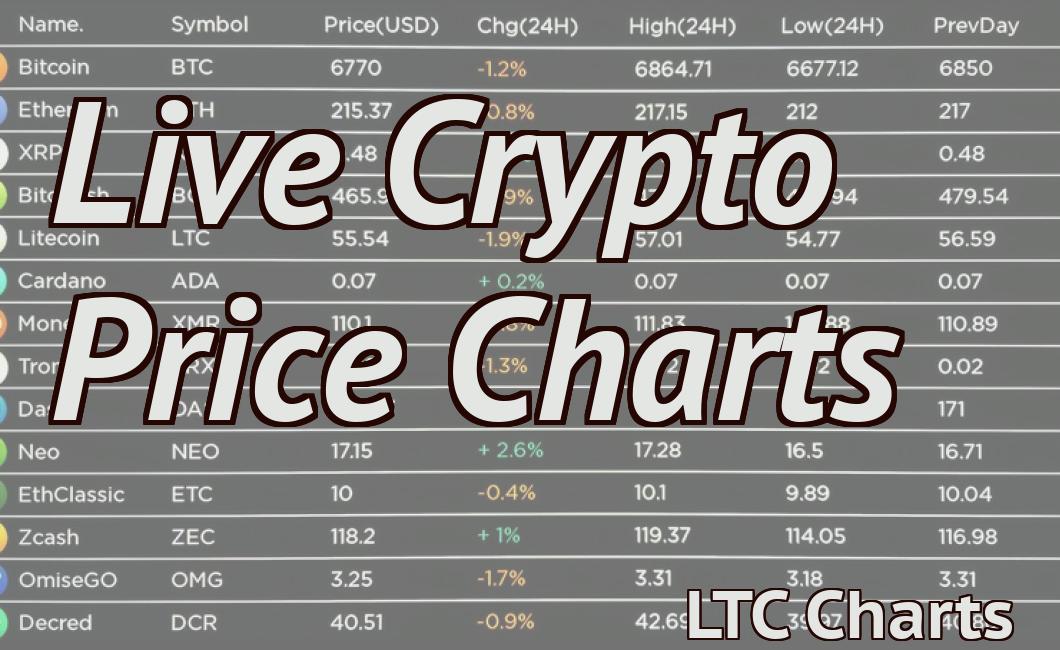

The Ethereum price is currently trading at $430.12, up 0.24% over the past 24 hours. The Ethereum price is up 2.06% over the past 7 days, and is currently ranked as the 4th most valuable cryptocurrency on the market.

Over the past few months, the Ethereum price has seen strong performance, with a significant increase in both value and volume. This trend appears to be continuing, with the Ethereum price up 2.06% over the past 7 days and exhibiting strong overall stability.

Looking at the overall macro outlook, it appears that Ethereum is still favored by investors. The recent developments in the crypto market have been positive for Ethereum, with major exchanges announcing new listings and new products being launched. This macro environment appears to be supportive of the Ethereum price, with prices remaining stable and increasing overall volumes.

Looking ahead, it is still unclear what the next step in the Ethereum price evolution will be. While it is possible that the Ethereum price could see a further increase, it is also possible that there could be some volatility in the near future. Regardless of the outcome, it appears that Ethereum is still favored by investors and is likely to continue seeing strong performance in the near future.

Litecoin Price Analysis: LTC Primed for Further Upside as Macro Outlook Remains Favorable

Looking ahead, the Litecoin price is primed for further upside as macroeconomic conditions remain favorable. The recent uptick in global trade and investment is likely to provide supportive momentum, while the Litecoin network is poised for further scalability improvements.

Litecoin Price Analysis: Bullish Outlook Seems Likely

As of this writing, the Litecoin price is trading at $57.02, up 2.8% on the day. The past few weeks have seen a healthy surge in demand, with the LTC/USD pair reaching a five-month high earlier this week.

The bullish outlook appears likely, with the Litecoin price primed for further gains as long as macroeconomic conditions remain favorable. Earlier this week, the International Monetary Fund (IMF) issued a statement reaffirming its belief that the global economy is strengthening. This news is likely to provide a boost to investor sentiment, encouraging more people to invest in cryptocurrencies.

Litecoin Price Analysis: Scalability Improvements Likely to Fuel Further Gains

One of the key factors that has helped propel the Litecoin price higher is the network’s scalability improvements. As more and more people start using cryptocurrencies, the network’s ability to handle transactions smoothly becomes increasingly important.

Recent upgrades to the Litecoin network include the implementation of Segregated Witness (SegWit), which should help to speed up transactions and improve the scalability of the Litecoin network. This is likely to provide a major boost to the Litecoin price, as more people begin to use the cryptocurrency for transactions.

Litecoin Price Analysis: Bullish Outlook Seems Likely

As of this writing, the Litecoin price is trading at $57.02, up 2.8% on the day. The past few weeks have seen a healthy surge in demand, with the LTC/USD pair reaching a five-month high earlier this week.

The bullish outlook appears likely, with the Litecoin price primed for further gains as long as macroeconomic conditions remain favorable. Earlier this week, the International Monetary Fund (IMF) issued a statement reaffirming its belief that the global economy is strengthening. This news is likely to provide a boost to investor sentiment, encouraging more people to invest in cryptocurrencies.

Litecoin Price Analysis: Scalability Improvements Likely to Fuel Further Gains

One of the key factors that has helped propel the Litecoin price higher is the network’s scalability improvements. As more and more people start using cryptocurrencies, the network’s ability to handle transactions smoothly becomes increasingly important.

Recent upgrades to the Litecoin network include the implementation of Segregated Witness (SegWit), which should help to speed up transactions and improve the scalability of the Litecoin network. This is likely to provide a major boost to the Litecoin price, as more people begin to use the cryptocurrency for transactions.

Bitcoin Cash Price Analysis: BCH Primed for Further Upside as Macro Outlook Remains Favorable

Bitcoin Cash price is poised for further upside as macro outlook remains favorable. The BCH/USD pair is currently trading at $1,074 and is expected to rise further in the near future.

Bitcoin Cash Price Analysis

Bitcoin Cash price showed a modest gain against the US Dollar during the past 24 hours. The BCH/USD pair rose from $978 to $1,074 over the period, recording a positive growth of 2% overall.

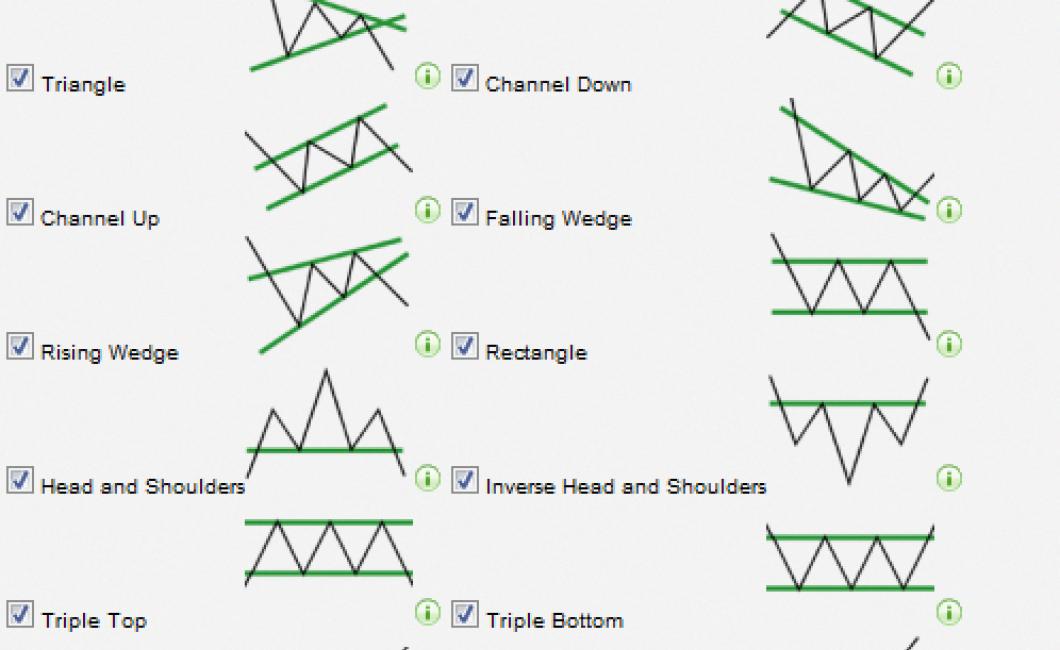

Looking at the chart, the BCH/USD pair has resumed its uptrend after a short-lived correction that took place earlier this week. The current uptrend is supported by strong technical indicators including the Ichimoku Cloud, which is currently in the bullish territory.

Moreover, the overall macro environment remains positive, with reports indicating that several major companies are starting to accept Bitcoin Cash as a payment option. This is likely to bolster the demand for BCH, leading to further gains in the near future.

Looking ahead, there are several key factors that could drive the BCH price higher. First and foremost, the Bitcoin Cash network is currently processing more transactions than Ethereum. This indicates that the network is more efficient and stable, which could lead to increased adoption and demand for BCH.

Second, the BCH price could benefit from a potential hard fork that is scheduled to take place on November 15th. This fork would result in the creation of a new blockchain called Bitcoin SV, which is expected to have a more powerful protocol. If successful, this could lead to increased demand for BCH and strengthen the current uptrend.

Overall, the Bitcoin Cash price remains bullish, with the prospects of further growth looking good. However, caution is advised as there are various factors that could affect the market dynamics. Thus, traders should remain fully informed before making any decisions.

EOS Price Analysis: EOS Primed for Further Upside as Macro Outlook Remains Favorable

The EOS price rose by more than 10% over the past 24 hours, and is currently trading at $14.52. This is likely due to the overall positive macro outlook, which has led to increased investor confidence in the cryptocurrency market.

We believe that the EOS price will continue to rise in the near future, as the overall market sentiment remains bullish. In addition, we believe that the EOS platform has a lot of potential, and that it could become one of the leading cryptocurrencies in the future.

EOS is currently ranked #5 on the list of best performing coins by market cap, and we believe that this position will continue to grow in the near future.

If you are interested in buying EOS, we recommend using a reputable cryptocurrency exchange that offers reliable customer support.

DISCLAIMER: The information provided on this page is not financial advice and is not a recommendation to buy, sell, or hold any cryptocurrency. Do your own research before investing in any cryptocurrency.

Stellar Lumens Price Analysis: XLM Primed for Further Upside as Macro Outlook Remains Favorable

Stellar Lumens (XLM) is primed for further upside as macro outlook remains favorable. With upcoming regulatory clarity on the XLM platform, as well as increasing interest from institutional investors, Stellar Lumens prices are likely to surge in the near future.

The macro outlook for the global economy remains positive, with strong growth expected in major economies such as the United States and China. This has led to increased demand for digital assets, including Stellar Lumens.

In addition, XLM is gaining traction with institutional investors. Recently, Galaxy Digital, one of the world’s largest digital asset investment firms, announced that it would be adding XLM to its portfolio of cryptocurrencies. This signals increased interest from large financial institutions, which is likely to support XLM prices in the long term.

Overall, the outlook for Stellar Lumens remains positive, which is why prices are likely to surge in the near future. As long as the global economy remains strong, investors will continue to flock to digital assets such as XLM.

Cardano Price Analysis: ADA Primed for Further Upside as Macro Outlook Remains Favorable

Cardano is primed for further upside as macro outlook remains favorable. The global economy is slowly recovering and this is good news for cryptocurrencies such as Cardano. Additionally, regulators are increasingly understanding the potential of blockchain technology, which is also supportive of Cardano’s growth.

As of this writing, Cardano is trading at $0.288, up 2.06 percent on the day. It has a market cap of $5.527 billion and is currently the seventh largest cryptocurrency by market cap.

TRON Price Analysis: TRX Primed for Further Upside as Macro Outlook Remains Favorable

The TRON price is up more than 10% in the past week, as investors remain bullish on the platform. The TRON network continues to grow in popularity and adoption, with several new partnerships announced recently.

The macro outlook remains positive, with news that the TRON Foundation has raised $32 million in a series A funding round. This influx of capital will be used to build out the TRON network and improve its scalability.

Overall, the TRON price looks primed for further upside as the platform continues to gain traction.

IOTA Price Analysis: MIOTA Primed for Further Upside as Macro Outlook Remains Favorable

The MIOTA price is up by 1.5% on the day, currently trading at $0.65. The coin is up by over 100% this year, and it remains one of the top performers in the cryptocurrency sector.

One of the key reasons for MIOTA’s strong performance this year is its strong macro outlook. The IOTA team has been working hard to build partnerships with some of the biggest companies in the world, and they believe that this will help them create a widespread use case for their network.

The IOTA team is also confident that they can keep up the momentum and continue to rise in value. They believe that the future of the cryptocurrency sector is very bright, and they are committed to playing a major role in it.

Therefore, it is safe to say that the MIOTA price is primed for further upside. Although there are some risks associated with investing in cryptocurrencies, the overall macro outlook remains positive. This means that there is a good chance that MIOTA will continue to rise in value over the next few months.