Technical Analysis Crypto Charts

If you're serious about making money in the cryptocurrency market, then you need to be serious about your technical analysis. That means using the right tools and charts to guide your decision-making. In this article, we'll show you the best crypto charts for technical analysis. We'll also explain some of the key concepts and indicators that you need to be aware of. By the end, you'll have a much better understanding of how to read and use crypto charts to your advantage. So, let's get started!

How to Read Crypto Charts for Beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

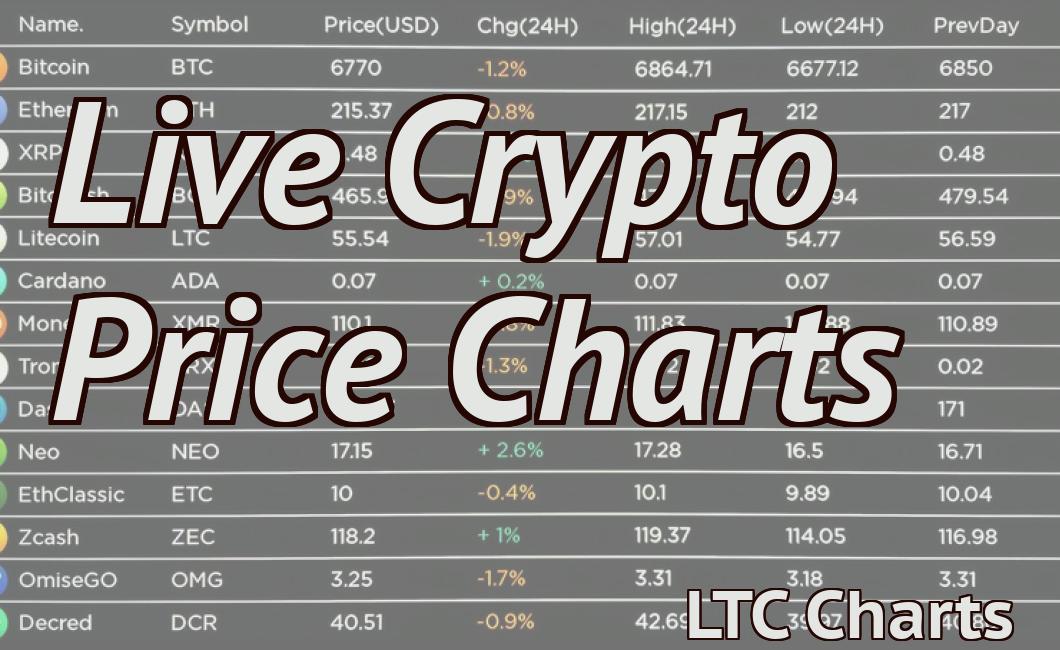

To read crypto charts, start by understanding what the different types of charts represent. Cryptocurrency charts usually display three different types of data: price, volume, and supply.

Price: The price of a cryptocurrency is the amount of money that a buyer is willing to pay for a unit of that cryptocurrency.

Volume: The volume of a cryptocurrency is the number of units of that cryptocurrency that have been traded on a specific exchange in a given period of time.

Supply: The supply of a cryptocurrency is the total number of units of that cryptocurrency that will be created over a specific period of time.

The Different Types of Crypto Charts

Cryptocurrency charts are used by investors, traders and enthusiasts to track the price movements of digital assets such as Bitcoin, Ethereum, Litecoin, and others.

There are several different types of cryptocurrency charts, each with its own benefits and drawbacks.

1) Candle Stick Chart

The candle stick chart is probably the most common type of cryptocurrency chart. It displays the price movement of a given cryptocurrency over a specific period of time using a candlestick metaphor.

The main advantage of the candle stick chart is that it is easy to understand. Candles represent how much money was spent on a given cryptocurrency over the course of a given period of time. The size and shape of the candles tell you how much money was made or lost during that period.

The main drawback of the candle stick chart is that it is not very granular. You can't see the exact moment when a given cryptocurrency increased or decreased in value.

2) Line Chart

A line chart is similar to a candle stick chart, but it displays the price movement of a given cryptocurrency over a period of time on a graph.

The main advantage of the line chart is that it is more granular than a candle stick chart. You can see the exact moment when a given cryptocurrency increased or decreased in value.

The main drawback of the line chart is that it can be harder to understand. It can be difficult to see how a given cryptocurrency's price has changed over the course of a given period of time.

3) Area Chart

An area chart is similar to a line chart, but it displays the price movement of a given cryptocurrency over a period of time on a graph.

The main advantage of the area chart is that it is easier to see how a given cryptocurrency's price has changed over the course of a given period of time.

The main drawback of the area chart is that it can be harder to understand. It can be difficult to see how a given cryptocurrency's price has changed over the course of a given period of time.

How to Use Technical Analysis with Crypto Charts

Technical analysis is a method of analyzing financial charts to help identify trends and predict future price movements. Crypto charts are no exception, and can be used in the same way as traditional stock charts.

To use technical analysis with crypto charts, start by finding a reliable cryptocurrency exchange where you can buy or sell the currency you're interested in. Once you have your desired digital asset, open a new tab in your browser and visit a reliable technical analysis website, such as TradingView.com.

On TradingView, enter the name of the cryptocurrency you're interested in and click on the "Cryptocurrency Charts" link at the top of the page. On the Cryptocurrency Charts page, you'll see two main types of charts: historical charts and technical charts.

Historical Charts

Historical charts show the price movement of a cryptocurrency over a specific period of time. To use historical charts to analyze a cryptocurrency's price movements, first find the date range you want to view (by clicking on the "Date Range" tab at the top of the page). Then, select the time frame you want to view (by clicking on the "Time Frame" tab at the top of the page).

Technical Charts

Technical charts show the various indicators that traders use to analyze a cryptocurrency's price movements. To use technical charts to analyze a cryptocurrency's price movements, first find the currency you're interested in and click on the "Cryptocurrency" link at the top of the TradingView page. Then, click on the "Technical Analysis" link near the bottom of the page.

On the Technical Analysis page, you'll see two main types of charts: candles and lines.

Candles

Candles show how much supply and demand is currently affecting a cryptocurrency's price. To use candles to analyze a cryptocurrency's price movements, first find the currency you're interested in and click on the " candle" link in the left-hand column. Then, select the time period you want to view (by clicking on the "Time Period" tab at the top of the page).

Lines

Lines show how a cryptocurrency's price is predicted to move in the future. To use lines to analyze a cryptocurrency's price movements, first find the currency you're interested in and click on the "line" link in the left-hand column. Then, select the time period you want to view (by clicking on the "Time Period" tab at the top of the page).

Once you've selected the information you want to view on the Technical Analysis page, you can start analyzing a cryptocurrency's price movements by viewing the candles and lines charts.

Candles

To view a cryptocurrency's candles chart, first find the currency you're interested in and click on the " Candle" link in the left-hand column. Then, select the time period you want to view (by clicking on the "Time Period" tab at the top of the page). On the Candle Chart page, you'll see a graph that displays how much supply and demand is currently affecting a cryptocurrency's price.

As you can see in the image above, there is a lot of supply (blue) and demand (red) currently affecting Ethereum's price. This means that Ethereum's price is likely to continue moving down in the short-term.

Lines

To view a cryptocurrency's lines chart, first find the currency you're interested in and click on the " Line" link in the left-hand column. Then, select the time period you want to view (by clicking on the "Time Period" tab at the top of the page). On the Line Chart page, you'll see a graph that predicts how a cryptocurrency's price is likely to move in the future.

As you can see in the image above, Ethereum's price is predicted to move up in the short-term, and down in the long-term.

The Benefits of Technical Analysis with Crypto Charts

Technical analysis can be a very valuable tool when it comes to trading cryptocurrencies. By understanding the technical indicators associated with a specific coin, you can gain a better understanding of how that coin is performing and make informed trading decisions. Here are some of the benefits of using technical analysis with crypto charts:

1. You Can Predict Price Movement

When you use technical analysis, you can start to predict where a cryptocurrency is likely to go in the future. By understanding the patterns that are associated with a coin's price movement, you can better predict where the price is likely to go next. This can help you make informed decisions about whether or not to buy or sell a coin.

2. You Can Detect Trends

When you use technical analysis, you can start to detect trends in the market. By looking at a coin's price movement over time, you can start to see patterns that suggest there is a trend present. This can help you make better investment decisions and avoid getting caught up in a trend that may not be worth investing in.

3. You Can Protect Yourself from Mass Panic

When the market begins to go crazy, it can be hard to keep yourself from getting caught up in the madness. By using technical analysis, you can start to detect patterns in the market that can help you stay calm and make informed decisions. This can protect you from being swept up in a mass panic and losing money in the process.

4. You Can Improve Your Trading Strategy

When you use technical analysis, you can start to develop a better trading strategy. By understanding how a coin is performing, you can start to develop a plan for when to buy and sell. This can help you make better informed decisions and improve your overall trading skills.

The Limitations of Technical Analysis with Crypto Charts

Technical analysis can be a helpful tool in understanding the behavior of digital assets. However, it has some limitations.

First, technical analysis is not always accurate. For example, price movements may not correlate perfectly with underlying fundamentals.

Second, digital assets are often highly volatile and may move rapidly and unpredictably. This can make it difficult to identify trends or establish whether a price movement is justified.

Finally, even if technical analysis is accurate, it does not always provide a complete picture of the underlying fundamentals. For example, it may not reveal important details about the company or project that is behind a digital asset.

7 Tips for Using Technical Analysis with Crypto Charts

1. Use technical analysis to identify trends and patterns in cryptocurrency prices.

2. Use technical analysis to anticipate where prices are likely to go next.

3. Use technical analysis to identify oversold and overbought conditions.

4. Use technical analysis to predict when a cryptocurrency is likely to reach a certain price point.

5. Use technical analysis to determine when a cryptocurrency is about to experience a buying or selling opportunity.

6. Use technical analysis to determine when a cryptocurrency is about to experience a price correction.

7. Use technical analysis to identify opportunities to buy or sell cryptocurrencies.

3 Simple Ways to Improve Your Technical Analysis Skills with Crypto Charts

1. Understand technical analysis concepts and how they work.

2. Use technical analysis tools to help make investment decisions.

3. Follow a set of technical analysis rules to improve your trading skills.

How to Avoid Making Common Mistakes When Analyzing Crypto Charts

There are a few things to keep in mind when analyzing crypto charts.

1. Don’t Overreact to Short-term movements

It can be tempting to react to short-term movements on crypto charts, but it’s important not to do so. The market is volatile and can move quickly, so it’s important not to get too caught up in the excitement.

2. Don’t Get Fooled by Hype

It’s important not to get fooled by hype. Sometimes, the most popular cryptocurrencies will experience significant price increases, which can be due to a lot of hype or because there’s actually something behind the coin that merits investment.

3. Be Vigilant for Ponzi Schemes

Be vigilant for Ponzi schemes. These types of coins typically involve investors putting in money that is never returned, and the only way to make money is to buy more coins. Be sure to do your research before investing in any cryptocurrency.

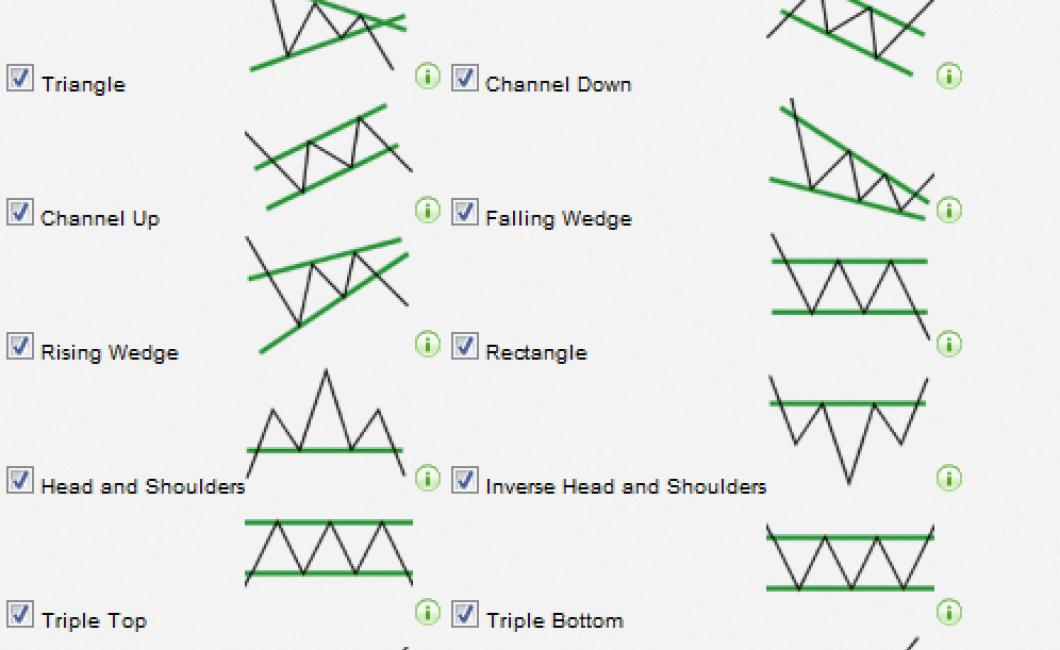

What You Need to Know About Cryptocurrency Charting Patterns

Cryptocurrency charts are a great way to get a snapshot of the current state of the cryptocurrency market. By analyzing the charts, you can identify trends and patterns that can help you make informed investment decisions.

Here are five key cryptocurrency charting patterns to keep an eye out for:

1. Head-and-Shoulders Patterns

Head-and-shoulders patterns are one of the most common trends you'll see on cryptocurrency charts. They occur when the price of a cryptocurrency rises sharply and then drops, before returning to the original price.

This pattern usually indicates that there is strong demand for the cryptocurrency and that people are optimistic about its future growth.

2. Fibonacci Retracements

Fibonacci retracements are another common trend you'll see on cryptocurrency charts. They occur when the price of a cryptocurrency moves higher or lower, but then reverses course and moves back towards the same price point.

This pattern usually indicates that there is strong demand for the cryptocurrency and that people are confident about its future growth.

3. Wadgets

Wadgets are small peaks and valleys that appear on cryptocurrency charts. They indicate short-term fluctuations in the price of a cryptocurrency, and can be useful for predicting future movements.

4. Time Series Analysis

Time series analysis is a method of analyzing historical data to identify patterns and trends. This is a powerful tool for understanding how the cryptocurrency market works, and can help you make informed investment decisions.

5. Elliott Wave Theory

Elliott wave theory is a popular theory that explains the patterns that occur in financial markets. It can be used to predict future movements in the cryptocurrency market, and can provide valuable insights into how the market works.

How to Recognize Important Trends in Crypto Charts

When it comes to cryptocurrency charts, it is important to be able to recognize important trends. Doing so will allow you to make informed investment decisions.

Here are four important trends to watch for when examining cryptocurrency charts:

1. Price Trends

One of the most important things to watch for on cryptocurrency charts is the trend of the price. This will tell you whether the price is going up or down, and how fast it is moving.

2. Volume Trends

Another important trend to watch for on cryptocurrency charts is the volume of the coins being traded. This will give you an indication of how active the market is, and how liquid the coins are.

3. MACD and RSI Reversals

Another important trend to watch for on cryptocurrency charts is the MACD (moving average convergence/divergence) and RSI (relative strength index) indicators. These indicators can signal when a currency is oversold or overbought, and may indicate a potential market crash.

4. Technical Indicators

Finally, another important trend to watch for on cryptocurrency charts is the use of technical indicators. These indicators can help you to determine when a coin is in a bull or bear market, and can help you to make informed investment decisions.

A Comprehensive Guide to Interpreting Crypto Charts

Cryptocurrency charts are an important part of understanding the market. By understanding how cryptocurrencies are moving, you can make more informed investment decisions.

This guide will teach you how to read cryptocurrency charts and use them to your advantage.

There is a lot of information on cryptocurrency charts, so we’ll start by discussing the most important things to look for.

1. Price Action

The first thing to look for on a cryptocurrency chart is price action. This refers to the movement of the cryptocurrency’s price over time.

Price action is important because it can tell you a lot about the underlying strength of the cryptocurrency. Look for trends in price action, and try to understand why the price is moving the way it is.

2. Supply and Demand

The second thing to look for on a cryptocurrency chart is supply and demand. Supply and demand refer to the amount of cryptocurrency that is available and wanted on the market.

The supply of a cryptocurrency refers to the number of coins that have been created. The demand for a cryptocurrency refers to the number of people who are interested in buying it.

The supply and demand of a cryptocurrency will affect the price of the cryptocurrency. If there is a lot of supply (less demand), the price of the cryptocurrency will be lower. If there is a lot of demand (less supply), the price of the cryptocurrency will be higher.

3. Volume

Volume is another important factor to look for on a cryptocurrency chart. Volume refers to the amount of transactions that are happening on the market.

A high volume indicates that there is a lot of interest in the cryptocurrency, and that people are buying and selling it a lot. A low volume indicates that there is low interest in the cryptocurrency, and that people are not buying or selling it much.

4. Technical Indicators

Technical indicators are indicators that are used to measure the performance of a market or asset. Technical indicators can help you identify trends in the market, and predict future prices.

Some common technical indicators include:

The Bollinger Band

The MACD

The RSI

The Chaikin Money Flow

5. Conclusion

When reading cryptocurrency charts, it is important to pay attention to price action, supply and demand, volume, and technical indicators. By understanding these factors, you can make more informed investment decisions.