Crypto Tradingview Charts

Crypto Tradingview Charts is a website that allows users to view and analyze cryptocurrency prices in real-time. The website also offers a variety of tools and resources for traders, including a news feed, a market analysis section, and a forum.

How to Use TradingView Charts for Cryptocurrency Trading

1. Open TradingView and create an account.

2. Click the "Charts" tab at the top of the screen.

3. Select the "Cryptocurrency" chart type.

4. Select the cryptocurrency you want to trade from the list on the left.

5. To see detailed information about the chart, select the "Data" tab.

6. To make changes to your chart settings, select the "Chart Settings" tab.

7. To find other helpful charts and information, select the "Help" tab.

The Benefits of Using TradingView Charts for Crypto Trading

TradingView charts are the perfect tool for cryptocurrency traders. They allow you to visualize complex information quickly and easily, which can help you make better investment decisions.

Here are some of the benefits of using TradingView charts for crypto trading:

1. Quick and easy access to important data:

TradingView charts are extremely user-friendly, making it easy to access important data quickly and easily. This helps you make better decisions about your investments, and avoid mistakes that could cost you money.

2. Visualization of complex information:

The visual presentation of TradingView charts makes complex information easy to understand. This allows you to better understand the dynamics of your investments, and make better strategic decisions.

3. More accurate analysis:

TradingView charts are designed specifically for cryptocurrency trading, which gives them a great deal of accuracy. This means that you can more easily identify trends and patterns in your investments, which can help you make better decisions.

4. Increased confidence in your trading:

Using TradingView charts can increase your confidence in your trading skills. This is because they provide an easy way to see how your investments are performing, and identify any potential problems early on.

The Best Features of TradingView Charts for Crypto Traders

There are many great features of TradingView charts for crypto traders. These include the ability to see real-time prices, technical analysis indicators, and more.

One of the most important features is the real-time price tracking. This allows you to see the latest prices for your chosen coins and track any changes in price. This is essential for anyone who wants to make informed trading decisions.

Another great feature is the technical analysis indicators. These allow you to analyse historical data and make informed decisions about future trends. This is an important tool for anyone who wants to be successful in crypto trading.

Overall, TradingView charts are a great way to stay up-to-date on the latest prices and trends for your chosen coins. They are essential for anyone who wants to make informed trading decisions.

How to Create a Custom Chart on TradingView for Crypto Trading

1. On TradingView, click on the "Accounts" tab at the top of the page.

2. In the Accounts section, click on the "Create Chart" button.

3. On the "Create Chart" dialog box, enter the following information:

Title: "My Crypto Trading Chart"

Description: This is a chart of my crypto trading activity.

Series: BTC/USD

Width: 600px

Height: 400px

4. Click on the "Create Chart" button to create your chart.

The Different Types of Charts Available on TradingView for Crypto Trading

There are a few different types of charts available on TradingView for crypto trading. They include:

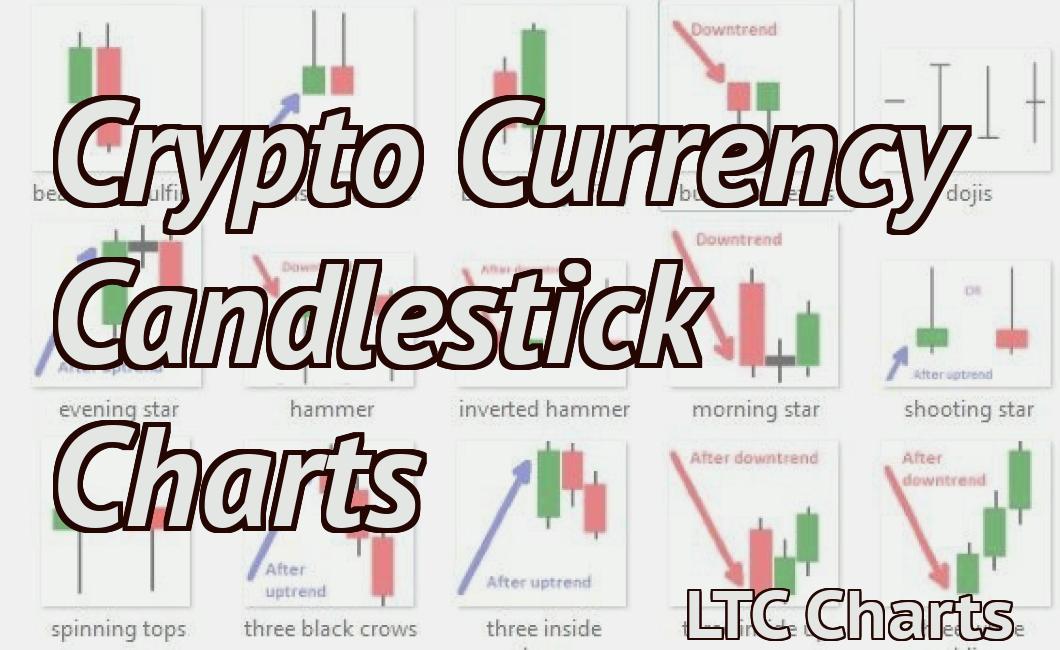

1. Candlestick charts are a type of chart used to depict the price movement of a security over a given period of time.

2. Line charts show the price action of a security over a given period of time on a chart with time intervals represented as lines.

3. Area charts show the price movement of a security over a given period of time on a chart with price areas represented as circles.

4. Gann charts are used to visualize patterns in price movements over a given period of time.

How to Analyze Candlestick Charts on TradingView for Crypto Trading

There are many different candlestick chart analysis methods that traders can use when analyzing crypto charts on TradingView. The most popular candlestick analysis method is the OHLC bar chart. Candlestick charts offer a visual representation of the price movement of a security over a given period of time.

In order to use the OHLC bar chart on TradingView, first create a new chart by clicking on the "Create Chart" button on the main toolbar. Select the "OHLC" type of chart from the dropdown menu. Next, select the timeframe for which you wish to analyze the data. For this example, we will be using the 1-day timeframe. Finally, select the asset for which you would like to view the data.

Now, select the "Candlesticks" tab from the main toolbar. This tab contains all of the different candlestick chart types that you can use on your chart. The "OHLC Bar" candlestick chart type is located in the "Analysis" section of the tab. To create a OHLC bar chart, click on the "Create OHLC Bar" button.

Next, enter the time period for which you would like to view the data in the "Time Frame" field. In this example, we will be viewing data for the 1-day timeframe. Next, select the asset for which you would like to view the data. In this example, we will be selecting the "Bitcoin" asset. Finally, select the " candles " tab from the main toolbar and select the " OHLC Bar " candlestick type from the list.

Now, you will need to fill in the "Data" field with the relevant data for your chart. In this example, we will be filling in the "Open" and "High" values for our candlestick chart. Next, you will need to fill in the "Close" value for your candlestick chart. Finally, you will need to fill in the "Volume" field with the relevant data for your chart. In this example, we will be filling in the "Volume" value for our candlestick chart.

Now, click on the "Create Chart" button to create your OHLC bar chart. Your chart should now be displayed on the main screen of TradingView.

Candlestick charts offer a great way to visually analyze the price movement of a security over a given period of time. By using the OHLC bar chart on TradingView, you can easily identify all of the important data points that are necessary for performing an accurate analysis of the security.

How to Analyze Bar Charts on TradingView for Crypto Trading

First, you need to identify the types of bars that are present on the chart. There are three main types of bars that you will see on a crypto trading chart:

The candle bar represents the value of an asset at the time the candle was created. The open and high bars represent the opening and highest point of the candle, respectively. The close and low bars represent the closing and lowest point of the candle, respectively.

You can also use the color of the bar to help you identify whether it is a buying or selling trend. For example, a green bar indicates that the market is buying the asset, while a red bar indicates that the market is selling the asset.

Next, you need to determine whether the trend is up or down. You can do this by examining the open, high, close, and low values of each bar. If the open value is higher than the high value and the close value is lower than the low value, then the trend is up. If the open value is lower than the high value and the close value is higher than the low value, then the trend is down.

Finally, you need to decide how much money you want to risk on the trend. You can do this by looking at the volume of the asset over time. If the volume is high, then you can assume that the market is bullish and therefore you should risk more money. If the volume is low, then you can assume that the market is bearish and therefore you should risk less money.

How to Analyze Line Charts on TradingView for Crypto Trading

When you're analyzing line charts on TradingView, you'll want to pay attention to the following factors:

1. The trendlines on the chart

The trendlines on the chart indicate whether or not the price is moving up or down. If the price is moving up along the trendline, then the trend is bullish and if the price is moving down along the trendline, then the trend is bearish.

2. The support and resistance levels

If the price is moving near the support level, this indicates that buyers are pushing the price up and if the price is moving near the resistance level, this indicates that sellers are pushing the price down.

3. The candles on the chart

The candles on the chart show how much money has been made or lost in a given period of time. If the candles are green, then this means that money has been made and if the candles are red, then this means that money has been lost.

How to Analyze Renko Charts on TradingView for Crypto Trading

There are a few ways to analyze Renko charts for crypto trading.

The first way is to look for areas of support and resistance. These are the areas where buyers and sellers are likely to clash, and where prices are likely to stay relatively stable. If the price falls below the support level, buyers may start to sell off their holdings, pushing the price down further. If the price exceeds the resistance level, sellers may start to buy up assets, pushing the price up.

The second way to analyze Renko charts is to look for patterns. These can be anything from Fibonacci retracements to engulfing and reverse patterns. If you see a pattern emerging, it can be an indication that a significant event is imminent, and that prices are likely to change direction as a result.

Finally, you can also look at volume levels to get a sense of how active the market is. If there are a lot of buyers and sellers trading assets, it may be indicative of a strong trend. If there are few transactions happening, it may be an indication that the market is relatively static.

How to Analyze Heikin Ashi Candles on TradingView for Crypto Trading

Heikin Ashi candles are used to indicate a security's ability to hold its value. The Heikin Ashi candle is a technical indicator used in the Japanese candlestick charting system. It is based on the idea that a security's price will not change significantly over a given period of time, if the security is "ashamed" of its closing price.

To use Heikin Ashi candles for crypto trading, first find the Heikin Ashi indicator on TradingView. Once located, open the chart and find the " candles " tab. Under the " candles " tab, you will find the Heikin Ashi candles chart.

The Heikin Ashi candles chart shows the average percentage of price change over a given period of time. The blue bars represent the closing prices of the securities, while the yellow bars represent the opening prices.

The Heikin Ashi candles are divided into two categories: "MA", which stands for Moving Average, and "EMA", which stands for Exponential Moving Average.

The EMA is a more accurate indicator of price stability, while the MA is more responsive to short-term price movements.

To use Heikin Ashi candles for crypto trading, first find the Heikin Ashi indicator on TradingView. Once located, open the chart and find the " candles " tab. Under the " candles " tab, you will find the Heikin Ashi candles chart.

The Heikin Ashi candles chart shows the average percentage of price change over a given period of time. The blue bars represent the closing prices of the securities, while the yellow bars represent the opening prices.

The Heikin Ashi candles are divided into two categories: "MA", which stands for Moving Average, and "EMA", which stands for Exponential Moving Average.

The EMA is a more accurate indicator of price stability, while the MA is more responsive to short-term price movements.

How to Analyze Point & Figure Charts on TradingView for Crypto Trading

There are a few different ways to analyze point & figure charts for crypto trading. The first way is to look at the chart and see where the price is currently located. You can also use the indicators on the chart to help determine where the price is likely to go next. The second way to analyze point & figure charts is to look at the chart and see where the price has been in the past. This will help you predict where the price is likely to go in the future.

How to Set Up Alerts on TradingView Charts for Crypto Trading

1. Go to the TradingView account that you want to set up alerts for.

2. Click on the "Alerts" tab at the top of the page.

3. On the "Alerts" page, click on the "Create Alert" button.

4. On the "Alert Creation" page, enter the following information:

Alert Name: Crypto Trading Alert

Description: This is an alert for cryptocurrency trading activity

5. Select the types of alerts that you want to set up.

6. Click on the "Create Alert" button.

7. On the "Alert Status" page, you will see all of the alerts that you have set up.

8. To add an alert, click on the "Add Alert" button.

9. On the "Alert Creation" page, enter the following information:

Alert Name: Crypto Trading Alert

Description: This is an alert for cryptocurrency trading activity

10. Select the types of alerts that you want to set up.

11. Click on the "Create Alert" button.

12. On the "Alert Status" page, you will see all of the alerts that you have set up.