Dollar Cost Avg Crypto Charts

This article discusses the dollar cost averaging crypto charts, which can be used to help investors buy cryptocurrencies at a lower price. The charts can be used to track the prices of various cryptocurrencies over time, and can help investors determine when to buy or sell.

How to Use Dollar Cost Averaging to Grow Your Crypto Portfolio

Dollar Cost Averaging is a technique that can be used to grow your cryptocurrency portfolio over time.

Understand what DCA is

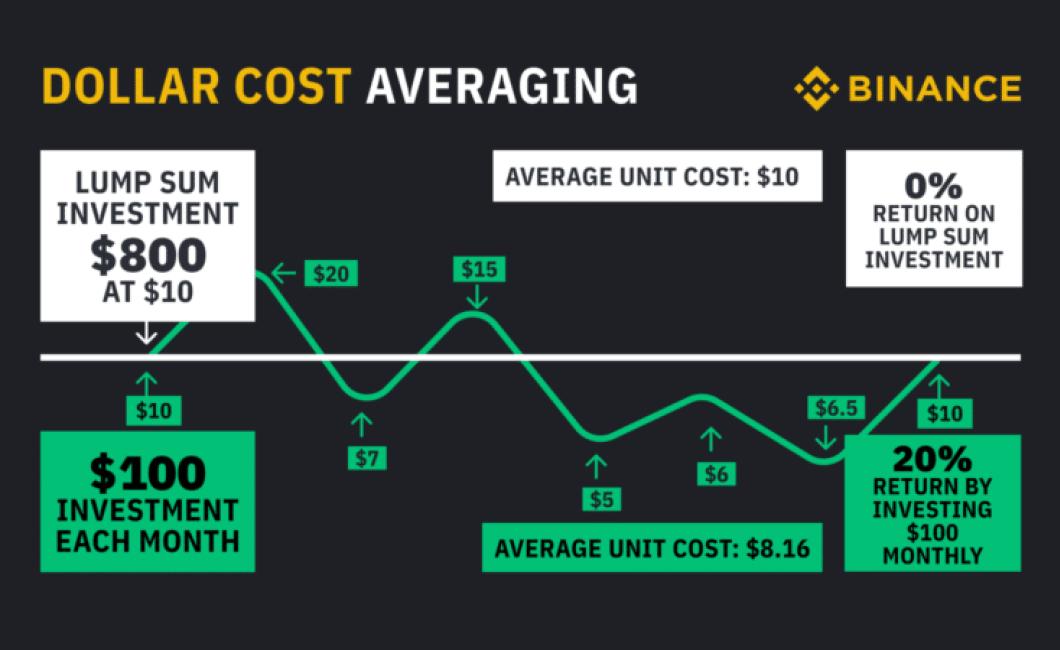

Dollar Cost Averaging (DCA) is a technique that allows you to purchase a security over time at a fixed price. This allows you to buy the security at a lower price than if you purchased it all at once.

The goal of DCA is to average down your investment. This means that you want to purchase a security over time, and then sell it after a certain period of time. The longer the period of time, the lower the price you can sell it for.

How to use dollar cost averaging

There are a few different ways to use dollar cost averaging. The most common way is to purchase a security over time, and then sell it after a certain period of time.

The other way is to purchase a security, and then hold on to it for a certain period of time. This allows you to get the benefits of dollar cost averaging, but without having to sell the security.

The Benefits of Dollar Cost Averaging in Crypto Trading

There are many benefits to dollar cost averaging in crypto trading. The most obvious benefit is that it allows you to spread your investment over a period of time, which reduces the risk of losing all of your capital in a single trade.

Another big benefit of dollar cost averaging is that it can help you avoid emotional investing. When you invest in a new asset class, it’s easy to get swept up in the hype and buy at the peak of the market. By investing over time, you’re less likely to get caught up in this kind of behavior.

Finally, dollar cost averaging can help you develop a longer-term investment strategy. Instead of trying to time the market, dollar cost averaging allows you to buy into a coin or token at a lower price and then wait for it to go up in value. This approach gives you more stability and reduces the risk of losing money on a short-term investment.

Why Dollar Cost Averaging is the Smart Way to Invest in Crypto

When it comes to investing in cryptocurrencies, there are a few different options open to you. One of the most popular methods of investment is called dollar cost averaging. This involves buying a fixed amount of cryptocurrency each month over a set period of time.

This is a smart way to invest in cryptocurrencies because it allows you to spread your risks out over a longer period of time. If the price of a cryptocurrency falls, you will still make money overall because you will have bought the currency at a lower price. Conversely, if the price of a cryptocurrency rises, you will still make money overall because you will have bought the currency at a higher price.

This is a risk-free way to make money from cryptocurrencies. There is no need to worry about losing your money if the price of a cryptocurrency falls. And there is no need to worry about making a quick profit if the price of a cryptocurrency rises.

Dollar cost averaging is the perfect way to get started with cryptocurrencies. It is easy to set up and you don’t need to worry about any technical details. You can also stop dollar cost averaging at any time if you want.

How Dollar Cost Averaging Can Help You Maximize Your Profits in Crypto Trading

Dollar Cost Averaging (DCA) is a popular technique used in trading to increase profits. DCA works by buying a fixed number of assets at fixed prices over a set period of time. This allows you to reduce the risk of large fluctuations in price and increases your chances of making a profit.

DCA can be used to increase profits in crypto trading by taking advantage of the long term trends in the market. By buying a fixed number of assets at fixed prices, you reduce the risk of large fluctuations in price. This allows you to make consistent profits over time by averaging out the price of the assets.

To use DCA in crypto trading, first find a set period of time for which you want to buy the assets. Next, find a fixed price at which you want to buy each asset. Finally, buy the assets at the fixed price and hold them for the set period of time.

DCA can be a useful tool for increasing profits in crypto trading. By using a fixed number of assets at fixed prices, you reduce the risk of large fluctuations in price. This allows you to make consistent profits over time by averaging out the price of the assets.

The Simple Strategy of Dollar Cost Averaging That Can Boost Your Crypto Returns

Dollar Cost Averaging is a simple investment strategy that can help you boost your crypto returns.

Dollar Cost Averaging is a technique that uses repeated buying of a security at fixed intervals over a period of time. The idea is to purchase the security at a lower price each time and average out the cost over the period of time. This will provide you with a better return on your investment over time.

There are several benefits to using dollar cost averaging when investing in cryptocurrencies. First, it allows you to buy a security at a lower price which can increase your total return. Second, it reduces your risk by spreading your investment across a number of different purchases. And finally, it helps you to avoid emotional reactions to market volatility.

To dollar cost average in cryptocurrencies, you will need to find a secure wallet where you can store your coins. Then, you will need to set up a buying schedule. You can buy a cryptocurrency every day, weekly, or monthly. You will also need to decide how much money you want to invest each time. Finally, you will need to wait for the price of the cryptocurrency to reach your set price before making your purchase.

By following these simple steps, you can increase your crypto returns by dollar cost averaging.

Get Ahead of the Curve With Dollar Cost Averaging in Crypto Trading

One of the most effective strategies for making money in the stock market is dollar cost averaging. This involves investing a fixed amount of money, or “cost,” into a security, over a period of time. This allows you to minimize your risk while still achieving potential rewards.

Dollar cost averaging is also a great strategy for cryptocurrency trading. By investing a fixed amount of money into a cryptocurrency over a period of time, you can minimize your risk while still achieving potential rewards. By following this strategy, you can help ensure that you are gradually building up your investment portfolio over time, rather than gambling it all on one investment.

There are a few things to keep in mind when dollar cost averaging in cryptocurrency trading. First, it is important to determine the length of time that you want to invest in a cryptocurrency. Some investors choose to invest for a short period of time, while others choose to invest for a longer period of time. Second, it is important to determine the investment amount that you want to invest. Some investors choose to invest smaller amounts of money, while others choose to invest larger amounts of money. Finally, it is important to determine the cryptocurrency that you want to invest in. Some investors choose to invest in multiple cryptocurrencies, while others choose to invest only in one cryptocurrency.

Dollar cost averaging is an effective way to make money in the stock market and cryptocurrency market. By following this strategy, you can help ensure that you are gradually building up your investment portfolio over time, rather than gambling it all on one investment.

How to Use Dollar Cost Averaging to Build a Successful Crypto Portfolio

You may be familiar with dollar cost averaging as a way to save money on your investments. This investing technique involves investing a fixed amount of money into a security or asset at regular intervals. This can help reduce the impact of short-term volatility and help you achieve a more consistent return over time.

Dollar cost averaging can be used to build a successful crypto portfolio. Here are four tips for doing so:

1. Choose a Cryptocurrency to Invest in

The first step is to choose a cryptocurrency to invest in. This is important because the success or failure of your portfolio will largely be determined by the performance of the selected coin.

2. Set a Minimum Investment Amount

The next step is to set a minimum investment amount. This will help you avoid entering too much money into a single coin, which could lead to high risk and potential loss.

3. Begin Investing Regularly

The third step is to begin investing regularly. This will help increase the chances that you will achieve consistent returns over time.

4. Adjust Your Investments as Needed

If the selected cryptocurrency begins to experience declines in value, you may need to adjust your investment amount. However, be sure to do so gradually in order to avoid selling at an unfavorable price point.

The Power of Dollar Cost Averaging in Cryptocurrency Trading

It is important to keep in mind that dollar cost averaging is a powerful tool in cryptocurrency trading. This is especially true when it comes to long-term investments. By investing a fixed amount of money over a period of time, you can average out the performance of your portfolio. This will help you avoid the risks associated with trading in a volatile market.

Dollar cost averaging can also help you make better investment decisions. By investing a fixed amount of money over a period of time, you can avoid making rash decisions based on short-term fluctuations in the market. This will help you maintain a more consistent portfolio over the long term.

In general, dollar cost averaging is a powerful tool for investors. It can help you avoid the risks associated with trading in a volatile market. It can also help you make better investment decisions.