What are crypto prices based on?

The article discusses how crypto prices are based on a variety of factors, including supply and demand, speculation, and the underlying blockchain technology.

Understanding the Factors that Influence Cryptocurrency Prices

There are a number of factors that influence the price of cryptocurrencies. These factors include global economic conditions, technical updates, and overall demand from buyers and sellers.

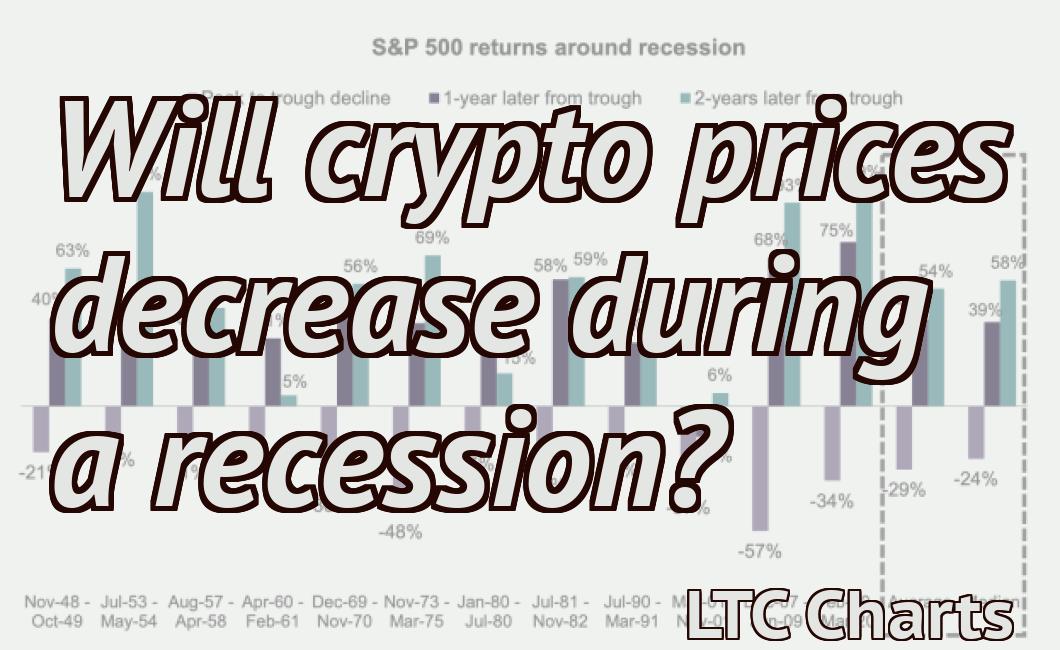

Global Economic Conditions

The global economic conditions play a big role in the price of cryptocurrencies. When the economy is doing well, people are more likely to invest in cryptocurrencies, which drives up the prices. Conversely, when the economy is bad, people are less likely to invest in cryptocurrencies, which drives down the prices.

Technical Updates

Technical updates are another factor that influences cryptocurrency prices. When a new algorithm is released that improves the performance of a cryptocurrency, this can lead to an increase in its price. Conversely, when a new algorithm is released that decreases the performance of a cryptocurrency, this can lead to a decrease in its price.

Overall Demand from Buyers and Sellers

Overall demand from buyers and sellers also plays a role in the price of cryptocurrencies. When there is a lot of interest in cryptocurrencies, the prices will be higher. Conversely, when there is little interest in cryptocurrencies, the prices will be lower.

How Supply and Demand Affect Cryptocurrency Prices

Cryptocurrency prices are affected by supply and demand. When more people want to buy a cryptocurrency, the price goes up. Conversely, when fewer people want to buy a cryptocurrency, the price goes down.

The Relationship Between Fiat Currency and Cryptocurrency Prices

Cryptocurrencies are decentralized digital tokens that use cryptography to secure transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are not regulated by governments and their value is determined by supply and demand.

Fiat currencies, like the U.S. dollar, are also decentralized digital tokens that use cryptography to secure transactions and to control the creation of new units. Fiat currencies are regulated by governments, and their value is determined by supply and demand.

The Impact of News and Media on Cryptocurrency Prices

There is no one definitive answer to this question as the impact of news and media on cryptocurrency prices can vary greatly depending on the specific situation. However, some general trends can be observed.

First and foremost, news and media can have a positive or negative effect on cryptocurrency prices. Positive news stories can boost prices, while negative stories may cause them to fall.

Second, the effect of news and media on cryptocurrency prices can also be highly unpredictable. This is because the volume and intensity of coverage of a particular cryptocurrency can vary significantly from day to day.

Finally, it is important to keep in mind that the impact of news and media on cryptocurrency prices is complex and tricky to assess. This is because there are a large number of factors that can influence prices, including demand and supply, technical analysis, and global economic conditions.

The Role of Exchange Rates in Determining Cryptocurrency Prices

When you buy or sell cryptocurrencies, the price you pay and the price you receive is determined by the exchange rate.

The exchange rate is the ratio of one currency to another. It is expressed as a number between 1 and 1,000,000. For example, if you buy Bitcoin at USD $10,000 and sell it at USD $11,000, the exchange rate is 10,000/11,000 or 1.1.

The exchange rate can change quickly and often depends on several factors, including political, economic, and trading conditions.

How Social Media Sentiment Impacts Cryptocurrency Prices

As cryptocurrencies and blockchain technology continue to gain in popularity, so too does the sentiment surrounding them. This sentiment can directly impact cryptocurrency prices, as investors and traders may react to positive or negative news stories or announcements.

For example, Bitcoin prices surged after the SEC announced it would not regulate the digital asset class. However, this positive sentiment was short-lived, as a few days later, a report emerged suggesting Facebook was planning to launch its own cryptocurrency. This news negatively impacted Bitcoin prices, as investors sold off their holdings.

On the other hand, Bitcoin prices surged after a South Korean court ruled that Bitcoin is not a currency, effectively legitimizing the digital asset class. This positive sentiment was reflected in the price of Bitcoin, which reached an all-time high.

The Technical Aspects that Drive Cryptocurrency Prices

When it comes to cryptocurrency prices, there are a few technical aspects that drive prices.

First and foremost, Bitcoin and other cryptocurrencies are digital or virtual assets. As such, their prices are based on supply and demand.

Supply is determined by the number of coins that have been mined (or created) so far. As more coins are mined, the supply decreases, which drives up prices.

Demand is influenced by a number of factors, including global interest in cryptocurrencies, news events that affect prices, and technical analysis.

Technical analysts look at charts to determine how the price of a cryptocurrency is behaving and whether it is overbought or oversold. If they determine that the price is too high, they may sell off their holdings. If they determine that the price is too low, they may buy more cryptocurrency.

The overall trend of the cryptocurrency market is also important. If investors believe that the market is headed in a positive direction, they may buy more cryptocurrency. If they believe that the market is headed in a negative direction, they may sell off their holdings.

The Fundamental Principles that Underpin Cryptocurrency Prices

Cryptocurrencies are based on the concept of cryptography, which is the practice of secure communication in the presence of third parties. Cryptography is a mathematical science used to protect information from unauthorized access. Cryptocurrencies use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are also anonymous, meaning users cannot be identified.

Cryptocurrencies are created through a process called mining. Miners are rewarded with new cryptocurrencies for verifying and validating transactions. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous individual or group known as Satoshi Nakamoto.

The Future of Cryptocurrency Pricing – What to Expect

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Historically, the price of cryptocurrencies has been highly volatile and often affected by a number of factors, including global economic conditions, news events, regulatory actions, and public opinion. In the short term, cryptocurrency prices are often influenced by speculative investors. In the long term, however, cryptocurrency prices are generally determined by supply and demand.

There is no one definitive answer to what will happen to cryptocurrency prices in the future. However, there are a number of factors that could have a significant impact on prices, including:

1. Government Regulations

Government regulations could have a major impact on the pricing of cryptocurrencies. For example, if the government decides to ban or restrict the use of cryptocurrencies, this could lead to a decrease in demand and subsequently a decrease in prices.

2. Economic Conditions

The overall economy is also a major factor that can affect the prices of cryptocurrencies. If the economy is experiencing a downturn, this could lead to a decrease in demand for cryptocurrencies and consequently a decrease in prices.

3. News Events

News events can also have a significant impact on the prices of cryptocurrencies. For example, if a major company adopts a cryptocurrency as a method of payment, this could lead to an increase in demand and subsequently an increase in prices.

4. Regulatory Actions

Regulatory actions could also have a significant impact on the prices of cryptocurrencies. For example, if the government imposes new regulations that make it difficult or impossible for users to purchase or sell cryptocurrencies, this could lead to a decrease in demand and subsequently a decrease in prices.