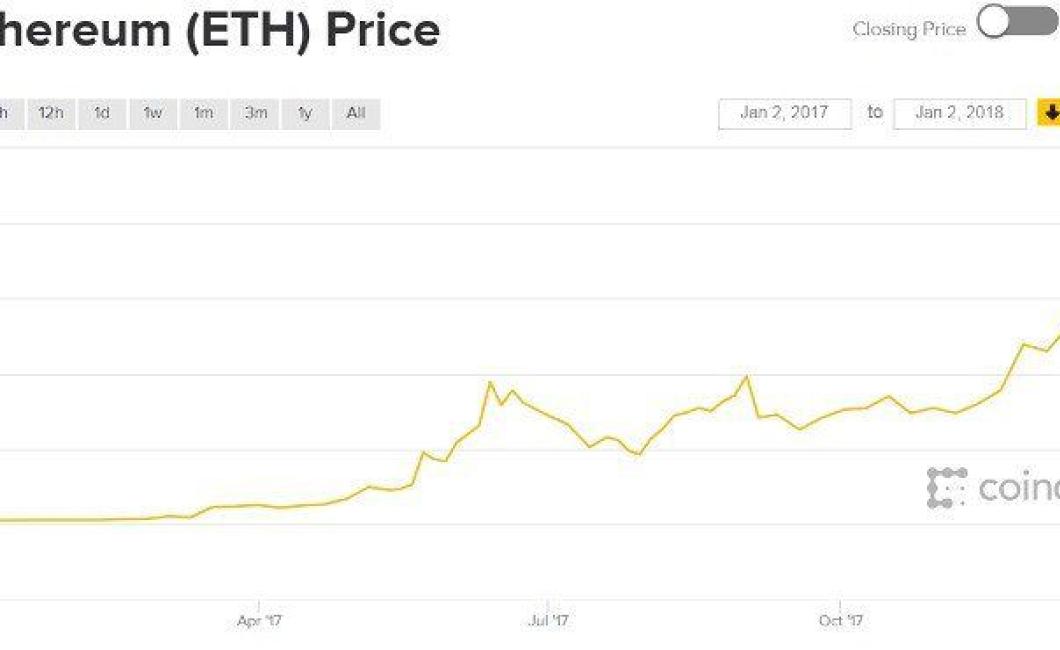

Crypto market prices in the beginning of 2017.

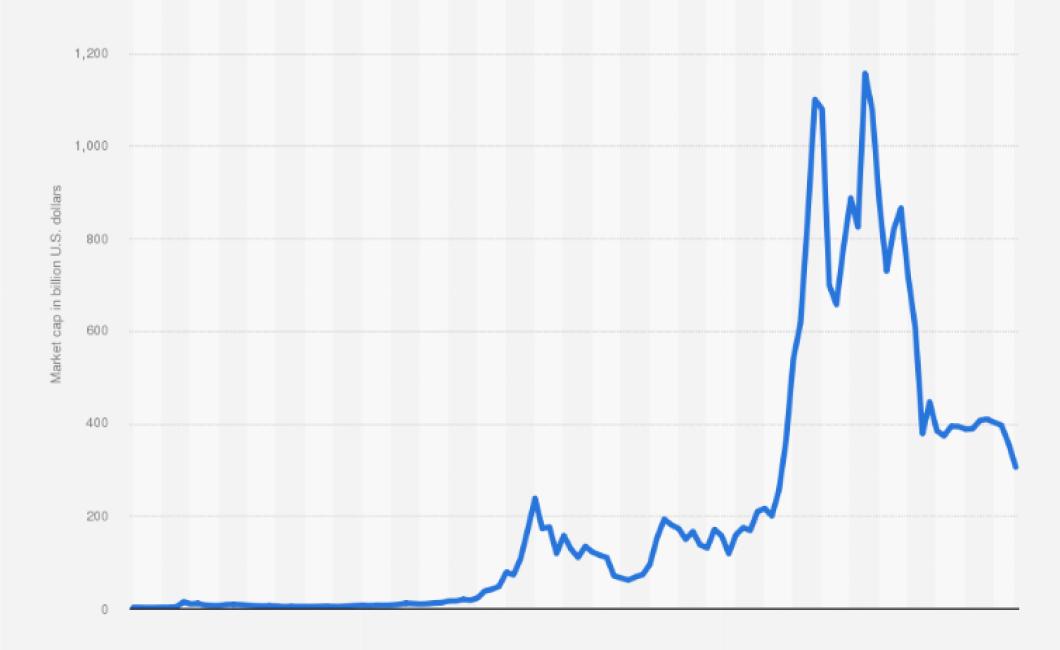

When 2017 began, the crypto market was on fire. Bitcoin was up over 100% since the beginning of the year, and Ethereum was up even more. All of the top 10 cryptocurrencies by market cap were in the green, and things looked good for the young industry. However, prices didn't stay high for long. By the end of January, the market had begun to correct, and by February, it was in full-blown bear mode. By the time March rolled around, most coins had lost 50% or more of their value from their January highs. What caused this crash? There are a few theories, but no one knows for sure. Some say that it was due to Chinese investors selling off their holdings as the government cracked down on cryptocurrency exchanges. Others believe that it was simply a case of the market getting ahead of itself and correcting back to more realistic levels. Whatever the cause, the crash of early 2018 was a harsh reality check for the crypto industry. Prices have slowly begun to recover since then, but they are still a far cry from where they were at the beginning of the year.

2017: The Year of Cryptocurrency Price Surges

In 2017, the price of cryptocurrency surged as investors bet on the future of digital assets. Bitcoin, Ethereum, and other major coins all saw significant increases in value, reaching new all-time highs.

While there are a number of factors that can contribute to the price surge, one of the most significant was the increasing interest from institutional investors. Several large financial firms began to invest in the space, signaling that cryptocurrencies could have a long-term future.

2018: The Year of Cryptocurrency Regulations

In 2018, the regulatory landscape around cryptocurrencies continued to change as various governments began to take notice of the growing popularity of digital assets.

As a result, several countries began to adopt stricter policies regarding cryptocurrency and related activities. China, for example, is notorious for its strict stance on internet censorship, which has led to a number of restrictions on digital currency activity.

However, despite these restrictions, the overall market trend continued to rise, with major coins seeing even larger gains. This has led some experts to believe that 2018 could be the year when cryptocurrencies become mainstream.

Bitcoin, Ethereum, and Litecoin Prices in the Beginning of 2017

Bitcoin, Ethereum, and Litecoin prices were all relatively low in the beginning of 2017. Bitcoin was trading at $1,000 per coin, Ethereum was trading at $10.68 per coin, and Litecoin was trading at $9.61 per coin.

January 2017: A Month of Fluctuating Cryptocurrency Prices

January 2017 was a month of significant price fluctuations for cryptocurrencies. Bitcoin prices saw a sharp increase in value, reaching a high of $1,100 before declining to around $960 by the end of the month. Ethereum prices also increased significantly, reaching a high of $405 before declining to around $320 by the end of the month.

February 2017: Another Month of Highs and Lows for Crypto Prices

As we head into another month of crypto prices, there have been a number of high and lows experienced by a variety of coins and tokens. Bitcoin, Ethereum, and Bitcoin Cash have all seen major price swings this month, with each coin experiencing its own set of highs and lows.

Bitcoin has been the most volatile coin this month, with a price swing of over 20% seen in some cases. Ethereum has also seen a lot of fluctuation, with a price swing of over 10% in some cases. However, Bitcoin Cash has seen the biggest price swings of all, with a price swing of over 50% seen in some cases.

Overall, it has been a month of high volatility for crypto prices, with a lot of movement seen in a variety of coins and tokens. This volatility could continue into February, with a number of big price swings possible.

March 2017: The Calm Before the Storm?

April 2017: The Road to the Midterms

March 2017: The Trump Administration in a Nutshell

February 2017: The State of the Union

April 2017: The Biggest Cryptocurrency Price Swings Yet

Bitcoin prices continued their climb in April, as the cryptocurrency reached new all-time highs.

In the week of April 10-16, Bitcoin prices surged by over 10%, reaching a value of $1,240 per coin. This marks the fourth consecutive month in which Bitcoin prices have increased by at least 10%, and the largest price increase yet for the year.

Overall, April was a very positive month for the cryptocurrency market, with Bitcoin prices increasing by over 60% from their value in March. This strong performance indicates that investors are continuing to invest in cryptocurrencies, despite some recent volatility.

Looking forward, Bitcoin prices are still relatively volatile and largely unpredictable, so it is difficult to predict future price movements. However, overall, April was a very positive month for the cryptocurrency market, and we are optimistic about the future growth of Bitcoin and other cryptocurrencies.

May 2017: Prices Finally Begin to Stabilize

After years of steadily increasing prices, the cost of goods and services in the United States begins to stabilize in early 2017. While there are still some price hikes, they are not as dramatic as they were earlier in the year. This gradual stabilization of prices is likely due to a number of factors, including increased competition among businesses, increased demand from international markets, and increased wages.

Looking Back on the First Half of 2017: The Rise and Fall (and Rise?) of Cryptocurrency Prices

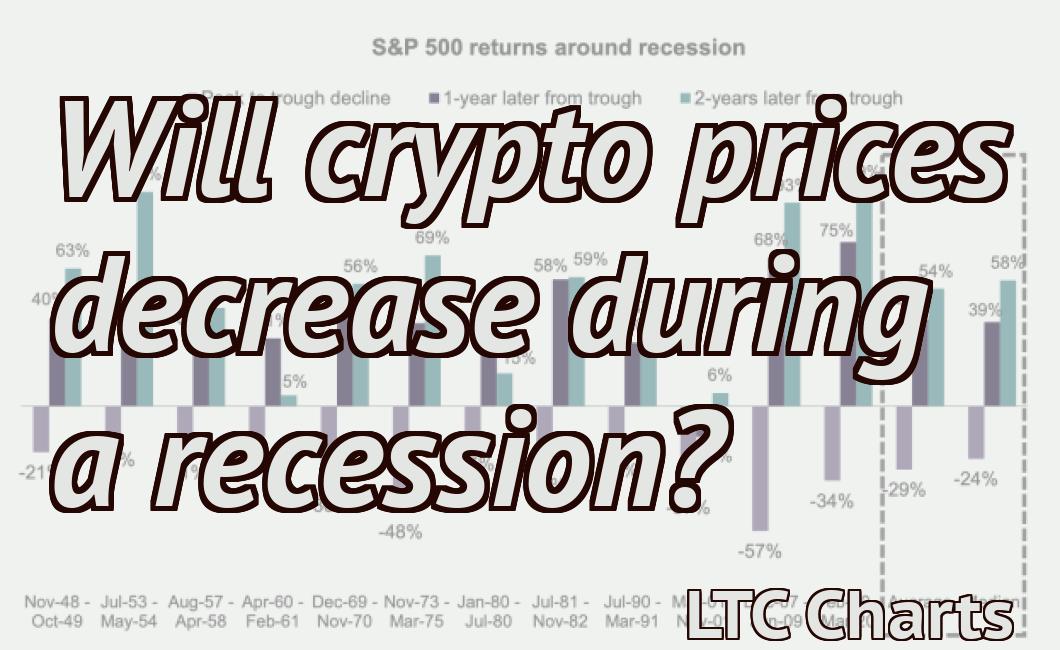

2017 has been an eventful year for cryptocurrency prices. Prices started the year at just over $1,000 per bitcoin, but by the end of June they had fallen to around $600. In the second half of the year, prices rose again, reaching a high of just under $20,000 in December. However, in January 2018 prices plummeted, and by the end of the month they had fallen below $6,000.

What caused these dramatic changes in cryptocurrency prices?

There are a number of factors that could have contributed to the rise and fall of cryptocurrency prices in 2017. Some of these include:

1. Increased interest in cryptocurrency and blockchain technology: 2017 saw a surge in interest in cryptocurrencies and blockchain technology, with many people becoming interested in this new phenomenon. This increased interest may have caused prices to rise initially, as investors began to invest in these new technologies.

2. Volatility: Cryptocurrency prices are highly volatile, and often change rapidly and dramatically. This makes it difficult for investors to predict how prices will change, which may lead to some people investing more money than they should and resulting in a loss of money.

3. Regulatory uncertainty: As cryptocurrencies continue to gain in popularity, there is greater regulatory uncertainty around them. This uncertainty can lead to negative investor sentiment and reduced investment, which can then lead to a decline in prices.

4. The cryptocurrency market is still very young: The cryptocurrency market is still very young, and there is a lot of speculation involved. This means that there is a lot of risk associated with investing in cryptocurrencies, and this can lead to price volatility.