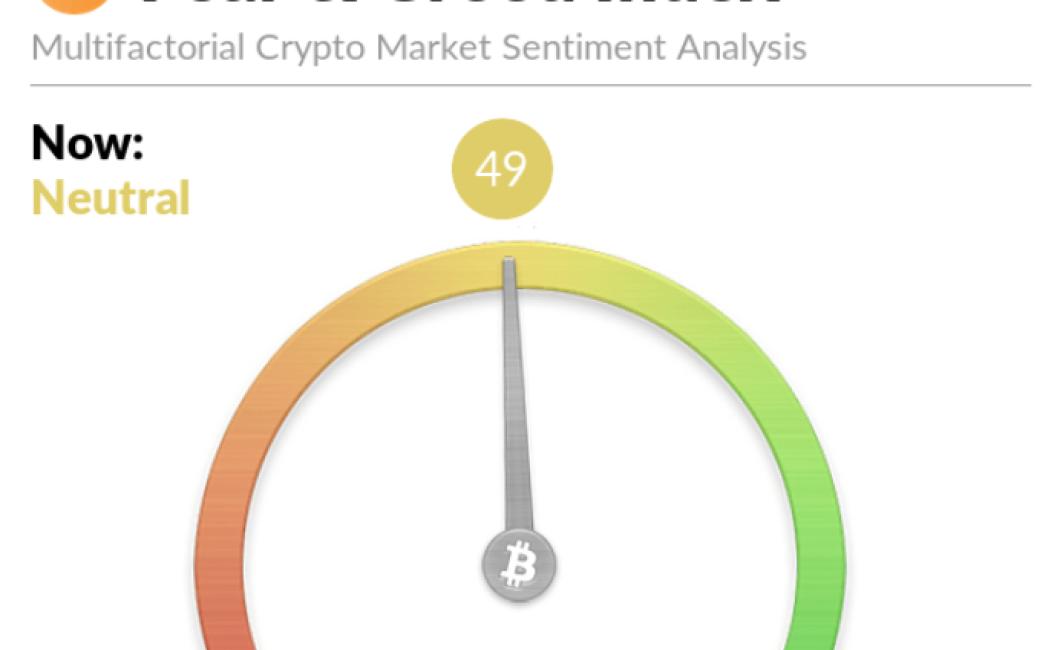

Market sentiment drives crypto prices.

In the cryptocurrency market, sentiment refers to the overall attitude of investors towards a particular coin or token. Positive sentiment usually drives prices up, while negative sentiment can lead to sell-offs and price declines. In general, market sentiment is influenced by a variety of factors, including news events, regulatory developments, and technical analysis.

Market Sentiment Dictates Crypto Prices

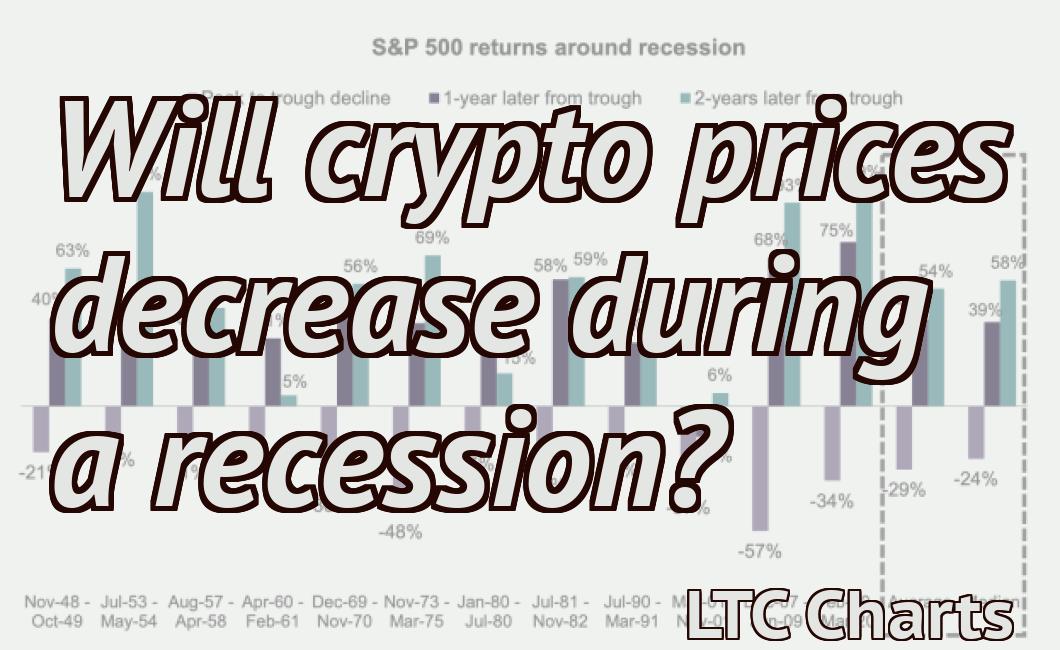

Cryptocurrencies are a new and volatile investment. They are often associated with criminal activity and are not regulated by any government. This makes them a high-risk investment.

The sentiment of the market dictates the prices of cryptocurrencies. When investors believe that the market is stable, the prices of cryptocurrencies tend to be more stable. When investors believe that the market is unstable, the prices of cryptocurrencies tend to be more volatile.

Investor Confidence Key to Cryptocurrency Prices

Investors are confidence key to cryptocurrency prices. When they believe that a cryptocurrency is a good investment, they will buy it and drive its price up. Conversely, when they believe that a cryptocurrency is a bad investment, they will sell it and drive its price down.

herd mentality among investors creates market conditions

that favor companies with large accumulated profits,

and against companies that are trying to reinvest in their businesses.

Large profits can be achieved through any number of methods, such as aggressive marketing and price gouging. This can lead to companies becoming entrenched in their markets, making it more difficult for new entrants to compete. Conversely, reinvesting in one's business can lead to innovation and growth, which is often more beneficial to the consumer. When investors have herd mentality, they are more likely to follow the lead of others, which can lead to market conditions that are unfavorable to new entrants.

how market sentiment affects cryptocurrency prices

When people are bullish on a certain cryptocurrency, they tend to buy more of that cryptocurrency. This drives up the price of that cryptocurrency. Conversely, when people are bearish on a certain cryptocurrency, they tend to sell more of that cryptocurrency. This drives down the price of that cryptocurrency.

what drives crypto prices: market sentiment or fundamentals?

Cryptocurrencies are primarily driven by market sentiment. This means that the price of a cryptocurrency is not based on fundamentals, such as the value of a underlying asset or the reliability of a blockchain network. Instead, prices are determined by how much people are willing to pay for a digital asset.

Some cryptocurrencies, such as Bitcoin, are built on blockchain networks that are believed to be secure and reliable. This may lead to increased demand for these cryptocurrencies, which could drive prices up. Other cryptocurrencies, such as Ethereum, are built on blockchain networks that are still in development. This may lead to decreased demand for these cryptocurrencies, which could drive prices down.

why market sentiment is everything for crypto prices

Believe it or not, sentiment is everything when it comes to crypto prices. If the general sentiment in the market is positive, then prices are likely to be higher. Conversely, if the sentiment is negative, then prices are likely to be lower.

how to trade based on market sentiment

There is no one silver bullet for trading based on market sentiment, but there are a few strategies you can use to help you get started.

1. Follow the news. Keeping up with the latest news stories can help you determine which stocks are in demand and which are being shunned by the market. This can help you identify opportunities to buy stocks before they become more expensive.

2. Watch price movements. closely. Watching prices move up and down can help you determine when a stock is overvalued or undervalued. When a stock is overvalued, it may be a good time to buy it because the price may eventually drop. When a stock is undervalued, it may be a good time to sell it because the price may eventually rise.

3. Use technical indicators. Technical indicators can help you identify patterns in stock prices that may indicate whether the stock is overvalued or undervalued. Some common technical indicators include the Bollinger Bands and the Relative Strength Index (RSI).

4. Use indicators for investment funds. There are several investment funds that use different indicators to help them make investment decisions. You can use these indicators to try to find stocks that are similar to the ones that the investment fund is investing in.