Overlap Crypto Charts

If you're a cryptocurrency trader, then you know that one of the most important things you can do is track the prices of all the different coins. And if you want to be really successful, you need to be able to quickly and easily compare the prices of different coins. That's where overlap crypto charts come in. These are charts that show the prices of two different cryptocurrencies side-by-side. This makes it easy to see how the prices are moving in relation to each other, and it can help you make better trading decisions. If you're serious about trading cryptocurrencies, then you need to start using overlap crypto charts. They're an essential tool for any trader who wants to be successful.

Crypto Charts: Overlapping Indicators Can Help You Find Trends

When you're analyzing crypto charts, it's important to pay attention to overlapping indicators. Overlapping indicators can help you identify trends in the market.

For example, if you see that the price of a cryptocurrency is going up and the volume of that cryptocurrency is going up, it might be a sign that the cryptocurrency is experiencing an uptrend. Conversely, if you see that the price of a cryptocurrency is going down and the volume of that cryptocurrency is going down, it might be a sign that the cryptocurrency is experiencing a downtrend.

Keep in mind that not every cryptocurrency will experience the same trend at the same time. It's important to pay attention to the overall trend of the market and not just one specific indicator.

How To Use Overlapping Cryptocurrency Charts

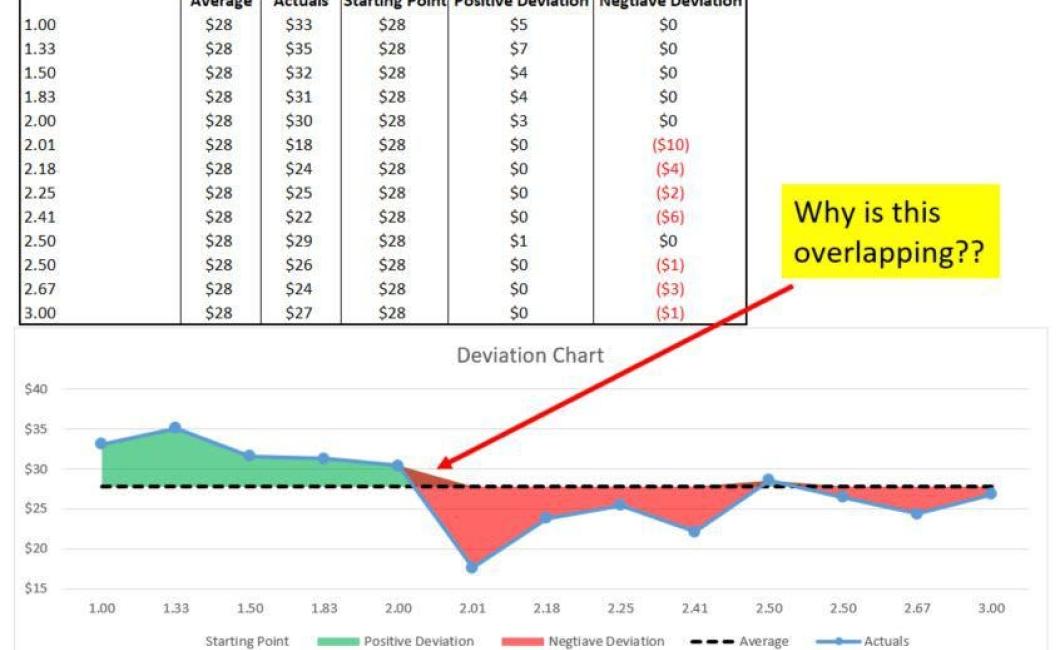

When considering how to use overlapping cryptocurrency charts, it is important to consider the purpose of the chart. For example, if you are looking to track the market performance of a specific cryptocurrency, then a simple line chart will suffice. However, if you are looking to track the price movement of multiple cryptocurrencies, then an overlapping cryptocurrency chart will be more helpful.

To create an overlapping cryptocurrency chart, first select the cryptocurrencies you wish to track. Next, create a chart by selecting the "Plotting Options" tab and selecting "Overlapping Chart." This will generate a chart with two columns: the left column will show the price movement of the selected cryptocurrency, while the right column will show the price movement of all other cryptocurrencies.

To zoom in on a specific cryptocurrency's price movement, simply select that cryptocurrency from the left column and click the "Zoom In" button. To zoom out, select another cryptocurrency from the left column and click the "Zoom Out" button.

How To Spot Trends Using Overlapping Crypto Charts

If you want to spot trends using crypto charts, you first need to identify what you're looking for. There are a few different types of trends you can track on a crypto chart, including market trends, technical trends, and fundamental trends.

Market Trends

Market trends are the most basic type of trend. They show how the price of a cryptocurrency is changing over time. You can use market trends to see whether the price is trending up or down, and whether the trend is accelerating or decelerating.

To track market trends, you first need to identify the cryptocurrency you're interested in. Then, you need to look at the price chart for that cryptocurrency. You can use a variety of different charting tools to track the price, so feel free to explore different options until you find a tool that works well for you.

Once you have the price chart open, you'll need to identify the trend. To do this, you'll need to look for patterns in the data. For example, if the price is trending up, you might look for evidence that the trend is accelerating. If the price is trending down, you might look for evidence that the trend is decelerating.

Once you've identified the trend, you can use that information to make informed decisions about how to invest in cryptocurrencies.

Technical Trends

Technical trends are also important factors to consider when trading and investing in cryptocurrencies. Technical trends show how the cryptocurrency is performing relative to other cryptocurrencies on the market.

To track technical trends, you first need to identify the cryptocurrency you're interested in. Then, you need to look at the various technical indicators for that cryptocurrency.

Technical indicators include things like the Bollinger Bandwidth and the MACD. These indicators help you track how volatile a cryptocurrency is, and how likely it is to continue moving forward in its current trend.

Once you have the technical indicators open, you'll need to identify the trend. To do this, you'll need to look for patterns in the data. For example, if the Bollinger Bandwidth is expanding upward, that might be an indication that the trend is accelerating. If the MACD is falling below the zero line, that might be an indication that the trend is decelerating.

Once you've identified the trend, you can use that information to make informed decisions about how to trade and invest in cryptocurrencies.

Fundamental Trends

Fundamental trends are also important factors to consider when trading and investing in cryptocurrencies. Fundamental trends show how a cryptocurrency is performing relative to its peers.

To track fundamental trends, you first need to identify the cryptocurrency you're interested in. Then, you need to look at the various fundamental indicators for that cryptocurrency.

Fundamental indicators include things like the supply and demand for a cryptocurrency, as well as its popularity on exchanges. These indicators help you track how healthy a cryptocurrency is, and how likely it is to continue moving forward in its current trend.

Once you have the fundamental indicators open, you'll need to identify the trend. To do this, you'll need to look for patterns in the data. For example, if the supply of a cryptocurrency is increasing, that might be an indication that the trend is accelerating. If the demand for a cryptocurrency is decreasing, that might be an indication that the trend is decelerating.

Once you've identified the trend, you can use that information to make informed decisions about how to trade and invest in cryptocurrencies.

4 Ways To Use Overlapping Crypto Charts

1. Compare the prices of different cryptocurrencies to see which are performing better than others.

2. Compare the prices of different cryptocurrencies to see which are performing worse than others.

3. Compare the prices of different cryptocurrencies to see which are performing the same as others.

4. Compare the prices of different cryptocurrencies to see which are experiencing a surge in price.

The Benefits Of Using Overlapping Crypto Charts

There are many benefits to using overlapping crypto charts.

1. They can offer a quick and easy way to compare the prices of different cryptocurrencies.

2. By showing the prices of multiple cryptocurrencies at the same time, overlapping crypto charts can help you to identify potential buying opportunities.

3. By highlighting key trends and developments over time, overlapping crypto charts can help you to make informed investment decisions.

4. By providing a visual representation of the cryptocurrency market, overlapping crypto charts can help you to better understand the dynamics of the market.

Why You Should Be Using Overlapping Crypto Charts

There are a few reasons you should be using overlapping crypto charts.

1. Overlapping crypto charts help you to identify trends.

2. Overlapping crypto charts can help you to identify potential investments.

3. Overlapping crypto charts can help you to identify potential market opportunities.

The Advantages Of Using Overlapped Crypto Charts

There are a number of advantages to using overlapped crypto charts.

1. It can help you to quickly identify trends in your data.

2. It can help you to identify patterns and correlations in your data.

3. It can help you to identify opportunities and threats in your data.

4. It can help you to improve your understanding of your data.

How Overlapping Crypto Charts Can Help You Find Trends

Cryptocurrencies are decentralized, digital tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are not subject to government or financial institution regulation.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Overlapping crypto charts can help you identify trends in the market, such as increases or decreases in prices, changes in volume, and changes in market capitalization.

using crypto charts to find trends

Cryptocurrencies are a relatively new asset class and there is still much to learn about them. Use crypto charts to help you identify trends and patterns.

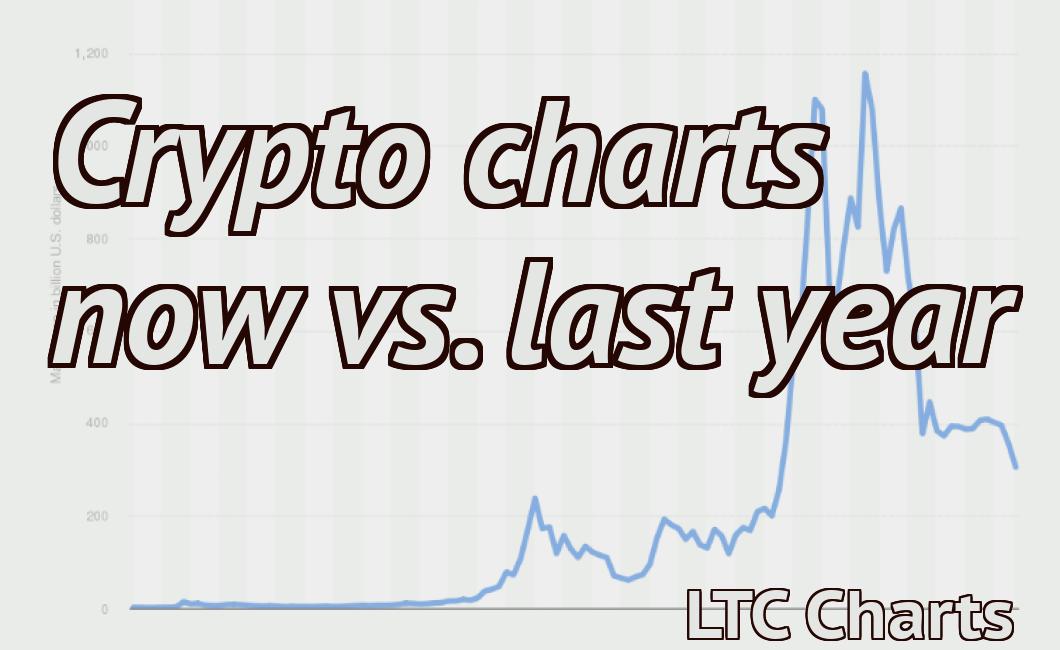

Some popular crypto charts include the Bitcoin chart, the Ethereum chart, and the Litecoin chart.

Bitcoin

The Bitcoin chart can help you track the price of Bitcoin over time. The chart shows the price of Bitcoin over the past 24 hours, 7 days, and 30 days.

Ethereum

The Ethereum chart can help you track the price of Ethereum over time. The chart shows the price of Ethereum over the past 24 hours, 7 days, and 30 days.

Litecoin

The Litecoin chart can help you track the price of Litecoin over time. The chart shows the price of Litecoin over the past 24 hours, 7 days, and 30 days.

What is an overlapped crypto chart?

An overlapped crypto chart is a type of chart that displays the price of a cryptocurrency over time. It is often used to show how a cryptocurrency is performing relative to its peers. Overlapped crypto charts can be confusing, so it is important to be aware of the different types of overlapped charts and how to use them.

An example of an overlapped crypto chart is shown below. The chart shows the price of Bitcoin over the past week. The green line represents the price of Bitcoin on Monday, and the blue line represents the price of Bitcoin on Sunday. The red line shows the average price of Bitcoin over the past seven days.

Overlapped crypto charts can be used to compare the performance of different cryptocurrencies. For example, you could compare the price of Bitcoin to the price of Ethereum to see which is doing better over the past week.