Interactive Crypto Charts

The article discusses various interactive crypto charts that are available online. These charts can be used to track the prices of various cryptocurrencies, as well as to see the trends in the market.

The Best Places to Find Interactive Crypto Charts

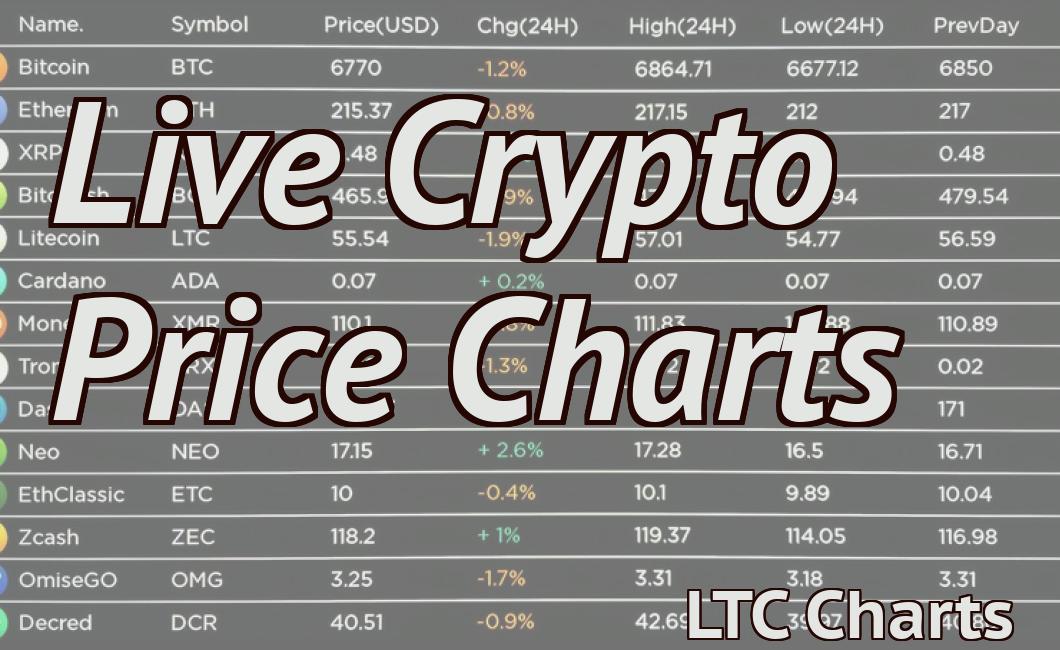

There are a variety of places where you can find interactive crypto charts. Some of the most popular include CoinMarketCap, TradingView, and CoinGecko.

How to Read and Understand Crypto Charts

Crypto charts are used to track the performance of digital assets. They can be used to identify trends and make informed investment decisions.

The first step is to understand what each column in a crypto chart represents. The leftmost column is the time period, and the other columns are the value of the asset (in BTC or USD) during that period.

The main thing to look for on a crypto chart is the trend. You can use a combination of the different columns to figure out what's going on.

For example, if you see that the value of an asset is going up over time, that might be a good indicator that the asset is worth investing in. If, on the other hand, the value of an asset is going down over time, that might be a sign that the asset is not worth investing in.

What do all the Lines on a Crypto Chart Mean?

A crypto chart typically shows the price of a digital asset over a period of time. The lines on the chart indicate the price movement of the asset.

How to Use Crypto Charts to Make Better Trades

Crypto charts are one of the most important tools you can use when trading cryptocurrencies. By using crypto charts, you can identify trends and make better trades. Here are three tips for using crypto charts to make better trades:

1. Use Technical Analysis to Make Better Trades

Technical analysis is the use of charts and other indicators to make trading decisions. You can use technical analysis to identify trends and make better trades.

For example, you can use a trendline to identify when a cryptocurrency is in a downtrend or uptrend. You can also use volume data to identify when a cryptocurrency is being traded heavily.

2. Use Relative Strength Indexes to Make Better Trades

The Relative Strength Index (RSI) is a technical analysis indicator that shows how much a cryptocurrency is oversold or overbought. When the RSI is oversold, the indicator suggests that the cryptocurrency is in a downtrend. When the RSI is overbought, the indicator suggests that the cryptocurrency is in an uptrend.

Using the RSI can help you identify when a cryptocurrency is about to reach a key resistance or support level. This can help you make better trades.

3. Use Technical Indicators to Make Better Trades

You can use technical indicators to help you make better trades. For example, you can use Bollinger Bands to identify when a cryptocurrency is oversold or overbought. You can also use moving averages to identify when a cryptocurrency is in a trending or consolidation phase.

What are the most Important Indicators for Crypto Trading?

There is no one-size-fits-all answer to this question, as the most important indicators for crypto trading will vary depending on the trader’s individual investment goals and strategies. However, some commonly cited indicators for cryptocurrency trading include:

1. Price volatility: A high degree of price volatility is generally considered to be a positive sign for the health of the market, as it indicates that buyers and sellers are engaged in active trade.

2. Trading volumes: High trading volumes can indicate that there is strong demand for a particular cryptocurrency, and may signal that the market is in good shape.

3. Cryptocurrency charts: Cryptocurrency charts are a valuable tool for analyzing the health of the market and predicting future trends.

4. Technical analysis: Technical analysis is a form of analysis that focuses on the behavior of financial markets in order to make accurate predictions about future trends.

How to Set Up Your Own Interactive Crypto Chart

To set up your own interactive crypto chart, you will need a public blockchain such as Bitcoin or Ethereum, CoinMarketCap.com, and a cryptocurrency trading platform such as Kraken or Bitfinex.

1. Go to CoinMarketCap.com and enter the name of the cryptocurrency you want to track.

2. Click on the “Charts” tab and select the “Cryptocurrency Chart” from the list.

3. On the cryptocurrency chart, select the “ candles ” tab.

4. On the candles tab, you will need to enter the amount of time between each candle.

5. To add a new candle, click on the blue “+” icon next to the “Candles” column.

6. To remove a candle, click on the red “-” icon next to the “Candles” column.

7. To add a new column, click on the blue “+” icon next to the “Columns” column.

8. To remove a column, click on the red “-” icon next to the “Columns” column.

9. To change the font size, click on the grey “+” icon next to the “Columns” column.

10. To change the color of the candle, click on the colour palette in the bottom right corner of the candle chart.

8 Types of Crypto Charts and How to Use Them

Cryptocurrencies are a hot topic and many investors are looking to get a better understanding of the market. There are a variety of ways to track cryptocurrencies and many charts can be helpful in making investment decisions.

Bitcoin Price Charts

The most popular way to track the price of bitcoin is with bitcoin price charts. These charts show the price of bitcoin over time and can be used to predict future prices.

To use a bitcoin price chart, first find the specific date range you want to view. For example, if you want to view the price of bitcoin between February 1, 2017 and February 2, 2017, you would search for “Bitcoin price chart February 1-2” on Google.

Once you have found the chart, you will need to determine the timeframe you want to view. Bitcoin price charts are often broken down into 24-hour periods, 6-month periods, and year-long periods.

To view the price of bitcoin between February 1, 2017 and February 2, 2017, you would select the “24 hour” timeframe. The chart will then show you the price of bitcoin from 00:00 UTC on February 1 to 23:59 UTC on February 2.

Ethereum Price Charts

Ethereum is a popular cryptocurrency that uses a different blockchain than bitcoin. To track the price of Ethereum, you will need to use an Ethereum price chart.

Ethereum price charts are similar to bitcoin price charts, but they are broken down into different time periods. Ethereum price charts are often broken down into 6-month periods, 12-month periods, and 2-year periods.

To view the price of Ethereum between January 1, 2017 and January 31, 2017, you would select the “6 month” timeframe. The chart will then show you the price of Ethereum from 00:00 UTC on January 1 to 23:59 UTC on January 31.

Litecoin Price Charts

Litecoin is a less popular cryptocurrency than bitcoin and Ethereum. To track the price of Litecoin, you will need to use a Litecoin price chart.

Litecoin price charts are similar to bitcoin price charts, but they are broken down into different time periods. Litecoin price charts are often broken down into 6-month periods, 12-month periods, and 2-year periods.

To view the price of Litecoin between January 1, 2017 and January 31, 2017, you would select the “12 month” timeframe. The chart will then show you the price of Litecoin from 00:00 UTC on January 1 to 23:59 UTC on January 31.

The Benefits of Using Interactive Crypto Charts

There are a number of benefits to using interactive crypto charts. They can help you make better investment decisions, understand market trends, and more.

1. They can help you make better investment decisions

When you use interactive crypto charts, you can see all of the relevant information at once. This can help you make better decisions about which coins to invest in and which ones to avoid.

2. They can help you understand market trends

Interactive crypto charts can show you how the market is performing over time. This can help you understand how the market is reacting to different events, and how it is likely to evolve in the future.

3. They can help you stay up-to-date on the latest news

When you use interactive crypto charts, you can stay up-to-date on the latest news and developments. This can help you make more informed decisions about what to invest in, and how to best protect your investments.

How to Create an Interactive Crypto Chart in Excel

To create an interactive crypto chart in Excel, follow these steps:

1. Open Excel and create a new worksheet.

2. In the worksheet, select the Chart tab.

3. In the Chart Properties window, select the Series tab.

4. In the Series Properties window, select the Data Series tab.

5. In the Data Series Properties window, select the Series Name box and enter "crypto."

6. Click the Add Series button and select the Cryptocurrency Prices (BTC, ETH, LTC, XMR) data series from your data source.

7. Click the Add Bar button and add the following bars:

- The first bar will have a width of 10 and a height of 20. The value of this bar will be the average price of Bitcoin over the time period you selected.

- The second bar will have a width of 5 and a height of 10. The value of this bar will be the average price of Ethereum over the time period you selected.

- The third bar will have a width of 2 and a height of 5. The value of this bar will be the average price of Litecoin over the time period you selected.

- The fourth bar will have a width of 1 and a height of 2. The value of this bar will be the average price of Monero over the time period you selected.

8. Click the Update Chart button to update the chart with your data.

9. To change the chart's layout, click the Layout button and select one of the following options:

- Column: This option will center the chart in a single column in the worksheet.

- Row: This option will center the chart in a single row in the worksheet.

- Both: This option will center the chart in both columns and rows in the worksheet.

5 Tips for Getting the Most Out of Interactive Crypto Charts

1. Look for Patterns

One of the best ways to get the most out of interactive crypto charts is to look for patterns. Patterns can indicate which assets are doing well or poorly, and can help you make more informed decisions.

2. Use Time-Lines to Analyse Data

Another way to get the most out of interactive crypto charts is to use time-lines. Time-lines can help you visualise data over a period of time, and can provide you with valuable insights.

3. Use Volume to Indicate Strength or Weakness

Volume is another important factor to consider when using interactive crypto charts. Volume indicates how much liquidity a given asset has, and can indicate how popular an asset is.

4. Watch for Trends

Trends can also be useful when using interactive crypto charts. Trends can indicate how the market is moving, and can help you make more informed decisions.

5. Stay Up-To-Date

Finally, it is important to stay up-to-date with latest interactive crypto charts news and information. This way, you will be able to make the most informed decisions when using these charts.

He wants her to be his girlfriend

I'm not sure what you mean by "he wants her to be his girlfriend."