Crypto currency charts

Crypto currency charts are a graphical representation of the movements in the prices of various cryptocurrencies. They can be used to track the performance of a particular cryptocurrency, or to compare the relative performance of different cryptocurrencies.

A Beginner's Guide to Crypto Currency Charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The Different Types of Crypto Currency Charts

Cryptocurrency charts are essential for anyone who wants to understand the current state of the market. They can help you identify all the important trends and movements in the market, and give you a good indication of where the price is headed.

There are a number of different types of cryptocurrency charts, but the most common ones are:

1. Price Chart

A price chart shows you the price of a cryptocurrency over time. You can see the price movement over a specific period of time, as well as the percentage change over that time.

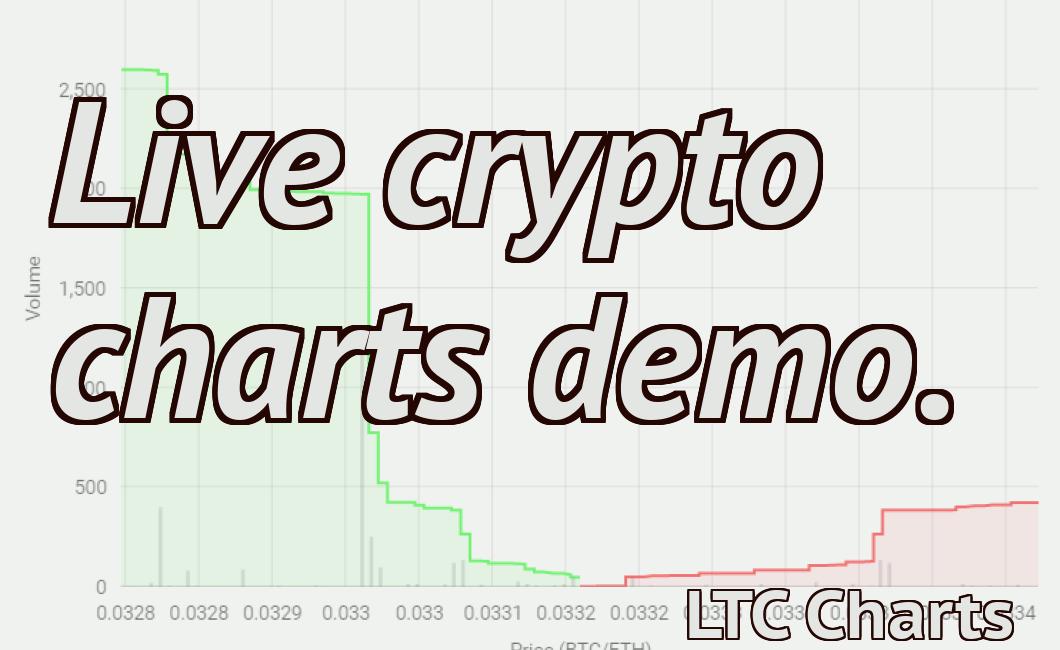

2. Volume Chart

A volume chart shows you the total amount of cryptocurrency exchanged over a specific period of time. This can be helpful for spotting trends in the market and identifying when there is a sudden surge in activity.

3. Supply and Demand Chart

A supply and demand chart shows you how much cryptocurrency is currently available on the market, as well as how much demand there is for it. This can be helpful for predicting where the price is likely to go next.

How to Read Crypto Currency Charts

Cryptocurrency charts are a great way to track the current price of a digital currency. They can be found online, and some cryptocurrency exchanges offer their own charts.

To read a cryptocurrency chart, you first need to find the currency you're interested in. You can do this by searching for the currency's name or ticker symbol on a reputable cryptocurrency exchange.

Once you've found the currency, you need to find the chart. Cryptocurrency charts are usually located on the exchange's home page or on their trading screen.

To find the chart, you'll need to first zoom in on the area you want to study. This can be done by clicking on the magnifying glass icon that appears at the top left corner of the chart.

Once you've zoomed in, you'll need to find the candlestick chart. Candlestick charts are usually green, and they show the current price of the currency as well as the previous and next prices.

To read the candlestick chart, you'll need to click on the candle that corresponds to the price you're interested in. Once you've clicked on the candle, a detailed analysis of the data will appear.

The Benefits of Using Crypto Currency Charts

Cryptocurrency charts can be a valuable tool for investors and traders. They can help you to identify trends, spot opportunities, and make informed decisions about your investments.

Here are some of the benefits of using cryptocurrency charts:

1. They can help you to identify trends.

Cryptocurrency charts can help you to identify patterns in the prices of different cryptocurrencies. This can help you to understand how the market is behaving and to make informed investment decisions.

2. They can help you to spot opportunities.

Cryptocurrency charts can help you to identify opportunities in the market. This can help you to make profits by trading on the information that they provide.

3. They can help you to make informed decisions about your investments.

Cryptocurrency charts can help you to understand the risks and rewards associated with investing in cryptocurrencies. This can help you to make informed decisions about which cryptocurrencies to invest in.

The Basics of Technical Analysis for Crypto Currency Trading

Technical analysis is the process of analyzing historical price movements in order to forecast future price movements. Technical analysis is a key component of any successful crypto currency trading strategy.

There are a number of different technical analysis indicators that can be used for crypto currency trading. Some of the most popular technical analysis indicators used for crypto currency trading include the moving average, Bollinger bands, and channel analysis.

Moving averages are a popular technical analysis indicator that can be used to measure the volatility of a cryptocurrency's price. Moving averages can be used to identify potential support and resistance levels in a given market.

Bollinger bands are an indicator that can be used to identify potential market trends. Bollinger bands can be used to determine where the market is likely to move next.

Channel analysis is a technique that can be used to identify potential risk factors in a given market. Channel analysis can be used to identify potential trends in a given market.

How to Use Candlestick Charts for Crypto Currency Trading

Candlestick charts are a simple way to visually track the performance of a crypto currency over time.

To use candlestick charts, first open a chart of a crypto currency you wish to trade. Next, locate the candlestick charting tool on the chart. This will be located near the bottom right hand corner of the chart.

Select the candlestick charting tool. This will display a set of horizontal lines on the chart.

Next, select the type of candlestick chart you wish to use. There are three types of candlestick charts available: open, high, and low.

Select the date range you wish to view. The date range will be displayed at the top of the chart.

Next, select the type of animation you wish to use. There are three types of animations available: simple, fast, and slow.

Select the timeframe you wish to view. The timeframe will be displayed in the bottom left hand corner of the chart.

Now, you are ready to start trading! To do this, first find the price you want to purchase or sell the crypto currency at. Next, position your buy or sell order at the price you found. Once your order is placed, wait for the price to reach your desired point on the chart before executing your trade.

How to Use Fibonacci Retracements in Crypto Currency Trading

Fibonacci retracements are a technical analysis tool that can be used in order to identify potential support and resistance levels in a given market.

When using Fibonacci retracements, it is important to keep in mind that they are not 100% accurate in predicting future market movements. However, they can be helpful in identifying areas where price action may be inclined to move.

Fibonacci retracements can be found on most popular trading platforms, and can be used to help identify potential support and resistance levels for a given cryptocurrency.

When using Fibonacci retracements, it is important to keep in mind that they are not 100% accurate in predicting future market movements. However, they can be helpful in identifying areas where price action may be inclined to move.

What Are the Most Important Crypto Currency Charting Tools?

There is no definitive answer to this question as it depends on personal preferences and the specific needs of the individual. However, some of the most important crypto currency charting tools include:

1. Coinmarketcap

Coinmarketcap is one of the most popular and widely used crypto currency charting tools. It provides detailed information on the market capitalization of all available cryptocurrencies, as well as their prices and trading volumes over the past 24 hours.

2. Coinwarz

Coinwarz provides detailed information on the market share, prices, and trading volumes of various cryptocurrencies. It also provides analysis of the historical performance of each coin.

3. Coinigy

Coinigy provides comprehensive information on the trends and performance of various cryptocurrencies. It also offers detailed analysis of the market conditions and potential investment opportunities.

4. Tradingview

Tradingview is a popular platform for traders and investors to monitor and trade various cryptocurrencies. It provides detailed information on the current market conditions, as well as live streaming of cryptocurrency trading sessions.

How to Create a Custom Crypto Currency Chart

The first step in creating a custom crypto currency chart is to gather the relevant data. You will need to know the price of each cryptocurrency, the total number of coins in circulation, and the percentage of each coin's market cap.

Once you have gathered this information, you can begin creating your chart. To start, you will need to create a table that lists each cryptocurrency's price, total number of coins in circulation, and percentage of market cap.

Next, you will need to create a graph that illustrates the data. To do this, you will need to create a line graph that plots each cryptocurrency's price against its total number of coins in circulation and percentage of market cap. You will also need to add labels to the graph to indicate which cryptocurrency is being plotted, and the date.

Finally, you will need to publish your chart online so that others can see it.

The Advantages of Using Crypto Currency Trading Bots

Crypto currency trading bots are a great way to make money. They allow you to make trades automatically, which means you can leave your computer alone and focus on other things. This can be a great advantage if you’re trying to make money while you sleep.

Another advantage of using crypto currency trading bots is that they can help you avoid mistakes. If you’re new to crypto currency trading, it can be difficult to know what to do. Automated trading can help you avoid making mistakes, which will help you make more money.

Crypto currency trading bots also allow you to make more money quickly. They can help you find good opportunities and make quick trades. This can help you make more money quickly and save you time.

How to Find the Best Crypto Currency Charts

The first step in finding the best crypto currency charts is to gather as much information as possible. This includes looking at the chart’s date, time, and volume. Additionally, you should look at the chart’s technical indicators, such as the Bollinger Bands and MACD.

Once you have collected all the information you need, you can start looking for the best crypto currency charts. One of the best ways to do this is by using a cryptocurrency charting platform, such as CoinMarketCap.

CoinMarketCap is a cryptocurrency charting platform that provides users with a variety of information, including the latest prices and volumes for all major cryptocurrencies. The platform also provides users with detailed technical indicators, such as the Bollinger Bands and MACD.

Overall, CoinMarketCap is one of the best platforms for finding the best crypto currency charts.