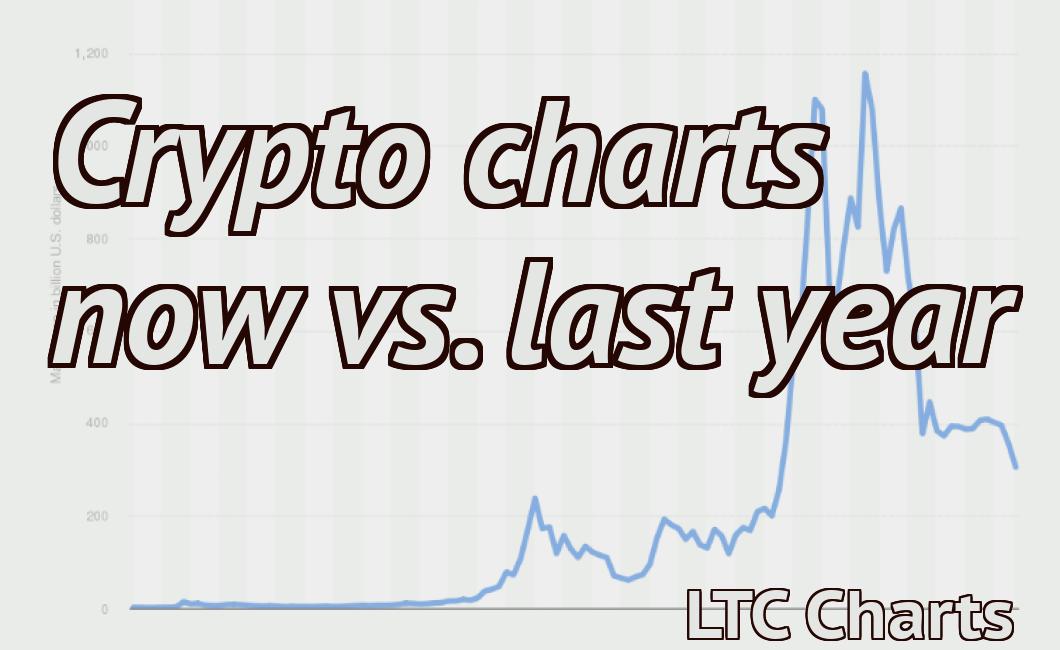

Cryptocurrency charts comparison.

This article compares the cryptocurrency charts of Bitcoin, Ethereum, and Litecoin.

The Different Types of Crypto Charts and How to Compare Them

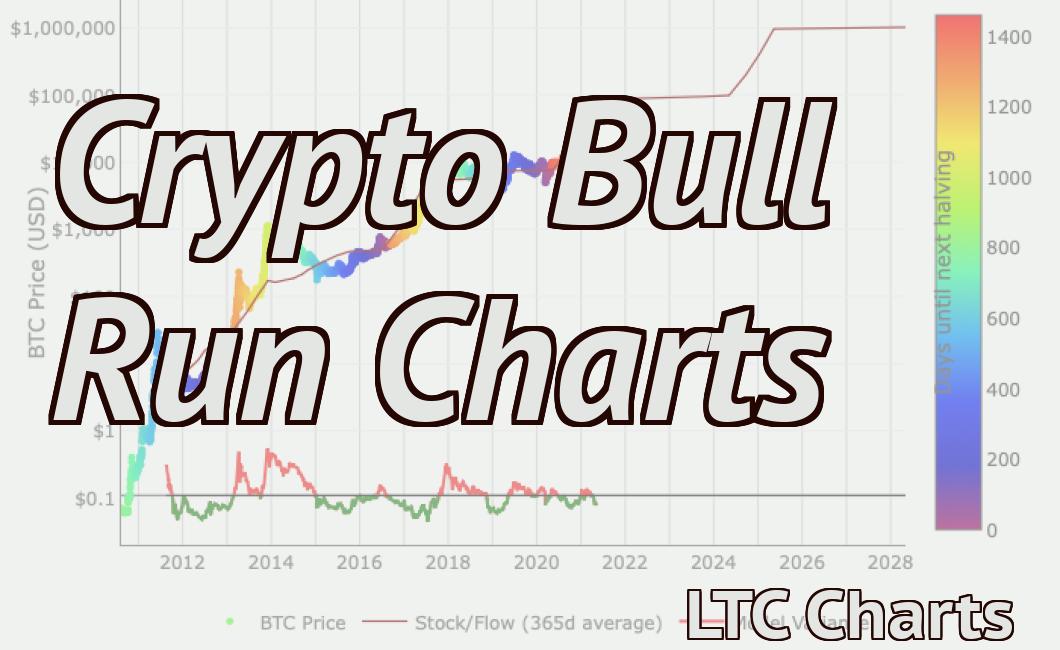

There are three main types of crypto charts: technical, fundamental, and sentiment.

Technical charts show the performance of a cryptocurrency over time by displaying its price and other technical indicators like volume and supply. Fundamental charts display the underlying fundamentals of a cryptocurrency, such as its market cap, circulating supply, and price action. Sentiment charts show how popular a cryptocurrency is by measuring social media reactions and other online data.

Each type of chart has its own advantages and disadvantages. To compare them, it’s important to understand the following concepts:

Volume: Volume is a good indicator of how active the market is and how many buyers and sellers are there. A high volume indicates that there’s a lot of interest in the cryptocurrency, while a low volume indicates that there’s not a lot of interest.

Price: The price of a cryptocurrency is determined by supply and demand. The more people want it, the higher the price will be.

Technical charts are good for tracking the performance of a cryptocurrency over time. They’re also good for identifying trends. Fundamental charts are good for determining the underlying fundamentals of a cryptocurrency, such as its market cap, circulating supply, and price action. Sentiment charts are good for measuring social media reactions and other online data.

How to Read and Understand Crypto Charts

Crypto charts can be confusing, so it’s important to read them carefully before making any investment decisions.

The first thing to understand is that crypto charts are not like traditional stock charts. They do not show the prices of individual assets, but instead show the prices of entire cryptocurrencies combined.

Secondly, it’s important to understand how cryptocurrency prices are calculated. The price of a cryptocurrency is not determined by the value of the assets that it contains, but by the amount of demand that is available for that cryptocurrency.

Cryptocurrency markets are very volatile, which means that the prices of individual cryptocurrencies can change rapidly. It’s important to keep this in mind when reading crypto charts.

The Most Commonly Used Crypto Charts and What They Mean

Cryptocurrency charts are a great way to track the prices of different cryptocurrencies. The most common charts are the 24-hour and 7-day charts.

The 24-hour chart shows the price of a cryptocurrency over the past day. The 7-day chart shows the price over the past 7 days.

The candlestick chart is a popular way to track the prices of cryptocurrencies. A candlestick is a graphic representation of the price of a cryptocurrency over a specific period of time.

A Beginner's Guide to Comparing Crypto Charts

Cryptocurrency charts are a great way to get a sense for the current market conditions of a particular cryptocurrency. By comparing different charts, you can get a better understanding of how the prices of different cryptocurrencies are trending.

There are a few things to keep in mind when comparing crypto charts:

The time period for each chart can vary.

The currencies represented on the charts can vary.

The data displayed on the charts can also vary.

In this beginner's guide, we will cover the basics of cryptocurrency charts, and then provide a few examples of different types of charts that can be used to compare cryptocurrencies.

Cryptocurrency Charts

Cryptocurrency charts are a great way to see how the prices of different cryptocurrencies are trending. The time period for each chart can vary, and the currencies represented on the charts can vary.

For example, a cryptocurrency chart might show the prices of Bitcoin, Ethereum, and Litecoin over the past 24 hours. A crypto chart for Bitcoin, Ethereum, and Litecoin might also show the prices of those currencies over the past week, month, or year.

Data Displayed on Cryptocurrency Charts

Cryptocurrency charts can display a lot of different data. For example, a cryptocurrency chart might show the amount of cryptocurrency that has been traded over the past day, week, or month. A crypto chart for Bitcoin, Ethereum, and Litecoin might also show the average price of those currencies over the past day, week, or month.

The Pros and Cons of Different Crypto Charting Tools

There are a few different crypto charting tools on the market, and it can be hard to decide which one is right for you. Here are the pros and cons of the most popular ones.

CoinMarketCap

CoinMarketCap is probably the most popular crypto charting tool on the market. It provides real-time data on the prices of cryptocurrencies across a variety of exchanges, and it has a very user-friendly interface.

One downside is that CoinMarketCap doesn't provide price data for a lot of smaller cryptocurrencies, so it may not be the best tool for tracking these coins. Additionally, CoinMarketCap can be a bit slow in updating its data, so it can be frustrating if you're looking for up-to-the-minute information.

Coinigy

Coinigy is another popular crypto charting tool. It offers more detailed data than CoinMarketCap, including price data for a wider range of cryptocurrencies.

One downside is that Coinigy can be a bit more complicated to use than CoinMarketCap, and it may be more difficult to find specific information. Additionally, Coinigy can be a bit slower in updating its data, so it can be frustrating if you're looking for up-to-the-minute information.

CryptoCurrency Explorer

CryptoCurrency Explorer is a relatively new crypto charting tool, but it's quickly becoming one of the most popular options on the market.

One big advantage of CryptoCurrency Explorer is that it provides data for a wide range of different cryptocurrencies, including some of the smaller coins that CoinMarketCap doesn't track.

Another big advantage is that CryptoCurrency Explorer is very fast in updating its data, so you can always be sure you're getting the latest information.

One downside is that CryptoCurrency Explorer is a bit more complicated to use than some of the other options on the market, and it may be harder to find specific information.

7 Best Crypto Charting Tools Compared & Reviewed

Below you will find a list of the top 7 crypto charting tools that are currently available on the market. We have reviewed each one and provide our thoughts on their features, usability, and overall quality.

1. CoinMarketCap

CoinMarketCap is without a doubt the most popular crypto charting tool on the market. It is free to use and has a wide range of features, including support for multiple currencies, market cap tracking, and detailed historical data.

One downside of CoinMarketCap is that it is not as user friendly as some of the other tools on this list. However, it is still one of the most comprehensive and user-friendly options out there.

Overall, CoinMarketCap is a great choice for anyone looking for a comprehensive crypto charting tool.

2. Tradingview

Tradingview is another popular option for crypto charting. It offers a wide range of features, including support for multiple currencies, real-time market data, and technical analysis.

One downside of Tradingview is that it can be a bit difficult to use, particularly if you are not familiar with trading platforms. However, if you are looking for a comprehensive crypto charting tool, Tradingview is definitely worth consideration.

3. Coingecko

Coingecko is a relatively new tool on the market, but it has quickly become one of the most popular options for crypto charting. It offers a wide range of features, including support for multiple currencies, market cap tracking, and detailed historical data.

One downside of Coingecko is that it is not as user friendly as some of the other options on this list. However, if you are looking for a comprehensive crypto charting tool, Coingecko is definitely worth consideration.

4. Kraken

Kraken is another popular option for crypto traders. It offers a wide range of features, including support for multiple currencies, real-time market data, and technical analysis.

One downside of Kraken is that it can be a bit difficult to use, particularly if you are not familiar with trading platforms. However, if you are looking for a comprehensive crypto charting tool, Kraken is definitely worth consideration.

5. Coinigy

Coinigy is another relatively new tool on the market, but it has quickly become one of the most popular options for crypto charting. It offers a wide range of features, including support for multiple currencies, market cap tracking, and detailed historical data.

One downside of Coinigy is that it can be a bit difficult to use, particularly if you are not familiar with trading platforms. However, if you are looking for a comprehensive crypto charting tool, Coinigy is definitely worth consideration.

6. Cryptocompare

Cryptocompare is a relatively old tool on the market, but it has quickly become one of the most popular options for crypto charting. It offers a wide range of features, including support for multiple currencies, market cap tracking, and detailed historical data.

One downside of Cryptocompare is that it can be a bit difficult to use, particularly if you are not familiar with trading platforms. However, if you are looking for a comprehensive crypto charting tool, Cryptocompare is definitely worth consideration.

7. Coinmarketcap.com

Coinmarketcap.com is arguably the most comprehensive option on this list. It offers a wide range of features, including support for multiple currencies, market cap tracking, and detailed historical data.

One downside of Coinmarketcap.com is that it can be a bit difficult to use, particularly if you are not familiar with trading platforms. However, if you are looking for a comprehensive crypto charting tool, Coinmarketcap.com is definitely worth consideration.

How to Tell the Difference Between Good and Bad Crypto Charts

Cryptocurrency charts are often used to help investors make informed decisions about whether or not to buy or sell a cryptocurrency. However, there is a big difference between good and bad crypto charts.

Good crypto charts are easy to understand and provide a clear visual representation of the current state of the market. They are also updated frequently so that investors can stay up to date with the latest trends.

Bad crypto charts, on the other hand, can be confusing and difficult to read. They often feature poorly designed charts and graphs, making it difficult to determine which cryptocurrencies are performing the best.

If you are looking for a good crypto chart to help you make informed decisions, be sure to check out the charts on CoinMarketCap.com. This website features the most up-to-date and comprehensive crypto charts available online.

How to Compare Crypto Charts Like a Pro

Crypto charts are a great way to follow the price of digital assets, but they can be confusing if you don't know how to compare them. Here are four tips to help you compare crypto charts like a pro.

1. Look at the Date and Time

The first thing to look at on a crypto chart is the date and time. This will give you an idea of how recent the data is. For example, if the data is from yesterday, it will be lower on the chart.

2. Compare the Volume

Another thing to look at is the volume. This will give you an idea of how active the market is and how liquid the assets are. If the assets have low volume, it may be more difficult to buy or sell them.

3. Compare the Prices

The final thing to look at is the prices. This will show you how much each asset is worth on different exchanges. If one asset is more expensive on one exchange than another, it may be worth considering buying it.

4. Compare the Charts

Finally, compare the charts to see which one is more accurate. Some crypto charts use different methods of data analysis, which can lead to different results.

10 Tips for Comparing Crypto Charts Successfully

1. Make sure you have a good understanding of crypto currencies and their underlying technology.

2. Compare crypto currencies based on their market capitalization, price, and circulating supply.

3. Compare crypto currencies based on their available information (e.g. website, whitepaper, team, etc.).

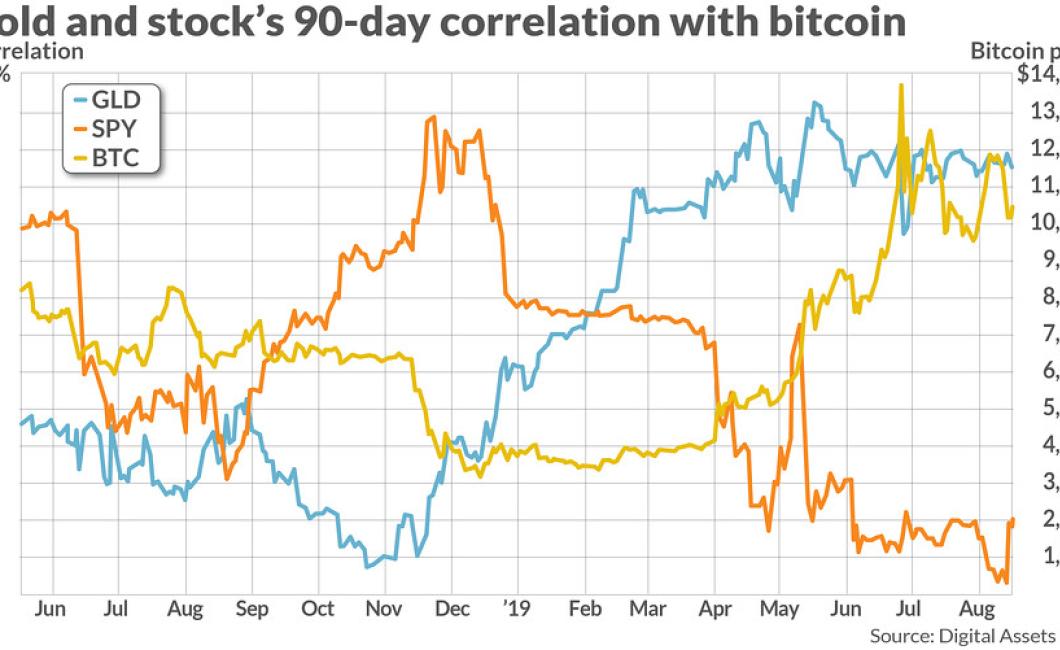

4. Compare crypto currencies based on their technical indicators (e.g. price volatility, market capitalization growth, etc.).

5. Compare crypto currencies based on their community sentiment.

6. Compare crypto currencies based on their overall risk/reward profile.

7. Compare crypto currencies based on their future potential.

What to Look for When Comparing Crypto Charts

When looking at crypto charts, you should pay close attention to the following factors:

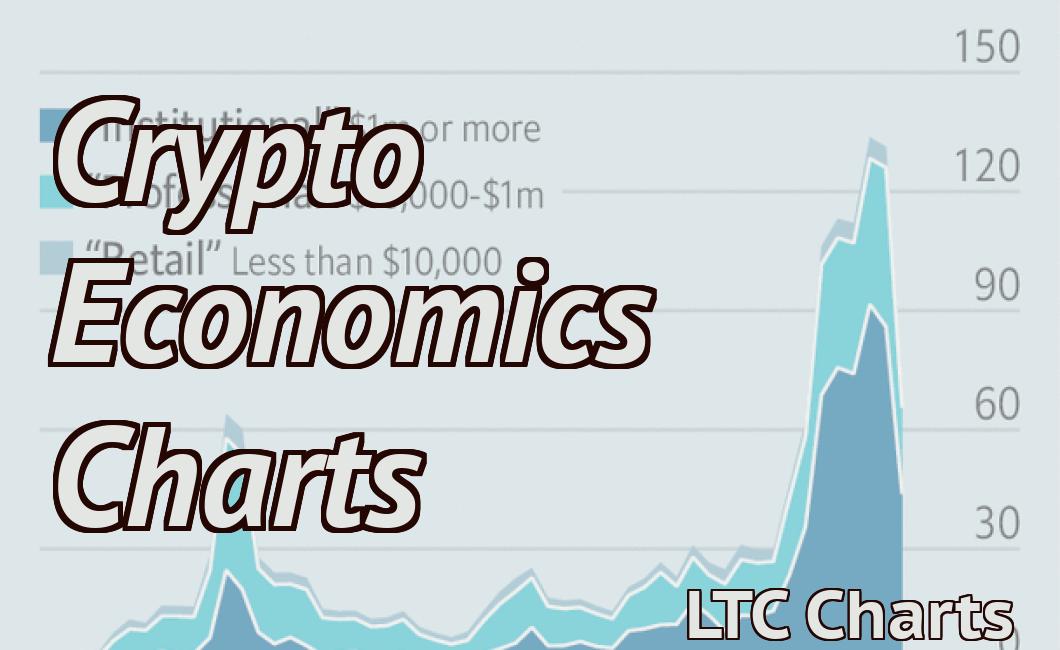

1. Market Cap

The market cap is the total value of all coins in circulation. It is a good indicator of a coin's popularity and overall market value.

2. Volume

Volume is a measure of how many coins are being traded each day. It is an important factor to consider because it shows how active the market is.

3. Circulation

Circulation is the number of coins that are in circulation. It is an important metric because it indicates how many people are using a coin.

4. Price Trend

Price trend is a measure of how much the price of a coin has changed over time. It is an important factor to consider because it can help you determine whether a coin is over or undervalued.

How to Avoid Common Mistakes When Comparing Crypto Charts

When comparing crypto charts, it is important to avoid common mistakes. Some of the most common mistakes include:

1. Focusing on the wrong metrics.

It is important to focus on the right metrics when comparing crypto charts. Some of the key metrics to focus on include:

· Market capitalization

· Circulating supply

· Volume

2. Not taking into account the time frame.

When comparing crypto charts, it is important to take into account the time frame. Some of the most important time frames to consider include:

· 24-hour period

· 7-day period

· 1-month period

3. Not using a credible source.

When comparing crypto charts, it is important to use a credible source. Some of the most credible sources include:

· CoinMarketCap

· CoinGecko

4. Focusing on the wrong exchanges.

It is important to focus on the right exchanges when comparing crypto charts. Some of the key exchanges to focus on include:

· Binance

· Bitfinex

· Coinbase

The Ultimate Guide to Comparing Crypto Charts

Cryptocurrencies are a new and volatile asset class. It is important to do your own research and not rely on anyone else’s opinion when it comes to choosing the best cryptocurrency to invest in.

Below, we have compiled the most important information you need to compare crypto charts and make an informed decision about which digital asset to invest in.

Cryptocurrency charts are available online and can be found on various platforms, such as Tradingview, CoinMarketCap and Coinexchange.

When looking at a cryptocurrency chart, you will see a number of different indicators, including the following:

Volatility: This measures the price fluctuation over time. A high volatility means that the price changes a lot, while a low volatility means that the price changes less.

This measures the price fluctuation over time. A high volatility means that the price changes a lot, while a low volatility means that the price changes less. Price: This shows the current price of the digital asset.

This shows the current price of the digital asset. 24-hour volume: This shows how much money has been exchanged in the past 24 hours.

This shows how much money has been exchanged in the past 24 hours. All-time high (ATH): This is the highest point that the cryptocurrency has reached.

This is the highest point that the cryptocurrency has reached. All-time low (ALT): This is the lowest point that the cryptocurrency has reached.

This is the lowest point that the cryptocurrency has reached. Circulating supply: This shows how many coins are in circulation.

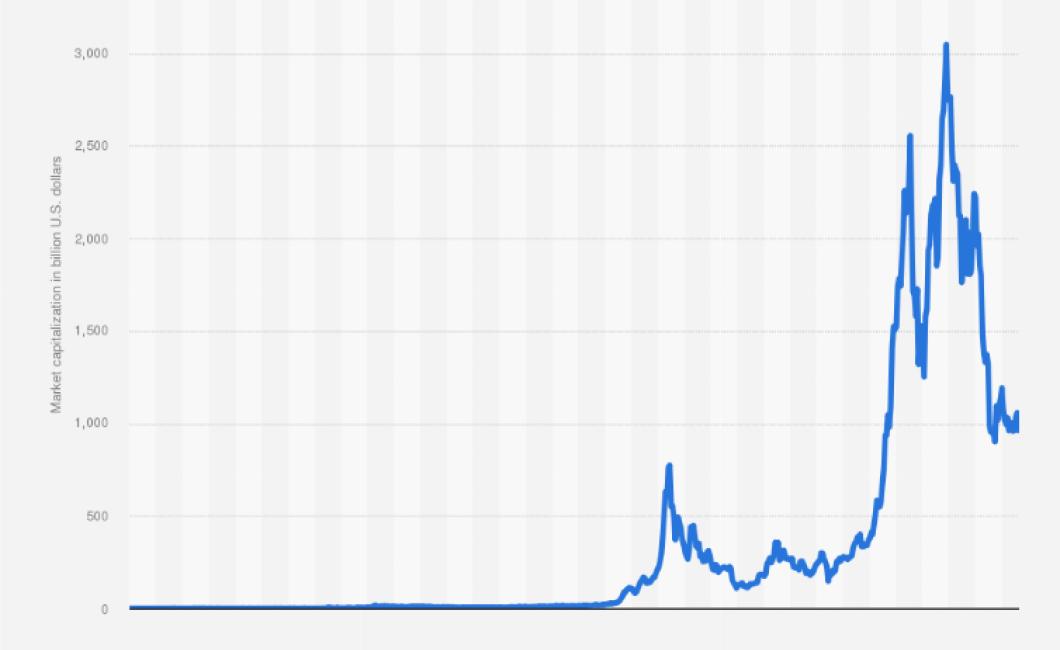

This shows how many coins are in circulation. Market cap: This shows how much money is currently invested in the digital asset.

Some of the other important things to look for when comparing crypto charts include:

The market capitalization: This is a measure of how much money is currently invested in the digital asset. The higher the market cap, the more valuable the digital asset is.

This is a measure of how much money is currently invested in the digital asset. The higher the market cap, the more valuable the digital asset is. The trading volume: This shows how much money has been exchanged in the past 24 hours. A high trading volume indicates that there is a lot of interest in the digital asset.

This shows how much money has been exchanged in the past 24 hours. A high trading volume indicates that there is a lot of interest in the digital asset. The trend: This shows whether the digital asset is going up or down. A rising trend indicates that the digital asset is gaining value, while a falling trend indicates that the digital asset is losing value.

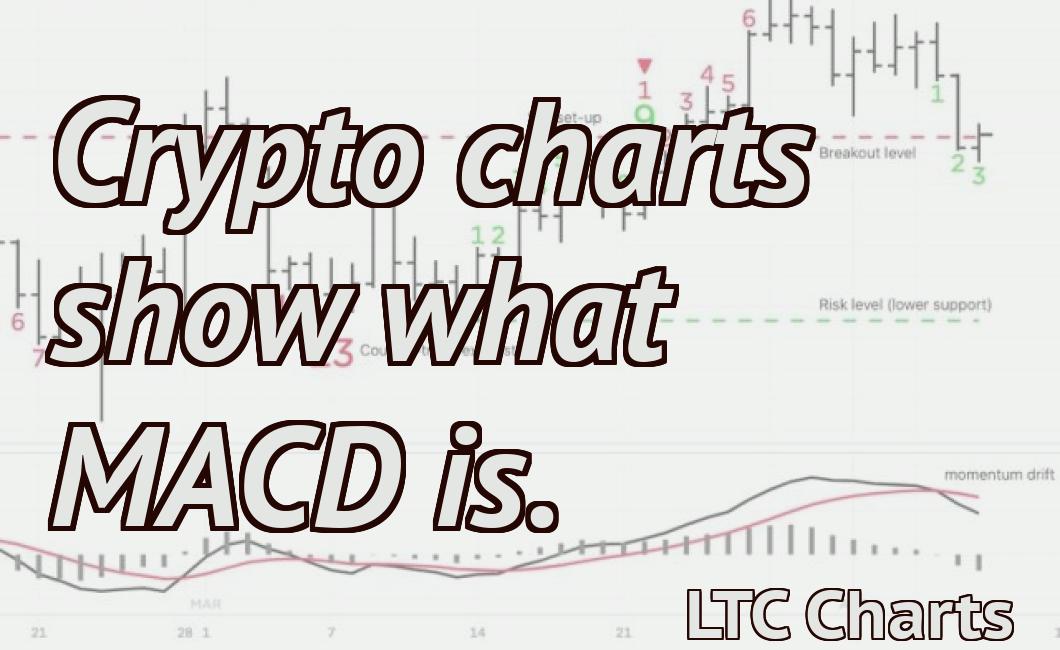

This shows whether the digital asset is going up or down. A rising trend indicates that the digital asset is gaining value, while a falling trend indicates that the digital asset is losing value. The technical indicators: These show whether the digital asset is overbought or oversold and whether it is likely to continue moving in that direction. They include indicators such as the RSI (relative strength index) and MACD (moving average convergence divergence).

It is important to do your own research when it comes to choosing a cryptocurrency to invest in. However, using some of the above tips will help you to compare crypto charts more effectively and make an informed decision about which digital asset to invest in.