Crypto currency stack and candle stick charts are real time.

Crypto currency stack and candle stick charts are real time. These allow you to keep track of your investments and see how they are doing in the market.

How to Read Crypto Currency Stack and Candle Stick Charts

Crypto currency stack and candle stick charts are used to help investors determine the health of a cryptocurrency by looking at its price and volume.

Cryptocurrency stack chart

The cryptocurrency stack chart shows the prices of cryptocurrencies along with their respective market caps. The chart helps investors determine the relative importance of different cryptocurrencies.

Candle stick chart

The candle stick chart shows the number of coins in circulation, as well as the volume of transactions. The chart helps investors determine the health of a cryptocurrency by looking at its circulating supply and demand.

A Beginner's Guide to Reading Crypto Currency Charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The Different Types of Crypto Currency Charts and What They Mean

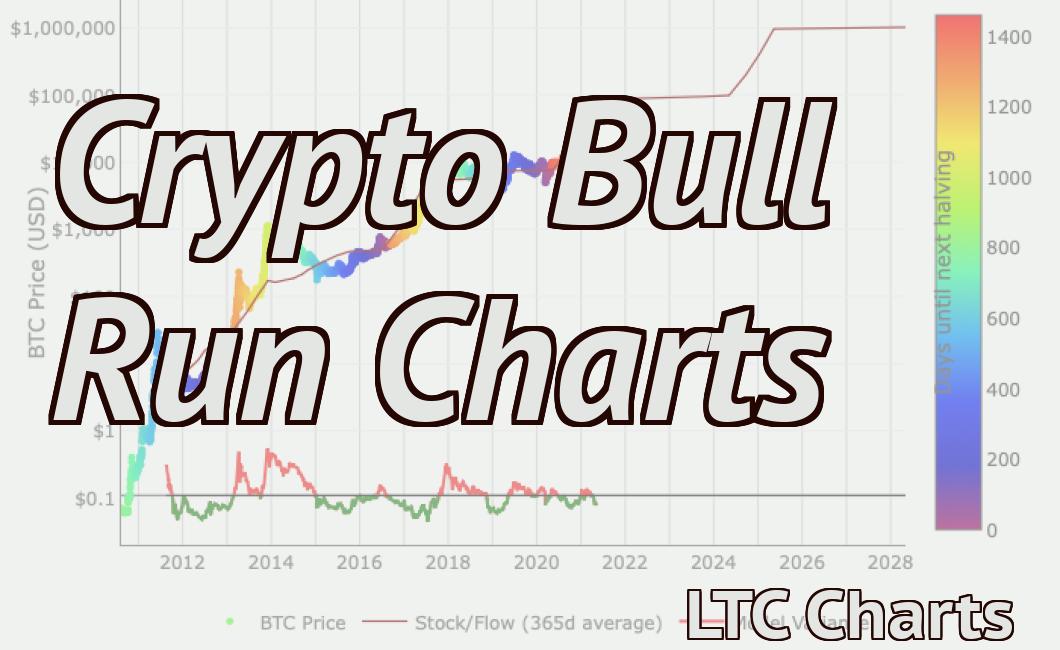

Crypto currency charts are a way to visualize the price of a digital asset over time. They can be divided into two main types: real-time and historical.

Real-time crypto currency charts display the current price of a digital asset as it changes in real time. They are useful for understanding how the value of a digital asset is changing right now.

Historical crypto currency charts display the price of a digital asset over a specific period of time. This can range from a few minutes to months or years.

The different types of charts and the information they provide can vary. Here are some examples:

Real-time crypto currency charts

Real-time crypto currency charts display the current price of a digital asset as it changes in real time. They are useful for understanding how the value of a digital asset is changing right now.

Some common features on real-time crypto currency charts include the following:

The price of a digital asset on the chart

The time of day

The market cap of the digital asset

The volume of trade on the chart

Historical crypto currency charts

Historical crypto currency charts display the price of a digital asset over a specific period of time. This can range from a few minutes to months or years.

Some common features on historical crypto currency charts include the following:

The date and time of the chart

The market cap of the digital asset at that point in time

The volume of trade at that point in time

The change in price over that period of time

How to Use Crypto Currency Stack and Candle Stick Charts to Make Better Trades

Cryptocurrency stack and candle stick charts are a great way to make better trades. These charts can help you identify patterns in the market and make better decisions when trading.

Cryptocurrency stack charts show the price of a cryptocurrency over time. You can use this information to identify trends and make better trading decisions.

Candle stick charts are a type of technical analysis chart. They show the prices of cryptocurrencies over time, but also the number of candles that have been closed at that price.

These charts can help you identify patterns in the market and make better trading decisions.

What do Candlesticks Reveal About the Current Market Trend?

Candlesticks reveal the current market trend by indicating whether the market is bullish or bearish. In a bullish market, the candlestick is tall and has a long body. This signifies that the market is rising, and investors are buying stocks. In a bearish market, the candlestick is short and has a short body. This signifies that the market is falling, and investors are selling stocks.

How to Spot Reversals and Continuations With Candlestick Charts

The candlestick chart is a powerful tool for traders and investors to help identify reversals and continuations.

To identify a reversal, look for a candlestick that closes below the opening price. This indicates that the price is declining.

If the candlestick closes above the opening price, this indicates that the price is increasing.

To identify a continuation, look for a candlestick that closes within the opening and closing prices. This indicates that the price is staying relatively stable.

Trading Strategies: How to Use Candlestick Charts

Candlestick charts are a great way to analyze and trade the markets. They are simple to use and can provide you with important information about the market.

Before using candlestick charts, it is important to understand how they work. Candlestick charts are a type of chart that shows the prices of assets over time. Each candlestick on the chart represents a different period of time.

To use candlestick charts, first identify the periods of time that you want to analyze. Next, identify the assets that you want to track. Finally, look for patterns in the data.

For example, suppose that you are interested in analyzing the market for stocks. You might want to look for patterns in the data over the course of a month. To do this, you would track the prices of stocks over the course of a month and identify the periods of time that have a significant change in price.

Once you have identified the periods of time that you want to analyze, you can look for patterns in the data. For example, you might look for patterns in the number of stocks that are selling or buying at each period of time.

Candlestick charts are a useful tool for trading the markets. They can help you identify important trends in the data and make informed decisions about whether to buy or sell assets.

Japanese Candlesticks - The Ultimate Guide

The Japanese Candlesticks are one of the most popular technical indicators in the world. They are also known as the Ichimoku Cloud and are used to measure the progress of a stock or cryptocurrency. In this guide, we will teach you everything you need to know about the Japanese Candlesticks and how to use them to make money.

How to Create a Candlestick Chart

To create a candlestick chart, you need to first collect data about the stock. You can use a variety of different methods to collect this data, such as market data, earnings data, or even news articles.

Once you have collected the data, you will need to create a chart template. You can find candlestick chart templates online or in various trading software programs. Once you have created the template, you will need to input the data into the chart.

To create a candlestick chart, you will first need to collect data about the stock. You can use market data, earnings data, or even news articles to collect this information.

Once you have collected the data, you will need to create a chart template. You can find candlestick chart templates online or in various trading software programs. Once you have created the template, you will need to input the data into the chart.

How to Analyze Candlestick Charts

Candlestick charts are a graphical representation of stock prices. They consist of a series of bars, each representing a day's trading activity. The width of the bars indicates how much the price has changed relative to the previous bar. The colors of the bars indicate whether the price is rising (green), falling (red), or unchanged (white).

To analyze a candlestick chart, first determine the trend. Is the price consistently rising or falling? If the price is falling, is there a specific point at which the fall becomes more pronounced? If the price is rising, does it have any major peaks or valleys? Once you have determined the trend, look for indicators that may indicate impending changes in direction. Are there any patterns in the color of the bars? Are there any patterns in the width of the bars? Are there any patterns in the volume of trading? Once you have identified potential indicators, watch for them to appear and try to make predictions about what will happen next.

Candlestick Charting 101

Candlestick charting is a type of charting that uses a series of candlesticks to display data. Candlesticks are graphical symbols that represent the opening and closing prices of stocks, commodities, futures contracts, and other financial instruments. Candlestick charts are used to show the movement of prices over time.

Candlesticks are divided into three parts: the body, the upper shadow, and the lower shadow. The body is the portion of the candlestick that is closest to the center of the chart. The upper shadow is the portion of the candlestick that is closest to the upper edge of the chart, and the lower shadow is the portion of the candlestick that is closest to the lower edge of the chart.

The color of a candlestick is determined by its position on the chart: green for the body, yellow for the upper shadow, and red for the lower shadow. The color of a candlestick will change as the price of the underlying asset changes.

The main feature of a candlestick chart is the open, high, low, and close (OHLC) lines. The OHLC lines show the prices at which a particular asset opened, peaked, and closed over the course of a given period of time. The OHLC lines can be used to identify patterns in the price movements of an asset.

Another feature of a candlestick chart is the volume indicator. The volume indicator shows the number of shares traded at each price point over the course of a given period of time. Volume can be used to identify patterns in the price movements of an asset.

The Basics of Interpreting Candlestick Charts

Candlestick charts are a type of technical analysis that allow traders to track the performance of a security over time. The candlestick chart consists of a series of vertical bars that represent the closing prices of a security over a given period of time. The color of the bar indicates whether the price was higher, lower, or unchanged during that period.

The purpose of candlestick charts is to provide a visual representation of the performance of a security over time. Candlestick charts are especially useful for analyzing short-term trends.