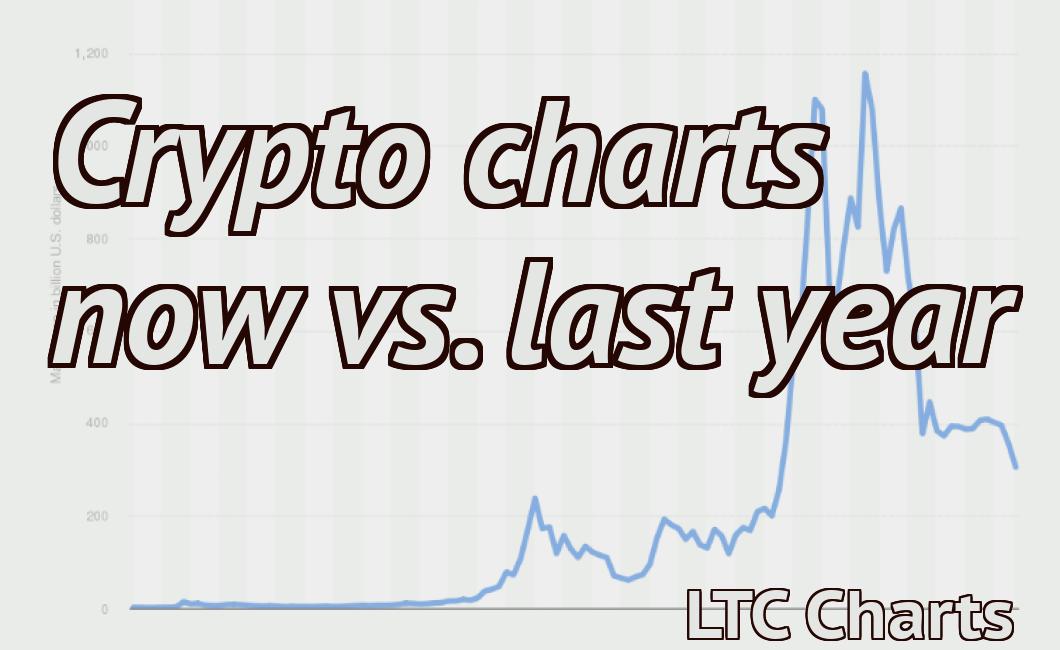

Candle Stick Charts For Crypto Market Cap

Candle Stick Charts are a popular way to visualize the crypto market. They allow traders to see the market's price action over a specific period of time, and can be used to identify trends and patterns.

How to Read Candle Stick Charts for Crypto Market Cap

There are a few ways to read candle stick charts for crypto market cap.

Method 1: Look at the Total Market Cap of All Cryptocurrencies

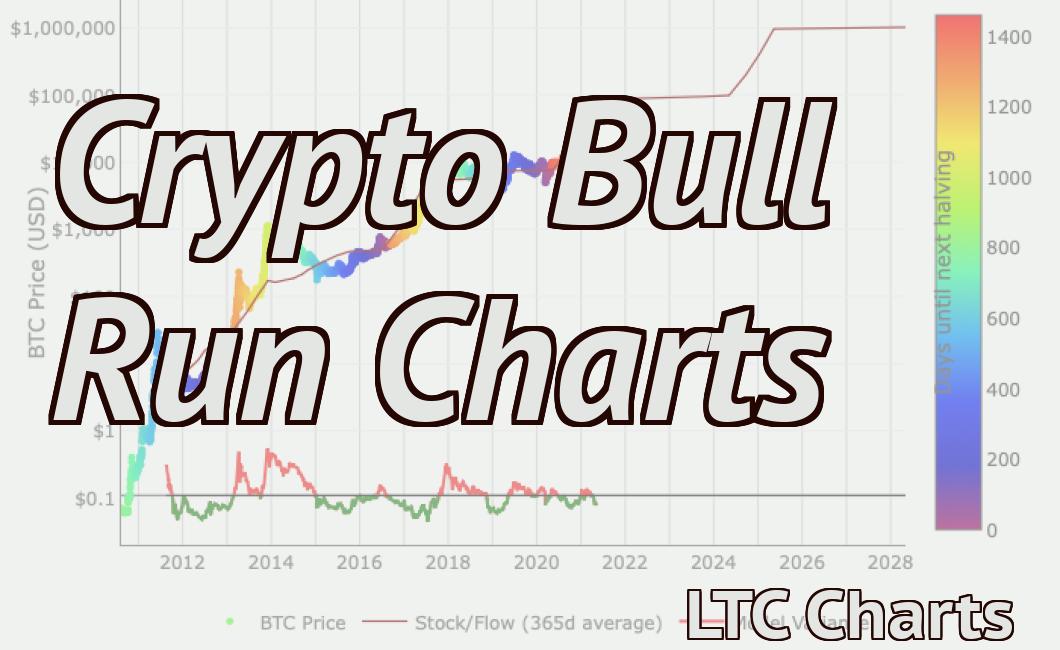

This is the most basic way to read a candle stick chart. You can see how the market cap of all cryptocurrencies has been changing over time.

Method 2: Compare Cryptocurrencies by Market Cap

You can also compare cryptocurrencies by their market caps. This will give you a better idea of which cryptocurrencies are worth investing in.

Method 3: Compare Cryptocurrencies by Volume

You can also compare cryptocurrencies by their volume. This will give you a better idea of which cryptocurrencies are gaining popularity.

3 Simple Tips for Understanding Candle Stick Charts for Crypto Market Cap

1. The first step to understanding candle stick charts for cryptocurrency market cap is to understand what they are and how they are used. A candle stick chart is a graphical representation of the price of a cryptocurrency over time. It is typically presented as a series of candles that each represent a 24-hour period.

2. The size of the candle indicates the price of the cryptocurrency at that particular moment. The further away the candle from the center, the higher the price of the cryptocurrency was at that time.

3. The color of the candle indicates the market trend at that particular moment. For example, a blue candle might indicate that the market is bullish and a red candle might indicate that the market is bearish.

4. The length of the candle indicates how long the particular market trend has been in effect. For example, a long candle might indicate that the market trend has been in effect for a few days, while a short candle might indicate that the market trend has been in effect for only a few minutes.

The Benefits of Using Candle Stick Charts for Crypto Market Cap

Candle Stick Charts offer a quick and easy way to monitor the market cap of cryptocurrencies. This type of chart provides a snapshot of the total value of a given cryptocurrency at any given time. Candle Stick Charts are especially helpful for monitoring smaller cryptocurrencies, which may not be well-covered by other types of charts.

Candle Stick Charts are also helpful for monitoring the overall trend of a cryptocurrency’s market cap. This type of chart can help you identify potential peaks and valleys in the market cap of a cryptocurrency. Candle Stick Charts can also be helpful for identifying new cryptocurrencies that may be worth investing in.

The Different Types of Candle Stick Charts for Crypto Market Cap

There are many different types of candle stick charts for cryptocurrency market cap.

The most popular type is the histogram. This chart shows how many coins are in each price range.

Another popular type of candle stick chart is the pie chart. This chart shows how much of the total market cap each coin represents.

Another type of candle stick chart is the density chart. This chart shows how many coins are in each price range, as a percentage of the total market cap.

How to Create a Candle Stick Chart for Crypto Market Cap

In order to create a candle stick chart for the cryptocurrency market cap, you will need to gather some information.

First, you will need to find the current market cap of all cryptocurrencies. To do this, you can use CoinMarketCap.com.

Once you have the market cap of all cryptocurrencies, you can start creating your candle stick chart.

To create your candle stick chart, you will first need to divide the total market cap of all cryptocurrencies by the number of cryptocurrencies.

Next, you will need to create columns for each cryptocurrency. In each column, you will list the name of the cryptocurrency, the market cap, and the percentage of the total market cap.

Finally, you will need to create rows for each cryptocurrency. In each row, you will list the name of the cryptocurrency, the market cap, and the percentage of the total market cap.

The Advantages of Candle Stick Charts for Crypto Market Cap

There are many benefits to using candle stick charts for cryptocurrency market cap. These charts are simple to create and easy to understand, making them an ideal tool for gauging the performance of individual cryptocurrencies.

One of the main advantages of candle stick charts is their ability to provide a clear overview of the performance of individual cryptocurrencies. By displaying the total value of all cryptocurrencies in a given period, candle stick charts make it easy to see which coins are performing well and which ones are struggling.

Candle stick charts also provide a useful visual representation of the distribution of cryptocurrency wealth. By showing the percentage of each coin’s total value represented by each currency, candle stick charts can help investors determine which coins are most valuable and which ones are worth less.

Finally, candle stick charts can be used to monitor the overall performance of the cryptocurrency market. By tracking the changes in cryptocurrency market cap over time, investors can gain a better understanding of how the market is evolving and what trends are developing.

The Disadvantages of Candle Stick Charts for Crypto Market Cap

There are a few disadvantages to using candle stick charts for measuring the market capitalization of cryptocurrencies.

First, candle stick charts can be misleading because they do not take into account the price of Bitcoin or other major cryptocurrencies. For example, if Bitcoin is trading at $6,000 on a candle stick chart, but it is actually worth $10,000, then the cryptocurrency's market capitalization would appear to be only $6,000 on the chart.

Second, candle stick charts can be inaccurate because they do not account for changes in the value of a cryptocurrency over time. For example, if Bitcoin is worth $6,000 on a candle stick chart, but it is actually worth $10,000 after one month, then the cryptocurrency's market capitalization would appear to be only $6,000 on the chart.

Finally, candle stick charts are not always easy to interpret. For example, if a cryptocurrency's market capitalization is listed as "$1 million," it may be difficult to determine which cryptocurrencies are worth more than $1 million and which are worth less.

How to Use Candle Stick Charts for Crypto Market Cap

Candle Stick Charts can be used to track the market cap of various cryptocurrencies. The market cap is the total value of all coins in circulation.

What is a Candlestick Chart and How to Use it for Crypto Trading?

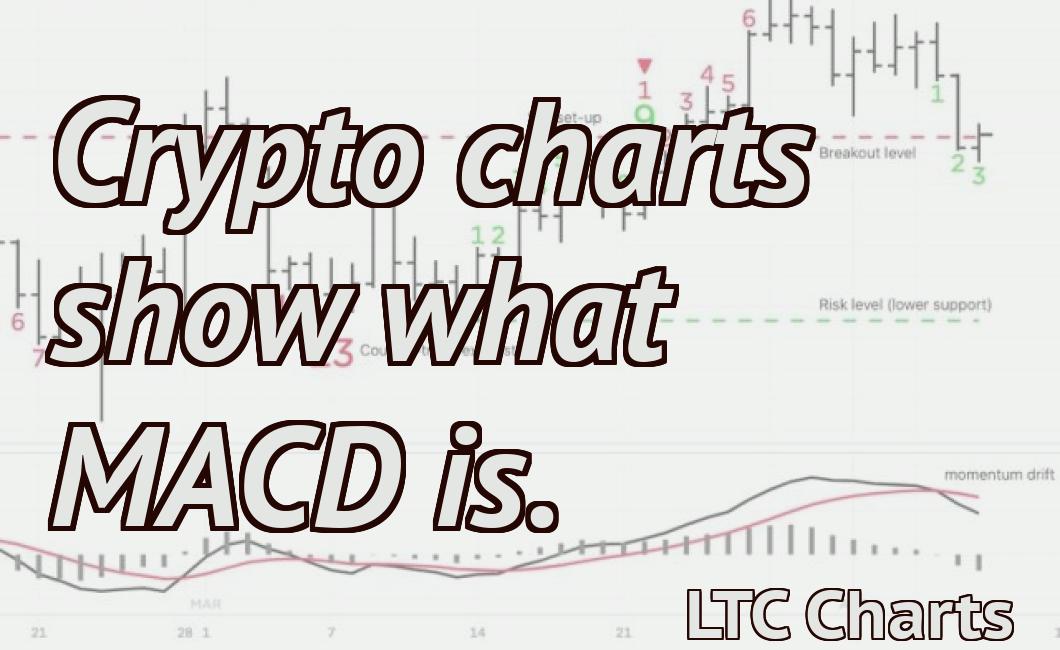

A candlestick chart is a graphical representation of price movements over time. Candlestick charts are most commonly used for trading cryptocurrencies, but can also be used for other markets.

When looking at a candlestick chart, you will first notice the time period covered. This time period will typically be 1, 2, 5, or 10 minutes. After the time period is displayed, you will see the open, high, low, and close prices for that time period. The color of the candlestick will indicate the direction of the price movement. For example, a red candlestick means the price moved in the opposite direction of the trend.

Once you have identified the direction of the price movement, you can begin trading based on that information. For example, if you see a red candlestick with an open price above the high and a close price below the low, you would expect the price to move down.

How to read and trade with candlestick charts for cryptocurrency

Candlestick charts are a popular way to read and trade cryptocurrency.

A candlestick chart is a graphical representation of price movement over time. Each candle is a snapshot of the current market conditions.

The horizontal axis represents time, from left to right. The vertical axis represents price, from bottom to top.

Each candle is composed of three parts: the body, the wick, and the flame.

The body is the largest part of the candle. It shows the current market conditions, such as the price, volume, and open interest.

The wick is the thin part of the candle. It represents how much money was raised or lowered in value.

The flame is the smallest part of the candle. It shows how long the candle was open.