Crypto Charts Example

This article provides an example of how to create a cryptocurrency chart using the Highcharts library.

How to read crypto charts for beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

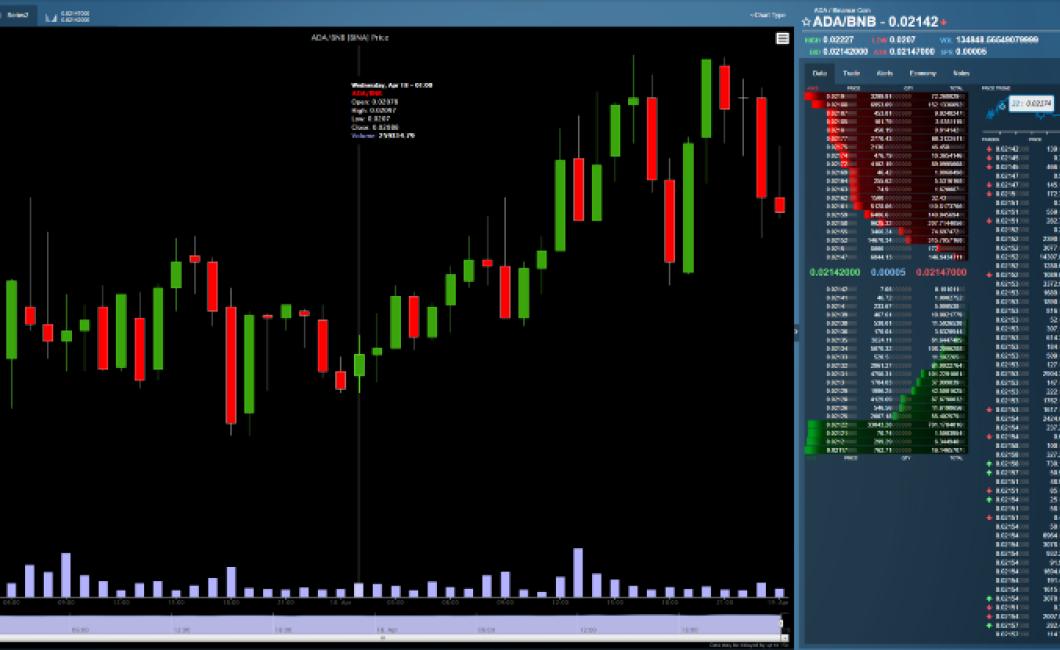

To trade cryptocurrencies, you need to understand how to read crypto charts. A crypto chart is a graphical representation of the prices of cryptocurrencies over time. Crypto charts can be used to identify patterns in the prices of cryptocurrencies, to predict how the prices of cryptocurrencies will change in the future, and to make investment decisions.

When you see a green arrow on a crypto chart, this means that the price of the cryptocurrency is increasing. When you see a red arrow on a crypto chart, this means that the price of the cryptocurrency is decreasing.

The color of the arrow indicates the direction of the price movement. If the arrow is pointing up, this means that the price of the cryptocurrency is increasing. If the arrow is pointing down, this means that the price of the cryptocurrency is decreasing.

The size of the arrow indicates the magnitude of the price movement. The bigger the arrow, the bigger the price movement.

To understand how to read crypto charts, you first need to understand what a cryptocurrency is. A cryptocurrency is a digital or virtual token that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are decentralized, meaning that they are not subject to government or financial institution control. This makes cryptocurrencies attractive to individuals and businesses who want to avoid centralized control over their finances.

Cryptocurrencies are not legal tender in any country, and there is no guarantee that they will ever be accepted as a form of payment by mainstream businesses. Nevertheless, cryptocurrencies are growing in popularity, and many experts believe that they will eventually become a form of mainstream currency.

To trade cryptocurrencies, you need to understand how to read crypto charts. A crypto chart is a graphical representation of the prices of cryptocurrencies over time. Crypto charts can be used to identify patterns in the prices of cryptocurrencies, to predict how the prices of cryptocurrencies will change in the future, and to make investment decisions.

When you see a green arrow on a crypto chart, this means that the price of the cryptocurrency is increasing. When you see a red arrow on a crypto chart, this means that the price of the cryptocurrency is decreasing.

The color of the arrow indicates the direction of the price movement. If the arrow is pointing up, this means that the price of the cryptocurrency is increasing. If the arrow is pointing down, this means that the price of the cryptocurrency is decreasing.

The size of the arrow indicates the magnitude of the price movement. The bigger the arrow, the bigger the price movement.

A guide to understanding crypto chart patterns

Crypto charts are a great way to monitor and track the price movement of digital currencies. While there is no single right or wrong way to analyze crypto charts, following some basic chart patterns can help you make better decisions when trading these assets.

1. Engulfing pattern

This is a pattern that occurs when the price of a cryptocurrency begins to rise quickly and then continues to rise until it reaches a certain point. At this point, the price may start to fall, and it will eventually hit the same point it reached during the initial surge.

2. Head-and-shoulders pattern

This is a pattern that occurs when the price of a cryptocurrency rises sharply from one price point to another, then falls back down before rising again. The price may reach a peak before falling back down again, or it may stay at the peak for a longer period of time.

3. Triangle pattern

This is a pattern that occurs when the price of a cryptocurrency moves between two price points for a prolonged period of time. The price may move up, down, or sideways between these points, and it may eventually reach a resolution at one of these points.

Trading cryptocurrencies using charts – a beginner’s guide

Cryptocurrencies are a new and exciting investment opportunity, but can be difficult to understand and trade.

This beginner’s guide will teach you how to use charts to trade cryptocurrencies.

1. Choose a cryptocurrency to trade

Before you can trade cryptocurrencies, you need to choose a currency to trade.

You can find a list of all the currently available cryptocurrencies on CoinMarketCap.com.

2. Find a cryptocurrency exchange

Once you have chosen a cryptocurrency to trade, you need to find an exchange where you can buy and sell them.

Exchanges offer a variety of trading options, including charts, order books, and 24/7 support.

3. Open a trading account with an exchange

Once you have found an exchange, you will need to open a trading account with them.

This will allow you to buy and sell cryptocurrencies without having to worry about depositing or withdrawing money.

4. Navigate through the exchange’s trading platform

Once you have logged in to your trading account, you will need to navigate through the exchange’s trading platform.

This will allow you to buy and sell cryptocurrencies, place orders, and track your portfolio.

5. Place orders using charts

When trading cryptocurrencies, you will often need to place orders using charts.

Charts allow you to see the price of a cryptocurrency over time, so you can identify areas of interest.

6. Trade cryptocurrencies using live order books

If you want to trade cryptocurrencies while they are still volatile, you should trade them using live order books.

Live order books allow you to place orders without waiting for the market to settle. This can help you make more profitable trades.

The different types of cryptocurrency charts and how to use them

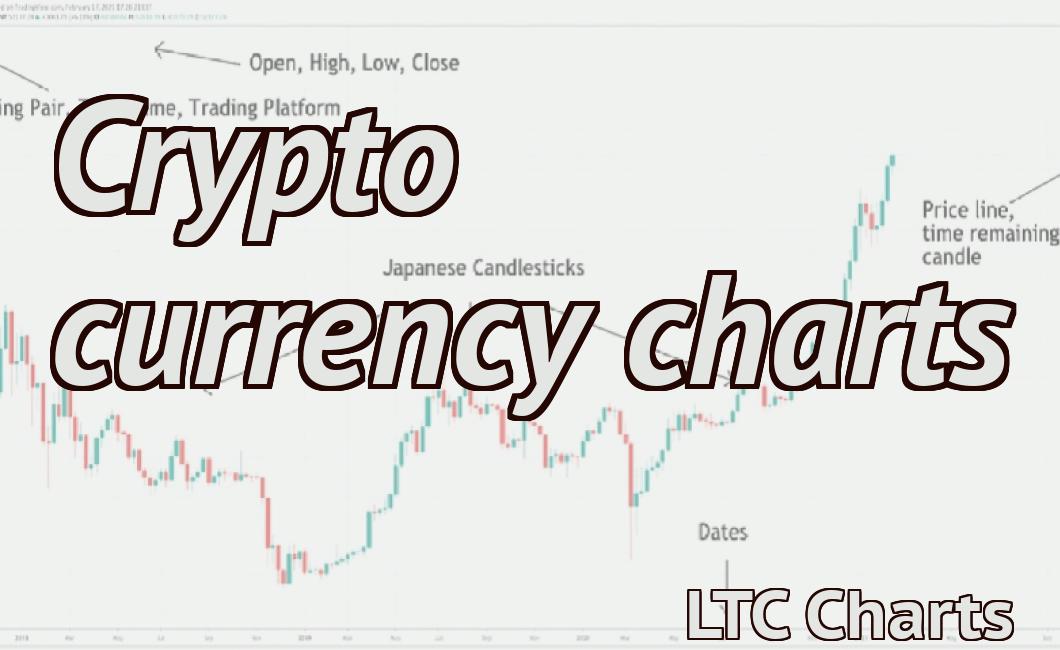

There are many types of cryptocurrency charts and each one has its own benefits and drawbacks.

The most common type of cryptocurrency chart is the price graph. This chart shows the price of a cryptocurrency over time. You can use this chart to see how the price has changed over time, how well the cryptocurrency is performing relative to other cryptocurrencies, and whether the cryptocurrency is trading at a high or low price.

Another common type of cryptocurrency chart is the volume graph. This chart shows the amount of cryptocurrency traded over time. You can use this chart to see how the value of a cryptocurrency is changing, how active the cryptocurrency market is, and whether the cryptocurrency is trading at a high or low price.

Another type of cryptocurrency chart is the candlestick chart. This chart shows the price and volume of a cryptocurrency over time. You can use this chart to see how the price of a cryptocurrency has changed over time, how well the cryptocurrency is performing relative to other cryptocurrencies, and whether the cryptocurrency is trading at a high or low price.

Finally, another type of cryptocurrency chart is the OHLC (over-the-counter) chart. This chart shows the price, volume, and open, high, low, and close prices for a cryptocurrency over time. You can use this chart to see how the price of a cryptocurrency has changed over time, how well the cryptocurrency is performing relative to other cryptocurrencies, and whether the cryptocurrency is trading at a high or low price.

How to spot trends and make predictions using crypto charts

Crypto charts can be used to spot trends and make predictions. For example, if you see that the price of a cryptocurrency is going up, it may be a good time to buy in. Conversely, if the price is dropping, it may be a good time to sell.

A beginner’s guide to technical analysis of crypto charts

Technical analysis is the study of how prices of assets, such as cryptocurrencies, tend to move over time.

1. Look for patterns

The first step in technical analysis is to look for patterns in price movement. This can involve studying past price movements and trying to find similar patterns in order to better understand how prices are likely to move in the future.

2. Study charts

After identifying patterns, the next step is to study charts in order to better understand the current state of the market. This can involve looking at various time frames (such as daily, weekly, or monthly charts) and analyzing the price action in order to gain an understanding of where the market is headed.

3. Make informed decisions

After studying the market and identifying potential trends, the final step is to make informed decisions about where to invest. This involves using technical analysis to determine where prices are likely to go next and whether or not it’s worth investing in that particular cryptocurrency or asset.

Using Fibonacci retracements to trade cryptocurrencies

Fibonacci retracements can be used to identify areas of potential price movement in cryptocurrencies. When used in conjunction with technical analysis, they can provide traders with valuable information about where the market is likely to go next.

To use Fibonacci retracements, traders first need to identify a suitable cryptocurrency to trade. Once they have selected a coin, they can use the Fibonacci retracement tool to identify potential support and resistance levels. If the price falls below the support level, traders may want to buy the cryptocurrency. Conversely, if the price rises above the resistance level, they may want to sell their holdings.

How to use moving averages to trade cryptocurrencies

Moving averages are a popular tool used by traders to help them identify potential trends and predict future price movements. To use moving averages, first identify the type of moving average you want to use. There are three common types of moving averages: simple, exponential, and weighted. Once you've chosen your type of moving average, find the appropriate time frame for your analysis. For example, if you are looking to use a 5-day moving average, look for data from 5/1/2018 to 5/7/2018. Once you've found your data, plot the moving average on a chart and use it to help predict future price movements.

Trading cryptocurrencies with Japanese Candlesticks

Cryptocurrencies are unique in that they are traded with Japanese candlesticks. This is a technical analysis indicator that shows the direction of the market.

The Japanese candlestick is composed of two connected candlesticks. The upper candlestick is called the high and the lower candlestick is called the low. The width of the high and low candlestick is measured in points.

The opening and closing prices for the Japanese candlesticks are used to calculate the change in value for the day.

Using Bollinger Bands to trade cryptocurrencies

Bollinger Bands are a technical indicator that is used to predict price movements. Bollinger Bands are created by dividing the range of a price graph into two bands, and then setting a lower limit for the first band and an upper limit for the second band.

The width of the bands is determined by the standard deviation of the price over the given period. The tighter the bands, the higher the volatility of the price.

When trading cryptocurrencies, it is important to use Bollinger Bands in order to identify potential price highs and lows. When prices move outside of the Bollinger Bands, this indicates that there is significant volatility and risk involved. When prices move within the Bollinger Bands, this indicates that the price is more stable and more likely to continue moving in a particular direction.