Trading Crypto Charts And

This article is about reading and understanding cryptocurrency trading charts. It covers the basic types of charts and how to read them, as well as some more advanced concepts.

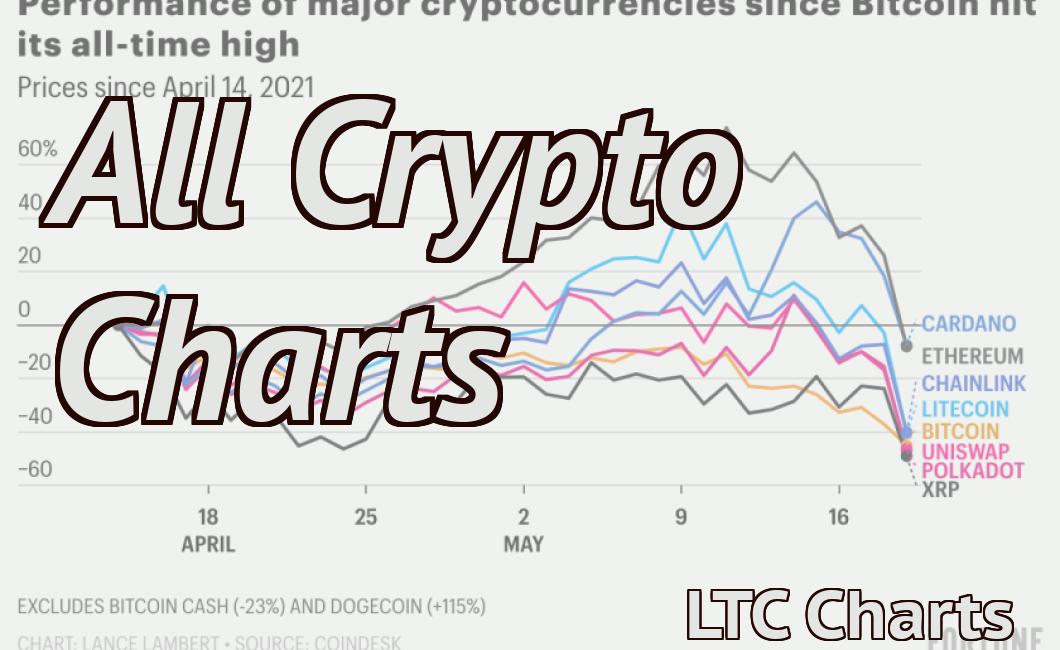

How to Read Crypto Charts

Crypto charts are used to track the prices of cryptocurrencies. The prices are represented as a series of vertical lines on the chart. The height of the line corresponds to the value of the cryptocurrency at that moment.

Cryptocurrencies are traded on exchanges and can also be bought and sold on a peer-to-peer basis. The prices of cryptocurrencies are highly volatile and can often change rapidly. Therefore, it is important to use caution when interpreting crypto charts.

Trading Crypto: Tips for Beginners

1. Buy low, sell high.

This is a basic rule of thumb for traders. When you buy a cryptocurrency, aim to buy it at a lower price than you sell it at. Similarly, when you sell a cryptocurrency, aim to sell it at a higher price than you bought it for.

2. Stay disciplined.

Don’t overthink your trading decisions – just follow your gut and do what feels right. If you find yourself getting emotionally attached to a cryptocurrency or a trade, try to step back and remember that trading is a business.

3. Do your research.

Before you start trading cryptocurrencies, it’s important to do your research. Learn about the different types of cryptocurrencies and how they work. Then, study the market conditions to see if there are any trends that you should be aware of.

4. Stay up-to-date.

Always be aware of the latest news and updates related to cryptocurrencies. This will help you make informed trading decisions.

5. Use a trading platform.

Using a trading platform will help you stay organized and track your progress. There are many different platforms available, so it’s important to choose one that is suited to your needs.

The Benefits of Chart Trading

Chart trading is one of the most popular trading methods used by day traders and swing traders. There are a few reasons why chart trading is so popular:

1. It is fast.

2. It is easy to follow.

3. It is visual.

4. It is easy to buy and sell.

5. It is safe.

6. You can trade any time of day or night.

7. You can trade any type of security.

8. You can trade any size order.

9. You can trade with a wide variety of brokers.

Why You Should Use Charts to Trade Crypto

Cryptocurrencies are not without their risks. In order to mitigate some of these risks, you should use charts to trade cryptocurrencies.

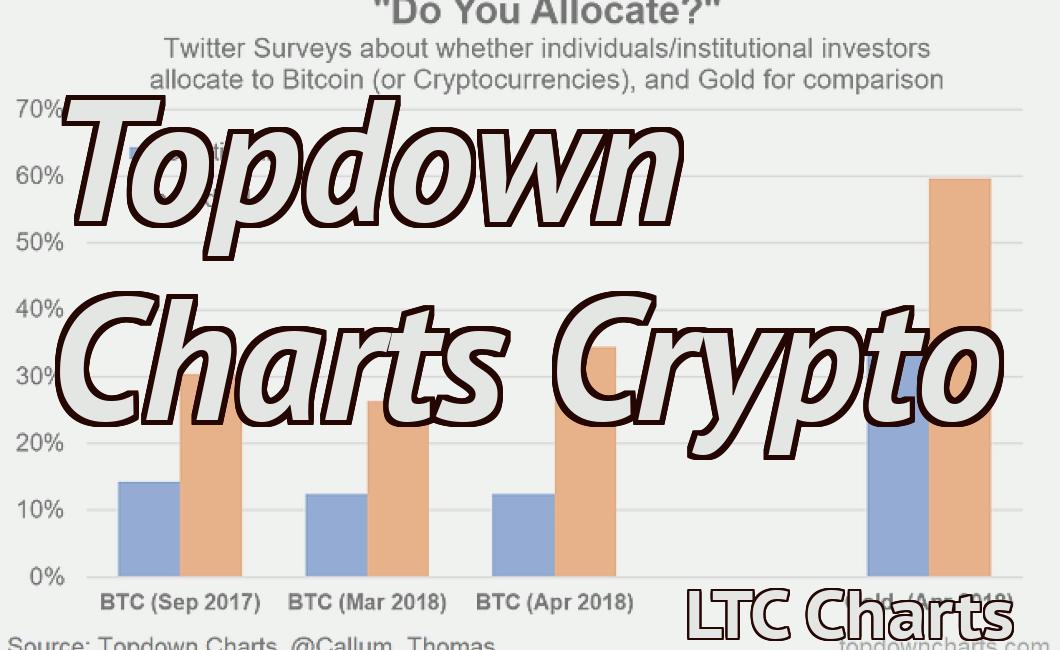

One of the most popular ways to use charts to trade cryptocurrencies is to use technical analysis. Technical analysis looks at the price and volume of a particular cryptocurrency over time in order to determine whether it is overvalued or undervalued.

You can also use charts to identify patterns and signals. For example, if you see a cryptocurrency that is consistently going up in price, this might be a sign that the market is overheating and that the price is likely to go down. In this case, you would want to sell your cryptocurrency before it goes down in price.

Finally, charts can be used to predict future events. For example, if you see that a particular cryptocurrency is about to undergo a major price change, you might want to buy into that cryptocurrency before the change happens in order to make money.

How to Trade Crypto Successfully Using Charts

Cryptocurrencies are all over the news, and they're also becoming more and more popular among traders. That's why it's important to learn how to trade them effectively.

One way to do this is to use charts. Charts can show you a lot about the movement of a cryptocurrency over time, and they can help you make informed decisions about when to buy or sell.

Here are some tips to help you trade cryptocurrencies successfully using charts:

1. Know Your Charts

Before you start trading, it's important to understand the charts. Look at the different indicators on the chart and figure out what they mean. For example, you might see a chart showing price trend, volume, or market capitalization.

2. Use Technical Analysis

Technical analysis is the use of charts and other technical indicators to make investment decisions. You might use technical analysis to try to predict future prices, or to identify patterns in the market.

3. Use Price Targets

When you're trading cryptocurrencies, it's important to set price targets. This will help you stay consistent with your trading strategy.

4. Watch for Patterns

When you're trading cryptocurrencies, it's important to watch for patterns. These patterns can help you identify opportunities to buy or sell.

5. Don't Overreact

It's important not to overreact to the movements of the market. If you do, you could end up losing your money. Instead, use charts and other technical indicators to make informed decisions about when to buy or sell.

7 Tips For Trading Crypto Charts

1. Use a reliable cryptocurrency trading platform

One of the most important things you can do to ensure success when trading cryptocurrencies is to use a reliable platform. A platform that is reliable will provide you with a user-friendly interface and robust features that will help you make informed decisions while trading.

2. Understand technical indicators

One of the most important aspects of trading cryptocurrencies is understanding technical indicators. Technical indicators can help you identify trends and provide you with valuable information that can help you make informed trading decisions.

3. Follow a disciplined approach to trading

It is important to have a disciplined approach to trading cryptocurrencies. This means that you should always keep an eye on your portfolio and make sure that you are using proper trading strategies.

4. Use a stop loss

One of the most important things you can do when trading cryptocurrencies is to use a stop loss. A stop loss is a trigger that will automatically sell your coins if the price falls below a certain level. This will help you avoid losing money if the price of the coin falls significantly.

5. Trade cautiously

When trading cryptocurrencies, it is important to be cautious. This means that you should only invest what you are willing to lose. If you are not comfortable with the risk involved, then it is best to avoid trading cryptocurrencies altogether.

The Do's and Don'ts of Trading Crypto Charts

Do's

1. Do your own research. There is no one answer to the best way to trade cryptocurrencies and different individuals will have different opinions on which cryptocurrencies are the best to invest in.

2. Do not invest more than you can afford to lose. Cryptocurrencies are volatile and can quickly lose value, so it is important to only invest what you are comfortable losing.

3. Only trade cryptocurrencies that you can afford to lose. Many cryptocurrencies are speculative and may be prone to price volatility, meaning that they could quickly lose value. If you cannot afford to lose any money trading cryptocurrencies, then do not trade them at all.

4. Only trade cryptocurrencies that you understand. Many cryptocurrencies are complex and can be difficult to understand. If you are not familiar with them, it is important to seek out advice from a professional before trading them.

5. Do not trade cryptocurrencies on margin. Trading cryptocurrencies on margin can be risky and can lead to sudden price crashes. If you are not sure if you are able to afford to lose any money trading cryptocurrencies, then do not trade them on margin.

6. Do not invest more than you are willing to lose. Just as with any investment, it is important not to invest more money than you are comfortable losing.

7. Do not trade when you are angry or emotional. It is important to keep a cool head when trading cryptocurrencies, as emotions can lead to irrational decisions.

8. Do not trade for short-term profits. Trading for short-term profits may lead to rapid price fluctuations, which can be dangerous for your investment.

9. Use a trading account that is safe and secure. Many online trading platforms offer cryptocurrency trading, but some of these platforms are less safe and secure than others. It is important to choose a platform that is safe and reliable, so that you do not lose any money trading cryptocurrencies.

10. Do not trade during market hours. Trading during market hours can be very volatile, and can lead to large price swings. If you are not sure if you are able to afford to lose any money trading cryptocurrencies, then wait until after market hours have concluded.

How to Make Money Trading Crypto Charts

Crypto trading is a volatile and risky activity. Before trading cryptocurrencies, be sure to do your own research and understand the risks involved.

Here are some tips on how to make money trading crypto charts:

1. Buy low and sell high

One of the best ways to make money trading crypto charts is to buy low and sell high. This means investing in cryptocurrencies when their prices are low and then selling them when their prices are high.

2. Trade with a strategy

Another way to make money trading crypto charts is to use a strategy. This means setting up a plan before you start trading, and following that plan. This will help you minimize your risk and maximize your profits.

3. Use a trading bot

If you don’t have time to trade cryptocurrency charts yourself, you can use a trading bot. These bots are computer programs that help you trade cryptocurrency charts. They’re easy to use, and they can save you a lot of time and effort.

What You Need to Know About Trading Crypto Charts

Cryptocurrency trading charts are essential for anyone wanting to make money from the cryptocurrency market. They provide a visual representation of the current state of the market, and allow you to make informed decisions about which cryptocurrencies to buy or sell.

The first thing to note about cryptocurrency trading charts is that they differ significantly from stock charts. Cryptocurrency charts are usually drawn on a logarithmic scale, which makes them much more responsive to price changes. This means that a small movement in the price of a cryptocurrency can result in a large change on the chart.

Secondly, cryptocurrency trading charts are often divided into two main sections: the buy side and the sell side. The buy side is typically populated by cryptocurrencies that are in demand, while the sell side is populated by cryptocurrencies that are being traded at a loss.

Finally, it is important to keep in mind that cryptocurrency trading charts are not a guarantee of success. Like any investment, success depends on your ability to make sound investment decisions.

Get an Edge in the Crypto Market by Trading Charts

Cryptocurrencies are a highly volatile and complex market. In order to make informed trading decisions, it is important to have access to reliable cryptocurrency trading charts.

There are a number of cryptocurrency trading platforms that offer free and premium charts. Some of the more popular platforms include CoinMarketCap, TradingView, and Bitfinex.

Charting platforms provide traders with real-time data on the price and volume of cryptocurrencies. This information can be used to make informed trading decisions.

For example, if you are trading Bitcoin, you can use a chart to see how the price has been moving over the past few hours. This information can help you determine if now is a good time to buy or sell.

Charting platforms also allow you to view historical data on the prices of different cryptocurrencies. This information can help you identify patterns in the market.

If you are new to cryptocurrency trading, charts can help you to sharpen your trading skills. By using charts, you can develop a better understanding of what is happening in the market.

Charting platforms are a valuable tool for traders. They provide real-time data on the price and volume of cryptocurrencies. This information can be used to make informed trading decisions.