Why do crypto prices move together?

Crypto prices move together because they are based on the same underlying technology. Bitcoin, for example, is based on blockchain technology. When the price of one crypto goes up, it often means that the price of other cryptos will also go up. This is because investors see the potential in the technology and are willing to invest in it.

The Herd Mentality of Cryptocurrencies

Cryptocurrencies have a herd mentality. This means that when people see others investing in a cryptocurrency, they are more likely to invest as well. This can lead to prices rising, as more and more people invest. However, this also means that if the cryptocurrency begins to decline in value, more and more people will sell, causing the price to drop.

Why Do Crypto Prices Move Together?

Cryptocurrencies are a digital or virtual asset designed to work as a medium of exchange that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution regulation.

Cryptocurrencies are often exchanged for other cryptocurrencies, real-world goods and services, or other digital assets. Each cryptocurrency is unique, with its own dynamics and trading patterns. Because cryptocurrencies are decentralized, they are not subject to the same economic forces that affect national currencies. This means that cryptocurrencies are more volatile and susceptible to price swings than national currencies.

Cryptocurrency prices are also influenced by news events and social media sentiment. When major financial institutions start to accept cryptocurrencies as a form of payment, this can increase demand and cause prices to rise. Conversely, when there are reports of fraud or security breaches associated with cryptocurrencies, this can lead to price drops.

The Correlation Between Cryptocurrencies

Cryptocurrencies are a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

There is no correlation between the price of cryptocurrencies and the value of the underlying assets. Cryptocurrencies are traded on decentralized exchanges and can be converted into other cryptocurrencies, fiat currencies, or other assets. The price of a cryptocurrency is based on supply and demand, and can fluctuate rapidly.

The Relationship Between Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Why Are Cryptocurrency Prices So Volatile?

Cryptocurrencies are highly volatile because they are not regulated by a government or central bank. This means that their prices can change rapidly and unpredictably.

What Factors Affect Cryptocurrency Prices?

There are a few factors that can affect cryptocurrency prices. These include global events, technical analysis, investor sentiment, and regulatory changes.

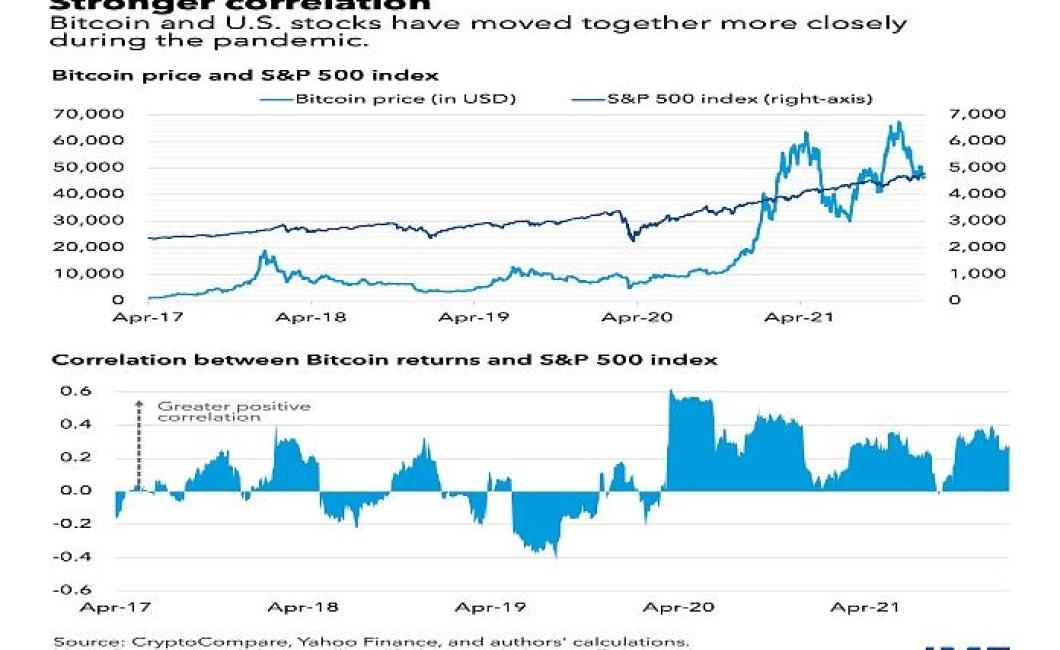

How Do Macroeconomic Conditions Affect Cryptocurrency Prices?

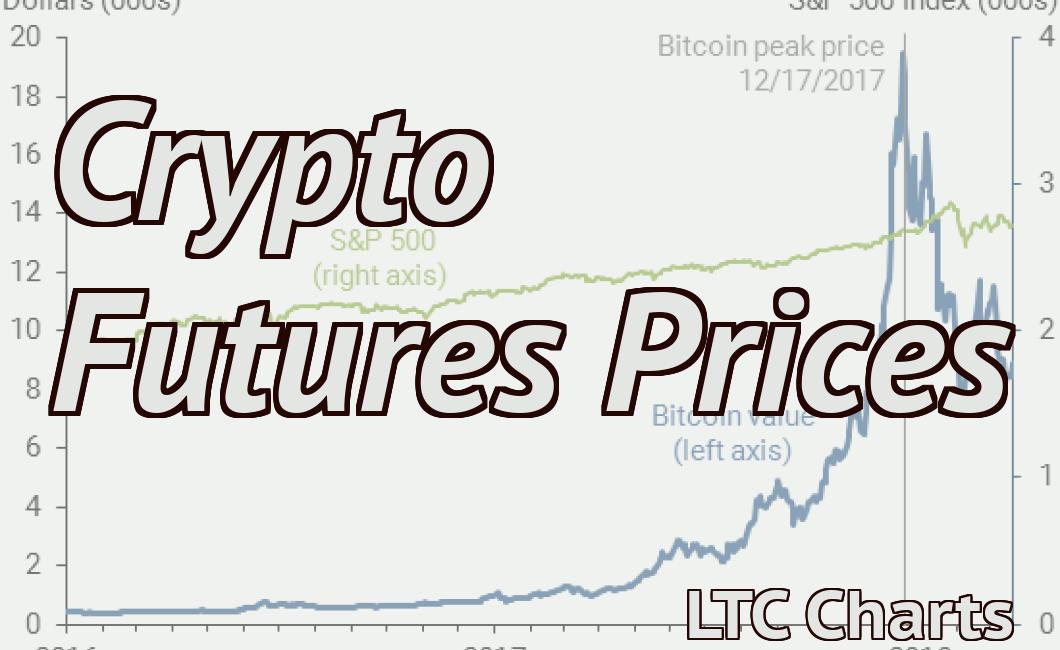

Cryptocurrencies are often associated with volatile prices. This is because the value of cryptocurrencies is based on a number of factors, including the supply and demand of the coins on the market, global economic conditions, and political events. Macroeconomic conditions can affect these factors in a variety of ways, which can impact cryptocurrency prices.

For example, a rise in global economic activity may lead to increased demand for cryptocurrencies, which in turn would cause their prices to rise. A decline in global economic activity could lead to a decrease in demand for cryptocurrencies, which would cause their prices to fall. Macroeconomic conditions can also affect the value of cryptocurrencies through their impact on the overall economy. For example, if the global economy is growing slowly, this could lead to increased demand for cryptocurrencies, which would cause their prices to rise. If the global economy is growing rapidly, this could lead to decreased demand for cryptocurrencies, which would cause their prices to fall.

Overall, macroeconomic conditions can have a significant impact on the price of cryptocurrencies.

What You Need to Know About Cryptocurrency Pricing

Cryptocurrency prices are notoriously volatile and can fluctuate significantly in short periods of time. In order to minimize the impact of price volatility on your investment portfolio, it is important to understand the factors that influence cryptocurrency prices.

Some of the key factors that influence cryptocurrency prices include:

Supply and Demand: The number of coins available for purchase on cryptocurrency exchanges is constantly changing, as new coins are created and old coins are sold. This creates a supply and demand imbalance, which affects prices.

The number of coins available for purchase on cryptocurrency exchanges is constantly changing, as new coins are created and old coins are sold. This creates a supply and demand imbalance, which affects prices. Regulatory Environment: Cryptocurrencies are legal tender in only a limited number of countries, which can affect demand and therefore prices. For example, when China banned cryptocurrency trading, prices fell sharply.

Cryptocurrencies are legal tender in only a limited number of countries, which can affect demand and therefore prices. For example, when China banned cryptocurrency trading, prices fell sharply. News Events: Significant news events (e.g. a major tech company announcing plans to start accepting cryptocurrencies) can cause the value of a coin to spike or fall.

Significant news events (e.g. a major tech company announcing plans to start accepting cryptocurrencies) can cause the value of a coin to spike or fall. Technical Analysis: Cryptocurrency traders use technical analysis to predict how a currency will perform in the future based on historical data. This can affect prices by influencing supply and demand.

Cryptocurrency traders use technical analysis to predict how a currency will perform in the future based on historical data. This can affect prices by influencing supply and demand. Forecasting: Cryptocurrency analysts often use mathematical models to make predictions about future trends in cryptocurrency prices. These predictions can also affect prices.

Cryptocurrency analysts often use mathematical models to make predictions about future trends in cryptocurrency prices. These predictions can also affect prices. Volume: The amount of currency exchanged in a given period is an indicator of how popular a currency is and how much demand there is for it. High volume signals that there is strong interest in a currency, which can lead to higher prices.

The amount of currency exchanged in a given period is an indicator of how popular a currency is and how much demand there is for it. High volume signals that there is strong interest in a currency, which can lead to higher prices. News Outlets: Cryptocurrency news outlets can have a significant impact on prices by reporting on developments that affect the market.

Cryptocurrency news outlets can have a significant impact on prices by reporting on developments that affect the market. Altcoins: Altcoins (alternative cryptocurrencies) are created by companies that are not affiliated with the original Bitcoin blockchain. These altcoins may have different characteristics (such as faster transaction times or different security measures), which can affect their prices.

It is important to keep track of these and other factors that can affect cryptocurrency prices in order to make informed investment decisions.