Crypto Charts With Indicators

If you're serious about cryptocurrency trading, then you need to be looking at crypto charts with indicators. This will help you make better informed decisions about when to buy and sell. Indicators can show you things like momentum, overbought/oversold levels, and much more. With this information, you can better time your entries and exits in the market.

The Benefits of Using Crypto Charts with Indicators

Cryptocurrencies are a digital asset and a payment system invented by an unknown person or group of people under the name of Satoshi Nakamoto. Cryptocurrencies are unique in that they use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This has made them attractive to some investors and users because they are not subject to the whims of traditional financial institutions.

Cryptocurrencies are also open-source, meaning they are available to be examined and studied by anyone. This makes them more reliable and secure than traditional financial institutions, since there is less opportunity for fraud or corruption.

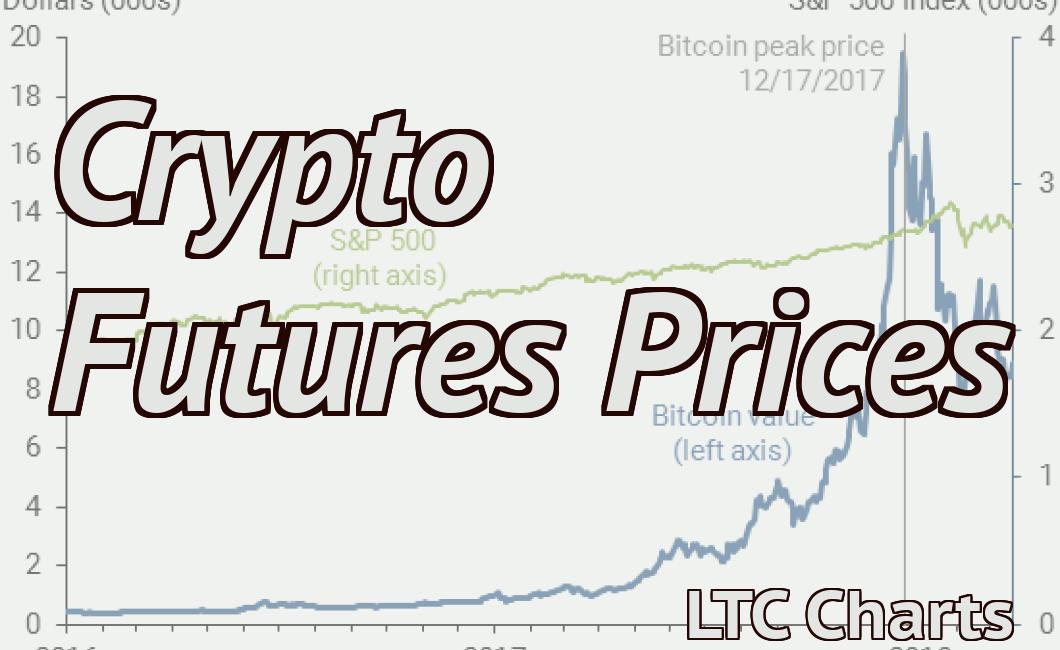

Cryptocurrencies are also volatile, which means their prices can fluctuate significantly. This makes them risky for investors, but it also makes them exciting and rewarding for those who are willing to invest in them.

How to Use Crypto Charts with Indicators

There are many different ways to use crypto charts with indicators. You can use them to monitor the price of a cryptocurrency over time, to help make financial decisions, or to help determine when it is best to sell a cryptocurrency.

To use crypto charts with indicators, first find the indicators that you want to use. Cryptocurrency markets are volatile, so it is important to use indicators that help you make informed decisions. Some common indicators used in crypto trading include the MACD, RSI, and the Bollinger Band.

Once you have found the indicators that you want to use, open a crypto chart in your trading platform of choice. Then, find the indicators that you want to use and drag them onto the chart.

Now, you need to set up the indicators. To do this, you will need to understand how each indicator works. Each indicator has a specific purpose, so it is important to understand how it works before you set it up.

Once you have set up the indicators, you need to start trading. To do this, you will need to place buy and sell orders based on the indicators. You can also use the indicators to help you make financial decisions. For example, you can use the RSI to determine when it is time to sell a cryptocurrency.

The Different Types of Crypto Charts with Indicators

Cryptocurrency charts are essential to understanding the performance of particular cryptocurrencies. There are many types of cryptocurrency charts, each with its own unique set of indicators.

The following are the most common types of cryptocurrency charts:

1. Price Chart

A price chart displays the price of a cryptocurrency over time. The horizontal axis shows the date, and the vertical axis shows the price of the cryptocurrency.

2. Volume Chart

A volume chart displays the number of transactions performed over a given period of time. The horizontal axis shows the date, and the vertical axis shows the volume of transactions.

3. Circulating Supply Chart

A circulating supply chart displays the number of coins in circulation over a given period of time. The horizontal axis shows the date, and the vertical axis shows the circulating supply of a cryptocurrency.

4. Price-To-Volume Ratio Chart

A price-to-volume ratio chart displays the price of a cryptocurrency compared to its volume. The horizontal axis shows the date, and the vertical axis shows the price-to-volume ratio.

The Advantages of Crypto Charts with Indicators

Cryptocurrency charts are a great way to monitor the health of a cryptocurrency portfolio. They can help you identify trends and make informed investment decisions.

Some of the advantages of using cryptocurrency charts include:

1. They can provide an overview of your overall portfolio performance.

2. They can help you identify when a particular cryptocurrency is in a good or bad trend.

3. They can help you spot potential market corrections.

4. They can give you an idea of when it might be time to sell your cryptocurrencies.

5. They can help you stay disciplined when investing in cryptocurrencies.

The Disadvantages of Crypto Charts with Indicators

Some of the disadvantages of using crypto charts with indicators include that they can be difficult to understand and use, and that they may not be as accurate as traditional charts. Additionally, crypto charts with indicators can be less accurate when it comes to predicting price movements, because they are based on a variety of factors other than just the price of a cryptocurrency.

How to Read Crypto Charts with Indicators

Cryptocurrency charts are visual representations of the price and volume of a cryptocurrency over a given period of time. They can be used to identify trends, spot opportunities, and predict future movements.

To read a crypto chart, first locate the currency you are interested in. This can be done by finding the name of the currency or the symbol associated with it.

Next, locate the specific timeframe you want to view the data in. This can be done by clicking on the "time frame" icon at the top left of the chart. You can select from a variety of timeframes, including daily, weekly, and monthly.

Finally, use the indicators to help you understand the data. These include the moving averages (MA), Bollinger Bands (BB), and Fibonacci retracements.

MA is a long-term indicator that shows the average price over a given period of time. BB is a short-term indicator that shows the range of prices over a given period of time. Fibonacci retracements are used to identify areas of support and resistance.

What do Crypto Charts with Indicators Mean?

Cryptocurrencies are a digital asset class that uses cryptography to secure the transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrencies are often compared to traditional currencies, such as the US dollar, because they are both forms of digital assets that use cryptography to secure the transactions. Cryptocurrencies also have a limited supply, meaning that new units cannot be created without being approved by the network.

How to Analyze Crypto Charts with Indicators

Cryptocurrencies are often traded on various exchanges and can be analyzed by various indicators.

Some common indicators used to analyze crypto charts include:

1) Price Volume: This indicator shows how much money is being traded in a given period of time. A high volume indicates that there is strong demand for the cryptocurrency, while a low volume may indicate that the cryptocurrency is not well-known or not widely accepted.

2) Price: This indicator shows the price of a cryptocurrency over a given period of time. A rising price indicates that the cryptocurrency is becoming more popular and valuable, while a falling price indicates that the cryptocurrency is becoming less popular and valuable.

3) RSI (Relative Strength Index): The RSI indicator shows how much the price of a given cryptocurrency is fluctuating relative to the rest of the market. A RSI of over 70 indicates that the cryptocurrency is heavily fluctuating, while a RSI of below 30 indicates that the cryptocurrency is relatively stable.

4) MACD (Moving Average Convergence Divergence): The MACD indicator shows how much the price of a given cryptocurrency is fluctuating relative to the MACD line, which is a moving average of the previous two periods. A MACD line that is falling indicates that the price of the cryptocurrency is declining, while a MACD line that is rising indicates that the price of the cryptocurrency is increasing.