What makes crypto prices change?

Cryptocurrencies are a type of digital asset that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. The prices of cryptocurrencies are volatile, meaning they can fluctuate greatly in price. The prices of cryptocurrencies are determined by supply and demand. When there is high demand for a cryptocurrency, the price will increase. When there is low demand, the price will decrease.

The forces that move cryptocurrency prices

Cryptocurrency prices are influenced by a number of factors, including news, technical analysis, and global events.

How supply and demand affects cryptocurrency prices

Cryptocurrencies are bought and sold on exchanges, and their prices are affected by supply and demand. When more people want to buy a cryptocurrency, its price goes up. Conversely, when fewer people want to buy a cryptocurrency, its price goes down.

The role of market sentiment in cryptocurrency pricing

There is no one definitive answer to this question. Some people believe that market sentiment is important in cryptocurrency pricing, while others believe that it is not as important as other factors.

How news and events can impact cryptocurrency prices

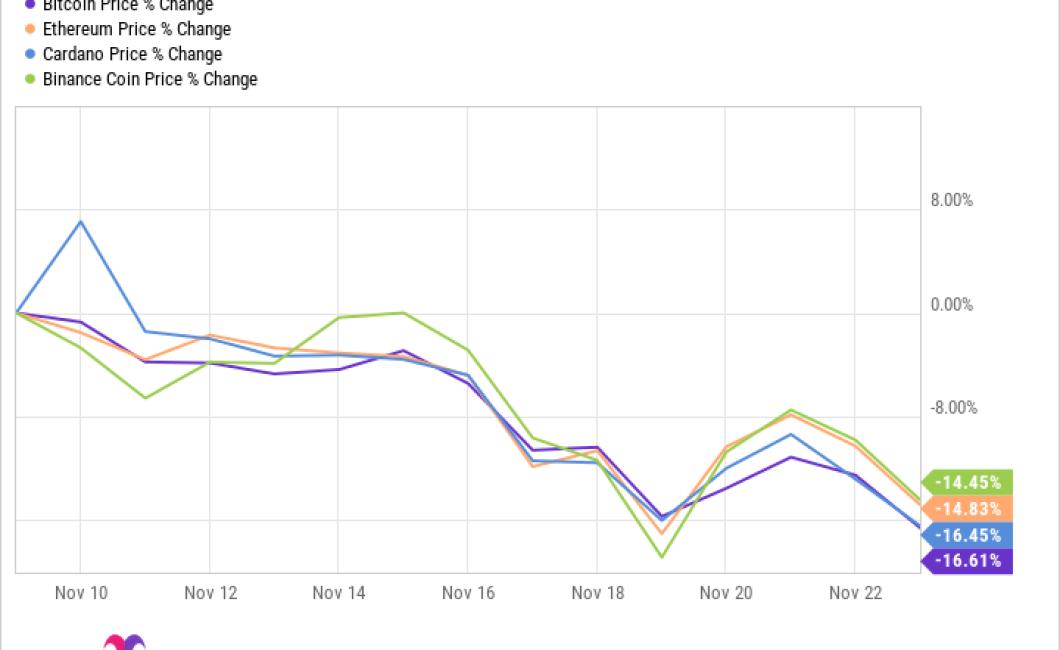

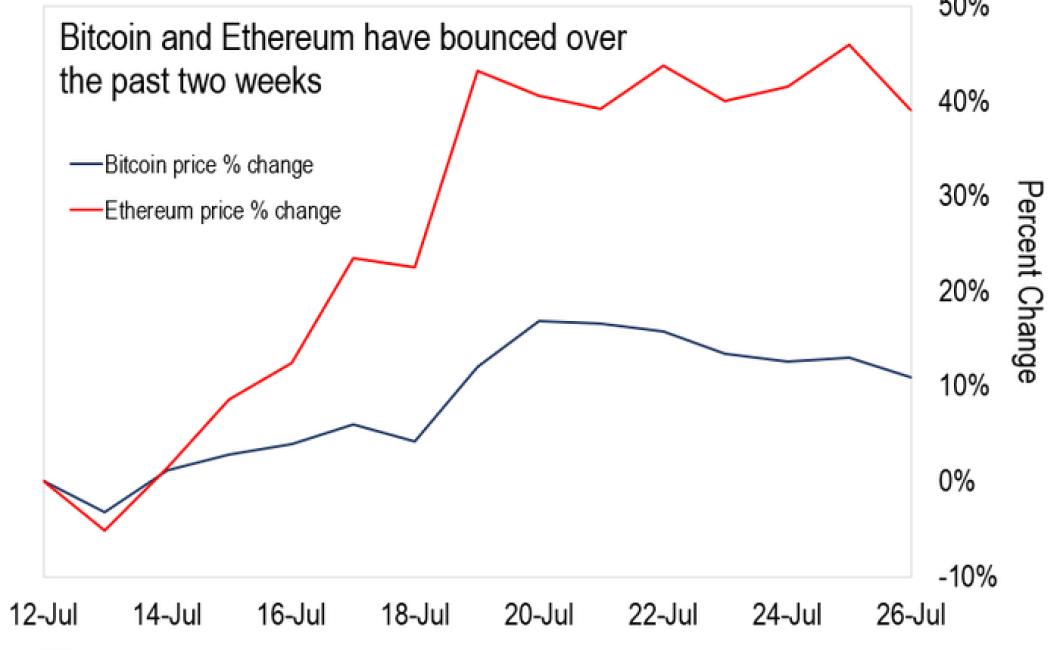

News and events can impact cryptocurrency prices in a number of ways. For example, if a major news event causes a sharp increase in demand for a cryptocurrency, its prices may rise. Conversely, if a major news event causes a sharp decrease in demand for a cryptocurrency, its prices may fall.

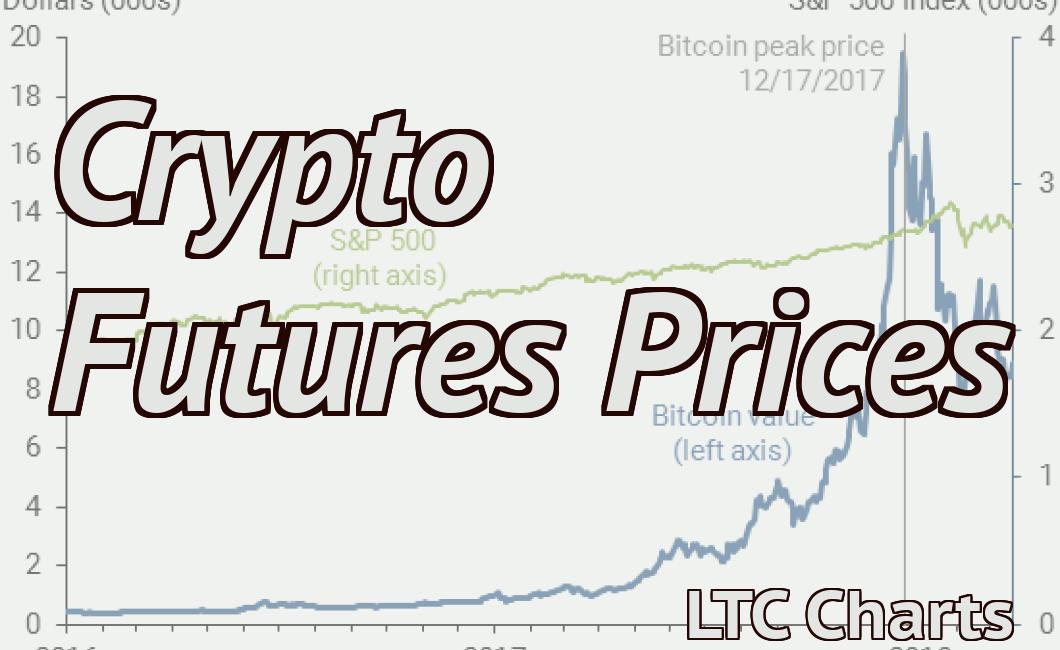

Cryptocurrency prices are also influenced by global economic conditions. For example, if the global economy is growing, then cryptocurrency prices may be expected to increase. Conversely, if the global economy is declining, then cryptocurrency prices may be expected to decline.

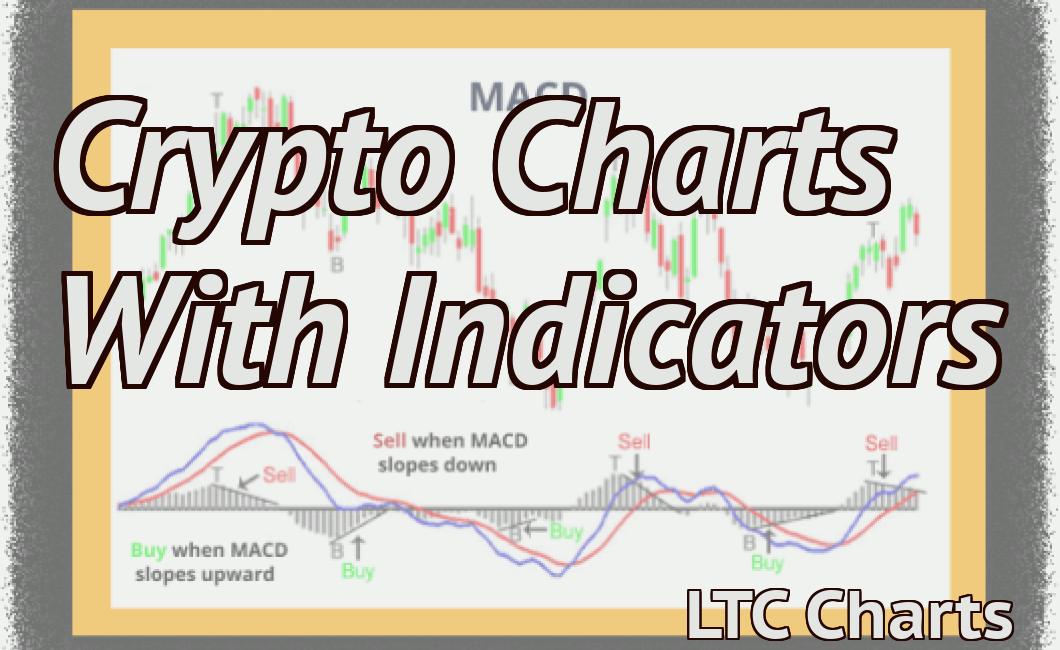

Technical analysis of cryptocurrency price movements

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be converted into traditional currencies. Bitcoin, the first and most well-known cryptocurrency, has been in existence for over 10 years.

The influence of whales on cryptocurrency prices

Whales are said to have a significant impact on the prices of cryptocurrencies. This is because they are able to move large amounts of digital assets in a short amount of time. This helps to create liquidity in the markets and gives investors a better opportunity to buy and sell cryptocurrencies.

How FOMO and FUD can impact cryptocurrency prices

In the world of cryptocurrency, there are two main emotions that can affect prices: FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt).

When people feel FOMO, they are often motivated to buy cryptocurrencies in order to gain an advantage over others. This can drive prices up, as people are willing to pay more for a digital asset that they believe is in high demand.

On the other hand, when people feel FUD, they are often motivated to sell their cryptocurrencies in order to avoid losing money. This can drive prices down, as people are willing to sell assets for less than they believe they are worth.

How forks and airdrops can affect cryptocurrency prices

Forks and airdrops can affect cryptocurrency prices in a few ways. The most direct way is that the influx of new coins or tokens can cause prices to increase. This is because new investors are interested in buying in, and the price of the underlying asset (in this case, cryptocurrency) goes up. Additionally, forks and airdrops can lead to the creation of new altcoins or tokens, which can also push prices up. Finally, news about a fork or airdrop can affect overall sentiment and thus, prices.

The role of exchanges in setting cryptocurrency prices

An exchange is a marketplace where buyers and sellers of cryptocurrencies can trade. Exchanges set the prices for cryptocurrencies and also allow people to buy and sell cryptocurrencies.

Why some investors believe that cryptocurrency is a bubble

Some investors believe that cryptocurrency is a bubble because it is not backed by any physical assets. Cryptocurrency prices are highly volatile and can be significantly affected by political, economic, and financial events. Additionally, there is a limited number of cryptocurrencies available for purchase, which may create an environment of speculation. Some investors may also believe that cryptocurrency is a bubble because it is difficult to use and is not accepted by many merchants.

How does the concept of value play into cryptocurrency prices?

One of the key concepts behind cryptocurrency is that it uses a decentralized system to manage and control its value. This means that there is no central authority that can control the value of cryptocurrencies. Instead, the value of a cryptocurrency is determined by how much people are willing to pay for it.