Crypto Futures Prices

Crypto futures prices are the prices of various cryptocurrencies at which futures contracts for those cryptocurrencies are traded. A crypto future is a contract that obligates the holder to buy or sell a cryptocurrency at a specified price on a specified date. Crypto futures prices are used by traders to speculate on the future price movements of cryptocurrencies.

Futures prices for Bitcoin, Ethereum, Litecoin and other cryptocurrencies.

Bitcoin, Ethereum, Litecoin and other cryptocurrencies.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin is the first and most well-known cryptocurrency. Bitcoin is traded on exchanges and can also be used to purchase goods and services. Ethereum is a more advanced cryptocurrency that allows developers to create applications that run on its blockchain technology. Litecoin is a more beginner-friendly cryptocurrency that is faster and cheaper to use than Bitcoin and Ethereum.

Cryptocurrency futures prices – where are they headed?

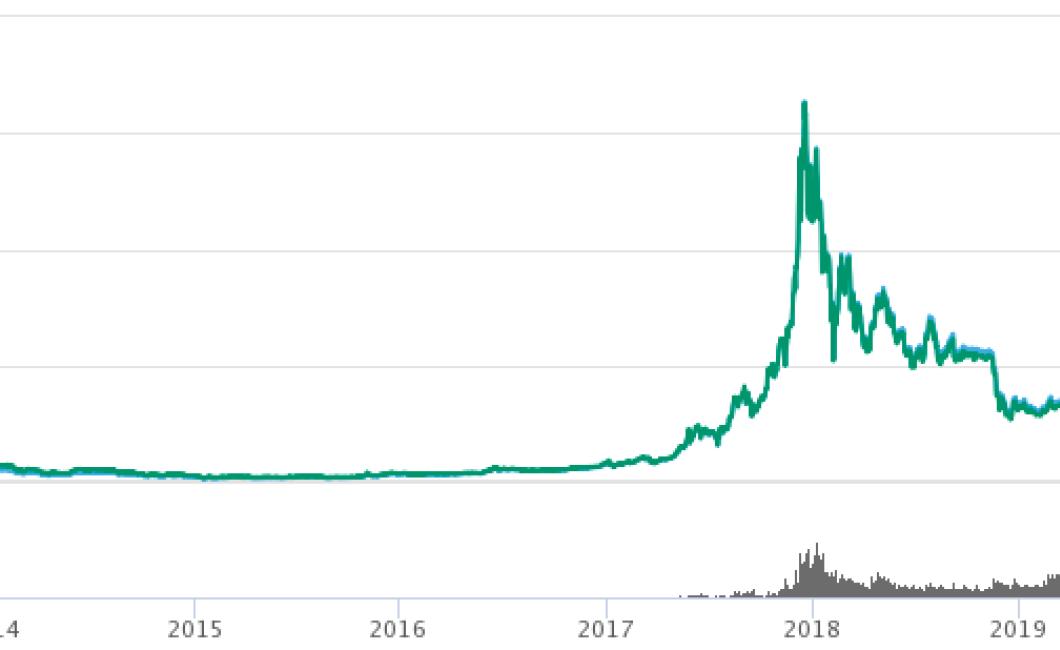

Cryptocurrency futures prices are notoriously volatile, with prices swinging up and down a great deal in response to news and global economic conditions.

As of this writing, the price of bitcoin futures contracts is down about 10% from their all-time high of over $19,000 set just a few weeks ago.

While it’s still early days for the cryptocurrency market, it’s possible that prices will continue to fluctuate in the near future.

If you’re thinking of investing in cryptocurrency futures contracts, it’s important to remember that they’re still very new and highly speculative products.

Bitcoin, Ethereum and Litecoin futures prices – what next?

Bitcoin, Ethereum and Litecoin futures prices are all up today following news that the CME Group plans to launch Bitcoin futures by the end of the year.

This news has sparked a lot of speculation as to what else might be in store for these digital currencies.

Some believe that other exchanges will soon follow suit and offer Bitcoin, Ethereum and Litecoin futures contracts, while others believe that these digital currencies will simply continue to rise in value as investors become more confident in their long-term prospects.

Whatever the case may be, we will continue to monitor these markets closely and provide updates as necessary.

Cryptocurrency futures trading – where to from here?

Cryptocurrency futures trading is a relatively new development and there is still much to learn about them. Here are some things to keep in mind as you continue to explore this exciting frontier:

1. Cryptocurrency futures trading is a relatively new development and there is still much to learn about them.

2. Always exercise caution when trading cryptocurrencies and be sure to do your own research before investing.

3. Remember that cryptocurrency futures trading is still in its infancy and there is a risk of losing your entire investment.

4. Always consult with a financial advisor before making any investment decisions.

How cryptocurrency futures prices are determined.

Cryptocurrency futures prices are determined by the exchange that is trading the contract. The exchange will use a variety of factors to determine the price of the contract, including the current market price of the cryptocurrency, the volume of trade in the contract, and the prevailing interest rates.

The role of cryptocurrency futures in price discovery.

Cryptocurrency futures are an important part of the price discovery process for cryptocurrencies. They allow investors to speculate on the price of a cryptocurrency by buying and selling contracts at a set price in the future. This helps to stabilize the price of a cryptocurrency and provides investors with a way to make informed decisions about whether or not to buy a particular cryptocurrency.

What impact do cryptocurrency futures have on prices?

Cryptocurrency futures are a derivative product that allow investors to bet on the price of a particular cryptocurrency. As such, they have the potential to impact prices in a number of ways. For example, they could lead to increased demand for a cryptocurrency, causing its price to rise, or they could lead to decreased demand for a cryptocurrency, causing its price to fall.

How do cryptocurrency futures affect price discovery?

Futures contracts are designed to limit the risk of price discovery in a market. When buyers and sellers agree to trade at a predetermined price, it eliminates the need for each party to independently determine the fair value of an asset.

Why do cryptocurrency futures matter for investors?

Cryptocurrency futures allow investors to bet on the future price of a cryptocurrency by buying or selling a contract that will expire at a set time in the future. This allows investors to speculate on the future price of a cryptocurrency, rather than investing in the actual cryptocurrency itself.

What you need to know about cryptocurrency futures

Cryptocurrency futures are contracts that allow investors to buy or sell a cryptocurrency at a set price on a future date. They provide a way for cryptocurrency investors to speculate on the future price of a cryptocurrency, without actually having to purchase or hold the cryptocurrency.

Cryptocurrency futures were first introduced in December 2017 by the Chicago Mercantile Exchange (CME), and they have since been offered by other major exchanges.

The main difference between cryptocurrency futures and traditional futures is that cryptocurrency futures are not regulated by the Securities and Exchange Commission (SEC). This means that they may not be subject to the same levels of regulation and oversight as traditional securities.

This has led to concerns about the legitimacy and safety of cryptocurrency futures, especially given the recent history of financial fraud and instability in the cryptocurrency market.

How do cryptocurrency futures work?

Cryptocurrency futures work like any other futures contract. They allow investors to buy or sell a particular cryptocurrency at a set price on a future date.

The main difference is that cryptocurrency futures are not actually backed by any physical cryptocurrency. Instead, they are based on a contract between the investor and the exchange that offers the cryptocurrency futures.

This means that the value of the cryptocurrency futures contract is ultimately based on the value of the underlying cryptocurrency, not on the physical currency itself.

This can lead to volatility in the price of the cryptocurrency futures contract, as the value of the underlying cryptocurrency can change rapidly and unpredictably.

Is cryptocurrency futures safe?

There are concerns about the safety and legitimacy of cryptocurrency futures, given the recent history of financial fraud and instability in the cryptocurrency market.

This is because cryptocurrency futures are not regulated by the SEC, which means that they may not be subject to the same level of regulation and oversight as traditional securities.

This has led to fears that exchanges that offer cryptocurrency futures may be vulnerable to fraud and manipulation.

There have also been reports of investors losing money in cryptocurrency futures contracts, although this is relatively rare.

How to buy cryptocurrency futures

To buy cryptocurrency futures, you will need to sign up with an exchange that offers them. This will usually involve submitting an application and providing your personal information.

Once you have registered with an exchange, you will need to deposit money into your account. This will be used to purchase the cryptocurrency futures contract.

You will then be able to trade the cryptocurrency futures contract on the exchange.