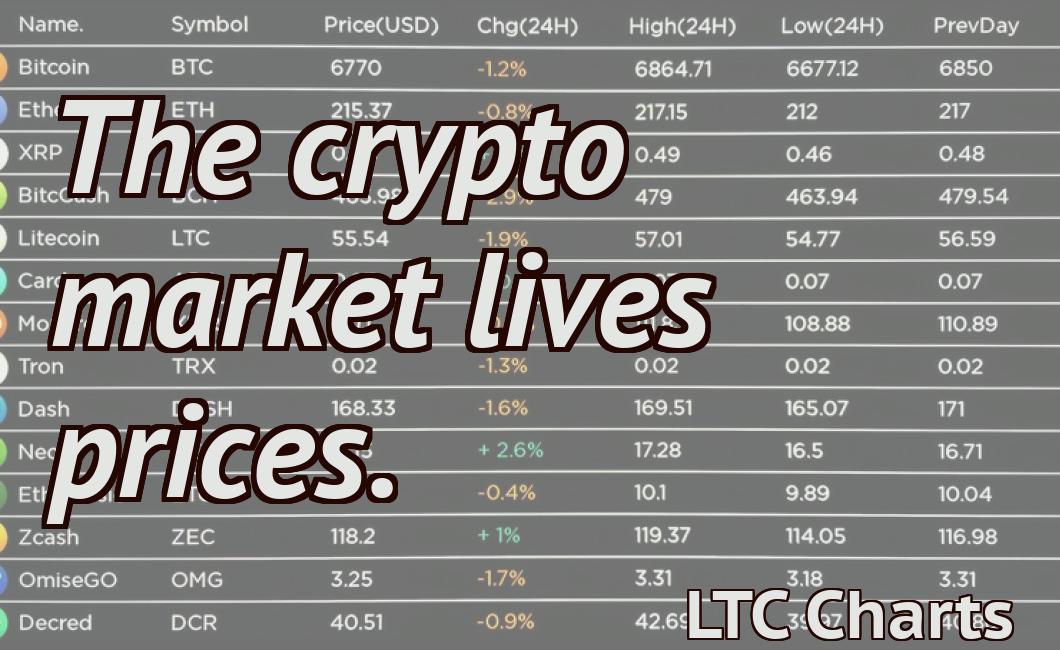

Who controls crypto prices?

Who controls crypto prices? It's a question that has been asked since the dawn of Bitcoin. There is no one answer, as there are many factors that can influence the price of cryptocurrencies. However, there are some key players in the space that can have a significant impact on prices.

Who Really Controls Crypto Prices?

The answer to this question is not as clear-cut as one might think. There are a number of factors that can influence the price of cryptocurrencies, including global market conditions, regulatory changes, and technological advances. While some people believe that the majority of crypto prices are controlled by large institutional investors, there is no clear consensus on who really controls the market.

The Forces Behind Crypto Price movements

Crypto prices are highly volatile and can be influenced by a number of factors. Some of the most common drivers of price movements include:

News and Events

Cryptocurrency market news and events can have a major impact on prices. For example, when a new cryptocurrency is released, its price can rise quickly. Similarly, when there is a significant event in the world of cryptocurrencies, prices can spike.

Economic Factors

Cryptocurrencies are often thought of as a financial instrument, and their prices are affected by global events that have an impact on the economy. For example, when the stock market suffers a dip, cryptocurrencies can also suffer. Conversely, when the stock market is performing well, the value of cryptocurrencies tends to rise as well.

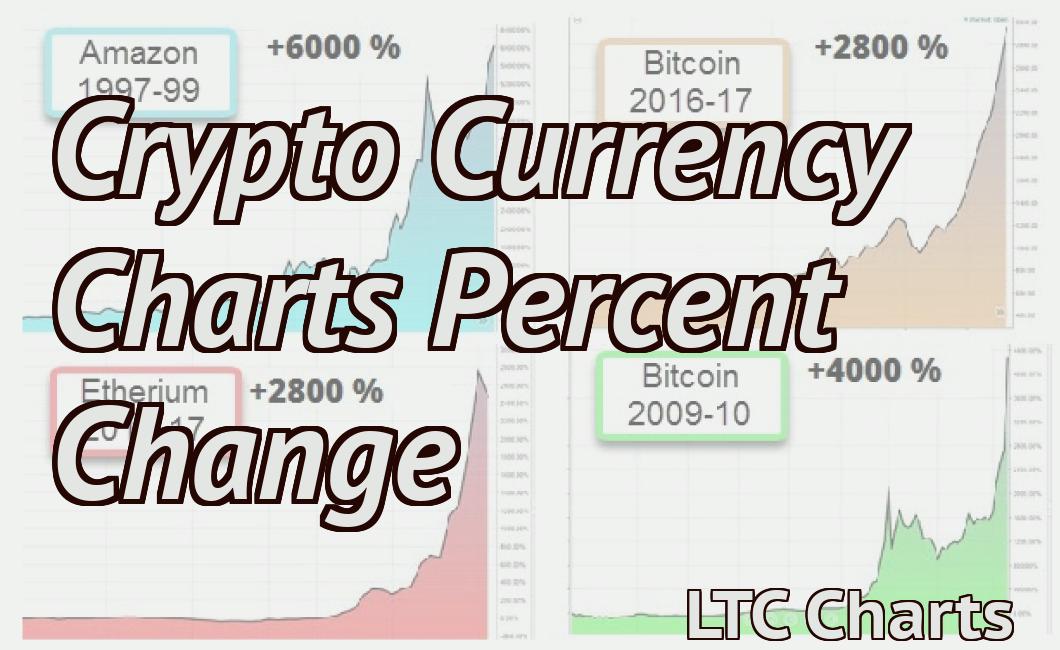

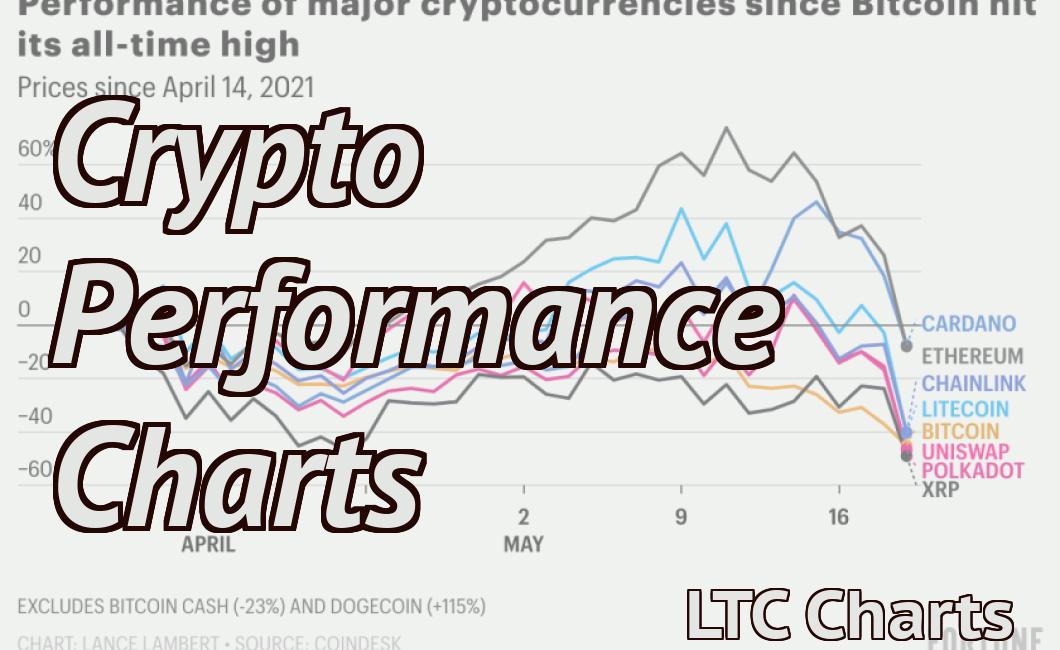

Technical Analysis

Technical analysts look at charts to predict future prices. They study patterns such as support and resistance levels, volume levels, and price action over time to make predictions. When technical analysts believe that prices are headed in a certain direction, they may invest in cryptocurrencies accordingly.

Speculation

Many people invest in cryptocurrencies simply because they believe that their value will increase in the future. This is known as speculation. As long as there is enough demand for cryptocurrencies, their prices will continue to rise. However, if there is a sudden decrease in demand, prices may drop quickly.

The Players That Drive Crypto Prices

Crypto prices are driven by a number of players, including miners, traders, and speculators.

Mining

Mining is the process of verifying and adding new transactions to the blockchain. Miners are rewarded with cryptocurrency for their efforts.

Traders

Traders are responsible for buying and selling cryptocurrencies on exchanges. They use this information to attempt to make money.

Speculators

Speculators are responsible for buying and selling cryptocurrencies in the hope of making a profit.

The Institutions That Influence Crypto Prices

Cryptocurrencies are traded on decentralized exchanges, which are not subject to the same regulatory regimes as traditional exchanges.

Cryptocurrency prices are influenced by a number of factors, including:

News and events related to cryptocurrencies and the blockchain technology that underpins them

Economic indicators, such as interest rates and inflation rates

Technical indicators, such as the performance of leading cryptocurrencies

Community sentiment

The role of institutional investors in the crypto market is still being investigated, but they could play an important role in future growth.

The Actors That Dictate Crypto Prices

Cryptocurrencies are often thought of as a Wild West market, where anything goes. But in reality, the price of cryptocurrencies is largely dictated by a small group of actors.

1. Developers

Cryptocurrencies are built on blockchain technology, which is maintained by a community of developers. As new applications and features are added to cryptocurrencies, the demand for blockchain technology will increase, which will incentivize more developers to continue developing the technology.

2. traders

Traders are responsible for driving the prices of cryptocurrencies up and down. They are constantly looking for opportunities to make money by buying and selling cryptocurrencies.

3. investors

Investors are mainly interested in cryptocurrency prices as a way to make money. They buy cryptocurrencies hoping to sell them at a higher price later on.

4. speculators

Speculators are people who gamble on the price of cryptocurrencies. They believe that the price of a cryptocurrency will go up or down, and so they invest in it hoping to make a profit.

The Groups That Regulate Crypto Prices

There are many groups that regulate crypto prices. Some of these groups are the SEC, CFTC, and FCA.

The SEC

The SEC regulates the securities industry and is responsible for overseeing the trading of stocks, bonds, and other securities. The SEC has been very active in regulating crypto markets. In March of 2018, the SEC issued a report warning investors about the risks of investing in cryptocurrencies and ICOs.

The CFTC

The CFTC is responsible for regulating the commodity markets and is particularly concerned with financial stability. The CFTC has been very active in regulating crypto markets. In December of 2017, the CFTC issued a report warning investors about the risks of investing in cryptocurrencies and ICOs. In March of 2018, the CFTC issued a report warning investors about the risks of investing in cryptocurrencies and ICOs.

The FCA

The FCA is responsible for regulating the banking and financial industries in the UK. The FCA has been very active in regulating crypto markets. In January of 2018, the FCA issued a notice warning investors about the risks of investing in cryptocurrencies and ICOs.

The Mechanisms That Control Crypto Prices

Cryptocurrencies are built on a decentralized network that relies on cryptography to secure transactions and to control the creation of new units. Cryptocurrencies are unique in that they are not regulated by any government or financial institution.

Cryptocurrencies are generated through a process called “mining.” Miners use powerful computers to solve complex mathematical problems in order to earn new units of a cryptocurrency. The first miner to solve the problem is rewarded with newly created cryptocurrency. This process is designed to ensure that new units are constantly being created and distributed throughout the network.

Cryptocurrencies are often traded on decentralized exchanges. These exchanges allow users to buy and sell cryptocurrencies without the need for a bank account or any other form of verification.

Cryptocurrencies are not immune to price fluctuations. The value of a cryptocurrency can rise and fall based on a number of factors including market sentiment, news events, and technical analysis.

The Algorithms That Set Crypto Prices

Cryptocurrency prices are determined by a complex set of algorithms. These algorithms use a variety of inputs, including global market conditions, news events, and investor sentiment.

Some of the most important algorithms used to set cryptocurrency prices are:

The Bitcoin Price Index (BPI)

The BPI is a measure of the average price of Bitcoin during a given period. The BPI is used to set the value of Bitcoin and other cryptocurrencies.

The Ethereum Price Index (EPI)

The EPI is a measure of the average price of Ethereum during a given period. The EPI is used to set the value of Ethereum and other cryptocurrencies.

The Ripple Price Index (XRP)

The XRP Price Index is a measure of the average price of Ripple during a given period. The XRP Price Index is used to set the value of Ripple and other cryptocurrencies.

The Bitcoin Cash Price Index (BCH)

The BCH Price Index is a measure of the average price of Bitcoin Cash during a given period. The BCH Price Index is used to set the value of Bitcoin Cash and other cryptocurrencies.

The Bots That Trade Crypto Prices

There are bots that trade cryptocurrencies, and they do it in a very automated way. These bots follow a set of pre-determined rules, and as a result, they are able to trade cryptocurrencies in a very fast and efficient way.

One of the most popular bots that trades cryptocurrencies is the Crypto Bot. This bot was created by a team of cryptocurrency traders, and it is one of the most advanced bots that is currently available.

The Crypto Bot is able to automatically trade cryptocurrencies in a very fast and efficient way. As a result, it is able to generate huge profits for its users.

Another popular bot that trades cryptocurrencies is the Poloniex Bot. This bot was created by the Poloniex exchange, and it is one of the most advanced bots that is currently available.

The Poloniex Bot is able to automatically trade cryptocurrencies in a very fast and efficient way. As a result, it is able to generate huge profits for its users.

These are just two of the most popular bots that trade cryptocurrencies. There are dozens of other bots that are available, and they all offer different features and advantages. It is important to research which bot is best suited for your needs before you start trading cryptocurrencies.

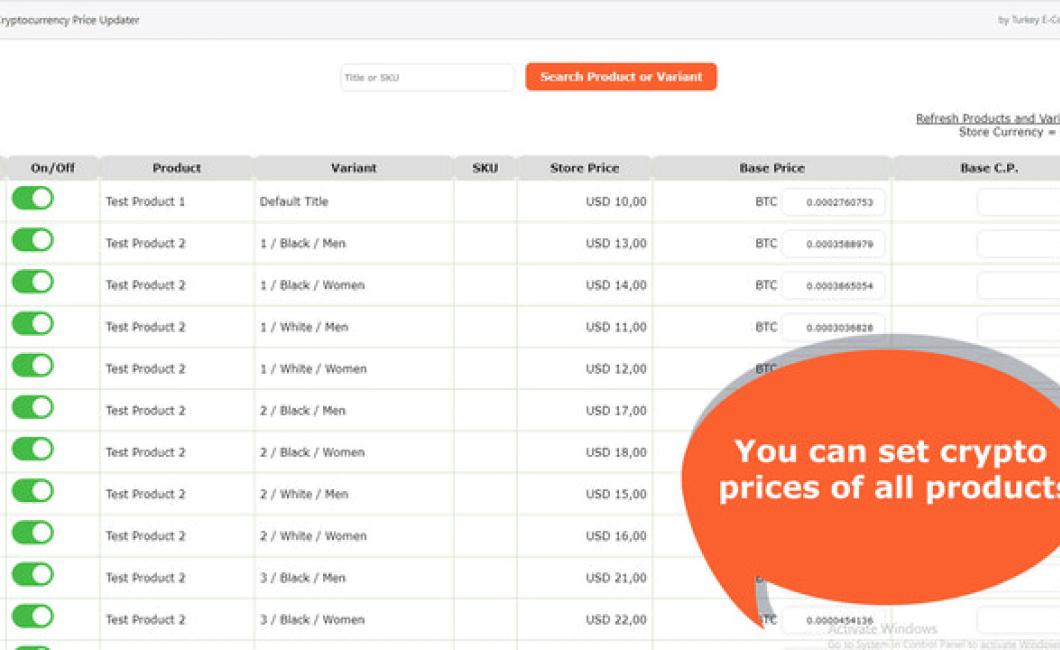

The Exchanges That List Crypto Prices

There are a few different exchanges that list crypto prices. These exchanges generally have a more diverse range of coins and can be more reliable than some of the other exchanges.

Coinbase

Coinbase is one of the most popular exchanges in the world. They offer a variety of cryptocurrencies, as well as a variety of trading options. Coinbase is generally considered to be one of the most reliable exchanges.

Binance

Binance is a relatively new exchange, but has quickly become one of the most popular exchanges in the world. They offer a variety of cryptocurrencies, as well as a variety of trading options. Binance is generally considered to be one of the most reliable exchanges.

Kraken

Kraken is another popular exchange. They offer a variety of cryptocurrencies, as well as a variety of trading options. Kraken is generally considered to be one of the more reliable exchanges.

The Miners That Validate Crypto Prices

Cryptocurrencies are based on a decentralized system where users are not subject to government or financial institution control. Cryptocurrencies are created through a process called mining. Miners are responsible for verifying and confirming transactions in a cryptocurrency network.

Mining is a resource-intensive process that requires a high level of computing power and specialized hardware. Miners are rewarded with cryptocurrency for verifying and confirming transactions. The more miners that participate in a cryptocurrency network, the more secure the network becomes.

Mining is a competitive process, and it is difficult to earn a profit without investing in specialized hardware. However, mining can be profitable if you have the right hardware and are willing to invest in equipment and software.

The Developers That Build Crypto Prices

Crypto prices are driven by a number of factors, including technological innovation, global political and economic conditions, and the behavior of large financial institutions.

Crypto Prices Are Driven by Innovation

Cryptocurrencies are built on a decentralized platform, which allows for a more secure and reliable transaction system. This technological innovation has led to increased interest from investors and developers, which in turn has driven up the prices of cryptocurrencies.

Cryptocurrencies Are Driven by Global Political and Economic Conditions

Global political and economic conditions can have a significant impact on the price of cryptocurrencies. For example, when the US Federal Reserve raises interest rates, this can lead to a decrease in the value of cryptocurrencies, as investors move their money into more stable investments. Similarly, geopolitical events such as the Brexit vote or the Syrian Civil War can have a significant impact on the value of cryptocurrencies.

Crypto Prices Are Driven by the Behavior of Large Financial Institutions

Large financial institutions are often responsible for driving the prices of commodities, such as gold and silver. Cryptocurrencies are no different, as they are often traded on exchanges controlled by large financial institutions. When large financial institutions start to invest in cryptocurrencies, this can drive up the price of cryptocurrencies.