Crypto Performance Charts

This article provides crypto performance charts for major cryptocurrencies including Bitcoin, Ethereum, Litecoin, and more. The charts track price movements, volume, market capitalization, and other data over time.

How to read crypto performance charts

Cryptocurrency performance charts are a valuable tool for understanding the performance of a cryptocurrency over time. To read a cryptocurrency performance chart, you first need to understand what the chart is measuring.

Cryptocurrency performance charts usually measure the total value of a cryptocurrency over a period of time, or the change in value of a cryptocurrency over a period of time.

The most important crypto performance indicators

Cryptocurrency prices are determined by a number of factors including supply and demand, global economic conditions, and news events. However, some of the most important performance indicators for cryptocurrencies include:

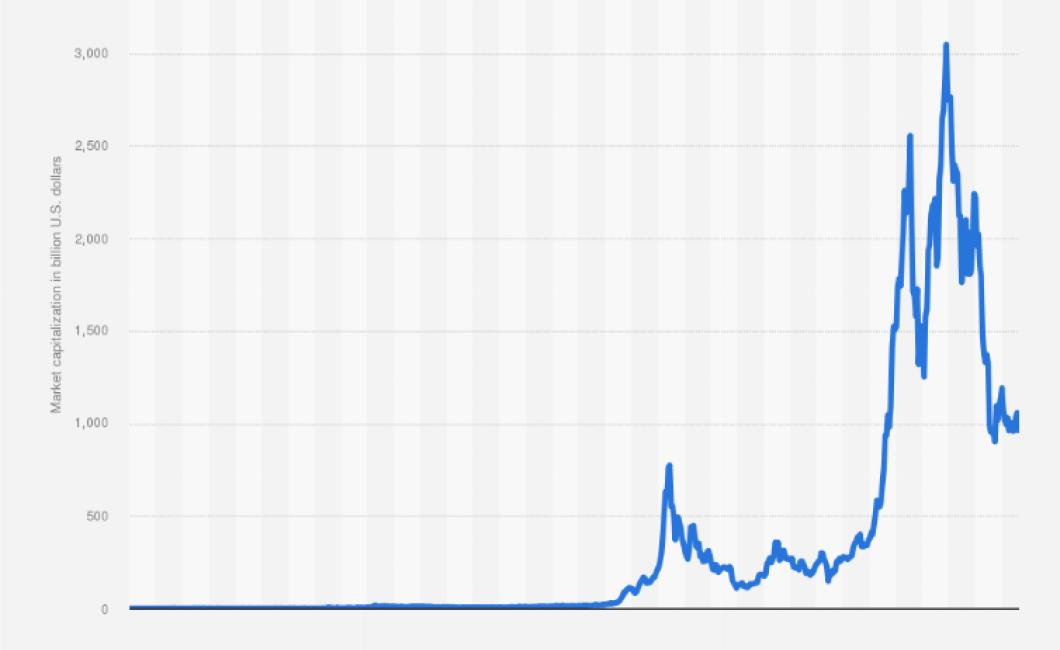

1) Market capitalization: This is the total value of all cryptocurrency tokens in circulation.

2) Volume: This is the number of cryptocurrency transactions made over a specific period of time.

3) Price volatility: This measures how much the price of a cryptocurrency changes over a given period of time.

Top 5 crypto performers of the week

1. Bitcoin – Up 2.5%

2. Ethereum – Up 7%

3. Bitcoin Cash – Up 10%

4. Litecoin – Up 3%

5. EOS – Up 8%

Bottom 5 cryptos of the week

1. Bitcoin (BTC)

2. Ethereum (ETH)

3. Ripple (XRP)

4. Litecoin (LTC)

5. Bitcoin Cash (BCH)

How to interpret crypto performance charts

When looking at crypto performance charts, it is important to understand what each column represents. The leftmost column is the time period, and the rightmost column is the value of the cryptocurrency.

The middle two columns are the percentage change from the previous time period and the average percent change from the previous time period.

The last two columns are the total value of all cryptocurrencies in that time period and the total value of all cryptocurrencies in all time periods.

The difference between good and bad crypto charts

Cryptocurrencies are notoriously volatile, meaning prices can go up and down a great deal. So, while one crypto chart may look good at one point, it may not look so good a few hours or days later.

Good crypto charts are designed to give you a clear overview of how the market is performing. They typically show the total value of all cryptocurrencies in circulation, as well as the price of each individual coin.

Bad crypto charts may show just one or two coins, or they may not show any prices at all. This can make it difficult to see how the market is performing overall.

How to make money from analyzing crypto charts

There are a number of ways to make money from analyzing crypto charts.

One way is to provide analysis and commentary on crypto charts for a fee.

Another way is to find profitable trades in the crypto markets and share those trades with clients.

And finally, some people make money by creating and selling cryptocurrency related products and services.

The most common mistakes people make when reading crypto charts

There are a few common mistakes people make when reading crypto charts. The first is underestimating the volatility of cryptocurrencies. While some coins may have more consistent growth, others can be much more volatile. This means that even if a coin is growing steadily, it could fall in value at any time.

Another mistake is focusing too much on one specific metric. While it can be helpful to track a coin’s price and volume, it’s important to remember that other factors can also impact a coin’s performance. For example, a coin that has received a lot of media coverage may be more likely to experience spikes in price. However, this attention may not be warranted and the coin may eventually fall in value.

Finally, it’s important to remember that crypto charts are not always accurate. Cryptocurrencies are still in their early stages and there are a lot of new developments happening every day. This means that some of the data shown on a chart may be inaccurate or outdated.

3 things you didn't know about crypto performance charts

1. Crypto performance charts are often used to predict future prices.

2. Crypto performance charts can be used to identify trends and patterns.

3. Crypto performance charts can be used to predict future prices and help traders make informed decisions.

How to use crypto performance charts to your advantage

Crypto performance charts can help investors and traders make informed decisions about which cryptos to invest in. By analyzing the historical performance of different cryptos, you can identify which ones are performing the best.

Here are some tips on how to use crypto performance charts:

1. Compare the performance of different cryptos over different time periods.

2. Compare the performance of different cryptos against each other.

3. Compare the performance of different cryptos against the overall market.

4. Use crypto performance charts to help make investment decisions.

The ultimate guide to reading crypto performance charts

So you’re curious about crypto performance charts and want to learn how to read them? Here’s everything you need to know!

First, it’s important to understand that crypto performance charts are simply a way of showing how a cryptocurrency is performing over time. They typically show the price (in USD or another currency) of a cryptocurrency over a specific period of time, and can be used to give an overview of a cryptocurrency’s performance.

Second, it’s important to understand that crypto performance charts are not always accurate. This is because they are based on24/7 market data, and as market conditions change (for example, if there is a major news event), this can affect the value of a cryptocurrency.

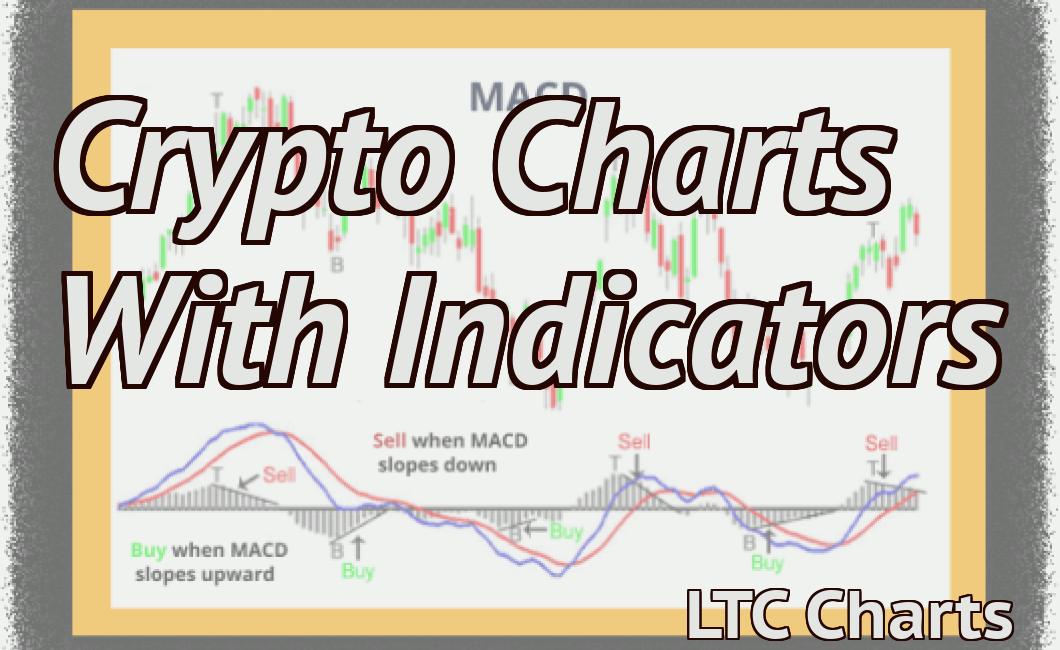

Third, it’s important to understand the different types of crypto performance charts. There are three main types of crypto performance charts:

1. Volume-based charts show how much a cryptocurrency has been traded over a given period of time.

2. Prices-based charts show the price of a cryptocurrency over a given period of time.

3. Weighted average prices (WAP) charts show the average price of a cryptocurrency over a given period of time, based on the volume of that cryptocurrency.

Fourth, it’s important to understand how to read crypto performance charts. The most important thing to note is that crypto performance charts are not always accurate, so it’s important to use them with caution. To get the most accurate information, you should also look at other factors (such as news events) that may have affected the value of a cryptocurrency.

Finally, it’s important to remember that crypto performance charts are just one tool that you can use to track the performance of a cryptocurrency. You should also consider other factors, such as the market conditions and the overall trend of the cryptocurrency.