Crypto Charts Pattern Recognition

This article discusses the process of recognizing patterns in crypto charts in order to make better trading decisions. It explains how to identify different types of patterns and how to assess their potential significance.

How to Read Crypto Charts for Beginners

Cryptocurrency charts are a great way to learn about the market and understand which coins are performing well.

The first step is to find a reputable cryptocurrency charting website. There are a few good options out there, including CoinMarketCap and Coindesk.

Once you've found a website, open it up in a new tab and click on the "Charts" link at the top of the page.

The first thing you'll want to do is find a coin or token you're interested in. This can be done by clicking on the "Select Market" button and selecting the relevant cryptocurrency from the list.

After you've selected your coin, you'll need to find a chart that shows its performance. To do this, click on the "Historical Data" button and select the date range you're interested in.

You'll next need to find a chart that shows the price of your chosen coin over that time period. To do this, click on the "Price" button and select the relevant date.

After you've selected your chart and data, you'll need to analyze it. This can be done by looking at the vertical axis (which shows the price) and the horizontal axis (which shows the time).

You'll also want to look at the colors of the bars on the chart to see how well the coin is performing. Green bars indicate that the price is increasing, while red bars indicate that the price is decreasing.

Finally, you can use the "Frequency" button to see how often the coin has been traded over the selected time period. This will give you an idea of how popular it is.

The Different Types of Crypto Chart Patterns

The different types of crypto chart patterns are:

1. Head and Shoulders

2. Double Top

3. Triangle

4. Hammer

5. Cup and Handle

6. Averaging Down

7. Averaging Up

How to Use Pattern Recognition to Trade Cryptocurrencies

Pattern recognition is a popular technique that can be used to trade cryptocurrencies.

To use pattern recognition, you first need to gather data about the cryptocurrency market. This data can come from a variety of sources, including news articles, exchanges, and social media.

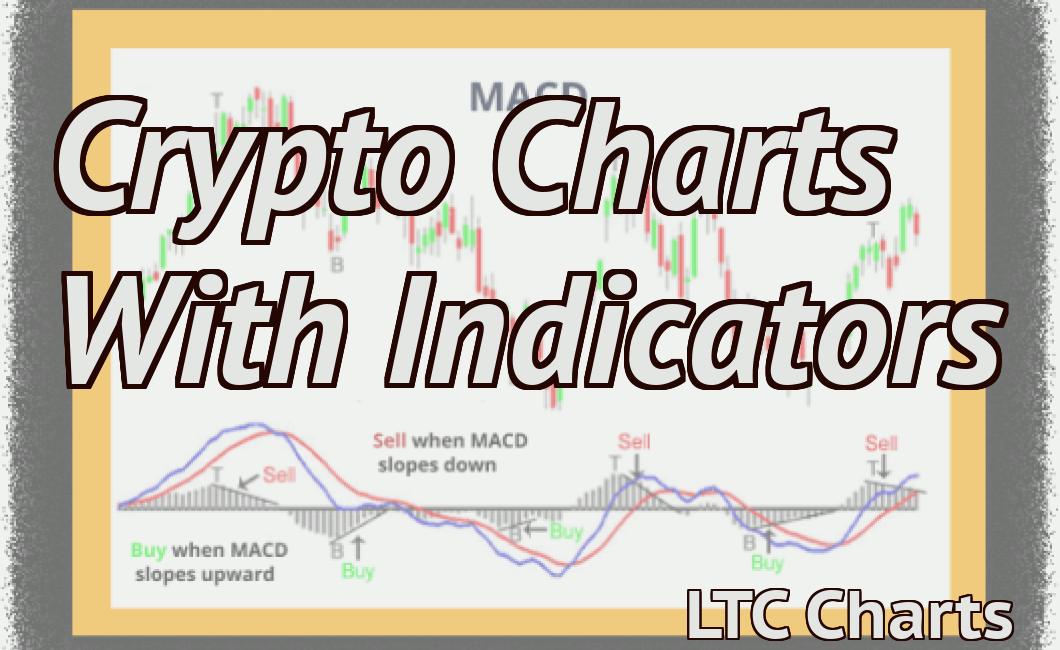

Once you have this data, you can start to look for patterns. These patterns could be specific price movements, news events, or any other indicators that might indicate a change in the market.

Once you have identified a pattern, you can use that information to make trading decisions. For example, if you see that the cryptocurrency market is starting to trend upward, you might want to buy into the market. Alternatively, if you see that the market is starting to decline, you might want to sell off your holdings.

Using pattern recognition to trade cryptocurrencies is a powerful tool that can help you make profitable trading decisions. If you are new to the cryptocurrency market, it is worth investing in some quality data-gathering tools so that you can start to identify patterns early on.

3 Most Common Crypto Chart Patterns & How to Trade Them

1. Head and Shoulders

When the price of a cryptocurrency rises sharply and then falls, it is often followed by a head and shoulders pattern. The price will rise until it hits the neckline, or upper boundary of the head, and then fall sharply and break below the shoulder line, or lower boundary of the head.

The trader who spots the pattern can buy the cryptocurrency at the neckline and sell it at the shoulder line, making a gain of up to 50%. However, it is important to note that this pattern is not always reliable and can be reversed at any time. So it is best to sell before the price falls below the shoulder line and wait for it to rebound before buying again.

2. Double Bottom

A double bottom is a rare but powerful pattern that indicates that the price of a cryptocurrency is about to increase. The price will drop sharply two times, and then rebound sharply each time.

The trader who spots the pattern can buy the cryptocurrency at the bottom of the first dip and sell it at the bottom of the second dip, making a gain of up to 100%. However, it is important to note that this pattern is not always reliable and can be reversed at any time. So it is best to sell before the price rebounds and wait for it to increase before buying again.

3. Head andshoulders reversal

If the price of a cryptocurrency rises sharply and then falls, it is often followed by a head and shoulders pattern. The price will rise until it hits the neckline, or upper boundary of the head, and then fall sharply and break below the shoulder line, or lower boundary of the head.

However, if the price of the cryptocurrency continues to rise even after the head and shoulders pattern has been completed, it is likely that a reversal has occurred and the price is now heading down. In this case, the trader should sell before the price falls below the shoulder line and wait for it to rebound before buying again.

The Ultimate Guide to Crypto Chart Patterns

Cryptocurrencies are a new and rapidly growing market. As such, there is still much to learn about this exciting new investment opportunity. This guide will help you identify and capitalize on crypto chart patterns.

Before we get started, it’s important to note that not all cryptocurrencies are created equal. Some, like Bitcoin, are considered “digital gold.” Others, like Ethereum, are more complex and offer a wider range of features and applications.

Cryptocurrencies are built on blockchain technology, which allows for secure, transparent and tamper-proof transactions. Cryptocurrencies are also decentralized, meaning they are not subject to government or financial institution control.

Chart patterns are a useful way to identify trends in the cryptocurrency market. They can help you make informed decisions about which cryptocurrencies to invest in and when to sell.

Here are four basic types of crypto chart patterns:

1. Head-and-shoulders

A head-and-shoulders pattern is a reversal of the trend in price. It consists of two peaks, with the second peak higher than the first. The pattern is named after the two peaks on a traditional stock chart.

2. Double bottom

A double bottom is a reversal of the trend in price that forms when the price falls below the lower boundary of the previous price peak and then rises above the upper boundary of the previous price peak.

3. Pitchfork

A pitchfork pattern is a reversal of the trend in price that forms when the price falls below the lower boundary of the previous price peak and then rises above the upper boundary of the previous price peak. The pitchfork pattern is named after the shape of the two peaks on a traditional stock chart.

4. Flag

A flag pattern is a reversal of the trend in price that forms when the price falls below the lower boundary of the previous price peak and then rises above the upper boundary of the previous price peak. The flag pattern is named after the four straight lines that form on a traditional stock chart.

How to Recognize Reversal & Continuation Patterns in Crypto Charts

In order to identify reversal and continuation patterns in crypto charts, you will need to first understand how crypto charts are constructed. Crypto charts are composed of two main components: the price axis and the volume axis.

The price axis shows the current price of a crypto asset, while the volume axis shows the amount of transactions that have taken place over a certain period of time. The two axes can be used to identify reversal and continuation patterns.

Reversal Patterns

A reversal pattern is a type of pattern that indicates that a cryptocurrency is heading in the opposite direction of its trend. Reversal patterns can be identified by looking for a sudden decrease in the price of a cryptocurrency followed by a sudden increase.

Continuation Patterns

A continuation pattern is a type of pattern that indicates that a cryptocurrency is continuing in the same direction as its trend. Continuation patterns can be identified by looking for a gradual decrease in the price of a cryptocurrency followed by a gradual increase.

Trading Cryptocurrencies with Pattern Recognition

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Trading cryptocurrencies with pattern recognition can help you make informed decisions about which cryptocurrencies to buy and sell.

To use pattern recognition in your cryptocurrency trading, first identify the following patterns:

1. Patterns of Bull and Bear Markets

When you see a cryptocurrency trading in a bull market, this means that the price of the cryptocurrency is rising. When you see a cryptocurrency trading in a bear market, this means that the price of the cryptocurrency is falling.

2. Patterns of Volume

When you see a large volume of trading activity in a cryptocurrency, this usually indicates that the price of the cryptocurrency is rising. When you see a small volume of trading activity in a cryptocurrency, this usually indicates that the price of the cryptocurrency is falling.

3. Patterns of Trends

When you see a cryptocurrency trending upwards, this usually indicates that the price of the cryptocurrency is rising. When you see a cryptocurrency trending downwards, this usually indicates that the price of the cryptocurrency is falling.

3 Essential Tips for Recognizing Patterns in Crypto Charts

1. Look for patterns in the data.

Cryptocurrencies are decentralized, meaning there is no one central authority that controls the supply of coins. This makes it hard to identify any patterns in the data. However, there are certain things to look for in order to identify trends.

One way to look for trends is to analyze how often a cryptocurrency is traded on different exchanges. Over time, you may be able to see whether a particular cryptocurrency is gaining or losing popularity on different exchanges.

2. Compare prices across different exchanges.

Another way to look for trends in the data is to compare prices across different exchanges. This will help you to identify which exchanges are trading a cryptocurrency more than others.

3. Compare volume across different exchanges.

Finally, another way to look for trends in the data is to compare volume across different exchanges. This will help you to identify which cryptocurrencies are being traded more than others.

Using Pattern Recognition to Find the Next Big Crypto Winner

Cryptocurrencies are a new and rapidly growing market. In order to make money in this market, it is important to be able to recognize the next big cryptocurrency winner.

One way to do this is to use pattern recognition techniques. This can help you identify the characteristics of a successful cryptocurrency.

For example, you could look for cryptocurrencies that are being traded on major exchanges. These cryptocurrencies are likely to be more successful than those that are not.

You could also look for cryptocurrencies that are growing rapidly in value. These are likely to be more successful than those that are not.

Finally, you could look for cryptocurrencies that have unique features that make them stand out from the rest. These features might make them more successful than other cryptocurrencies.