Different Prices On Different Crypto Exchanges

Different cryptocurrency exchanges offer different prices for the same digital assets. This is because each exchange has a different supply and demand for certain assets. Some exchanges might have more buyers than sellers, while others might have more sellers than buyers. The price of an asset on an exchange is usually determined by the amount of people trading it.

Why do different crypto exchanges charge different prices for Bitcoin?

Cryptocurrency exchanges charge different prices for Bitcoin because of the different costs associated with buying, selling, and storing the digital asset. Some exchanges charge a higher price for Bitcoin because of the increased costs associated with operating a platform that allows users to buy and sell the cryptocurrency. Other exchanges charge a lower price for Bitcoin because they do not charge fees for buying or selling the cryptocurrency.

How do I find the best price for Bitcoin on a specific exchange?

There is no one definitive answer to this question. Each exchange has its own pricing mechanisms, and the best way to find the best price for Bitcoin on a specific exchange depends on the specific exchange. Some exchanges offer live consultations with customer service representatives who can help you find the best price for Bitcoin on that exchange.

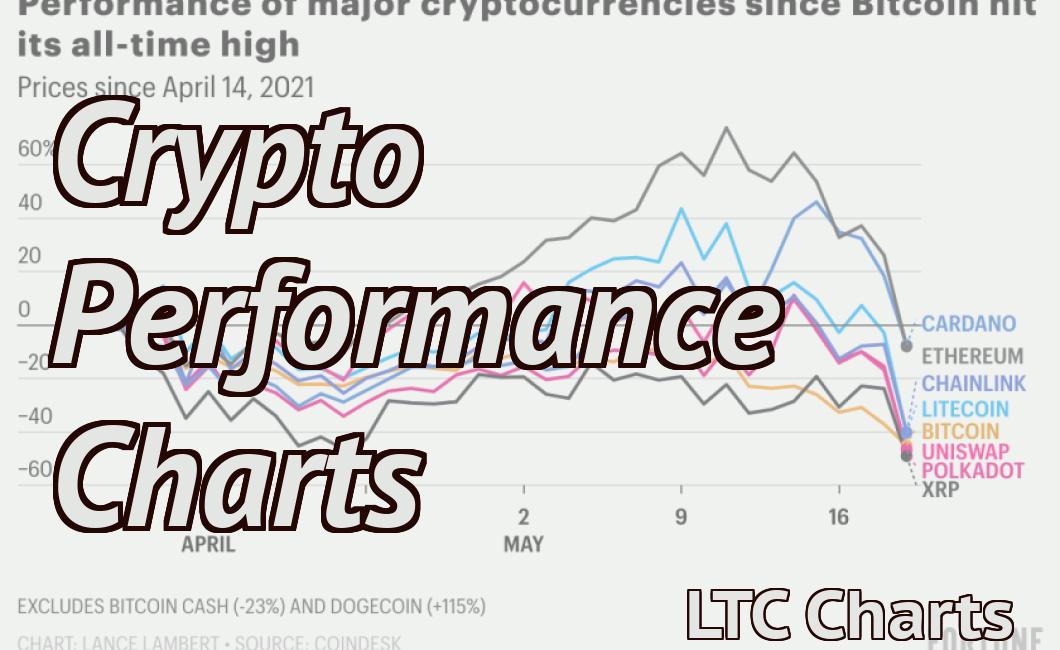

Why is the price of Bitcoin different on different exchanges?

The price of Bitcoin can be different on different exchanges for a number of reasons. Some exchanges may have a higher volume of trades, meaning that they may have more liquidity and therefore a higher price. Other exchanges may have a higher buy or sell limit for Bitcoin, meaning that they may not be able to sell or buy as much Bitcoin as another exchange. Additionally, some exchanges may charge more for Bitcoin than others.

How do exchange rates for Bitcoin differ between exchanges?

Bitcoin exchanges differ in terms of their exchange rates. Some exchanges offer a higher exchange rate than others.

What factors influence the price of Bitcoin on different exchanges?

The price of Bitcoin on different exchanges is influenced by a variety of factors, including demand from buyers and sellers, available supply, and global economic conditions.

How do I get the best value when buying or selling Bitcoin on an exchange?

The best way to get the best value for your Bitcoin is to find an exchange that has a high volume of transactions. The higher the volume, the more likely you are to get a good price for your Bitcoin.

What should I be aware of when trading Bitcoin on different exchanges?

Bitcoin trading on different exchanges can be a risky investment. Make sure you understand the risks involved before you start trading.

Some common risks include:

1. The exchange may not be licensed or regulated by the appropriate financial authorities. This could lead to the exchange being shut down, resulting in your losses.

2. The exchange may be subject to fraud or cybercrime. This could lead to your funds being stolen or lost forever.

3. The exchange may be less reliable than other exchanges. This could lead to you losing money when the price of Bitcoin falls.

4. The exchange may be subject to technical issues that prevent you from trading. This could lead to you losing money when the price of Bitcoin rises.

Is it worth using multiple exchanges to get the best price for Bitcoin?

There is no definite answer because it depends on your individual circumstances. Some people may find it more advantageous to use several different exchanges to get the best price for Bitcoin, while others may find it more convenient to use a single exchange. Ultimately, it is up to the individual to decide what is best for them.