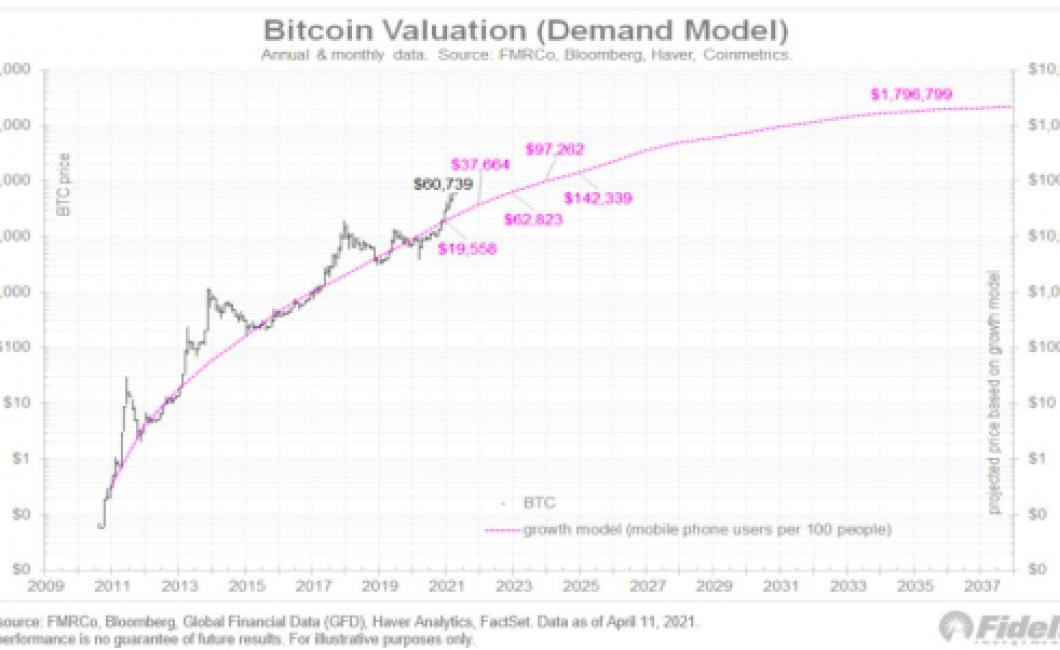

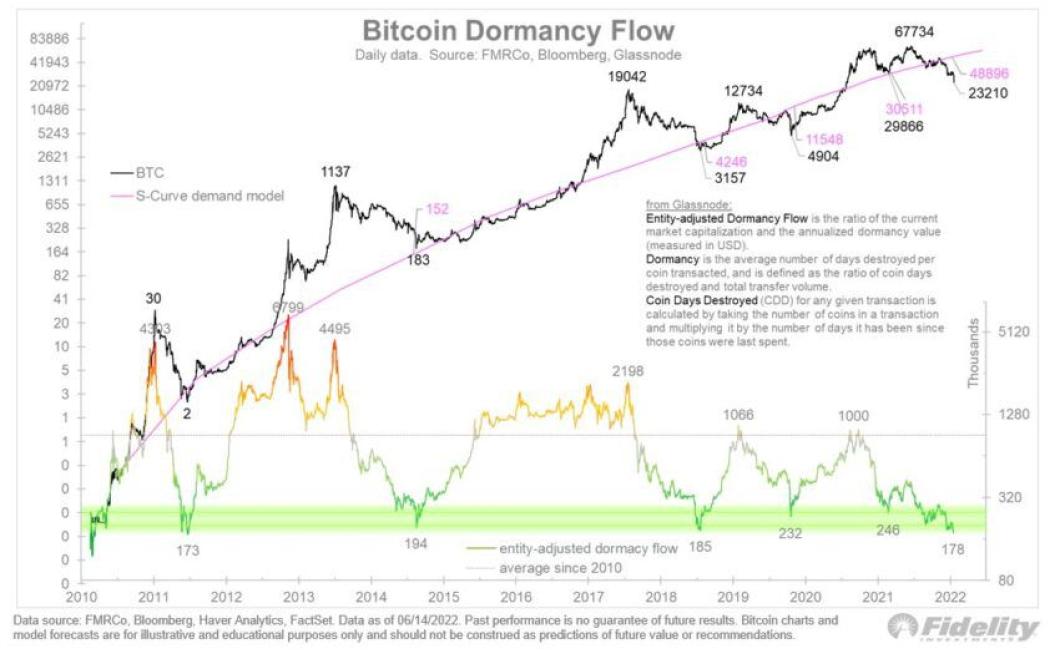

Fidelity crypto charts

Fidelity Investments has launched a new tool that allows customers to track their cryptocurrency holdings. The tool, called Fidelity Crypto Charts, provides users with an overview of their portfolio and performance, as well as market data for major cryptocurrencies. The launch comes as Fidelity prepares to launch its own digital asset exchange later this year.

fyidality crypto charts: The Future of Currency

In the world of crypto, there is a lot of speculation and excitement around new coins and tokens. But what is really going to be the future of currency?

There are a few different ways that crypto could go in the future. One is that cryptocurrencies could become more widespread and accepted as a form of payment. This would likely lead to increased prices and adoption of these coins and tokens.

Another possibility is that government regulations could crackdown on cryptocurrencies, making them less popular and valuable. This would likely lead to a decrease in prices and adoption.

It's hard to say which scenario will happen, but it's exciting to watch the development of the cryptocurrency market!

fyidality crypto charts: A New Way to Invest

There is a new way to invest in cryptocurrencies and it is called fidality. Fidality is a new investment platform that uses blockchain technology to create a trustless system for investing.

Fidality is a new platform that uses blockchain technology to create a trustless system for investing. The fidality platform allows users to invest in cryptocurrencies and other assets.

The fidality platform allows users to invest in cryptocurrencies and other assets. The fidality platform also allows users to buy and sell fidal tokens.

The fidality platform also allows users to buy and sell fidal tokens. Fidality also offers a loyalty rewards program for customers.

Fidality also offers a loyalty rewards program for customers. The fidality platform has a three-tier structure. The first tier is for investors who want to buy fidal tokens. The second tier is for investors who want to sell fidal tokens. The third tier is for companies who want to use the fidality platform to raise funds.

The fidality platform has a three-tier structure. The first tier is for investors who want to buy fidal tokens. The second tier is for investors who want to sell fidal tokens. The third tier is for companies who want to use the fidality platform to raise funds. The fidality platform is currently in beta testing.

The fidality platform is currently in beta testing. The fidality platform has not yet released any information about its fees or how it works.

The fidality platform has not yet released any information about its fees or how it works. The fidality platform is based in Switzerland.

fyidality crypto charts: The Pros and Cons

The main benefits of using fidality crypto charts are that they can provide an accurate overview of a coin’s overall performance, and they can help you make informed decisions about investing in a particular coin.

However, there are also some potential drawbacks to using fidality crypto charts. For example, they can be time-consuming to create and maintain, and they may not be as widely available as other types of crypto charts. Additionally, fidality crypto charts may not be as useful if you are looking for information about specific coins or ICOs.

fyidality crypto charts: How to Get Started

There is no one-size-fits-all answer to this question, as the best way to get started with cryptocurrency trading may vary depending on your experience and preferences. However, some tips on how to get started with crypto trading include reading up on cryptocurrency exchanges and platforms, finding a reliable broker, and setting up a secure wallet.

fyidality crypto charts: What You Need to Know

There are a number of different crypto charts that can be useful in assessing the ebullience or bearishness of a given cryptocurrency.

The most popular crypto charts are the 24-hour and 7-day charts. The 24-hour chart shows the price movement over the past day, while the 7-day chart shows the price movement over the past 7 days.

Other popular crypto charts include the monthly and yearly charts. The monthly chart shows the price movement over the past month, while the yearly chart shows the price movement over the past year.

Other crypto charts that may be useful in analyzing a cryptocurrency include the volume and supply charts. The volume chart shows the amount of cryptocurrency traded over the past 24 hours, while the supply chart shows the total number of cryptocurrency tokens in circulation.

fyidality crypto charts: The Benefits of Crypto Currency

Cryptocurrency is an innovative way of conducting transactions that uses cryptography to secure the information. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are also anonymous, meaning that users’ identities are not verified.

There are a number of benefits to using cryptocurrency, including:

-Transparency: Cryptocurrencies are transparent, meaning that everyone can see how many coins are being traded and which wallets are involved.

-Security and anonymity: Cryptocurrencies are secure and anonymous, making them ideal for transactions that require privacy.

-Lower transaction fees: Cryptocurrencies have lower transaction fees than traditional payment methods.

-Ease of use: Cryptocurrencies are easy to use, making them popular among those who want to avoid traditional banking institutions.

-Global acceptance: Cryptocurrencies are accepted by a wide range of businesses and individuals worldwide, making them a viable option for global transactions.

fyidality crypto charts: The Risks of Crypto Currency

The risks associated with investing in cryptocurrencies are numerous and varied. Below we’ll explore some of the most common risks, as well as how to mitigate them.

1. Lack of regulation

Cryptocurrencies are not subject to the same regulation as traditional financial assets, meaning there is a greater risk of fraud and theft. This lack of oversight has led to a number of high-profile cryptocurrency scams, such as the $460 million Ponzi scheme Bitconnect.

2. Volatility

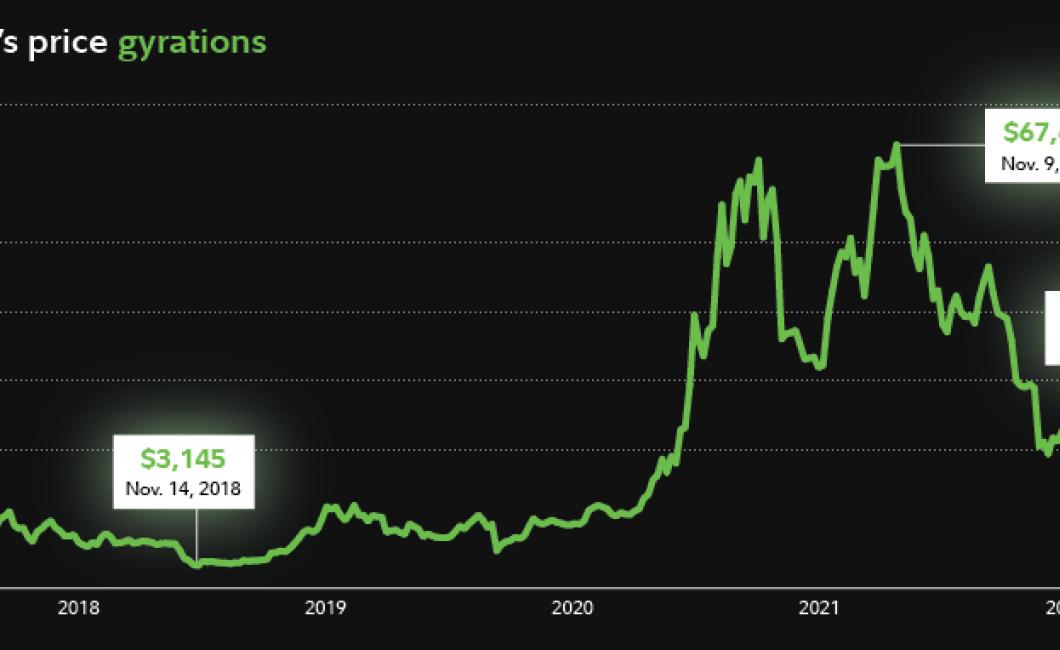

Cryptocurrencies are highly volatile, meaning their prices can change rapidly. This volatility makes it difficult for investors to make long-term investments in cryptocurrencies, and it can be difficult to predict how prices will trend.

3. Bitcoin and other cryptocurrencies are not backed by any real assets

Bitcoin and other cryptocurrencies are not backed by any real assets, meaning they are not immune to market crashes. In fact, Bitcoin has experienced several major price crashes over the past few years.

4. Cryptocurrency prices are highly volatile

Cryptocurrency prices are highly volatile, meaning they can be incredibly volatile and unpredictable. This unpredictability can make it difficult for investors to make long-term investments in cryptocurrencies.

5. Cryptocurrencies are not legal tender

Cryptocurrencies are not legal tender, meaning they cannot be used to purchase goods and services. This means that cryptocurrencies cannot be used as a form of currency.

6. Cryptocurrencies are not insured

Cryptocurrencies are not insured, meaning there is no government or financial institution that guarantees their value. This means that if you lose all your cryptocurrencies, you will have no recourse.

7. Cryptocurrencies are not backed by anything

Cryptocurrencies are not backed by anything, meaning they have no intrinsic value. This means that cryptocurrencies can be volatile and risky, and their value may be subject to market speculation.

8. Cryptocurrencies are not immune to cyberattacks

Cryptocurrencies are not immune to cyberattacks, meaning hackers can potentially steal your coins. This can lead to financial losses, and could also damage your reputations if your coins are associated with a high-profile cryptocurrency scam.

9. Cryptocurrencies are not FDIC-insured

Cryptocurrencies are not FDIC-insured, meaning you cannot rely on the Federal Deposit Insurance Corporation (FDIC) to protect your money if something happens to your cryptocurrency holdings.

10. Cryptocurrencies are not backed by anything tangible

Cryptocurrencies are not backed by anything tangible, meaning their value is entirely dependent on the faith of the community in that particular cryptocurrency. This means that cryptocurrencies may be less stable than traditional financial assets, and their value may be subject to market speculation.

fyidality crypto charts: The Top 10 Coins

Bitcoin (BTC)

Ethereum (ETH)

Bitcoin Cash (BCH)

Litecoin (LTC)

EOS (EOS)

Ripple (XRP)

Cardano (ADA)

NEO (NEO)

Stellar (XLM)

fyidality crypto charts: The Bottom 10 Coins

1. Bitcoin (BTC)

2. Ethereum (ETH)

3. Bitcoin Cash (BCH)

4. Litecoin (LTC)

5. Ripple (XRP)

6. EOS (EOS)

7. Cardano (ADA)

8. IOTA (MIOTA)

9. TRON (TRX)

10. Binance Coin (BNB)

fyidality crypto charts: How to Choose the Right Coin

Cryptocurrencies are a new form of currency that relies on cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

fyidality crypto chart

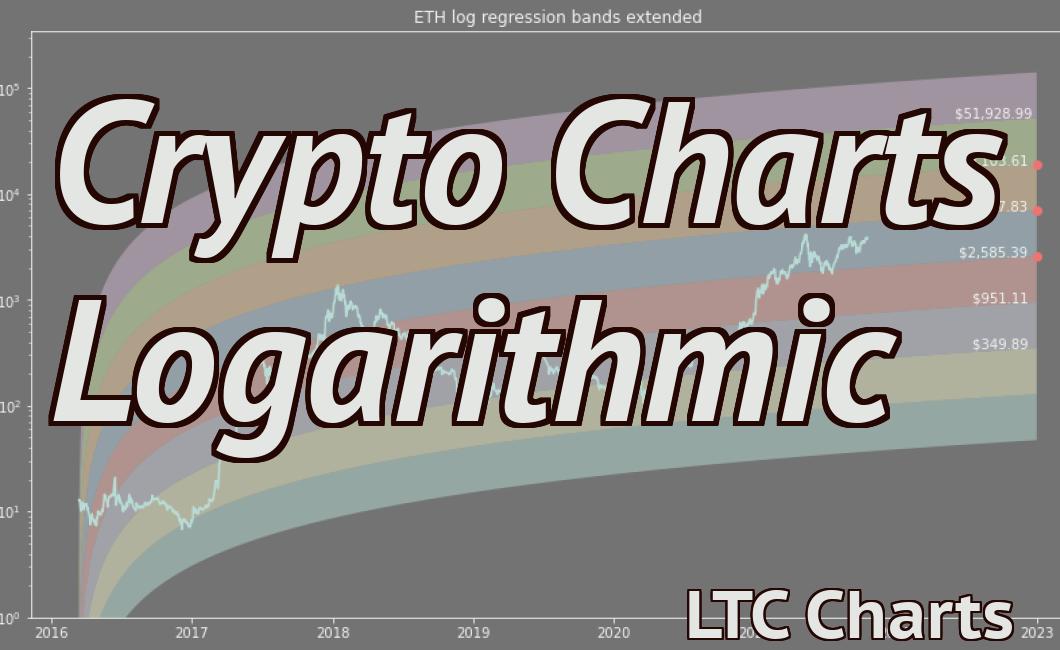

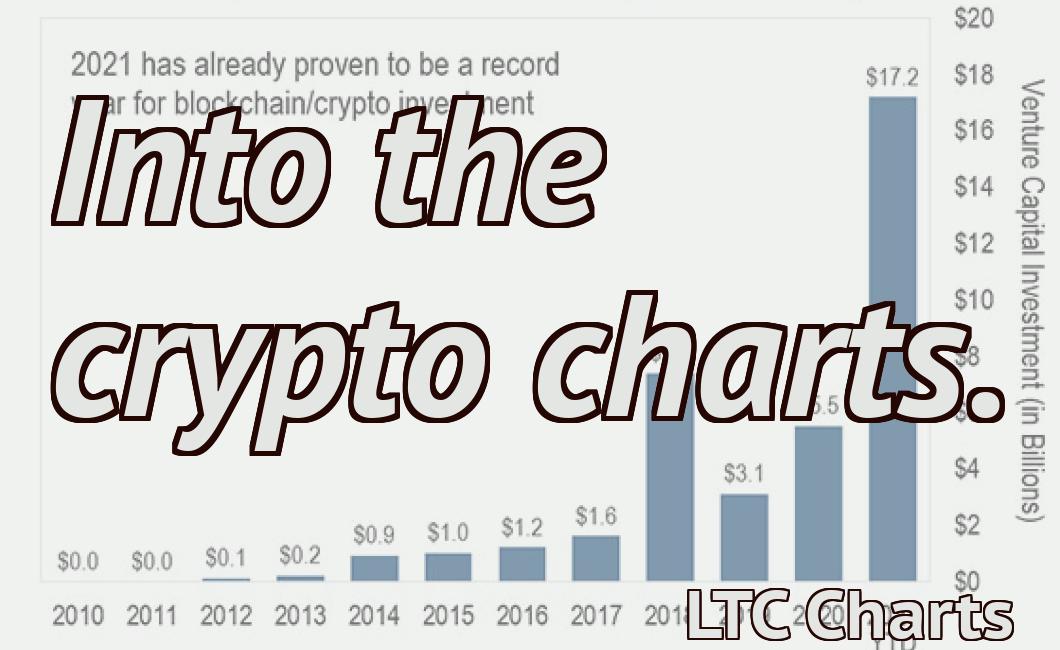

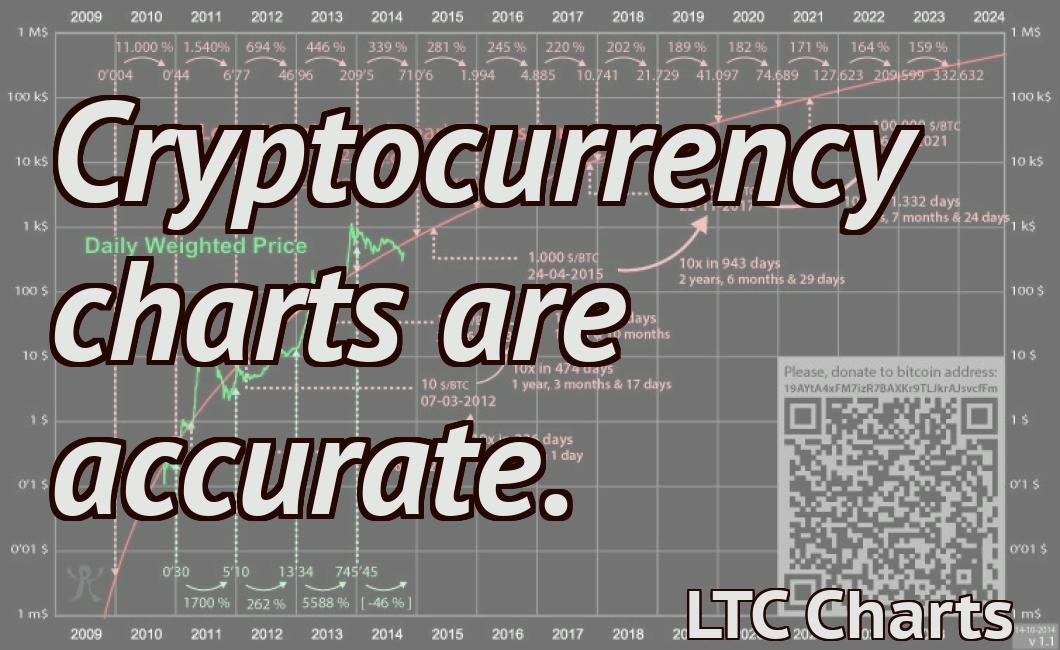

A crypto chart can help investors and traders visualize the price movement of different cryptocurrencies over time. Crypto charts are often used to track the performance of specific cryptocurrencies, as well as to identify trends.

Cryptocurrencies are often traded on digital exchanges and can be bought and sold with fiat currencies, such as US dollars or euros. The price of a cryptocurrency is determined by supply and demand.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them susceptible to price fluctuations and other risks.