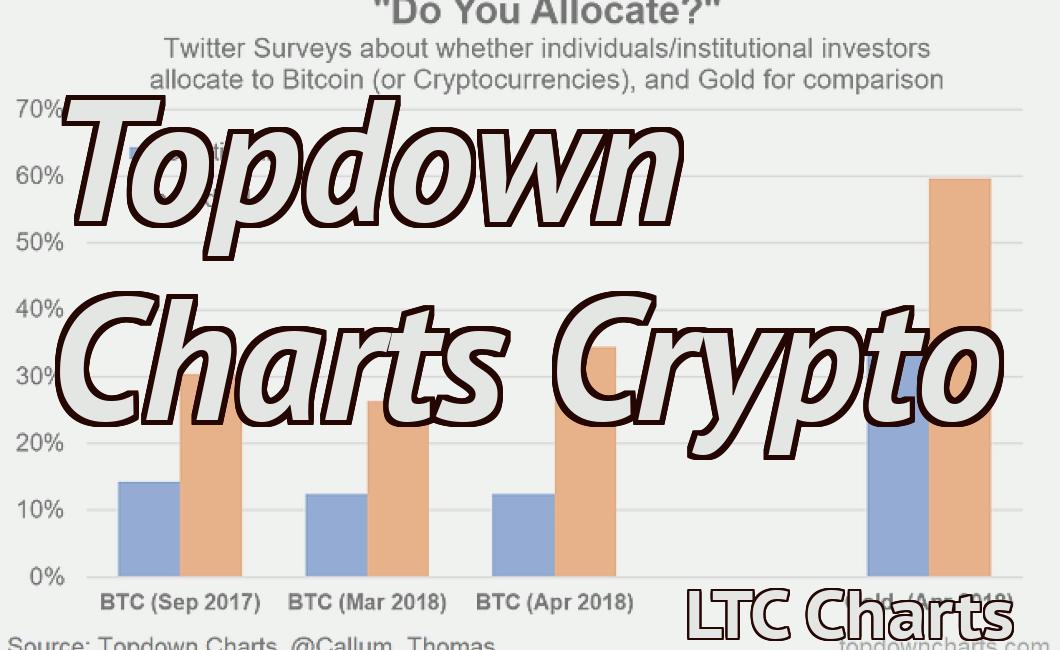

Where should I look at crypto charts?

If you're interested in tracking the progress of cryptocurrencies, you should take a look at crypto charts. These can be found on a variety of websites, and they offer valuable insights into how different digital currencies are performing. By looking at crypto charts, you can get a better idea of which coins are worth investing in and which ones are losing value.

How to Read Crypto Charts

Cryptocurrency charts can be read in a few different ways.

The most common way to read cryptocurrency charts is to look at the overall trend. This can be done by looking at the plotted data over time, or by reading the market data points.

Another way to read cryptocurrency charts is to look at the individual coins. This can be done by looking at the price data, or by looking at the volume data.

Finally, cryptocurrency charts can also be read to see if a coin is overpriced or underpriced. This can be done by looking at the relative values of the coins, or by looking at the supply and demand data.

A Beginner's Guide to Crypto Charting

Cryptocurrencies are a new and exciting financial ecosystem. While there is a great deal of information available on the subject, it can be difficult to know where to start. This guide will help you get started with crypto charting, and give you the tools you need to make informed investment decisions.

What is Crypto Charting?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which are platforms that allow users to buy and sell cryptocurrencies and other digital assets. Crypto charting is the process of monitoring the prices of cryptocurrencies on decentralized exchanges in order to gain an understanding of how the market is performing.

Why Use Crypto Charting?

Cryptocurrencies are new and rapidly growing markets. By using crypto charting, you can monitor the performance of the market and make informed investment decisions.

Cryptocurrencies are also volatile markets, which means that the prices of cryptocurrencies can change rapidly. By monitoring the prices of cryptocurrencies, you can stay informed about how the market is performing and make informed investment decisions.

How to Use Crypto Charting

To use crypto charting, you will first need a cryptocurrency wallet. A cryptocurrency wallet is a digital platform that allows you to store your cryptocurrencies. There are many different types of cryptocurrency wallets, so find one that is compatible with your needs.

Once you have a cryptocurrency wallet, you will need to create an account on a decentralized exchange. A decentralized exchange is a platform that allows users to buy and sell cryptocurrencies. There are many different decentralized exchanges, so find one that is compatible with your needs.

Once you have an account on a decentralized exchange, you will need to deposit your cryptocurrencies into your cryptocurrency wallet. To deposit your cryptocurrencies, you will need to provide your cryptocurrency wallet address. Once you have deposited your cryptocurrencies, you will need to create a trading account on the decentralized exchange. To create a trading account, you will need to provide your name, email address, and password.

Once you have created your trading account, you will need to deposit your cryptocurrency into your trading account. To deposit your cryptocurrency, you will need to provide your trading account address. Once you have deposited your cryptocurrency, you will be able to start trading cryptocurrencies.

How to Use Crypto Charting

To use crypto charting, first create a cryptocurrency wallet. Next, create an account on a decentralized exchange. Finally, deposit your cryptocurrencies into your trading account on the decentralized exchange.

The Different Types of Crypto Charts

There are a few different types of crypto charts that can be used to better understand the market conditions.

1) Hourly Chart

An hourly chart is used to track the price of a cryptocurrency over time. This type of chart can be used to identify peaks and valleys in the price of a coin, as well as the rate of movement.

2) Daily Chart

A daily chart is used to track the price of a cryptocurrency over a specific period of time. This type of chart can be used to identify patterns in the price movement, as well as how volatile the market is.

3) Crypto Candle Stick Chart

A crypto candle stick chart is used to track the price of a cryptocurrency over a period of time. This type of chart can be used to identify trends in the market, as well as how long it will take for a particular coin to reach a certain price point.

The Most Important Crypto Charts for Beginners

When you first start cryptocurrencies, it can be confusing to know where to start.

To make things easier, we’ve put together the most important cryptocurrency charts for beginners.

These charts will show you how the prices of different cryptocurrencies are correlated, how much market capitalization each one has, and how many transactions are being made on a daily basis.

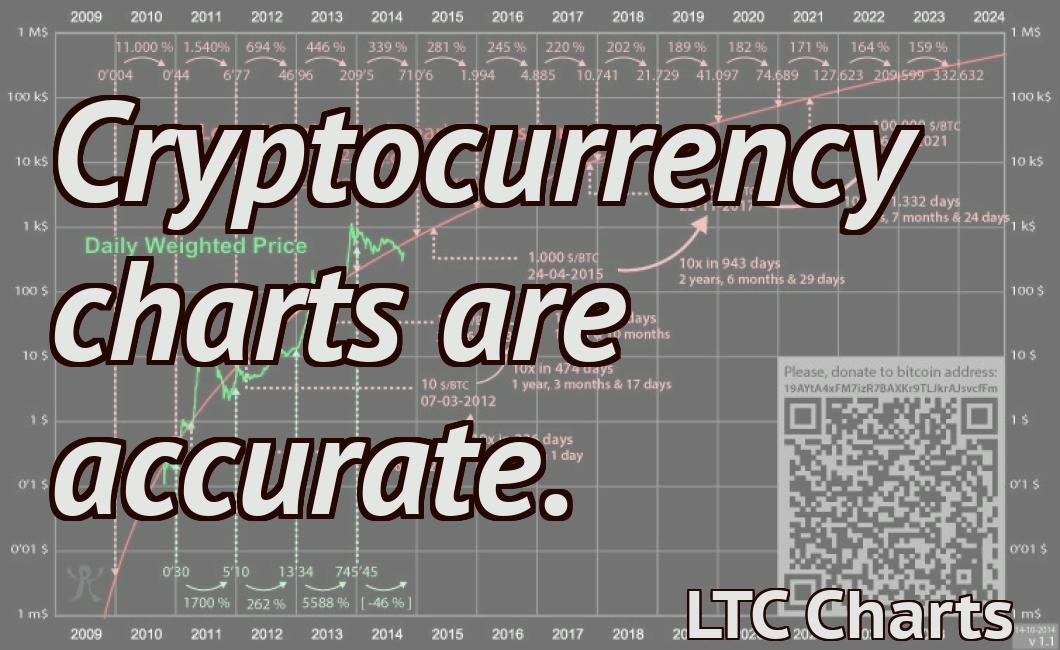

1. Bitcoin Price Chart

The most important Bitcoin price chart for beginners is the BTC/USD chart.

On this chart, you can see how the prices of Bitcoin have fluctuated over the past few years.

You can also see how the prices of Bitcoin are correlated with the prices of other cryptocurrencies.

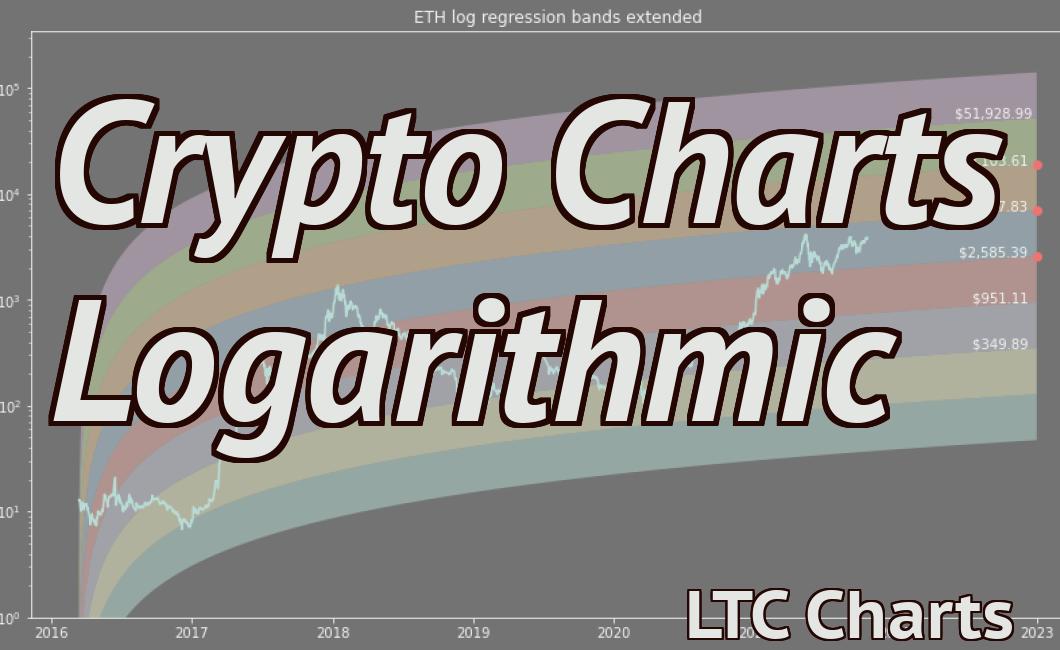

2. Ethereum Price Chart

The Ethereum price chart is another important Bitcoin price chart for beginners.

On this chart, you can see how Ethereum prices have fluctuated over the past few years.

You can also see how the prices of Ethereum are correlated with the prices of other cryptocurrencies.

3. Bitcoin Cash Price Chart

The Bitcoin Cash price chart is also an important Bitcoin price chart for beginners.

On this chart, you can see how Bitcoin Cash prices have fluctuated over the past few years.

You can also see how the prices of Bitcoin Cash are correlated with the prices of other cryptocurrencies.

4. Litecoin Price Chart

The Litecoin price chart is another important Bitcoin price chart for beginners.

On this chart, you can see how Litecoin prices have fluctuated over the past few years.

You can also see how the prices of Litecoin are correlated with the prices of other cryptocurrencies.

How to Use Crypto Charts to Make Better Trading Decisions

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on digital currency exchanges and can also be used to purchase goods and services. Trading cryptocurrencies is risky, and you could lose all your money. Before you start trading cryptocurrencies, you should learn about the risks involved.

Cryptocurrency charts can help you make better trading decisions. Bitcoin, Ethereum, and other major cryptocurrencies are often traded on digital currency exchanges. These exchanges provide live price charts that show the prices of cryptocurrencies over time.

You can use cryptocurrency charts to find trends and to track the prices of cryptocurrencies over time. You can also use cryptocurrency charts to find opportunities to buy or sell cryptocurrencies.

Before you start trading cryptocurrencies, you should do your own research. You should also read the cryptocurrency news and watch cryptocurrency videos to learn more about cryptocurrency trading.

The Benefits of Using Crypto Charts

Cryptocurrency charts are a powerful tool that can help you make better decisions when it comes to investing in digital assets. They can help you identify trends and patterns, and help you to make informed decisions about where to put your money.

Cryptocurrencies are volatile markets, and it can be difficult to predict how prices will move in the future. But by using cryptocurrency charts, you can increase your chances of making profitable investments.

Cryptocurrency charts can also help you to identify opportunities. For example, if you see that a particular cryptocurrency is trading at a low price, this may be an opportunity to buy the asset. Conversely, if a cryptocurrency is trading at a high price, this may be an opportunity to sell the asset.

Cryptocurrency charts can also help you to make better decisions when it comes to trading. For example, you can use cryptocurrency charts to identify patterns in the market, and to predict when prices are likely to change. This can help you to make more informed decisions when trading digital assets.

The Best Crypto Charting Tools

There are a few different crypto charting tools out there, so it can be hard to decide which one to use.

Here are the four best crypto charting tools that we have found:

1. Tradingview

Tradingview is one of the most popular crypto charting tools out there. It is free to use, and it has a lot of features.

One of the main benefits of Tradingview is that it is very user-friendly. You can create your own charts, and you can also use the built-in indicators and strategies.

Overall, Tradingview is a great tool for crypto traders.

2. CoinMarketCap

CoinMarketCap is another popular crypto charting tool. It is free to use, and it has a lot of features.

One of the main benefits of CoinMarketCap is that it has a wide range of data. You can see the prices of all the major cryptocurrencies, as well as the overall market cap.

Overall, CoinMarketCap is a great tool for crypto traders.

3. Coinigy

Coinigy is another popular crypto charting tool. It is free to use, and it has a lot of features.

One of the main benefits of Coinigy is that it has a wide range of data. You can see the prices of all the major cryptocurrencies, as well as the overall market cap.

Overall, Coinigy is a great tool for crypto traders.

4. Blockchain.info

Blockchain.info is another popular crypto charting tool. It is free to use, and it has a lot of features.

One of the main benefits of Blockchain.info is that it has a wide range of data. You can see the prices of all the major cryptocurrencies, as well as the overall market cap.

Overall, Blockchain.info is a great tool for crypto traders.

The Different Types of Crypto Technical Analysis

There are three main types of crypto technical analysis: technical analysis of the supply and demand of a digital asset, technical analysis of the performance of a digital asset during a specific time period, and fundamental analysis.

Technical Analysis of the Supply and Demand of a Digital Asset

Technical analysis of the supply and demand of a digital asset focuses on the analysis of an asset’s price and volume data to determine whether there is an over- or under-supply of that digital asset. This type of analysis can help determine when to buy or sell an asset.

Technical analysis of the performance of a digital asset during a specific time period

Technical analysis of the performance of a digital asset during a specific time period focuses on the analysis of an asset’s price and volume data to determine whether the asset is profitable or not. This type of analysis can help determine when to buy or sell an asset.

Fundamental Analysis

Fundamental analysis is the study of an asset’s intrinsic value. This type of analysis looks at factors such as the assets underlying technology, the company behind the asset, and the market conditions. Fundamental analysis can help you decide whether to buy or sell an asset.

How to Use Crypto Charts for Long-Term Investment Planning

Cryptocurrencies are a new type of investment that can be volatile and risky. Before investing in cryptocurrencies, it is important to understand their long-term potential and how they work.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which allow for peer-to-peer trading. Some cryptocurrencies are also available as tokens on decentralized applications (dApps).

Cryptocurrencies are not backed by any government or financial institution, so their value is based on supply and demand. Their value can rise and fall quickly, which is why it is important to do your research before investing.

If you are interested in investing in cryptocurrencies, it is important to understand their properties and how they work. Crypto charts can help you track the performance of different cryptocurrencies and determine whether they are a good investment.

Cryptocurrencies are often traded on decentralized exchanges, which allow for peer-to-peer trading.

To use crypto charts for long-term investment planning, first find a cryptocurrency that you want to invest in. Next, find an appropriate charting platform, such as CoinMarketCap.com or TradingView.com.

Once you have found a charting platform, click on the “cryptocurrencies” tab, and select the cryptocurrency you want to track. You can then view the cryptocurrency’s historical prices and market cap.

To make long-term investment decisions, it is important to understand the cryptocurrency’s potential long-term growth. To do this, you can use the “historical growth” and “technical analysis” tabs to analyze the cryptocurrency’s performance.

You can also use the “fundamental analysis” tab to examine the cryptocurrency’s underlying technology and its potential future value.