Crypto Obv Charts

Crypto Obv Charts is a website that allows users to create and track the progress of their cryptocurrency investments. The site provides charts and graphs that show the current value of various cryptocurrencies, as well as the changes in value over time. users can also set up alerts to be notified when certain conditions are met, such as when a currency reaches a certain price.

Bitcoin and Ethereum Price Analysis: BTC at All-Time Highs, ETH Flirting With ATH

Bitcoin and Ethereum prices are both at all-time highs right now. BTC is currently trading at $8,200, while ETH is sitting at $1,370.

Bitcoin has been on an absolute tear this year, increasing by more than 1,000% since the beginning of the year. Ethereum has also seen significant growth, increasing by more than 300% during the same time period.

Overall, these prices are indicative of a healthy market that is expanding rapidly. However, there are some risks associated with this market.

First and foremost, it is important to remember that these prices are not guaranteed to continue going up. There are a number of factors that could cause them to decrease, including a potential crash.

Second, Bitcoin and Ethereum are not the only cryptocurrencies in the market. There are a number of other coins that are also experiencing high prices, and some of them could potentially lose value over time.

Overall, though, these prices are indicative of a healthy market that is expanding rapidly.

Bitcoin and Ethereum Price Prediction: BTC to $100K, ETH to $10K

Bitcoin and Ethereum are two of the most popular digital currencies in the world. They both have a very large user base and continue to grow in popularity. Bitcoin is currently trading at $6,700 and Ethereum is trading at $705.

There is a lot of speculation about what will happen to the prices of these digital currencies. However, we can make some predictions about what might happen.

We predict that Bitcoin will reach $100,000 by the end of 2020. Ethereum will also reach $10,000 by the end of 2020.

Bitcoin vs Ethereum: Which is the better investment?

There is no one-size-fits-all answer to this question, as the best investment depends on your individual circumstances. However, some factors that could impact which cryptocurrency is the better choice for you include:

1. Financial stability

Bitcoin and Ethereum are both digital currencies, which means that their value is based on how much people are willing to exchange them for. While this has made both cryptocurrencies relatively stable throughout the years, there is always the risk that one or the other may experience a sudden price decline.

2. Scalability

One of the key benefits of investing in Bitcoin or Ethereum is that they are both relatively scalable. This means that their networks can handle a greater number of transactions than traditional fiat currencies. This makes them ideal for use in online transactions and other applications that require quick and easy processing.

3. Volatility

Bitcoin and Ethereum are both relatively volatile cryptocurrencies. This means that their values can fluctuate a great deal from day to day and from week to week. This can make them difficult to invest in without proper risk management guidelines in place.

5 Reasons to invest in Bitcoin and Ethereum

1. Bitcoin and Ethereum are digital currencies that can be used to purchase goods and services.

2. Bitcoin and Ethereum are not subject to government or financial institution control.

3. Bitcoin and Ethereum are unique in that their value is based on demand from buyers and sellers, rather than a fiat currency.

4. Bitcoin and Ethereum have a low barrier to entry, making them more accessible to a wider range of investors.

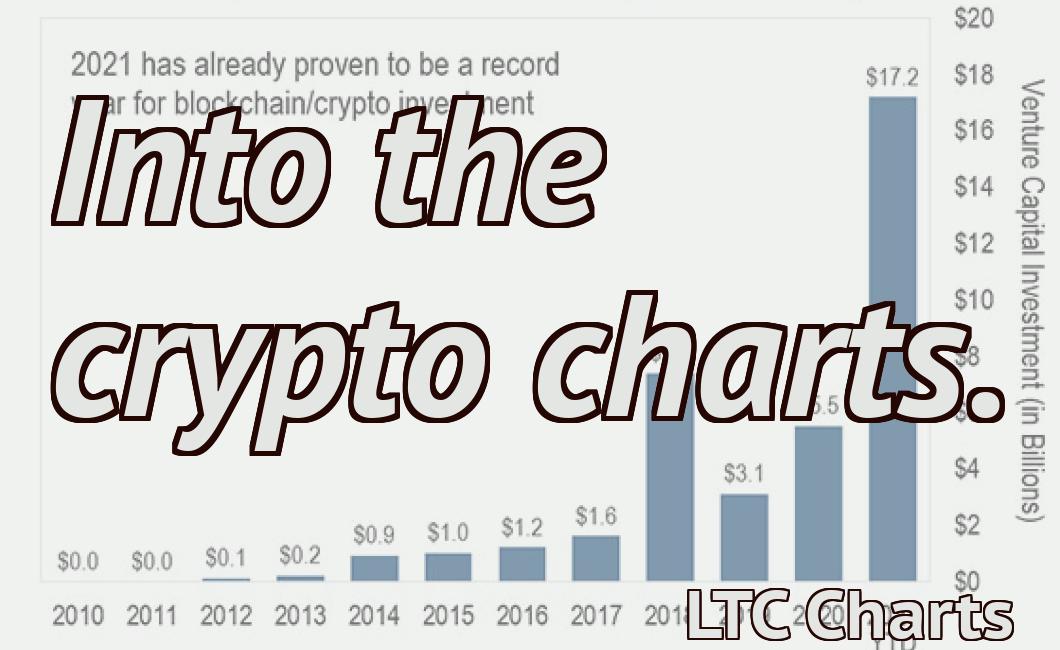

5. Bitcoin and Ethereum are growing in popularity, with large global investments being made in the space.

3 Reasons to be cautious about investing in Bitcoin and Ethereum

1. Bitcoin and Ethereum are both highly volatile investments.

2. There is a risk that you could lose all of your investment if the price of Bitcoin or Ethereum falls significantly.

3. Bitcoin and Ethereum are not regulated by any government or financial institution, so there is a risk that they could become unstable or no longer function as a viable currency.

Bitcoin and Ethereum: A Tale of Two Coins

Bitcoin and Ethereum are two of the most popular digital currencies in the world. They share many similarities, but also have some notable differences. Here's a look at their history, features, and future prospects.

Bitcoin

Bitcoin was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Bitcoin is a cryptocurrency - a type of digital asset that uses cryptography to secure its transactions and to control the creation of new units.

Bitcoin is decentralized, meaning it is not subject to government or financial institution control. This makes it an attractive option for people who want to avoid traditional financial institutions.

Bitcoin is also secure - its transactions are verified by network nodes through cryptography. This makes Bitcoin resistant to fraud and other attacks.

Bitcoin has been growing in popularity since its creation, and it has been reported that there are now over 100,000 active users. Bitcoin is also traded on various exchanges around the world.

Ethereum

Ethereum is a different kind of digital currency than Bitcoin. Ethereum is based on blockchain technology, which is a distributed database that allows for secure, transparent and tamper-proof transactions.

Ethereum also has a different approach to security - its transactions are not verified by network nodes. Instead, Ethereum relies on a system known as "gas" to ensure that transactions are processed correctly.

Ethereum has also been growing in popularity since its creation, and it has been reported that there are now over 10,000 active users. Ethereum is also traded on various exchanges around the world.

How to read crypto charts for beginners

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

To read crypto charts, you'll first need to understand how to read price charts. Once you understand how to read price charts, you can then read crypto charts.

Price charts show the price of a cryptocurrency over time. You'll need to understand how to read a price chart in order to read a crypto chart.

Cryptocurrency prices are represented by a cryptocurrency's price index (or market capitalization). The price index is the sum total of all cryptocurrency prices on a given day.

The following are three things to look for on a crypto chart:

1. The height of the candle. This is the point at which the candle reached its highest point.

2. The candle's width. This is the distance between the left and right sides of the candle.

3. The trend. This is the direction in which the cryptocurrency's prices are moving.

You can also use indicators to help you read crypto charts. An indicator is a graphic that displays information about a cryptocurrency's prices or other parameters.

Some of the most common indicators used to read crypto charts are the Bollinger Band, the Ichimoku Cloud, and the RSI (relative strength index).

A beginner's guide to cryptocurrency trading

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

The most popular cryptocurrency exchanges

1. Coinbase

2. Bitfinex

3. Binance

4. Kraken

How to store your cryptocurrencies safely

There are a few ways to store your cryptocurrencies safely:

1. Use a hardware wallet. A hardware wallet is a secure way to store your cryptocurrencies offline, and they come in many different types. Some examples include the Ledger Nano S and the Trezor.

2. Use a software wallet. A software wallet is a type of digital wallet that runs on your computer or mobile device. They are more convenient than a hardware wallet, but they are not as secure.

3. Store your cryptocurrencies in an online wallet. An online wallet is a type of digital wallet that is hosted by a third-party. This means that your cryptocurrencies are not as secure as if they were stored in a hardware or software wallet, but they are more convenient.

What are the risks of investing in cryptocurrencies?

There are a number of risks associated with investing in cryptocurrencies. Some of the risks include:

• The value of cryptocurrencies can be highly volatile and may increase or decrease in value

• Cryptocurrencies are not backed by any government or central institution, and there is no guarantee that they will continue to be accepted as a form of payment

• Cryptocurrencies may be illegal in some jurisdictions, which could lead to criminal activities involving cryptocurrencies

• Cryptocurrencies may be vulnerable to cyber-attacks, which could cause them to lose value or be lost entirely

• Cryptocurrencies are not subject to the same financial regulations as traditional currencies, which could lead to greater risks if they fail to perform as expected

• There is no guarantee that a cryptocurrency will be available to be used in the future, which could lead to its value declining

5 things you need to know before investing in cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.