How do crypto prices work?

Crypto prices are based on a number of factors, including supply and demand, media hype, and overall market conditions. Like any other asset, the price of cryptocurrencies can fluctuate wildly.

How do crypto prices work?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Prices are determined by supply and demand.

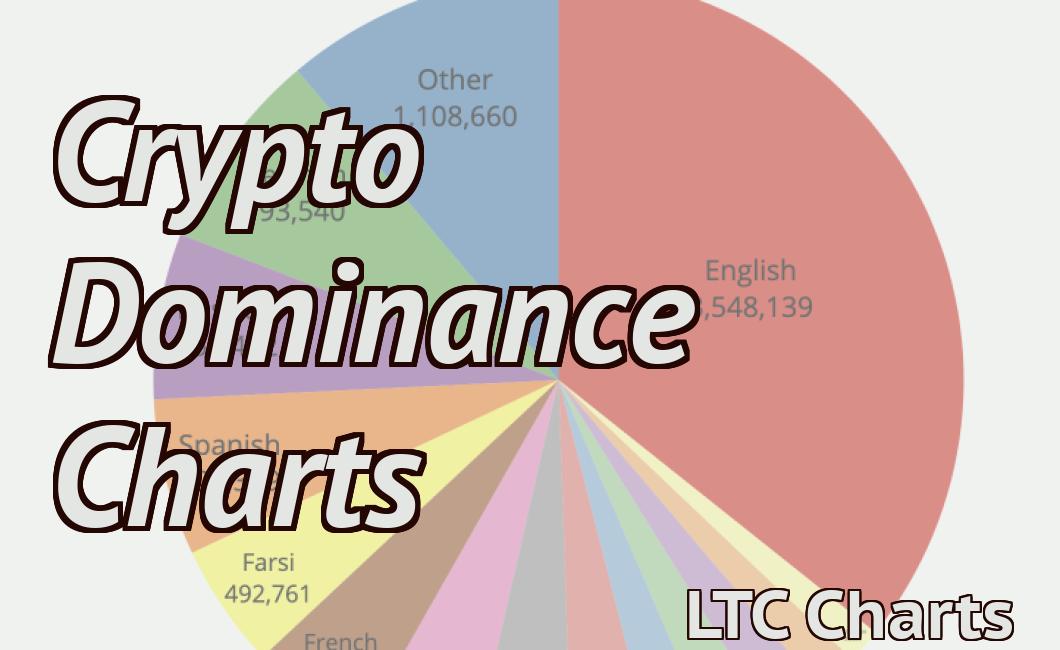

The basics of cryptocurrency pricing

Cryptocurrency prices are determined by supply and demand. In the simplest terms, there is a finite number of bitcoins that will ever exist, while the demand for bitcoin is constantly increasing. This means that the price of bitcoin will rise when more people want to buy it, and fall when fewer people want to buy it.

How supply and demand affects crypto prices

Supply and demand affects crypto prices in two ways. First, when more people want to buy a cryptocurrency, the price will go up. Second, when more people want to sell a cryptocurrency, the price will go down.

The role of market sentiment in crypto pricing

There is no one answer to this question as the role of market sentiment in crypto pricing will vary depending on the specific cryptocurrency and market conditions. However, some factors that may influence market sentiment include news events, regulatory developments, and overall market conditions.

How news and events can impact cryptocurrency prices

Cryptocurrencies are built on blockchain technology and are not tied to any government or financial institution. As such, news and events that impact the global economy or the banking system can have a ripple effect on cryptocurrency prices. For example, if the global economy weakens, investors may sell off cryptocurrencies in order to seek safety in traditional assets. This can cause prices to decline. Conversely, if the global economy strengthens, investors may buy more cryptocurrencies, pushing prices up.

Technical factors that influence crypto prices

Cryptocurrencies are traded on decentralized exchanges and can also be bought and sold on online marketplaces. Many factors affect prices of cryptocurrencies, including global economic conditions, regulatory changes, and news events.

The importance of liquidity in crypto pricing

Liquidity is one of the most important factors when it comes to pricing cryptocurrencies. Liquidity refers to the ability of an asset to be bought and sold quickly and at a fair price.

Cryptocurrencies that have high liquidity tend to be more expensive than those with low liquidity. This is because investors who are looking to buy or sell a cryptocurrency quickly can do so at a fair price. Conversely, investors who are looking to hold a cryptocurrency for longer periods of time may be willing to pay more for an asset with high liquidity.

Liquidity is also important because it ensures that there is always a supply of cryptocurrencies available for purchase. If there is not enough liquidity, buyers may not be able to purchase a desired cryptocurrency at a fair price, which can lead to shortages.

Overall, liquidity is one of the key factors that determine the price of a cryptocurrency. It is important to watch for trends in liquidity in order to make informed investment decisions.

How price discovery works in the cryptocurrency markets

In the cryptocurrency markets, buyers and sellers come together to determine the price of a digital asset. This process is known as price discovery.

Price discovery happens when buyers and sellers negotiate a price for an asset. This process allows for more accurate pricing of digital assets and promotes a healthy market.

The role of order books

An order book is a list of all the orders that have been placed for an asset. It allows buyers and sellers to find each other and negotiate a price.

When buyers place an order, it is added to the order book. Similarly, when sellers place an order, it is also added to the order book.

The order book is a public record of all the orders that have been placed for an asset. It allows buyers and sellers to find each other and negotiate a price.

The order book is important because it allows buyers and sellers to find each other and negotiate a price. This process allows for more accurate pricing of digital assets and promotes a healthy market.

Why prices can vary between exchanges for the same coin

Some exchanges may have higher or lower prices for the same coin than others. This can be due to a variety of factors, including location, fees, and liquidity.

Why some coins are more volatile than others

Some coins are more volatile than others because they are more likely to be worth more or less in the short term. Bitcoin, for example, has been known to be very volatile and can be worth a lot or a little in the short term.

What factors will influence cryptocurrency prices in the future?

There is no one definitive answer to this question since cryptocurrency prices are highly volatile and determined by a variety of factors, including global economic conditions, major news events, and regulatory changes. Some experts believe that the price of cryptocurrencies will continue to be highly volatile in the future, while others believe that they will become more stable over time.