What causes cryptocurrency prices to change?

Cryptocurrency prices are highly volatile and can change rapidly due to a variety of factors. These include news events, changes in global markets, and even rumors.

The ever-changing world of cryptocurrency

Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The volatile nature of cryptocurrency prices

Cryptocurrencies are highly volatile and can be very risky investments. Their prices can fluctuate widely in short periods of time, and there is always the risk that you could lose all your money.

This makes it important to be very careful when investing in cryptocurrencies, and to only do so if you are prepared to accept the risk of losing your money.

The causes of cryptocurrency price fluctuations

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

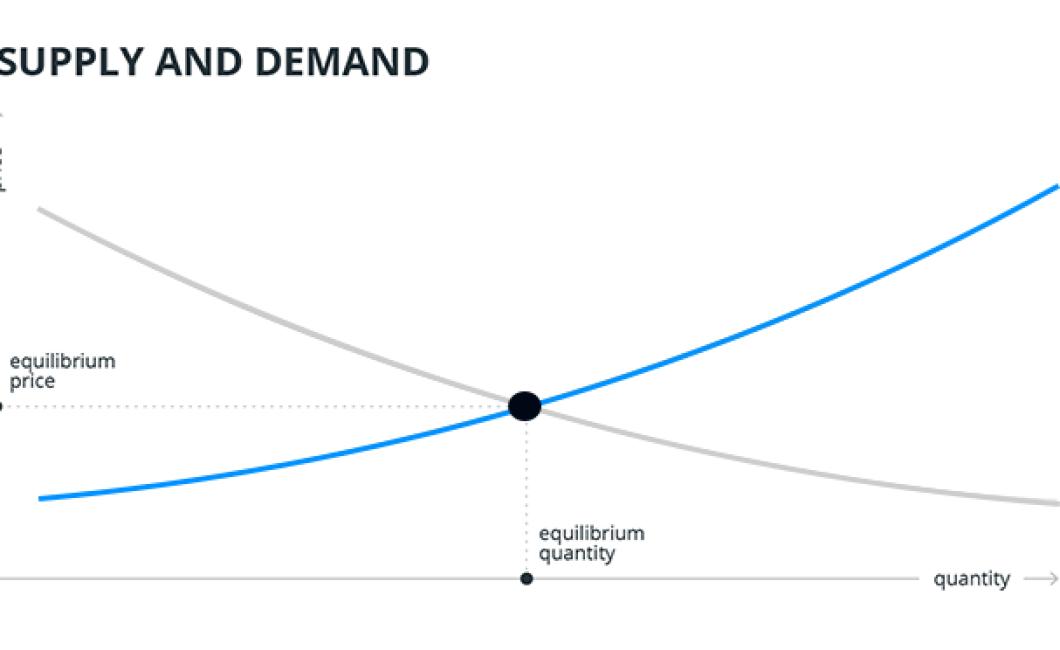

The value of cryptocurrencies is based on their supply and demand, as well as their popularity. Cryptocurrencies that have a high level of demand are likely to have a higher value than those with a low level of demand. Cryptocurrencies can also be affected by political or economic events.

Why do cryptocurrency prices fluctuate?

Cryptocurrency prices fluctuate because they are susceptible to supply and demand. When more people want to buy a cryptocurrency, the price goes up. When there is a lot of demand for a cryptocurrency, but not enough available, the price goes up.

How do external factors affect cryptocurrency prices?

External factors can affect cryptocurrency prices in a number of ways. Some of these factors include political events, economic trends, and technical developments.

What drives cryptocurrency prices?

Cryptocurrency prices are driven by supply and demand.

The underlying factors of cryptocurrency prices

Cryptocurrencies are often highly volatile and speculative, which means that their prices are highly sensitive to a variety of factors. Here are some of the most important factors that can influence cryptocurrency prices:

1. Supply and demand

Cryptocurrencies are mined by computers, so their supply is limited. This makes them valuable as a form of payment, because there is a finite number of them that can be created. As more people want to own them, the price will rise.

2. News and events

Cryptocurrencies are often highly sensitive to news and events. If a major financial institution starts to accept them as a form of payment, this will drive up the price. If a new cryptocurrency comes out that is seen as more valuable than the others, this will also drive up the price.

3. The Bitcoin network

The Bitcoin network is the most valuable and well-known cryptocurrency network. Its value is largely dependent on the number of people who are using it and the belief that it will continue to be valuable in the future. If there are any problems with the Bitcoin network, this could lead to a decline in its value.

How news affects cryptocurrency prices

News can have a big impact on cryptocurrency prices. For example, if there is news that a major financial institution is going to start trading cryptocurrencies, this can cause prices to go up. Conversely, if there is news that a major financial institution is banning cryptocurrencies, this can cause prices to go down.

The impact of regulation on cryptocurrency prices

There is no one-size-fits-all answer to this question as the impact of regulation on cryptocurrency prices will vary depending on the specific case. However, some factors that could potentially impact cryptocurrency prices include:

The type of regulation in place: If regulation restricts the flow of cryptocurrency into and out of the market, this could lead to a decline in prices. On the other hand, if regulation promotes the use of cryptocurrencies and provides protection for investors, this could lead to an increase in prices.

The magnitude of the regulation: If regulation is minor, this could have minimal impact on prices. Conversely, if regulation is significant, this could lead to a decline in prices.

The timing of the regulation: If regulation is implemented at a time when prices are high, this could cause a decline in prices. Conversely, if regulation is implemented at a time when prices are low, this could have a minimal impact on prices.

The enforcement mechanism: If regulation is enforced through taxation or other means that make buying and selling cryptocurrencies difficult, this could lead to a decline in prices. On the other hand, if regulation is enforced through legislation or rules that are less restrictive, this could lead to an increase in prices.

The role of speculation in cryptocurrency pricing

Speculation is a major factor in cryptocurrency pricing. Speculators are people who buy and sell cryptocurrencies based on the belief that the prices will go up. This causes the prices to be volatile, which makes it difficult for people to invest in cryptocurrencies.

Manipulation and other malicious activity in the crypto markets

Cryptocurrencies are highly volatile and can be easily manipulated. This makes them vulnerable to scams and hacks, which can result in financial loss for investors.

For example, in December 2017, the $530 million Bitfinex hack was the largest cryptocurrency theft to date. In April 2018, $532 million worth of NEM tokens were stolen from the Japanese cryptocurrency exchange Coincheck. And in July 2018, $40 million worth of EOS tokens were stolen from the EOSIO platform by a hacker.

These hacks and scams have had a negative impact on the overall stability of the crypto markets. They have also led to a decline in the value of many cryptocurrencies.