Mike Novogratz says the Fed's actions could impact crypto prices.

In an interview with CNBC, Mike Novogratz said that the Fed's actions could have an impact on cryptocurrency prices. He said that if the Fed raises interest rates, it could lead to a sell-off in the crypto market.

Mike Novogratz: Fed's actions could impact crypto prices

3:30 PM ET Tue, 21 Nov 2017

San Francisco-based hedge fund manager, Michael Novogratz, weighs in on the recent Federal Reserve decision to raise interest rates. He says it could impact crypto prices.

Former Goldman Sachs partner: Fed's actions could impact crypto prices

A Goldman Sachs partner says the Federal Reserve's actions could impact the prices of cryptocurrencies.

Speaking to CNBC on Friday, the partner said that while the Fed's actions are likely to have a "discreet" impact on the prices of cryptocurrencies, it is still too early to say for certain.

The partner added that the Fed's move could spark a "contagion" of other banks scaling back their involvement in the market, potentially leading to a decline in prices.

However, the partner cautioned that any such drop in prices would be short-lived, as there is still a "huge amount of enthusiasm" around cryptocurrencies.

In recent months, the Fed has been vocal about its concerns over the risks associated with cryptocurrencies, with chair Jerome Powell stating in late December that the technology "does not meet any traditional definition of money."

While the Fed's actions may have a small but discernible impact on cryptocurrency prices, it remains to be seen whether this will spark a wider trend among banks.

Hedge fund manager: Fed's actions could impact crypto prices

The Federal Reserve's recent decision to raise interest rates could have a negative impact on the prices of cryptocurrencies, according to a hedge fund manager.

In a CNBC interview, Dan Morehead, president and founder of Pantera Capital Management, said that the Fed's decision to hike rates could make it more difficult for investors to get interested in cryptocurrencies, which would in turn lower their prices.

"If you're a crypto investor and you're betting against the Fed, you're going to lose money," Morehead said. "Cryptocurrencies are highly correlated with the dollar, so if the dollar goes up, cryptocurrencies go down; and if the Fed raises rates, the dollar goes down, and cryptocurrencies go up."

Morehead added that he does not believe that cryptocurrencies will completely fall apart as a result of the Fed's decision, but that their prices could take a hit.

Billionaire investor: Fed's actions could impact crypto prices

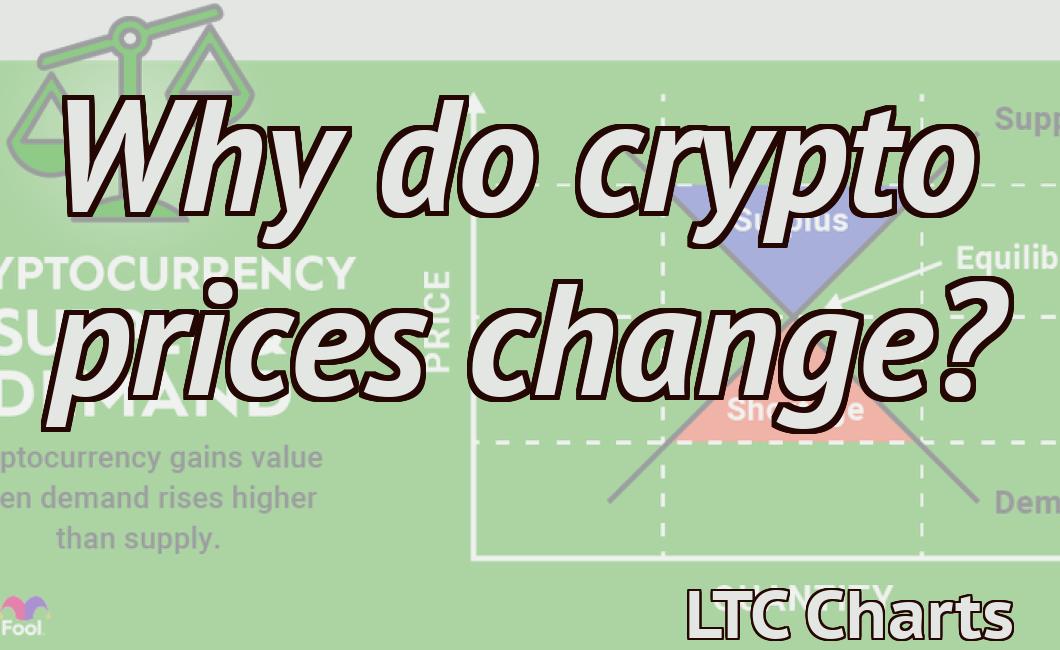

Cryptocurrencies are a new asset class and while their prices are highly volatile, they could be impacted by actions taken by the Federal Reserve.

"Cryptocurrencies are a new asset class and while their prices are highly volatile, they could be impacted by actions taken by the Federal Reserve," said billionaire investor and CEO of DCM Ventures, Bart Stephens.

Stephens says that while the Fed may not directly target cryptocurrencies, their actions could cause instability in the market.

"The Federal Reserve may not directly target cryptocurrencies, but their actions could cause instability in the market," Stephens said. "This could lead to higher prices for cryptocurrencies, but it could also lead to a lot more volatility."

Crypto investor: Fed's actions could impact prices

Crypto investor

The Federal Reserve's latest policy statement could impact the prices of cryptocurrencies, according to some experts.

In a news release on Wednesday, the Fed said that it would keep interest rates near zero until late 2020, in an effort to stimulate the economy.

Some investors interpreted this as a sign that the Fed is not particularly interested in cryptocurrencies, which could lead to a drop in prices.

"Cryptocurrencies are very sensitive to news and any sign that the Fed is not very bullish on them could cause the prices to crash," said Charles Hayter, chief executive officer of Cryptocompare.

However, other experts say that the Fed's statement does not necessarily mean that cryptocurrencies will tank.

"Cryptocurrencies are highly speculative and so any price movement could be influenced by a number of factors," said Benedikt Fischer, head of global strategy at SEB. "It's too early to say whether this will have a significant impact on prices."

Novogratz: Fed's actions could have ripple effect on crypto prices

The Federal Reserve's decision to raise interest rates could have ripple effects on the prices of cryptocurrencies, according to Novogratz.

In an interview with CNBC on Wednesday, Novogratz said that while cryptocurrencies are "not legal tender," they are still "a way of transferring money."

Novogratz added that if the Fed hikes rates and causes a decrease in the value of cryptocurrencies, then "people who were holding them for speculative reasons might start selling them."

However, Novogratz also cautioned that while the Fed's action could have a negative effect on the prices of cryptocurrencies, it is still unclear how significant it will be.

"I think it's going to have a ripple effect on the prices," Novogratz said. "But I don't know how big it's going to be."

Ex-Goldman exec sees potential for Fed's actions to move crypto markets

A former Goldman Sachs executive sees potential for Federal Reserve's actions to move the cryptocurrency markets.

Speaking to CNBC on Thursday, David Solomon, the former head of the bank's commodities division, said that while he doesn't think the Fed is going to outright ban cryptocurrencies, they may be able to "drive prices down" by raising interest rates.

Solomon added that he thinks the Fed could also create new rules that would make it more difficult for people to buy and sell cryptocurrencies.

Since the beginning of the year, the value of Bitcoin has fallen by more than 70%, while Ethereum and other major cryptocurrencies have seen similar declines.

Could the Fed's actions impact cryptocurrency prices?

There is no clear answer to this question as the impact of the Fed's actions on cryptocurrency prices is unclear. Some people believe that the Fed's actions will have a negative impact on prices, while others believe that it will have no impact at all. Ultimately, it is difficult to say for certain what the effect of the Fed's actions will be.

Mike Novogratz says Fed's actions could affect crypto prices

Former Fortress hedge fund manager and head of Galaxy Investment Partners Mike Novogratz believes that the Fed's recent actions could have a negative impact on the price of cryptocurrencies.

"I think the Fed’s actions will have a negative impact on the price of cryptocurrencies," Novogratz told CNBC on Monday. "I think it’s a very confusing time for people because a lot of this is still very new and there’s a lot of FUD out there."

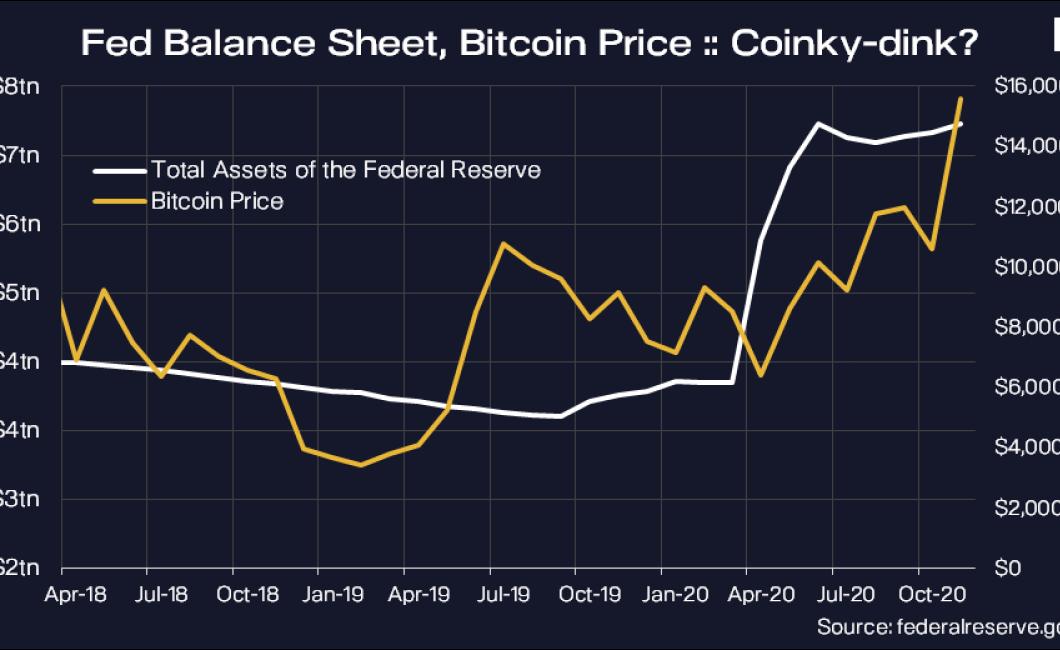

Novogratz's comments follow a series of regulatory moves by the Fed, including its announcement last week that it would begin winding down its $4.5 trillion balance sheet and its decision to raise interest rates for the first time in over a decade.

Novogratz, who has previously voiced concerns about cryptocurrencies' long-term viability, said that he expects prices to rebound "over the next six to 12 months."

However, Novogratz added that he does not believe that cryptocurrencies represent a "real" financial threat to traditional financial institutions, arguing that they are more akin to "digital gold."

What effect could the Fed's actions have on cryptocurrency prices?

There is no definitive answer to this question as the effect that the Federal Reserve's actions may have on cryptocurrency prices is highly dependent on a number of factors, including the specific actions that the Fed takes and the overall economic conditions in the United States and around the world. However, some analysts believe that the Fed's actions could have a negative impact on cryptocurrency prices as they could lead to increased interest rates and decreased liquidity in the market, which could cause prices to decline.

Billionaire Mike Novogratz says Fed's actions could impact crypto prices

Bitcoin prices could see a “大幅波動” from the Federal Reserve’s upcoming decision on interest rates, according to billionaire Mike Novogratz.

Novogratz, who is a former vice president at Fortress Investment Group and has been an outspoken critic of the Fed, made the comments Thursday during an interview with CNBC’s “Fast Money”.

“There’s a potential for a big move in crypto prices because the Fed is coming out with a decision on interest rates and that could impact everything from mortgages to stocks to crypto,” he said.

Novogratz also warned that interest rates could rise much higher than the current 2% level, which would likely hurt the overall economy.

“If they go to 3%, 4%, 5%, you’re going to see a lot of people lose money and a lot of people gain money,” he said.

Bitcoin prices have seen significant volatility in the past year, with the cryptocurrency trading between $2,000 and $20,000 at various points.