Why do crypto prices change?

The prices of cryptocurrencies can change for a variety of reasons. Some of the most common reasons are changes in the overall market conditions, news about the project or currency, and changes in regulation.

Why do crypto prices change?

Cryptocurrencies are created through a process called mining. Miners are rewarded with cryptocurrencies for verifying and committing transactions to the blockchain. As the number of new cryptocurrency transactions increases, the difficulty of mining them decreases. This allows miners to earn more cryptocurrencies, which in turn drives up the price of those cryptocurrencies.

What drives crypto prices?

Cryptocurrencies are created as a way to secure and transfer value between two parties without the need for a central authority. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are generated through a process called mining, in which users solve mathematical puzzles to unlock new coins. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

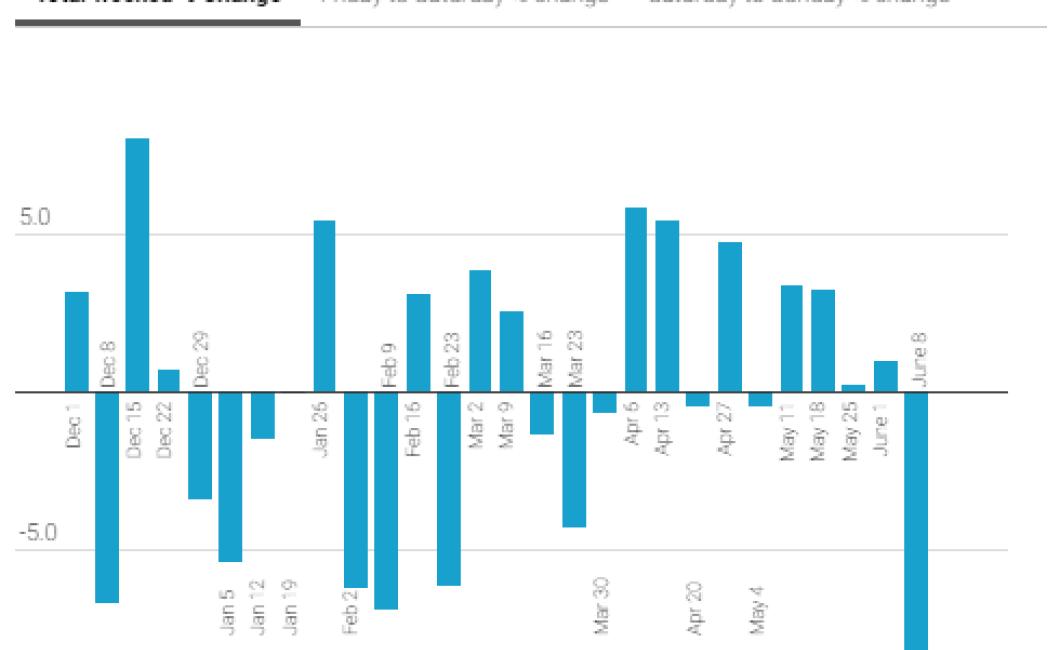

How do crypto prices fluctuate?

Cryptocurrencies are traded on a variety of exchanges and can be bought and sold at different prices throughout the day. Prices can also be affected by news or events.

The reason behind crypto price movements

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The forces that influence crypto prices

There are a number of forces that influence crypto prices, including global economic conditions, regulatory changes and technical analysis.

Why do some cryptos perform better than others?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. They can be used to purchase goods and services, or exchanged for other cryptocurrencies, fiat currencies, or other digital assets.

Cryptocurrencies that use blockchain technology are considered to be more reliable and secure than those that do not. Blockchain is a distributed database that is constantly growing as “completed” blocks are added to it with a new set of recordings. Each time a block is added, it is verified by a network of nodes to make sure it is legitimate. Bitcoin, Ethereum, and other blockchain-based cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Another reason some cryptocurrencies perform better than others is because of their popularity. Cryptocurrencies that have received a lot of media attention are often more valuable than those that have not. Bitcoin, for example, has consistently been one of the most valuable cryptocurrencies since it was created in 2009.

How market conditions affect crypto prices

Cryptocurrencies are highly volatile and are very sensitive to market conditions. When the market is bullish, prices are higher and when the market is bearish, prices are lower.

The role of news in crypto price changes

News articles can have a significant impact on the price of cryptocurrencies. In some cases, a news article may cause the price of a cryptocurrency to increase, while in other cases, a news article may cause the price of a cryptocurrency to decrease.

Cryptocurrencies are often highly volatile, and the price of a cryptocurrency can change rapidly depending on the latest news. For example, if a new cryptocurrency is announced, the price of that cryptocurrency may increase quickly. Conversely, if a news article is released that negatively impacts the reputation of a particular cryptocurrency, the price of that cryptocurrency may decline.

Can we predict crypto price movements?

It is difficult to make predictions about the price of cryptocurrencies, as their prices are highly volatile and tend to move in response to a variety of factors. Factors that can influence prices include global economic conditions, news events, and regulatory changes. Some people believe that predicting price movements is impossible, while others believe that it is possible to make some educated guesses.

What technical indicators tell us about crypto prices

Cryptocurrencies are based on blockchain technology and as such, their prices are determined by a number of technical indicators. These indicators can be used to predict changes in the prices of cryptocurrencies, as well as to measure the overall health of the blockchain industry.

Some of the most important technical indicators for cryptocurrencies include the following:

Bitcoin price. This is the most important technical indicator for cryptocurrencies, as it is the main currency that is traded on the market. The price of Bitcoin is determined by a number of factors, including global demand and supply, political events, and technical analysis.

Dollar value of cryptocurrency. This is another important indicator, as it shows the total value of all cryptocurrencies in circulation. The dollar value of cryptocurrency is determined by a number of factors, including global demand and supply, political events, and technical analysis.

Volume of cryptocurrency trading. This indicator shows the amount of cryptocurrency that is being traded on the market. It is important to note that this volume is constantly changing, and can be affected by a number of factors, including global demand and supply, political events, and technical analysis.

Blockchain industry health. This indicator measures the overall health of the blockchain industry, by looking at factors such as market cap, user base, and number of transactions.

How to profit from changing crypto prices

There is no guaranteed way to profit from changing cryptocurrency prices, but some methods are available.

1. Invest in a cryptocurrency mining rig

Mining cryptocurrencies is a process of solving complex mathematical problems to earn rewards in the form of new cryptocurrency. GPUs are the best hardware for mining cryptocurrencies, as they offer great processing power and heat dissipation.

2. Trade cryptocurrencies

Many people trade cryptocurrencies in order to make a profit. Trade strategies vary, but typically, you want to buy low and sell high. It’s important to do your research before making any trades, as various factors can affect prices including news, global economic conditions, and trader sentiment.

3. Hold cryptocurrencies

Some people choose to hold cryptocurrencies in order to gain long-term value appreciation. Cryptocurrencies are generally considered to be relatively volatile, so it’s important to do your research and monitor prices closely in order to make the most informed decisions.