Crypto Prices Comparison

This article provides a crypto prices comparison, allowing users to see the prices of various cryptocurrencies side-by-side.

How to Compare Crypto Prices: A Beginner's Guide

When you want to compare crypto prices, you need to understand how to do it. This guide will walk you through the basics of how to compare crypto prices.

First, you need to identify the coins or tokens you are interested in. You can do this by searching for them on a variety of cryptocurrency exchanges and databases.

Once you have identified the coins or tokens, you need to find an exchange that offers them. Exchanges offer a variety of features, so it is important to choose one that offers the features you are looking for.

Once you have found an exchange, you need to find the coins or tokens you are interested in. This can be done by searching for them on the exchange, or by using the exchange's search function.

After you have found the coins or tokens, you need to find their prices on the exchange. To do this, you need to look at the buy and sell tabs on the exchange, or use the exchange's order book.

Once you have found the prices, you can compare them to each other to see which is the best deal.

The Different Ways to Compare Crypto Prices

There are a variety of ways to compare crypto prices, and each has its own advantages and disadvantages.

1. CoinMarketCap

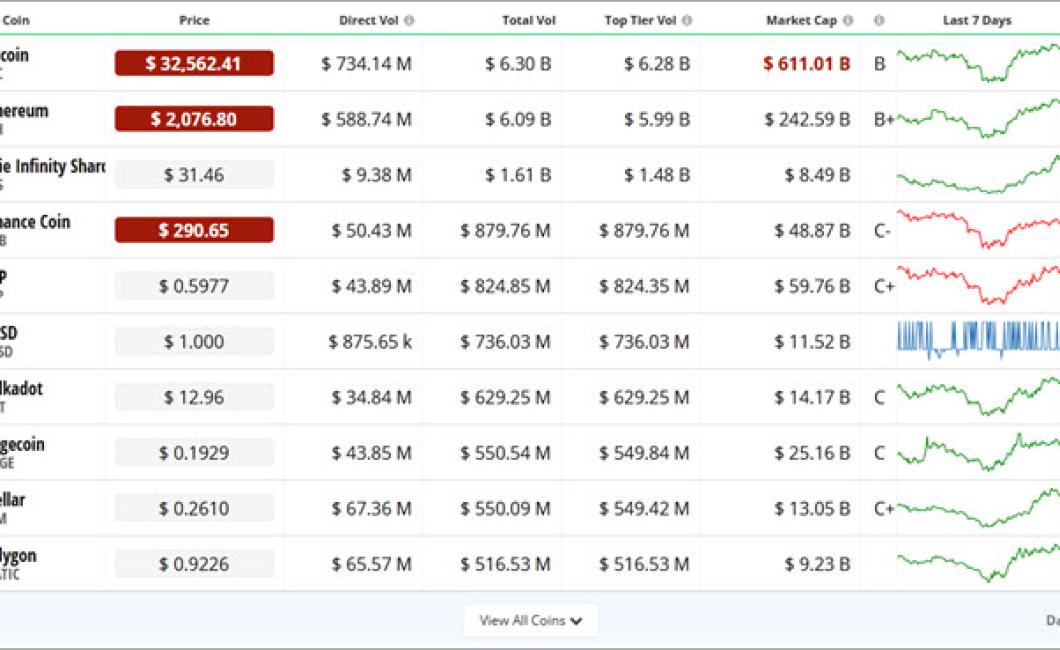

CoinMarketCap is probably the most well-known and widely used crypto price comparison tool. It provides real-time data on the prices of over 6000 cryptocurrencies, as well as their market capitalization and circulating supply.

CoinMarketCap has several advantages. First, it's very user-friendly: you can search for a specific cryptocurrency, or compare the prices of multiple cryptocurrencies simultaneously. Second, it's quite comprehensive: it includes data on a wide range of factors, such as market capitalization, trading volume, and price change over time.

However, CoinMarketCap can be a bit overwhelming for beginners. It can be difficult to find the information you're looking for, and the charts can be hard to understand.

2. CoinDesk

CoinDesk is another well-known crypto price comparison tool. It provides data on the prices of over 3000 cryptocurrencies, as well as their market capitalization and circulating supply.

CoinDesk has several advantages. First, it's very user-friendly: you can search for a specific cryptocurrency, or compare the prices of multiple cryptocurrencies simultaneously. Second, it's quite comprehensive: it includes data on a wide range of factors, such as market capitalization, trading volume, and price change over time.

However, CoinDesk can be a bit less comprehensive than CoinMarketCap. For example, it doesn't include data on price change over time (only market capitalization). Additionally, CoinDesk's charts can be difficult to understand.

3. CoinGecko

CoinGecko is a relatively new crypto price comparison tool. It provides data on the prices of over 2000 cryptocurrencies, as well as their market capitalization and circulating supply.

CoinGecko has several advantages. First, it's very user-friendly: you can search for a specific cryptocurrency, or compare the prices of multiple cryptocurrencies simultaneously. Second, it's quite comprehensive: it includes data on a wide range of factors, such as market capitalization, trading volume, and price change over time.

CoinGecko also has some unique features not found in other tools, such as a "live" market cap chart that updates every few minutes. However, CoinGecko's charts can be difficult to understand, and it doesn't have as much data as some of the other tools.

4. CoinMarketCap (Android)

CoinMarketCap (Android) is a free app that provides data on the prices of over 6000 cryptocurrencies, as well as their market capitalization and circulating supply.

CoinMarketCap (Android) has several advantages. First, it's very user-friendly: you can search for a specific cryptocurrency, or compare the prices of multiple cryptocurrencies simultaneously. Second, it's quite comprehensive: it includes data on a wide range of factors, such as market capitalization, trading volume, and price change over time.

However, CoinMarketCap (Android) can be a bit less comprehensive than CoinMarketCap. For example, it doesn't include data on price change over time (only market capitalization). Additionally, CoinMarketCap (Android)'s charts can be difficult to understand.

The Pros and Cons of Comparing Crypto Prices

There are a few pros and cons to comparing crypto prices.

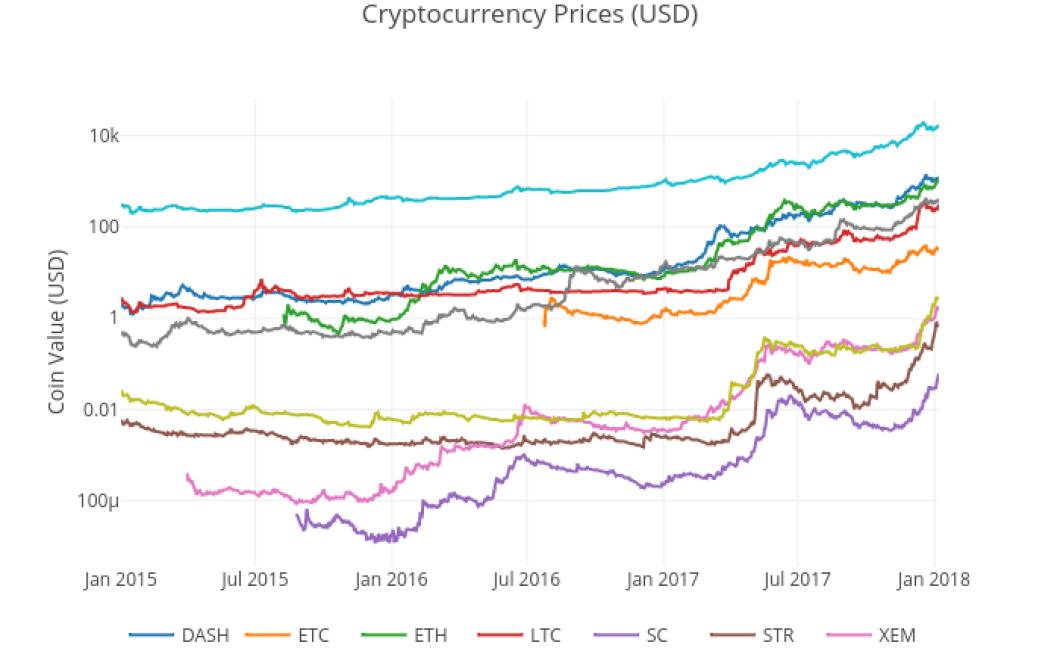

One pro is that it can be a quick and easy way to see how prices have changed over time.

Another pro is that it can help you get an idea of where the market is headed.

However, there are also some cons to comparing crypto prices.

One con is that it can be difficult to discern the real value of a cryptocurrency when comparing it to others.

Another con is that it can be risky to invest in a cryptocurrency based on its price alone.

Why You Should (or Shouldn't) Compare Crypto Prices

Cryptocurrencies are unique in that their prices are often highly volatile and can be difficult to predict. Consequently, it is often tempting to compare cryptocurrency prices in order to make informed decisions about whether or not to buy or sell. However, there are a few reasons why you should (or shouldn't) compare crypto prices:

1. Crypto Prices Are Volatile

Cryptocurrencies are often highly volatile, which means that their prices can change rapidly and without warning. This makes it difficult to make informed decisions about whether or not to buy or sell, and can also lead to some investors becoming emotionally attached to their investments and becoming too afraid to sell even when the price has fallen significantly.

2. Crypto Prices Are Subject to Manipulation

Many people believe that cryptocurrencies are subject to manipulation, which means that their prices can be artificially inflated or deflated by a third party in order to gain an advantage in the market. This can lead to investors losing money, and it is therefore important to be cautious when comparing cryptocurrency prices.

3. Crypto Prices Are Highly Volatile

Even if a cryptocurrency is not subject to manipulation, its prices are still highly volatile. This means that even small changes in the price of a cryptocurrency can have a large impact on its value. It is therefore important to be patient when investing in cryptocurrencies, and to avoid making hasty decisions based on inaccurate information.

4. There Is No Guarantee That a Cryptocurrency Will Continue to Grow

Cryptocurrencies are unique in that their value is based on the belief that they will continue to grow in popularity and value. However, this is not always the case, and there is no guarantee that a cryptocurrency will continue to grow in value. Therefore, it is important to be prepared for a cryptocurrency's value to fluctuate, and to only invest what you are willing to lose.

How to Use Price Comparisons to Your Advantage

When you are looking at prices of items, be sure to use price comparisons to your advantage. By doing this, you will be able to find the best deal on the items you are looking for.

Here are some tips to help you use price comparisons to your advantage:

1. Compare multiple stores.

When you are looking at prices, it is important to compare multiple stores. This way, you will be able to get the best possible deal on the items you are looking for.

2. Look for sales.

When you are looking for prices, be sure to look for sales. This way, you can save even more money on the items you are looking for.

3. Compare shipping costs.

When you are looking at prices, be sure to compare shipping costs as well. This way, you will be able to find the best possible deal on the items you are looking for.

The Best Times to Compare Crypto Prices

There is no single answer to this question, as the best time to compare crypto prices will vary depending on the cryptocurrency in question, the time of day, and your location. However, some general tips that may help include checking cryptocurrency prices regularly throughout the day, using a cryptocurrency tracking app, and keeping up to date with news and announcements.

The Worst Times to Compare Crypto Prices

There are a number of times when it is not the best idea to compare crypto prices. Here are four of the worst times to do so:

1. When the market is volatile

When the crypto market is volatile, it is difficult to make accurate comparisons between different coins. This is because prices can change rapidly and unpredictably, making it difficult to determine which coin is actually worth investing in. If you are looking to invest in cryptocurrencies, it is important to be prepared for the possibility of large price fluctuations.

2. When the market is in a bubble

When the cryptocurrency market is in a bubble, prices are inflated beyond what is justified by the underlying fundamentals of the market. This means that it is often difficult to make accurate comparisons between different coins. If you are looking to invest in cryptocurrencies, it is important to be aware of the fact that these markets can be highly volatile and prone to crashes.

3. When the market is in a bear market

When the cryptocurrency market is in a bear market, prices are depressed relative to their historical norms. This means that it is often difficult to find good deals on cryptocurrencies. If you are looking to invest in cryptocurrencies, it is important to be prepared for the possibility of long-term declines in prices.

4. When the market is experiencing turmoil

When the cryptocurrency market is experiencing turmoil, this can lead to widespread price crashes. This makes it difficult to make accurate comparisons between different coins. If you are looking to invest in cryptocurrencies, it is important to be aware of the fact that these markets can be very volatile and prone to crashes.

How to Get the Most Out of Crypto Price Comparisons

Cryptocurrencies are volatile and can change quickly in value. It is important to do your own research when making price comparisons.

1. Consider the Time Frame for the Comparisons

Cryptocurrencies can be very volatile and can change quickly in value. Make sure to compare prices over a short period of time, such as a day or a week. Compare prices over a longer period of time, such as a month or a year.

2. Consider the Volume of the Cryptocurrencies

Cryptocurrencies are often traded on decentralized exchanges. This means that the number of transactions that take place affects the prices. When there is a large volume of trades, the prices for the cryptocurrencies will be higher. When there is less volume, the prices for the cryptocurrencies will be lower.

3. Consider the Geographic Location of the Cryptocurrencies

Cryptocurrencies are often traded on decentralized exchanges. This means that the prices for the cryptocurrencies can vary depending on where in the world the trader is located. When there is a large concentration of traders in a particular region, the prices for the cryptocurrencies will be higher. When there is less concentration of traders, the prices for the cryptocurrencies will be lower.