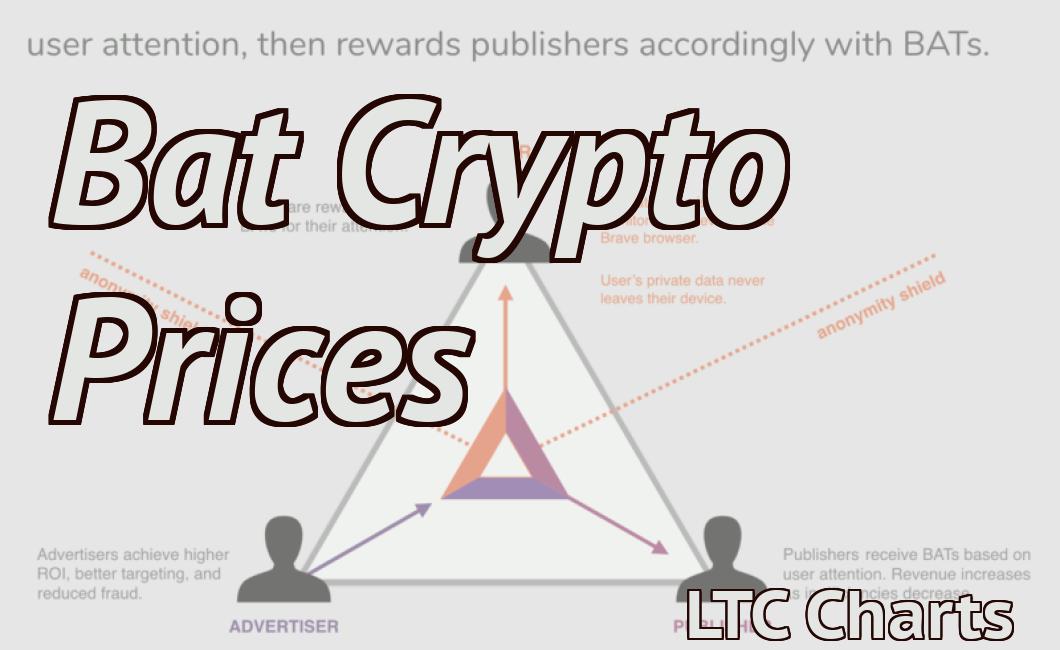

How to read cryptocurrency prices based on bitcoin.

Bitcoin is the world's first and most popular cryptocurrency, and its price has been highly volatile since it was first created in 2009. In this article, we'll explain how to read cryptocurrency prices based on bitcoin, and how you can use this information to make better investment decisions.

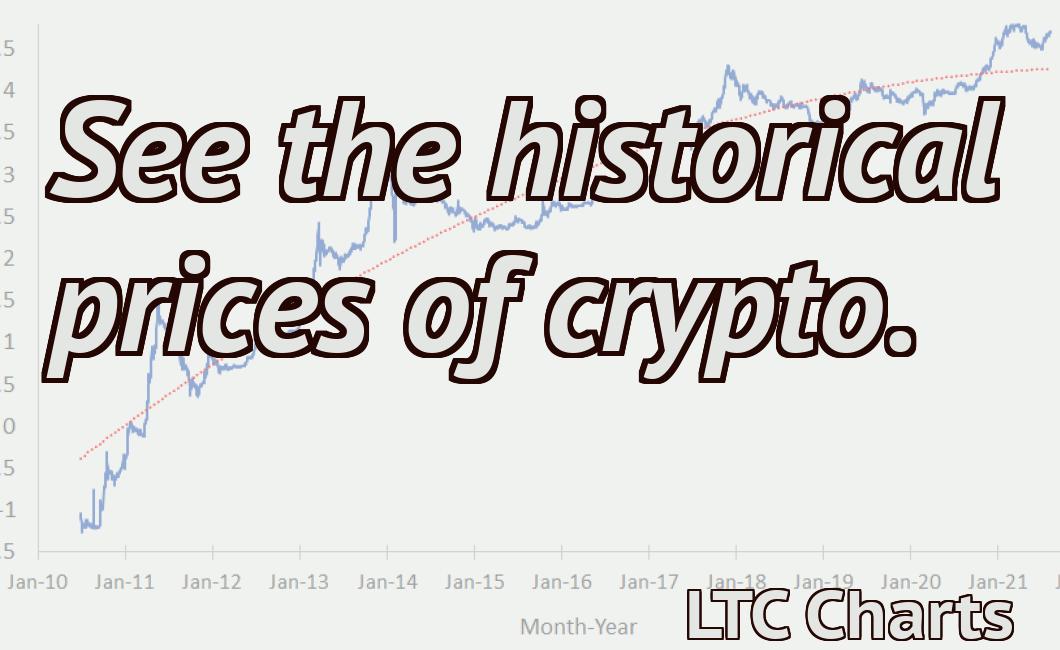

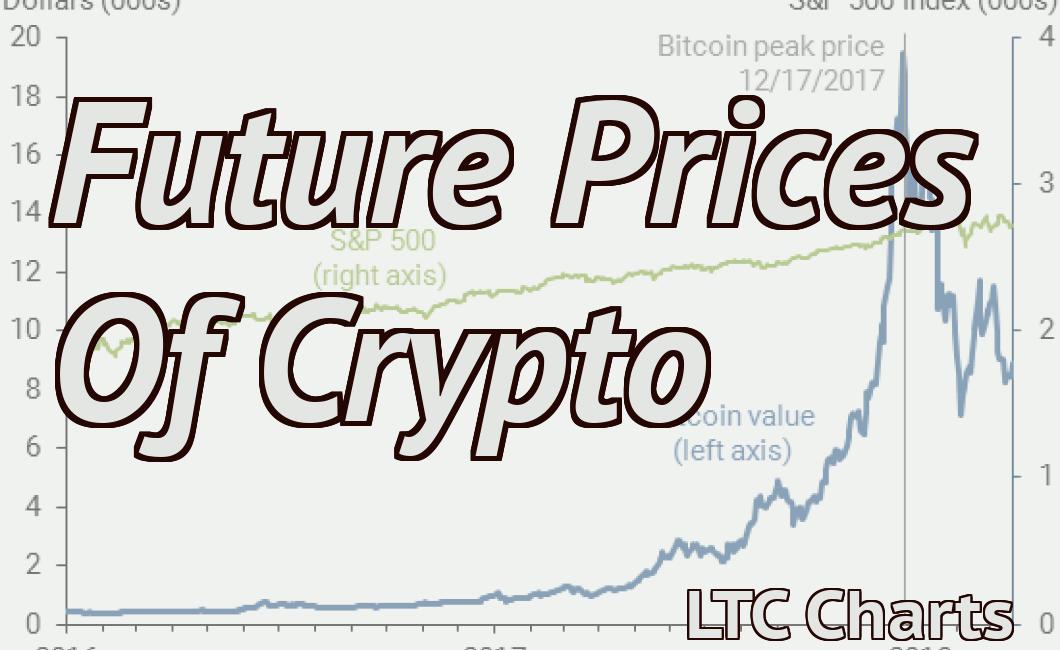

Bitcoin price analysis – how to read the charts and interpret the data

Reading the charts on bitcoin is a great way to get a sense for what's going on with the cryptocurrency. Here's a guide on how to read the charts and interpret the data.

Bitcoin price analysis – the basics

The first thing to understand is that bitcoin is traded on exchanges between different currencies. This means that the prices shown on the charts are not always accurate, as they are based on an exchange rate.

A couple of things to note when looking at the charts:

The price of bitcoin is usually in a downward trend. This means that over time, the value of bitcoin has fallen.

The price of bitcoin can go up or down a lot, which means that it's not always a good indicator of where the cryptocurrency is heading.

Bitcoin price analysis – moving averages

Moving averages are a handy way to help you understand whether the price of bitcoin is trending up or down. They show you how much the price has fluctuated over a certain period of time.

The two most common moving averages used for bitcoin are the 50-day and 100-day moving averages.

The 50-day moving average shows you how much the price has fluctuated over the past 50 days. The 100-day moving average shows you how much the price has fluctuated over the past 100 days.

Both moving averages can be used to help you determine whether the price of bitcoin is trending up or down.

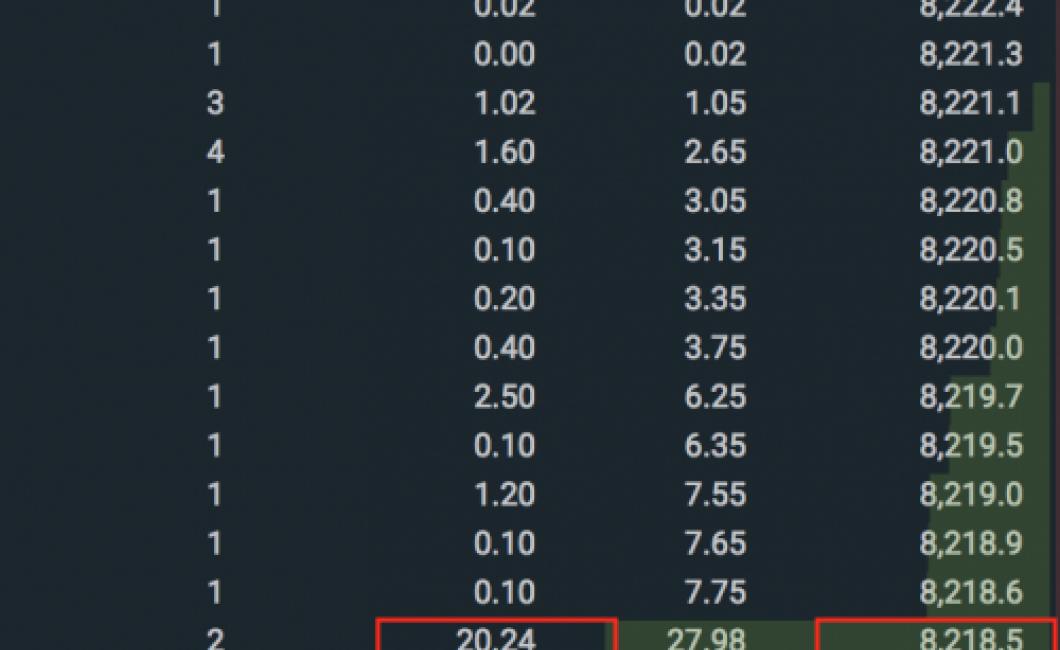

Bitcoin price analysis – volume

Volume is another important factor to consider when looking at bitcoin charts. Volume indicates how many bitcoins are being traded on an exchange.

When the volume is high, it indicates that there is a lot of interest in the cryptocurrency. When the volume is low, it may indicate that there is not a lot of interest in bitcoin.

Bitcoin price analysis – technical indicators

There are several technical indicators that can be used to help you understand how the bitcoin market is performing.

The most common technical indicator used for bitcoin is the Bollinger Band. The Bollinger Band shows you how volatile the price of bitcoin is, relative to its average.

Another technical indicator that is commonly used for bitcoin is the RSI (Relative Strength Index). The RSI indicates how strong the momentum of the bitcoin market is.

How to make money from bitcoin – a beginner's guide to cryptocurrency trading

Cryptocurrency trading is a process where investors buy and sell cryptocurrencies, such as bitcoin and ether, in order to make money. There are a few different ways to make money from bitcoin trading, and this beginner's guide will outline the most common methods.

1. Day trading bitcoin

Day trading is the most common way to make money from bitcoin trading. This involves trading bitcoin on a regular basis in order to make a profit. Day trading is risky, and it is important to do your research in order to ensure that you are making the right decisions.

2. Trading bitcoin and other cryptocurrencies

Another way to make money from bitcoin trading is to trade bitcoin and other cryptocurrencies. This involves buying and selling cryptocurrencies in order to make profits. This is a more complex process than day trading, and it is important to have a good understanding of cryptocurrency trading strategies in order to succeed.

3. Investing in bitcoin and other cryptocurrencies

Another way to make money from bitcoin trading is to invest in bitcoin and other cryptocurrencies. This involves buying into a cryptocurrency project in order to gain profits. This is a more long-term approach than day trading or trading cryptocurrencies, and it requires a lot of patience and skill.

Bitcoin – is it worth investing in the digital currency?

Bitcoin is a digital currency created in 2009. Bitcoin is not backed by any government or central bank, and there is no physical Bitcoin currency. Bitcoin is traded on decentralized exchanges and can also be used to purchase goods and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.

How to buy Bitcoin – a step-by-step guide to purchasing cryptocurrency

If you want to purchase Bitcoin, you first need to find an exchange that will allow you to do so. There are a number of exchanges available, so it is important to find one that is reputable and has good customer service.

Once you have found an exchange, you will need to create an account and provide some personal information. Next, you will need to deposit money into your account in order to purchase Bitcoin. Once you have deposited money, you can then trade Bitcoin for other cryptocurrencies or fiat currencies.

What is Bitcoin – a brief introduction to the world's first digital currency

Bitcoin is a digital or virtual currency created in 2009. Unlike traditional currencies such as the U.S. dollar, Bitcoin is not regulated by a central bank or government. Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services.

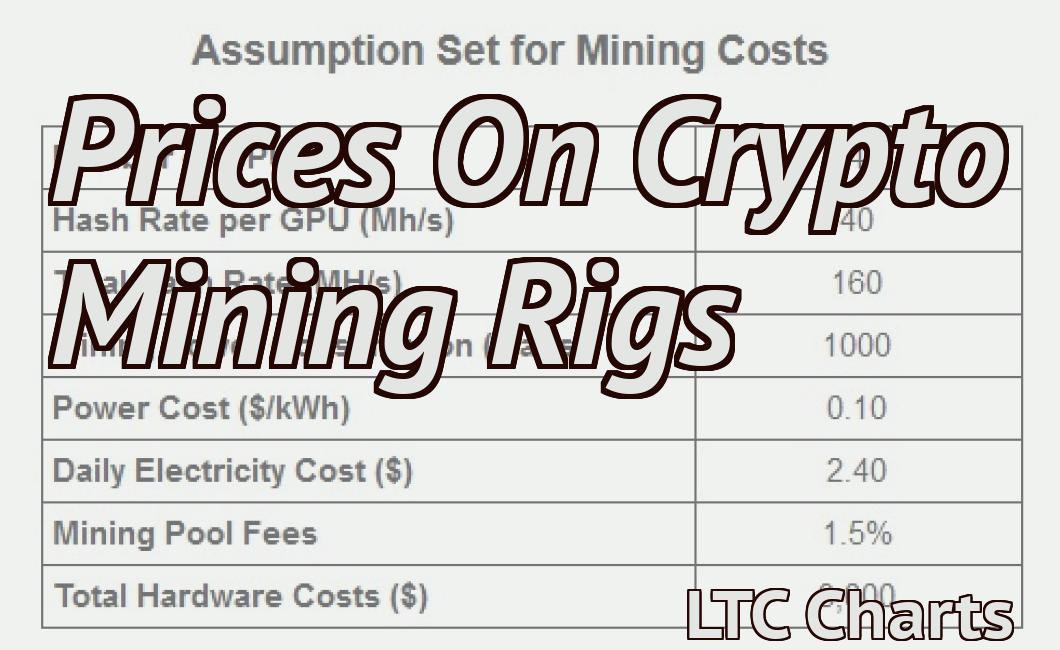

How to mine Bitcoin – a beginner's guide to cryptocurrency mining

Cryptocurrency mining is the process of verifying and adding new transactions to the blockchain. Miners are rewarded with cryptocurrency for their efforts. Bitcoin, the most well-known cryptocurrency, is mined using a distributed network of computers.

To start mining bitcoin, you will need to acquire some bitcoin mining software. There are many different programs available, so it is important to find one that fits your hardware and mining configuration. Once you have the software, you can start mining bitcoin.

There are a few things you will need to keep in mind while mining bitcoin. The first is to make sure your computer is equipped with the required hardware. You will need a bitcoin mining hardware, such as a graphics card, CPU, and motherboard. The second thing to keep in mind is to make sure your computer is running properly. Make sure your computer is configured correctly and has the latest updates installed. Finally, be sure to save your work regularly. If you lose your work, you will not be able to continue mining.

What are Bitcoin wallets – and which one should you use?

A Bitcoin wallet is a software application that allows you to store your bitcoins. There are many different wallets available, and each has its own pros and cons. The most popular wallets are Bitcoin Core and Electrum.

How to store Bitcoin – a beginner's guide to cryptocurrency storage

Bitcoin is a digital asset and a payment system invented by Satoshi Nakamoto. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin is unique in that there are a finite number of them: 21 million.

The best way to store bitcoin is to use a hardware wallet. A hardware wallet is a secure offline device that enables you to store your bitcoins offline. There are many different types of hardware wallets, and the most popular ones are TREZOR and Ledger.

If you don't have a hardware wallet, you can also store your bitcoins on an online wallet. Online wallets are easy to use, but they are not as secure as a hardware wallet.

What are Bitcoin exchanges – and how to choose the right one for you

A Bitcoin exchange is a digital marketplace where you can buy and sell bitcoin and other cryptocurrencies.

There are many different exchanges, so it’s important to choose the right one for you. Here are some tips:

1. Look for an exchange with a high level of security

One of the most important factors to consider when choosing an exchange is the level of security it offers. Look for exchanges that have implemented state-of-the-art security measures, such as 2-factor authentication and a secure login process.

2. Consider the fees associated with the exchange

Another important factor to consider is the fees associated with the exchange. Some exchanges charge a commission on each transaction, while others may charge a flat fee for all transactions.

3. Evaluate the available options for trading cryptocurrencies

When choosing an exchange, it’s important to evaluate the available options for trading cryptocurrencies. Some exchanges offer a wide variety of cryptocurrencies to trade, while others only offer a few.

4. Compare the prices of different cryptocurrencies

Another important factor to consider when choosing an exchange is the prices of different cryptocurrencies. Compare the prices of different cryptocurrencies to find the best deal.

What is the difference between Bitcoin and Ethereum?

Bitcoin is a cryptocurrency and a payment system, first proposed by an anonymous person or group of people under the name Satoshi Nakamoto in 2008. Bitcoin is decentralized, meaning it is not subject to government or financial institution control. Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference.