How do crypto exchanges determine prices?

Cryptocurrency exchanges are online platforms where you can buy, sell, or trade digital assets for other assets, such as fiat currencies or cryptocurrencies. Prices on cryptocurrency exchanges are determined by the market forces of supply and demand. When there is more demand for an asset than there is available supply, the price of the asset goes up. Conversely, when there is more supply than demand, the price goes down.

How Do Crypto Exchanges Determine Prices?

Cryptocurrencies are bought and sold on digital exchanges, where buyers and sellers agree on a price. Cryptocurrency exchanges use various techniques to calculate prices, including order books, supply and demand, and arbitrage.

By evaluating the supply and demand of the coins traded on the exchange.

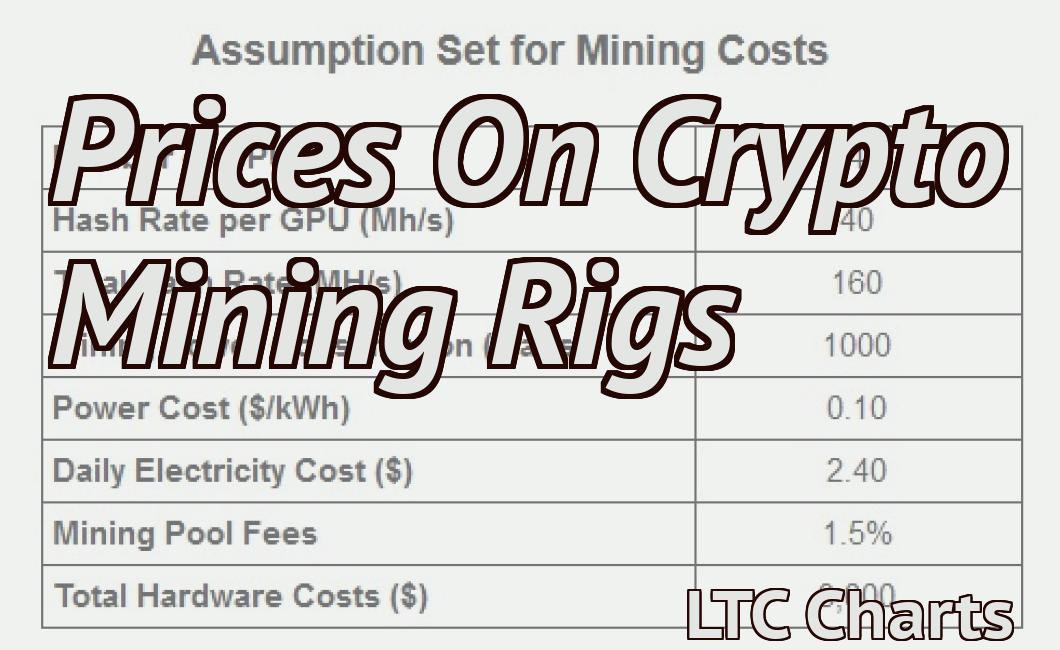

The supply of Bitcoin on the exchange is fixed at 21 million coins. The demand for Bitcoin on the exchange is also fixed at 21 million coins. Therefore, the price of Bitcoin on the exchange will always be equal to the cost of mining a new Bitcoin.

By following the prices set by other exchanges.

Binance is one of the most popular exchanges that you can use to buy and sell cryptocurrencies. Binance offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and TRON.

Some other popular exchanges for buying and selling cryptocurrencies include Coinbase, Kraken, and Bitfinex.

By setting prices based on the coin's underlying blockchain.

One way to price items using the blockchain is to use the coin's underlying blockchain as a basis for pricing. For example, if a coin has a blockchain that tracks the price of gold, then the coin could be priced in gold units. Similarly, if a coin has a blockchain that tracks the price of oil, then the coin could be priced in oil units.

By looking at the buy and sell orders placed on the exchange.

The buy order is placed at a higher price than the sell order. This indicates that the buyer believes that the price of the asset will rise.

The sell order is placed at a lower price than the buy order. This indicates that the buyer believes that the price of the asset will fall.

By considering the trading volume of the coins on the exchange.

The most popular cryptocurrency exchange in the world is Coinbase. Coinbase has a daily trading volume of over $1.5 billion. Other exchanges with high trading volumes include Binance, Bitfinex, and OKEx.

By analyzing the trends in the crypto market.

The crypto market is constantly on the rise. The total value of all cryptocurrencies has been increasing over the past few years. In January of this year, the total value of all cryptocurrencies was just over $17 billion. By mid-December of 2018, the total value of all cryptocurrencies had increased to over $7 trillion. This increase in value is due to several factors, including increasing adoption, new investment opportunities, and increasing demand from traders and investors.

There are a number of different cryptocurrencies available on the market. Bitcoin is the most well-known and dominant cryptocurrency, accounting for more than half of the total value of all cryptocurrencies. Other well-known cryptocurrencies include Ethereum, Bitcoin Cash, Litecoin, and Ripple. There are also a number of new cryptocurrencies available on the market that are not well-known yet. These new cryptocurrencies are likely to become more popular in the future.

Cryptocurrencies are not backed by any physical assets. They are instead based on a digital ledger known as a blockchain. This ledger records every transaction that takes place in the cryptocurrency system. This makes it difficult for anyone to counterfeit or fake a cryptocurrency.

The price of a cryptocurrency is determined by a number of factors, including the demand from traders and investors, the supply of available cryptocurrencies, and the performance of the cryptocurrency in the market. The price of a cryptocurrency can also be affected by events in the market, such as a major recession or financial crisis.

By studying the behavior of other investors in the market.

One way to determine whether a particular investment is a good or bad idea is to look at the behavior of other investors in the market. If other investors are buying the investment, it may be a good idea to buy as well. If other investors are selling the investment, it may be a good idea to sell as well.

By using algorithms to predict future prices.

An algorithm is a set of instructions for solving a problem. Algorithms can be used to predict future prices, especially if you have data on past prices.

By making use of artificial intelligence to study price patterns.

One way to use artificial intelligence to study price patterns is to create a model that can identify trends in prices over time. By understanding how prices change over time, you can better predict future prices and make more informed investment decisions.

Another way to use artificial intelligence to study price patterns is to use machine learning algorithms to analyze historical data. This can help you identify patterns in customer behavior, product demand, and other market indicators. By understanding these patterns, you can better predict future trends and make more informed investment decisions.

By tracking the social media Sentiment around cryptocurrencies.

Looking at the sentiment on social media around cryptocurrencies can provide a valuable insight into the public’s opinion on the technology. For example, if the sentiment is positive, this could suggest that more people are interested in cryptocurrencies and may be potential future investors. Conversely, if the sentiment is negative, this could suggest that the public is not as interested in cryptocurrencies and may be less likely to invest in them.

By evaluating news and events that could impact prices.

-Brexit

-China devaluation

-U.S. trade war with China

-Mexico tariffs

-Saudi Arabian oil production

Brexit

The Brexit referendum on the United Kingdom's membership in the European Union was held on 23 June 2016. The result was a victory for the "leave" campaign, with 51.9% of the vote. This decision has since led to the United Kingdom leaving the European Union on 29 March 2019. This could lead to a decrease in demand for UK goods, as well as an increase in prices for goods imported from other countries.

China devaluation

On 1 August 2018, the Chinese government announced that it would be devaluing its currency, the renminbi. This move was designed to make Chinese exports more competitive in the global market and to stimulate economic growth. The devaluation caused global markets to react negatively, with stock prices worldwide falling by approximately 2%. The renminbi continued to depreciate over the next few months, reaching a new low of 6.9 to the U.S. dollar on 5 December. This could lead to an increase in prices for goods imported from China, as well as a decrease in demand for Chinese goods exported overseas.

U.S. trade war with China

On 6 September 2018, the United States announced that it would be beginning a trade war with China. This conflict began with U.S. tariffs on Chinese goods, which were increased to 25% on $200 billion worth of imports on 25 July 2018. In response, China announced that it would be increasing tariffs on a number of U.S. products, including pork and soybeans. The trade war has continued to escalate, with the United States announcing on 16 December 2018 that it would be imposing tariffs on an additional $267 billion worth of Chinese goods. This conflict could lead to a decrease in demand for Chinese goods, as well as an increase in prices for goods imported from the United States.

Mexico tariffs

On 25 May 2019, the United States announced that it would be imposing tariffs on imported goods from Mexico. The tariffs would apply to a variety of items, including pork, aluminum, and steel. Mexico responded by imposing its own tariffs on a number of U.S. goods, including pork and tomatoes. This conflict could lead to a decrease in demand for Mexican goods, as well as an increase in prices for goods imported from the United States.

Saudi Arabian oil production

On 12 November 2017, Saudi Arabia announced that it would be producing more oil than previously estimated. This decision was made in order to try and offset the impact of the global oil price crash, which was caused by OPECmembers reducing their production. The increased production could lead to an increase in prices for oil and gas products, as well as a decrease in demand for these items.

By consulting with experts in the field to get their opinion on prices

When pricing a product, it is important to consult with experts in the field to get their opinion on prices. This will help ensure that the prices you set are appropriate and will not lead to lower sales or damage your brand.