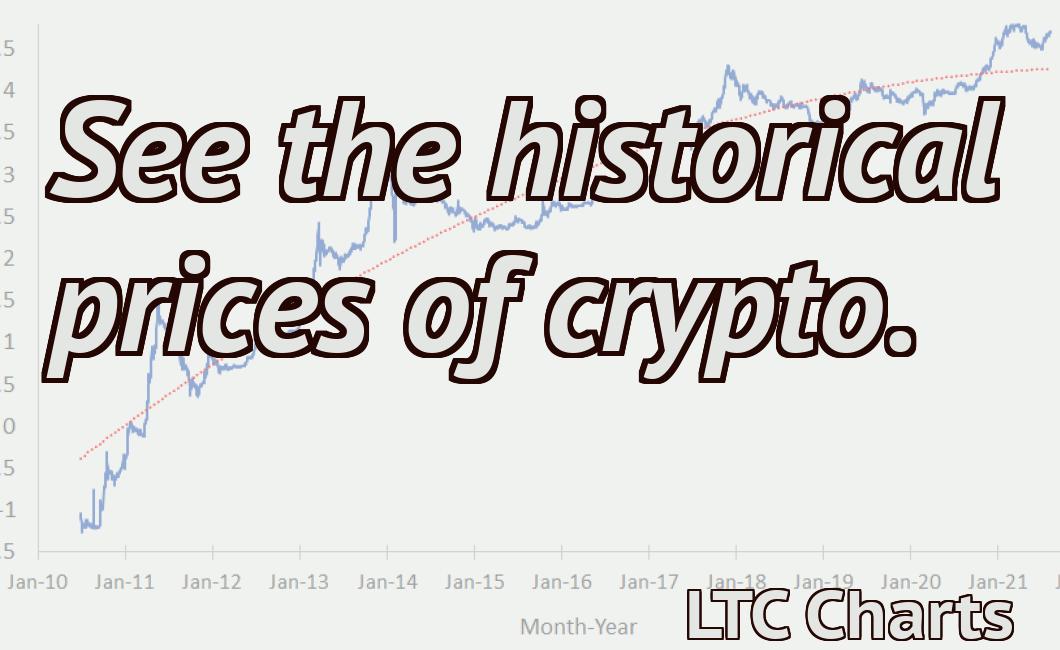

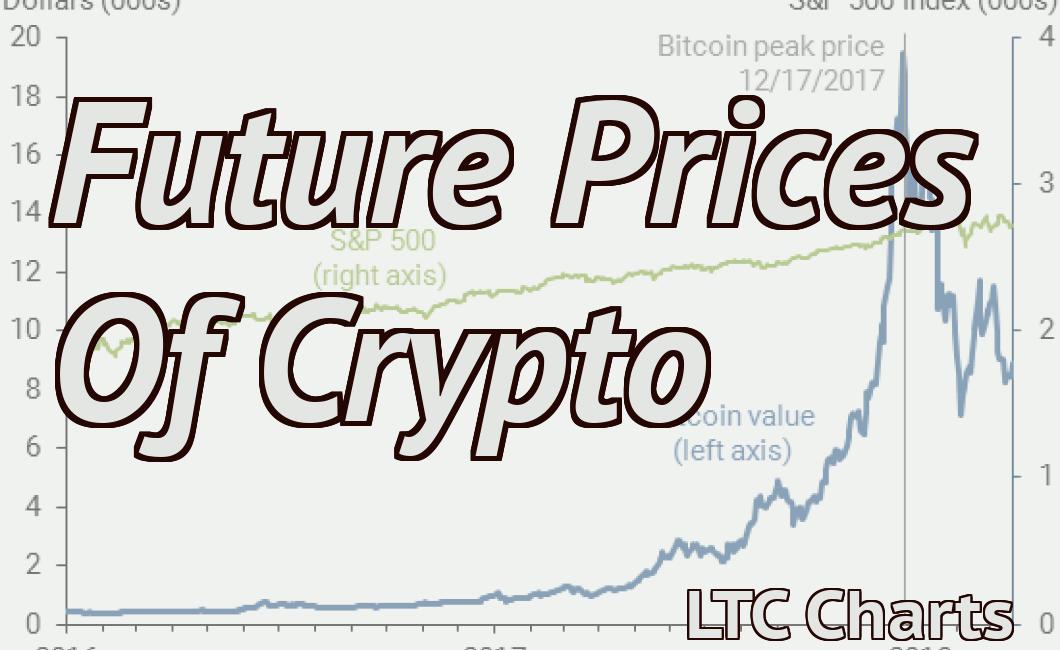

Will crypto prices rise again?

The article looks at whether cryptocurrency prices will rebound after a sharp decline in 2018. It notes that some experts are optimistic about the prospects for 2019, while others are more cautious.

Is the crypto market due for a rebound?

There is no one answer to this question as the answer will depend on a variety of factors, including overall market conditions, regulatory developments, and individual investor sentiment. However, if past trends are any indication, a rebound in the crypto market is likely in the near future.

How soon could we see another crypto price surge?

Cryptocurrencies are notoriously volatile and can see large price swings over short periods of time. While it is impossible to predict the exact timing of future price surges, it is generally safe to say that they will occur in waves, with each surge followed by a period of consolidation and eventual decline.

What factors are influencing crypto prices at the moment?

Cryptocurrency prices are influenced by a number of factors, including global economic conditions, regulatory changes, technical analysis, and investor sentiment.

Are there any signs that crypto prices will start to rise again?

There is no definitive answer, but some indicators suggest that prices may start to rise again in the near future. For example, the number of new cryptocurrency wallets being created has been on the rise in recent months, which suggests that more people are becoming interested in cryptocurrencies. Additionally, the number of exchanges listing new cryptocurrencies has been increasing, which suggests that more people are becoming interested in trading cryptocurrencies.

Why did crypto prices drop in the first place?

There are a variety of reasons why crypto prices could drop. For example, if a major financial institution announces that it is going to start trading cryptocurrencies, this could cause a sell-off in the market. Additionally, if there is news that a government is planning to crackdown on cryptocurrencies, this could cause investors to sell off their tokens.

Could government regulation impact crypto prices in the future?

There is no definitive answer to this question as it largely depends on the specific regulations in place. However, some observers believe that tighter regulation could lead to a decline in prices, while others believe that it could have a minimal impact. Ultimately, it is difficult to say for certain what the future holds for crypto prices.

What do experts think about the current state of the crypto market?

There is no one definitive answer to this question, as opinions on the current state of the crypto market vary greatly. Some experts believe that the market is in a bubble, while others believe that it is still in its early stages and has plenty of potential for growth.

Is there anything investors can do to prepare for another price surge?

There is no surefire way to predict when or if a price surge will happen, but investors can take some basic steps to prepare for the possibility. First, be aware of current market conditions and what is driving prices up. Secondly, be aware of potential catalysts that could cause a price surge, such as new product releases, regulatory changes, or economic indicators. Finally, keep an eye on overall market volatility and make sure to have a diversified portfolio in case prices go up and down significantly.

What are the risks of investing in cryptocurrencies?

There are a number of risks associated with investing in cryptocurrencies, including the risk of losing all your money. Other risks include the risk that a cryptocurrency may not be accepted as a valid payment method, the risk of cyber-attacks, and the risk of market volatility.

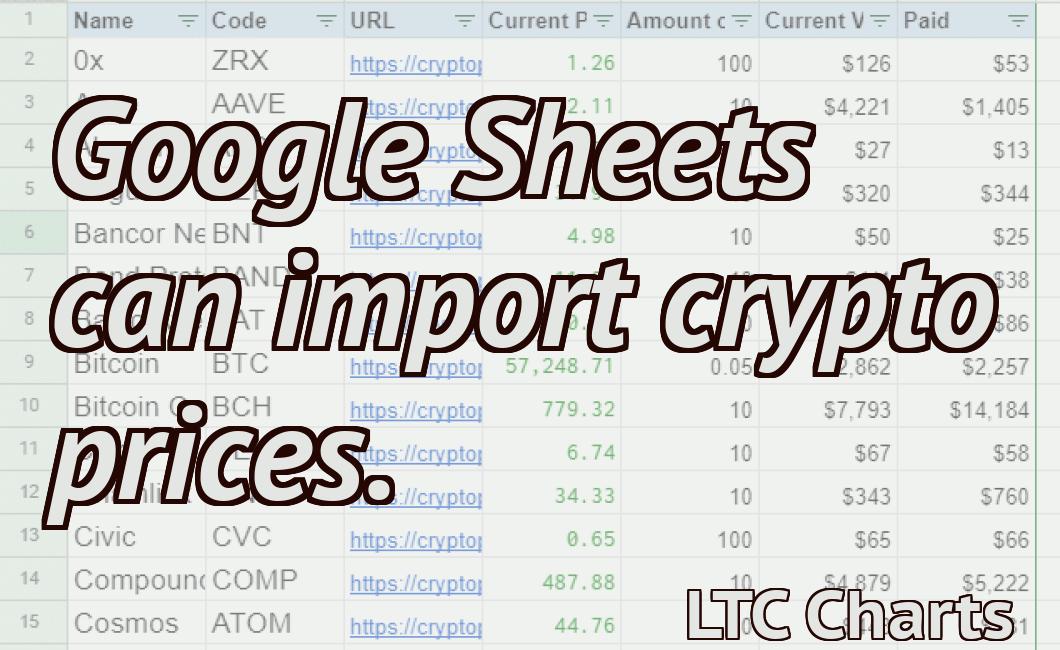

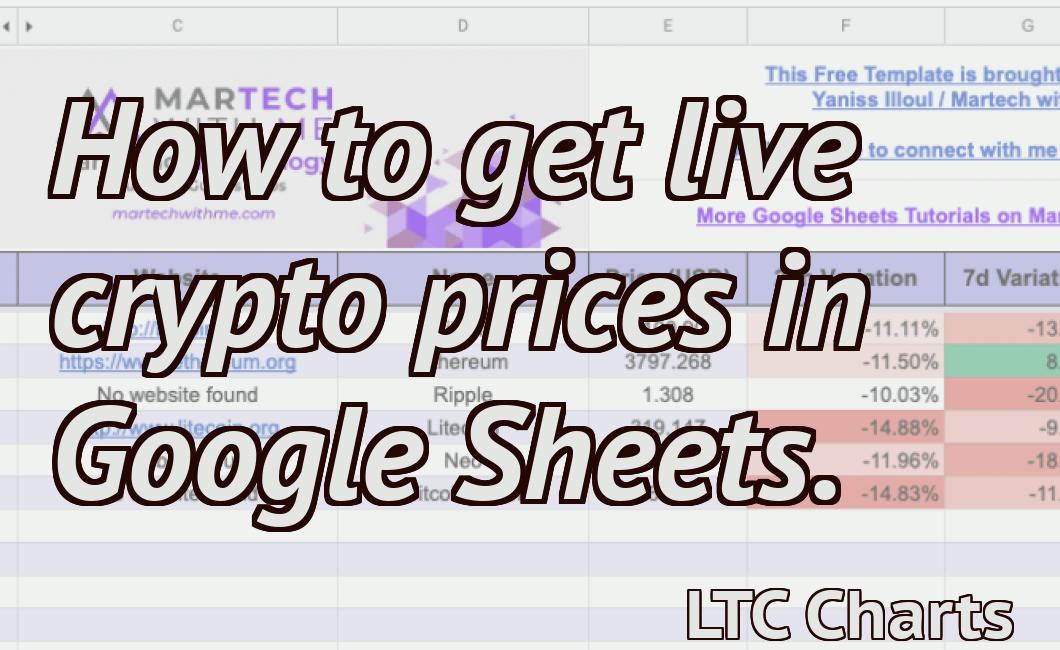

How can investors diversify their portfolios with cryptocurrencies?

Cryptocurrencies can be used to diversify a portfolio of investments by providing an additional avenue for risk and return. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them appealing to some investors who want to take on greater risk. Cryptocurrencies also offer the potential for greater returns than traditional investments, though this is still a relatively new phenomenon.

What are the tax implications of investing in cryptocurrencies?

The tax implications of investing in cryptocurrencies are not well understood. Generally, cryptocurrencies are treated as property, meaning that they are subject to capital gains and losses. However, there is still much uncertainty surrounding how cryptocurrencies will be taxed in the future.