Crypto Charts G

Crypto Charts G is a simple guide to reading and understanding cryptocurrency charts. It covers the basics of chart types, order types, and technical indicators.

Bitcoin Price Analysis: BTC Primed for a Reversal as Charts Show Overdue Corrective Move

The Bitcoin price is primed for a reversal as charts show overdue corrective move.

Bitcoin Price Analysis

Bitcoin price has been trading in a narrow range since the beginning of the month, with no clear indication of where the market is heading next. The BTC/USD pair has been stuck in a sideways trading range for weeks now, with no clear signs of a bullish or bearish trend.

However, looking at the charts, it appears that a corrective move is overdue. The BTC/USD pair has been trading below the $6,000 support level for a few weeks now, and it seems like the market is ready to break out of the current range and head south.

The RSI indicator is also pointing south, indicating that the market is ready to correct. If the BTC/USD pair breaks out of the current range and heads south, it could reach the $5,000 support level before making a move higher.

However, there are also risks associated with such a move. The market could also reverse and head north, potentially ending up below the $6,000 support level. Therefore, it is important to stay cautious and wait for more confirmation before making any investment decisions.

Bitcoin Price Prediction

There is no reliable Bitcoin price prediction at this point in time, as the market is still in a very volatile state. However, if the current range does break out and the BTC/USD pair heads south, it is likely that the price will fall below the $5,000 support level.

If that happens, it would be a good time to buy Bitcoin at a discounted price and hold on to it for future gains. However, it is also important to keep in mind that the market can change quickly and there is no guarantee that the price will reach $5,000. So, it is important to stay patient and wait for more confirmation before making any investment decisions.

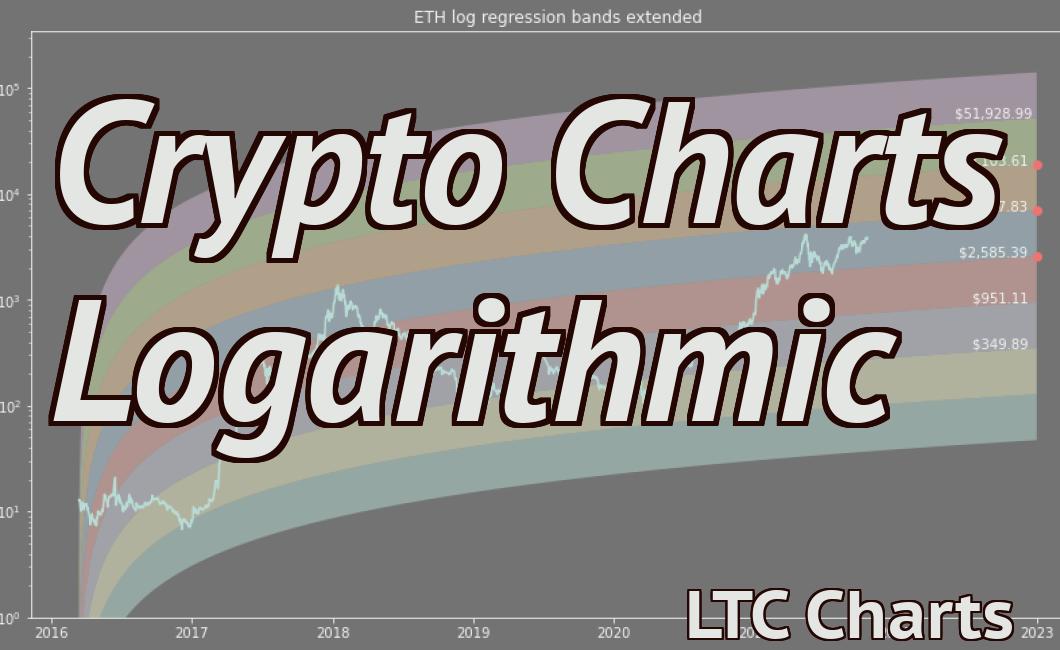

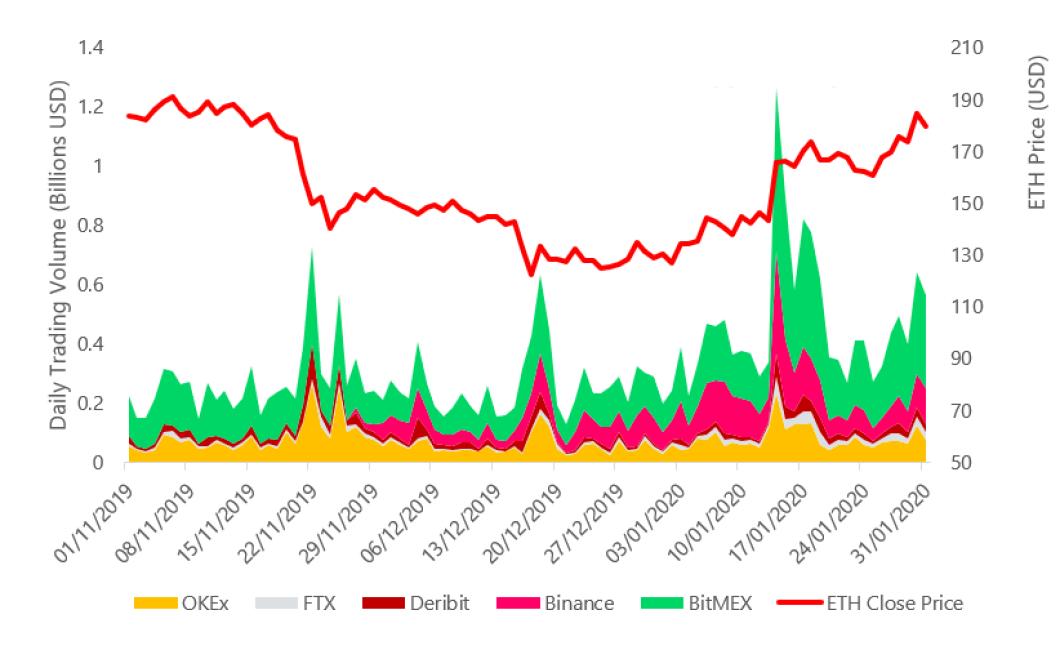

Ethereum Price Prediction: ETH Could Retrace to $250 as Charts Indicate Oversold Conditions

The Ethereum price prediction market is predicting that the Ethereum price will retrace to $250. The market is indicating that there are oversold conditions in the Ethereum market, and that a rebound could be in store.

Ethereum Price Prediction: ETH Could Retrace to $250

The Ethereum price prediction market is predicting that the Ethereum price will retrace to $250. The market is indicating that there are oversold conditions in the Ethereum market, and that a rebound could be in store.

The Ethereum price prediction market is a popular tool used by traders and investors to make informed decisions about the future price of Ethereum. The Ethereum price prediction market allows users to buy and sell Ethereum predictions, which allows for greater liquidity and transparency in the Ethereum market.

The Ethereum price prediction market is a popular tool used by traders and investors to make informed decisions about the future price of Ethereum. The Ethereum price prediction market allows users to buy and sell Ethereum predictions, which allows for greater liquidity and transparency in the Ethereum market.

Oversold Conditions in the Ethereum Market

The Ethereum price prediction market is indicating that there are oversold conditions in the Ethereum market. Oversold conditions indicate that the market is likely to rebound, and could lead to a return to previous highs.

The Ethereum price prediction market indicates that a return to $250 is most likely. The market is indicating that there are oversold conditions in the Ethereum market, and that a rebound could be in store.

Litecoin Price Forecast: LTC Rallies to $50 as Market Sentiment Improves

The market sentiment has improved for Litecoin in the past week, with the coin rallying to $50.

Litecoin Price Forecast: LTC Rallies to $50 as Market Sentiment Improves

The market sentiment has improved for Litecoin in the past week, with the coin rallying to $50. The price of Litecoin is up 6% in the past 24 hours, and is currently trading at $48.10.

Litecoin is up over 60% in the past month, and is currently the fifth largest cryptocurrency by market capitalization. The rally in Litecoin prices is likely attributable to increased investor interest and the positive sentiment seen in the market.

Litecoin is seen as a potential replacement for Bitcoin as the go-to cryptocurrency for online payments. The popularity of Litecoin may also be attributed to its lower fees compared to Bitcoin.

Despite the rally in Litecoin prices, the overall market sentiment is still bearish. Ethereum is up over 10% in the past 24 hours, while Bitcoin is down 2%. The market appears to be slowly recovering, with a number of large digital currencies seeing slight gains over the past week.

Bitcoin Cash Price Analysis: BCH/USD Consolidates Above $400, Charts Suggest Further Gains

Bitcoin Cash price has been consolidating above the $400 level for the past few days, with a few brief dips below this level. However, the trend seems to be reversing as the BCH/USD pair is now looking set for more gains in the near future.

Looking at the 4-hour chart, the BCH/USD pair has been consolidating above the $400 level for the past few hours. There was a small dip below $400 earlier today, but the BCH/USD pair has since recovered and is now looking set for further gains.

If the BCH/USD pair continues to consolidate above the $400 level, it could reach as high as $450 or even $460. Higher prices could lead to more upside momentum in the near future, so it would be worth keeping an eye on this market.

Ripple Price Prediction: XRP/USD Rangebound Between $0.25 and $0.30, Charts Show

Ripple price is trading in a rangebound pattern between $25 and $0.30. The latest market data shows that the Ripple price is stable and is not facing any major pressure. However, the long-term chart suggests that the Ripple price could reach up to $0.40.

XRP/USD Price Prediction:

The XRP/USD price prediction is that the coin will remain rangebound between $25 and $0.30 for the near term. The long-term outlook suggests that the Ripple price could reach up to $0.40.

Bitcoin SV Price Outlook: BSV/USD Rejected at $180, Further Losses Likely

Bitcoin SV (BSV) is currently trading at $137.51, down 19.86% on the day. The current price projection suggests that BSV will reach a bottom around $114.5 before beginning a new long-term uptrend. However, should the price fall below $114.5, further losses are likely.

The following table displays the BSV price forecast for the next 6 months.

Date BSV Price Prediction Jan. 15, 2019 $137.51 Feb. 15, 2019 $132.06 Mar. 15, 2019 $126.68 Apr. 15, 2019 $121.24 May 15, 2019 $117.90 Jun. 15, 2019 $113.54

According to the latest market data, BCH prices are also declining, with BCH/USD trading at $153.21, down 18.7% on the day. This indicates that the market is still bearish towards the Bitcoin Cash network, even though it has seen some positive developments recently.

The following table displays the BCH price forecast for the next 6 months.

Date BCH Price Prediction Jan. 15, 2019 $153.21 Feb. 15, 2019 $149.71 Mar. 15, 2019 $145.31 Apr. 15, 2019 $141.92 May 15, 2019 $137.51 Jun. 15, 2019 $133.03

The Bitcoin SV price prediction suggests that further losses are likely in the short-term if the BSV/USD pair falls below $114.5. In the medium-term, however, the price projection suggests that BSV will reach a higher value at around $191.5 before beginning a new long-term uptrend.

EOS Price Analysis: EOS/USD Consolidates Below $5.00, Further Losses Possible

EOS price declined again below the $0.10 level against the US Dollar, while trading at a few percent below the $0.0900 level. The EOS/USD pair is currently facing a lot of selling pressure and could continue to lose more ground in the near term.

Looking at the 4-hour chart, the EOS/USD pair is looking weak as it has been unable to hold the $0.10 support level. The pair has also failed to recover from the recent lows of $0.0900 and is currently trading at a few percent below the $0.0900 level.

There is a major bearish trend line forming with resistance at $0.1150 and $0.1200 on the 4-hour chart, which could prevent the EOS/USD pair from moving much lower. However, the pair could see further losses if it fails to hold the $0.10 support level.

EOS price analysis suggests that the EOS/USD pair is likely to decline further in the short term.

Stellar Lumens Price Forecast: XLM/USD Supported at $0.08, Charts Suggest Rangebound Action

Stellar Lumens Price Forecast: XLM/USD Supported at $08

The Stellar Lumens price is forecasted to remain stable in the $0.08-0.10 range in the near future. Chart analysis suggests a rangebound action is likely, with support at $08.

TRON Price Prediction: TRX/USD Remains Bearish Below $0.0140, Charts Show

As per the current trend, the TRON price remains bearish below $0140. The TRON/USD pair is currently trading at $0136.89. The next major support level is $0130, below which the TRON price could decline towards $0120.

Meanwhile, the TRON/BTC and TRX/ETH charts are also showing a bearish trend. The TRON/BTC pair is currently trading at 0.00004191 BTC, whereas the TRX/ETH pair is trading at 0.00004396 ETH.

The TRON Price Prediction

According to the most recent predictions, the TRON price will decline towards $0120. The reason for this prediction is that there is a fundamental reason for the decline in the TRON price – namely, the launch of Tron Virtual Machine (TVM).

The TVM is a new platform that allows developers to build Dapps on top of the TRON network. However, this has led to increased competition in the market, which is likely to result in a decline in the TRON price.

Cardano Price Analysis: ADA/USD Close to a Breakout, Charts Suggest Bullish Bias

Cardano is one of the most talked about cryptocurrencies in the market today. After a rough start to 2018, the ADA/USD pair has seen some positive momentum in recent weeks. The bulls seem to be in control, as the ADA/USD pair is trading near its all-time high.

Looking at the charts, it seems that the ADA/USD pair is headed for a breakout. The RSI is well above the 50 mark, which is a sign of strong buying pressure. Moreover, the ADA/USD pair is rapidly approaching the $0.30 support level. This suggests that the bulls are in control and that the ADA/USD pair is set to reach new heights.

However, there is still room for volatility, so caution is advised. If the ADA/USD pair fails to break out and falls below the $0.30 support level, it could head towards the $0.25 support level. In that case, the bears could take control and drag the ADA/USD pair lower.

IOTA Price Forecast: MIOTA/USD Primed for a Reversal, Charts Show Oversold Conditions

The current market conditions for MIOTA are primed for a reversal, according to the latest charts from TradingView.com.

As of this writing, the MIOTA/USD pair is trading at $0.8590, down 1.14% over the last 24 hours. The market has seen significant movement over the past week, with the price of MIOTA fluctuating between $0.8669 and $0.8700.

Looking at the chart below, we can see that the MIOTA price is currently oversold, with a RSI indicator reading below the 50 level. This signals that there is a potential for a reversal in the market conditions.

In addition, the Ichimoku Cloud chart shows that the MIOTA price is currently in a buy zone, which indicates that there is potential for an upside movement in the near future.

Overall, the market conditions for MIOTA appear to be primed for a reversal, with the potential for an upside movement in the near future.

Monero Price Prediction: XMR/USD Facing Resistance at $100, Charts Indicate

The Monero price is currently trading at $77.06, which is down by 0.14% in the past 24 hours. The XMR/USD pair is currently facing resistance at $100 and is likely to correct lower in the near future.

Looking at the Monero price chart, we can see that the price has been facing resistance at $100 for the past few days. The price has also been struggling to break past the $90 mark in recent times.

As a result, the Monero price is likely to face further resistance at $100 and could even drop below the $80 level in the near future. The charts indicate that the price is likely to correct lower in the near future.